MATC Vision Milwaukee Area Technical College is committed to being a

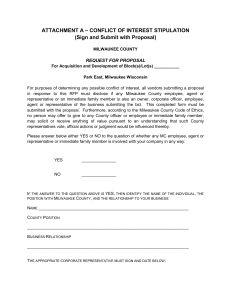

advertisement