Stat 551 HW 2 Solutions

advertisement

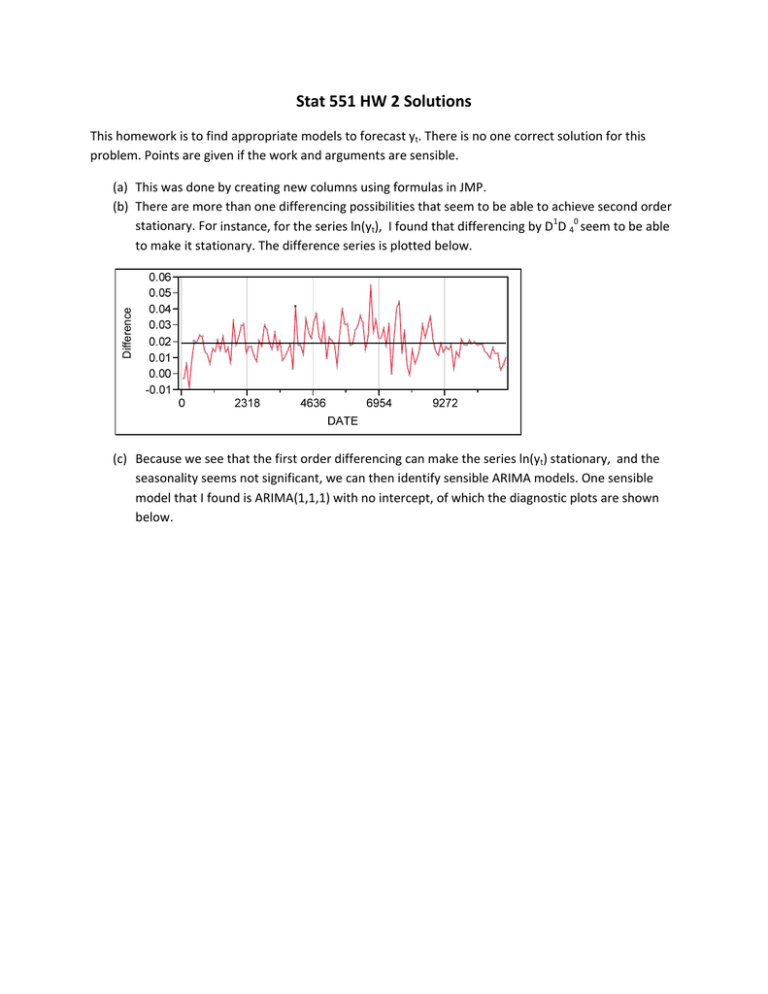

Stat 551 HW 2 Solutions This homework is to find appropriate models to forecast yt. There is no one correct solution for this problem. Points are given if the work and arguments are sensible. Difference (a) This was done by creating new columns using formulas in JMP. (b) There are more than one differencing possibilities that seem to be able to achieve second order stationary. For instance, for the series ln(yt), I found that differencing by D1D 40 seem to be able to make it stationary. The difference series is plotted below. (c) Because we see that the first order differencing can make the series ln(yt) stationary, and the seasonality seems not significant, we can then identify sensible ARIMA models. One sensible model that I found is ARIMA(1,1,1) with no intercept, of which the diagnostic plots are shown below. Residuals 0.03 Residual Value 0.02 0.01 0.00 -0.01 -0.02 -0.03 0 2318 4636 6954 9272 DATE Lag AutoCorr -.8-.6-.4-.2 0 .2 .4 .6 .8 1.0000 0 0.1287 1 0.0678 2 -0.0565 3 -0.0056 4 -0.2127 5 -0.0210 6 -0.0456 7 -0.1353 8 -0.0262 9 0.1399 10 0.1751 11 -0.0373 12 -0.0128 13 0.0078 14 -0.0724 15 0.1011 16 -0.0149 17 0.1382 18 -0.0825 19 0.0857 20 0.0378 21 0.0362 22 -0.1511 23 -0.0181 24 0.0673 25 Ljung-Box Q . 2.1208 2.7133 3.1288 3.1329 9.1184 9.1769 9.4564 11.9407 12.0343 14.7360 19.0049 19.2001 19.2233 19.2320 19.9884 21.4761 21.5086 24.3426 25.3626 26.4727 26.6903 26.8920 30.4473 30.4985 31.2172 p-Value . 0.1453 0.2575 0.3722 0.5358 0.1044 0.1639 0.2215 0.1539 0.2114 0.1420 0.0610 0.0838 0.1163 0.1563 0.1724 0.1609 0.2044 0.1441 0.1489 0.1508 0.1813 0.2154 0.1370 0.1688 0.1819 Lag 0 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 Partial -.8-.6-.4-.2 0 .2 .4 .6 .8 1.0000 0.1287 0.0521 -0.0729 0.0070 -0.2096 0.0297 -0.0228 -0.1631 0.0235 0.1181 0.1405 -0.1098 -0.0672 0.0515 -0.0466 0.1692 -0.0871 0.1840 -0.0577 0.0227 0.0716 -0.0509 -0.0567 0.0025 0.1508 (d) 95% prediction limits for my model from (c) for s=12 future values of yt. 8000 7000 6000 Y 5000 4000 3000 2000 1000 0 0 Y 2000 4000 6000 8000 1000012000 GNP predicted DATE Upper CL (0.95) GNP (e) Fitting ARIMA(1,1,1) with no intercept model on the five contaminated series of ln(yt), we can get the following fitted parameters. 1. No contamination 2. Doubled at t=25 3. Doubled at t=50 4. Doubled at t=75 5. Doubled at t=100 6. Doubled at t=125 The above fitted parameters show that contamination has a serious effect on estimation of an AR parameter. If the contamination is near the end of a time series dataset , it will also have a serious effect on estimation of a MA parameter. However, if the contamination is not at the beginning or in the middle, it does not seem to have significant effect on estimation of a MA parameter. Compare forecasts s=4,8, 12 uncontaminated t=25 t=50 t=75 s=4 8.674735 8.573254 8.569558 8.567928 s=8 8.715713 8.573254 8.569558 8.567928 s=12 8.755691 8.573254 8.569558 8.567928 (f) t=100 8.584568 8.584568 8.584568 t=125 11.34189 11.99709 12.15554 Fitting ARIMA(1,1,1) with no intercept model on the five contaminated series of ln(yt), we can get the following fitted parameters. 1. No contamination 2. Step change at t=25 3. Step change at t=50 4. Step change at t=75 5. Step change at t=100 6. Step change at t=125 Compare forecasts s=4,8,12 uncontaminated s=4 8.674735 s=8 8.715713 s=12 8.755691 t25 8.624948 8.624944 8.624944 t50 8.627008 8.627001 8.627001 t75 8.629923 8.629913 8.629913 t100 8.631565 8.631524 8.631522 t125 8.644293 8.653095 8.659797 (g) The fitted parameters for the transfer function model using a pulse at time t=100 covariate are: Output The fitted and predicted values are shown in the graph below: The fitted parameters for the transfer function model using a level shift at time t=100 covariate are: The fitted and predicted values are shown in the graph below: Output (h) The best model that I found is ARIMA(1,1,1) on ln(yt) with covariates first differenced log PCE and that of GPDI. The fitted parameters are as following. Residual Value The residual plot is as following, which looks like white noise. (i) Comparing the two models, MAE is smaller for the model with covariates; MAPE is smaller for the model without covariates. Therefore, it is not clear which model is definitely better. Model Summary DF Sum of Squared Errors Variance Estimate Standard Deviation Akaike's 'A' Information Criterion Schwarz's Bayesian Criterion RSquare RSquare Adj MAPE MAE -2LogLikelihood 121 0.00345407 0.0000125 0.00353565 -1047.4577 -1036.1445 0.88281475 0.87990933 35.880772 0.00284675 -957.32613 (j) and (k): the method of (j) is the same as (d); the method of (k) is the same as in (e) and (f).