This article was published in an Elsevier journal. The attached... is furnished to the author for non-commercial research and

advertisement

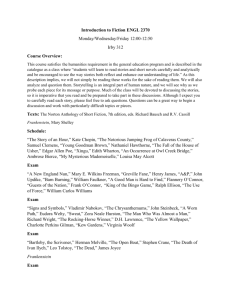

This article was published in an Elsevier journal. The attached copy is furnished to the author for non-commercial research and education use, including for instruction at the author’s institution, sharing with colleagues and providing to institution administration. Other uses, including reproduction and distribution, or selling or licensing copies, or posting to personal, institutional or third party websites are prohibited. In most cases authors are permitted to post their version of the article (e.g. in Word or Tex form) to their personal website or institutional repository. Authors requiring further information regarding Elsevier’s archiving and manuscript policies are encouraged to visit: http://www.elsevier.com/copyright Author's personal copy ARTICLE IN PRESS Journal of Econometrics 141 (2007) 492–516 www.elsevier.com/locate/jeconom On the second-order properties of empirical likelihood with moment restrictions Song Xi Chena,, Hengjian Cuib a b Department of Statistics, Iowa State University, Ames, IA 50011-1210, USA Department of Statistics and Financial Mathematics, Beijing Normal University, Beijing 100875, China Available online 22 November 2006 Abstract This paper considers the second-order properties of empirical likelihood (EL) for a parameter defined by moment restrictions, which is the inferential framework of the generalized method of moments. It is shown that the EL defined for this general framework still admits the delicate secondorder property of Bartlett correction. This represents a substantial extension of all the established cases of Bartlett correction for the EL. An empirical Bartlett correction is proposed, which is shown to work effectively in improving the coverage accuracy of confidence regions for the parameter. r 2006 Elsevier B.V. All rights reserved. JEL classification: C14; C30; C40 Keywords: Bartlett correction; Coverage accuracy; Empirical likelihood; Generalized method of moments 1. Introduction Generalized method of moments (GMM) introduced by Hansen (1982) are an important inferential framework in econometric studies. GMM is based on, upon given a model, some known functions gðX ; yÞ of a random observation X 2 Rd and an unknown parameter y 2 Rp , where g : Rdþp ! Rr , such that EfgðX ; yÞg ¼ 0 which constitutes moment restrictions on the relationship between X and y. The power of GMM is in its allowing rXp, namely the number of moment restrictions (instruments) can be larger than the number of parameter, which leads to a full exploration of inference opportunities Corresponding author. Tel.: +1 515 294 2729; fax: +1 515 294 4040. E-mail address: songchen@iastate.edu (S.X. Chen). 0304-4076/$ - see front matter r 2006 Elsevier B.V. All rights reserved. doi:10.1016/j.jeconom.2006.10.006 Author's personal copy ARTICLE IN PRESS S.X. Chen, H. Cui / Journal of Econometrics 141 (2007) 492–516 493 provided by the given model. There is a vast pool of literatures on GMM. Here, we only cite the reviews by Andrews (2002), Brown and Newey (2002), Imbens (2002) and Hansen and West (2002). Empirical likelihood (EL) introduced by Owen (1988) is a computer-intensive statistical method that facilitates a likelihood-type inference in a non-parametric or semiparametric setting. It is closely connected to the bootstrap as the EL effectively carries out the resampling implicitly. On certain aspects of inference, EL is more attractive than the bootstrap, for instance, its ability of internal studentizing so as to avoid explicit variance estimation and producing confidence regions with natural shape and orientation; see Owen (2001) for an overview of EL. A key property of EL is that the log EL ratio is asymptotically chi-squared distributed, which resembles the Wilks’ theorem in parametric likelihood. The Wilks’ theorem was established in the original proposal of Owen (1988) for the means, in Hall and La Scala (1990) for smoothed function of means, Qin and Lawless (1994) for parameters defined by moment restrictions and Kitamura (1997) for moment restrictions with weakly dependent observations. There have been comprehensive studies of EL in econometrics. Imbens (1997) shows that the maximum EL estimator of y is a one-step variation of the two-stage GMM estimator in the over-identified case of r4p, and achieves the same asymptotic efficiency as the two-stage estimator. Testing is considered in Kitamura (2001) for moments restrictions, Tripathi and Kitamura (2004) for conditional moment restrictions and Chen and Gao (2006) for constructing an adaptive and rate-optimal test for a regression model. Estimation and testing with conditional moment restrictions are studied in Donald et al. (2003) and Kitamura et al. (2004). They found that EL possesses the attractive features of avoiding estimating optimal instruments and achieving asymptotic pivotalness. Tilted EL and other variations are studied in Kitamura and Stutzer (1997), Smith (1997) and Newey and Smith (2004). Another key property of the EL is Bartlett correction, which is a delicate second-order property that implies a simple mean adjustment to the likelihood ratio can improve the approximation to the limiting chi-square distribution by one order of magnitude and hence can be used to enhance the coverage accuracy of likelihood-based confidence regions. In the context of testing hypotheses, the Bartlett correction reduces the errors between the nominal and actual significant levels of an EL test. Bartlett correction has been established for EL by DiCiccio et al. (1991) for smoothed functions of means and Chen (1993, 1994) for linear regression. Baggerly (1998) showed that EL is the only member within the Cressie–Read power divergence family that is Bartlett correctable. Jing and Wood (1996) revealed that the exponentially tilted EL for the means does not admit Bartlett correction as the tilting alters the delicate second-order mechanism of EL. Recently, Chen and Cui (2006) show that EL is Bartlett correctable in the presence of a nuisance parameter with just-identified moment restrictions. In this paper we show that the EL with over-identified moment restrictions is Bartlett correctable. The finding represents a substantial extension to all the established cases of Bartlett correction, which all consider just-identified cases in GMM. The establishment of the Bartlett correction for the just-identified case is easier as the log maximum EL takes a constant value n logðnÞ (n is the sample size). However, in the over-identified case the maximum EL is no longer a constant, rather it introduces many extra terms into the log EL ratio and makes the study of Bartlett correction far more challenging as can be seen from the analysis carried out in this paper. The establishment of Bartlett correction in this Author's personal copy ARTICLE IN PRESS 494 S.X. Chen, H. Cui / Journal of Econometrics 141 (2007) 492–516 general case indicates that EL inherits the delicate second-order mechanism of the parametric likelihood in a much wider situation. This together with the findings of Imbens (1997), Kitamura (2001) and Newey and Smith (2004) and others suggests that the EL is an attractive inferential tool in the context of moment restrictions. The establishment of the Bartlett correction leads to a practical Bartlett correction, which is confirmed to work effectively for coverage restoration in our simulation studies reported in Section 4. The paper is organized as follows. Section 2 provides an expansion for the log EL ratio for parameters defined by moment restrictions. Bartlett correction and coverage errors assessment of EL confidence regions are investigated in Section 3. Simulation results are reported in Section 4, followed by a general discussion in Section 5. All technical details are left in Appendix A. 2. EL for generalized moment restrictions Let X 1 ; X 2 ; . . . ; X n be d-dimensional independent and identically distributed random sample whose distribution depends on a p-dimensional parameter y which takes values in a compact parameter space Y Rp . The information about y is summarized in the form of rXp unbiased moment restrictions gj ðx; yÞ, j ¼ 1; 2; . . . ; r, such that E½gj ðX 1 ; y0 Þ ¼ 0 for a unique y0 , which is the true value of y. Let gðX ; yÞ ¼ ðg1 ðX ; yÞ; g2 ðX ; yÞ; . . . ; gr ðX ; yÞÞT and V ¼ VarfgðX 1 ; y0 Þg. We assume the following regularity conditions: ðiÞ V is a r r positive definite matrix and the rank of E½qgðX 1 ; y0 Þ=qy is p; ðiiÞ for any j; 1pjpp; all the partial derivatives of gj ðx; yÞ up to the third order with respect to y are continuous in a neighborhood of y0 and are bounded by some integrable functions; respectively; in the neighborhood; ðiiiÞ lim supjtj!1 jE½expfitT gðX 1 ; y0 Þgjo1 and EkgðX 1 ; y0 Þk15 o1. ð2:1Þ Conditions (i) and (ii) are standard requirements for establishing Wilks’ theorem and higher-order Taylor expansions of the EL ratio. The first part of Condition (iii) is the Cramér’s condition on the characteristic function of gðX ; y0 Þ. Requiring a finite 15th moment is to ensure finite 5th moment for the sign square root of the EL ratio statistic, which together with Cramer’s condition are needed in establishing the Edgeworth expansion for the EL ratio statistic. To facilitate simpler expressions, we transform gðX i ; yÞ to wi ðyÞ ¼ CV 1=2 gðX i ; yÞ where C is a r r orthogonal matrix such that qgðX i ; y0 Þ 1=2 CV E (2.2) U ¼ ðL; 0ÞTrp . qy Here U ¼ ðukl Þpp is an orthogonal matrix and L ¼ diagðl1 ; . . . ; lp Þ is non-singular. Define O ¼ ðokl Þpp ¼:UL1 where okl ¼ ukl l1 l . Here no summation over the subscript l is carried out due to L being a diagonal matrix. Let p1 ; p2 ; . . . ; pn be non-negative weights allocated to Q the observations. The PnEL for y n as proposed in Qin and Lawless (1994) is LðyÞ ¼ i¼1 pi subject to i¼1 pi ¼ 1 Author's personal copy ARTICLE IN PRESS S.X. Chen, H. Cui / Journal of Econometrics 141 (2007) 492–516 and Pn i¼1 495 pi wi ðyÞ ¼ 0. Let ‘ðyÞ ¼ 2 logfLðyÞ=nn g. Standard derivations in EL show ‘ðyÞ ¼ 2 n X logf1 þ lT ðyÞwi ðyÞg, i¼1 P where l ¼ lðyÞ is the solution of n1 ni¼1 wi ðyÞ=ð1 þ lT wi ðyÞÞ ¼ 0. According to Qin and Lawless (1994), the maximum EL estimator y^ and its ^ are solutions of corresponding l, denoted as l, Q1n ðl; yÞ ¼ n 1 n X i¼1 Q2n ðl; yÞ ¼ n 1 wi ðyÞ ¼ 0 and 1 þ lT wi ðyÞ n X ðqwi ðyÞ=qyÞT l i¼1 1 þ lT wi ðyÞ ¼ 0. (2.3) (2.4) ^ The log EL ratio is rðyÞ ¼ ‘ðyÞ ‘ðyÞ. ^ respectively. To expand ‘ðy0 Þ, In the following we develop expansions for ‘ðy0 Þ and ‘ðyÞ, define j j aj1 ...j k ¼ Efwi1 ðy0 Þ . . . wi k ðy0 Þg and n X j j wi1 ðy0 Þ . . . wi k ðy0 Þ aj 1 ...jk . Aj1 ...jk ¼ n1 i¼1 Here we use aj to denote the jth component of a vector a. Then, it may be shown that n1 ‘ðy0 Þ ¼ Aj Aj Aji Aj Ai þ 23 ajih Aj Ai Ah þ Aji Ahi Aj Ah þ 23 Ajih Aj Ai Ah 2ajih Agh Aj Ai Ag þ ajgf aihf Aj Ai Ah Ag 12 ajihg Aj Ai Ah Ag þ Op ðn5=2 Þ. ð2:5Þ We use here a convention where if a superscript is repeated a summation over that superscript is understood. This expansion has the same form as DiCiccio et al. (1991) for the mean parameter and Chen (1993) for linear regression. ^ in the general case of r4p, two new systems of notations are introduced. To expand ‘ðyÞ Let Z ¼ ðl; yÞ, QðZÞ ¼ ðQT1n ðZÞ; QT2n ðZÞÞT , S21 ¼ UðL; 0Þ and S 12 ¼ S T21 . Due to the early transformation in (2.2), ! I S 12 qQð0; y0 Þ S ¼: E ¼ . S21 0 qZ Put GðZÞ ¼ S1 QðZÞ. Now we can introduce the notations involving GðZÞ and their derivatives ! n k j q G ð0; y0 Þ 1X qk Gj ð0; y0 Þ j;j 1 ...j k j;j 1 ...j k b ¼E ¼ bj;j 1 ...j k and B qZj 1 . . . qZj k n i¼1 qZj 1 . . . qZjk and the notations involving wi ðyÞ and their derivatives. Author's personal copy ARTICLE IN PRESS S.X. Chen, H. Cui / Journal of Econometrics 141 (2007) 492–516 496 gj;j1 ...j l ;k;k1 ...km ;...;p;p1 ...pt ql wji ðy0 Þ qm wki ðy0 Þ qt wpi ðy0 Þ ¼E p1 qy . . . qypt qyj1 . . . qyj l qyk1 . . . qykm ! and C j;j 1 ...jl ;k;k1 ...km ;...;p;p1 ...pt n 1X ql wji ðy0 Þ qm wki ðy0 Þ qt wpi ðy0 Þ ¼ p1 gj;j1 ...jl ;k;k1 ...km ;...;p;p1 ...pt . n i¼1 qyj1 . . . qyj l qyk1 . . . qykm qy . . . qypt ^ yÞ ^ is the solution of Gð^ZÞ ¼ 0, by inverting this equation, we derive in Since Z^ ¼ ðl; Appendix A.2 that for j; k; l; m 2 f1; 2; . . . ; r þ pg, Z^ j Zj0 ¼ Bj þ Bj;k Bk 12 bj;kl Bk Bl Bj;k Bk;l Bl þ 12 bk;lm Bj;k Bl Bm þ bj;kl Bk;m Bm Bl 12 bj;kl bk;mn Bm Bn Bl 12 Bj;kl Bk Bl þ 16 bj;klm Bk Bl Bm þ Op ðn2 Þ. ð2:6Þ Note that (2.6) contains expansions for l^ j when jpr and for y^ j when j4r, respectively. Note that ^ ¼2 ‘ðyÞ n X i¼1 T ^ 1 ½l^ T wi ðyÞ ^ 2 þ 1 ½l^ T wi ðyÞ ^ 3 1 ½l^ T wi ðyÞ ^ 4 l^ wi ðyÞ 2 3 4 þ Op ðn3=2 Þ. (2.7) From now on, we fix the ranges of the superscripts a; b; c; d 2 f1; 2; . . . ; r pg, f ; g; h; i; j 2 f1; 2; . . . ; rg, k; l; m; n; o 2 f1; 2; . . . ; pg and q; s; t; u 2 f1; 2; . . . ; r þ pg. It is shown in Appendix A.2 by substituting (2.6) into (2.7) that ^ ¼ 2Bj Aj Bj Bj þ 2C i;k Bi Brþk;q Bq þ 1 bj;uq brþk;st gj;k Bu Bq Bs Bt n1 lðyÞ 2 bj;uq Bu Bq Brþk;s Bs gj;k brþk;uq Bu Bq C i;k Bi Bj Bi Aji 23 ajih Bj Bi Bh þ 2C j;k fBj Brþk Bj;p Bp Brþk ½2; j; r þ k þ 12 bj;uq Bu Bq Brþk ½2; j; r þ kg þ gj;kl fBj Brþk Brþl þ Bj Brþk Brþl;q Bq ½3; j; r þ k; r þ l 12 bj;uq Brþk Brþl Bu Bq ½3; j; r þ k; r þ lg C j;kl Bj Brþk Brþl 23 Ajih Bj Bi Bh Bj;u Bu Bj;q Bq 14 bj;uq bj;st Bu Bq Bs Bt þ bj;uq Bu Bq Bj;s Bs þ 2gj;i;h;k Bj Bi Bh Brþk þ Bj Bi;q Bq Aji ½2; j; i 12 bj;uq Bu Bq Bi Aji ½2; j; i þ 13 gj;k;lm Bj Brþk Brþl Brþm þ 2gj;i;l fBj Bi Brþl Bj Bi Brþl;q Bq þ 12 brþl;uq Bj Bi Bu Bq Brþl Bi Bj;q Bq ½2; j; i þ 12 bj;uq Bu Bq Bi Brþl ½2; j; ig þ 2Bj Bi Brþl C j;i;l ðgj;i;lk þ gj;l;i;k ÞBj Bi Brþl Brþk þ 2ajih Bj Bi Bh;q Bq ajih bj;uq Bu Bq Bi Bh 12 ajihg Bj Bi Bh Bg þ Op ðn5=2 Þ, ð2:8Þ where ½2; j; i indicates there are two terms by exchanging the superscripts i and j, and ½3; j; i; k means three terms such that the three superscripts take turns to occupy the ^ is more complicated than the just-identified case of position of j. Expansion (2.8) for ‘ðyÞ ^ ¼0 r ¼ p. In that case, all the Bj ¼ 0 from a result established in (A.1), which means ‘ðyÞ and rðy0 Þ ¼ ‘ðy0 Þ. This is the situations of all the existing studies on Bartlett correction of ^ contains more terms than that of ‘ðy0 Þ, which the EL. When r4p, the expansion of ‘ðyÞ increases substantially the difficulty of the second-order analysis. Author's personal copy ARTICLE IN PRESS S.X. Chen, H. Cui / Journal of Econometrics 141 (2007) 492–516 497 Combining (2.5) and (2.8), and carrying out further simplifications, n1 rðy0 Þ ¼ Al Al Akl Ak Al 2Al;pþa Apþa Al þ 23 aklm Ak Am Al þ 2okl C pþa;k Apþa Al þ ð2akl;pþa gpþa;mn omk onl ÞApþa Ak Al þ Aji ðAhi Aj Ah Bi;q Bq Bj ½2; i; jÞ þ 2ðal;pþa;pþb gpþa;pþb;k okl ÞApþa Apþb Al þ Bj;u Bj;q Bu Bq þ 2C j;k Bj;q Brþk Bq gj;kl Brþk Brþl Bj;q Bq 2gj;kl Bj Brþl Brþk;q Bq 2ajih Bj Bi Bh;q Bq þ 2gj;i;l ðBj Bi Brþl;q Bq þ Brþl Bi Bj;q Bq ½2; j; iÞ þ ðgj;i;lk þ gj;l;i;k ÞBj Bi Brþl Brþk þ ð14 bj;uq bj;st 12 bj;uq brþk;st gj;k ÞBu Bq Bs Bt þ ðajih bh;uq gj;i;l brþl;uq ÞBj Bi Bu Bq þ ðgj;kl brþl;uq gi;j;k bi;uq gj;i;k bi;uq ÞBu Bq Bj Brþk þ 12 gj;kl bj;uq Bu Bq Brþl Brþk 13 gj;klm Bj Brþk Brþl Brþm 2gj;i;h;k Bj Bi Bh Brþk þ 12 ajihg Bj Bi Bh Bg þ C j;kl Bj Brþk Brþl 2C j;i;l Bj Bi Brþl þ 23 Ajih ðBj Bi Bh þ Aj Ai Ah Þ 2ajih Agh Aj Ai Ag þ ajgf aihf Aj Ai Ah Ag 12 ajihg Aj Ai Ah Ag þ Op ðn5=2 Þ. ð2:9Þ This expansion leads to the following signed root decomposition: n1 rðy0 Þ ¼ Rj Rj þ Op ðn5=2 Þ, where R ¼ R1 þ R2 þ R3 and Ri ¼ Op ðni=2 Þ for i ¼ 1; 2 and 3. By matching Rl1 Rl1 with the only term Al Al of order n1 in (2.9), we have Rl1 ¼ Al . (2.10) Then we match 2Rl1 Rl2 with the terms of order n3=2 and obtain Rl2 ¼ 12 Akl Ak Al;pþa Apþa þ 13 aklm Ak Am þ okl C pþa;k Apþa þ ðakl;pþa 12 gpþa;mn omk onl ÞApþa Ak þ ðal;pþa;pþb gpþa;pþb;k okl ÞApþa Apþb ð2:11Þ and Rj1 ¼ Rj2 ¼ 0 for j 2 fp þ 1; . . . ; rg. Similarly, by matching 2Rl2 Rl3 with the rest of the terms in (2.9) after removing terms contributing to ðRl1 þ Rl2 ÞðRl1 þ Rl2 Þ, the form of Rl3 is given in Appendix A.2. d From (2.9), rðy0 Þ ¼ nAl Al þ op ð1Þ which means that rðy0 Þ ! w2p and leads to an EL confidence region for y with nominal confidence level 1 a: I a ¼ fyjrðyÞpca g where ca is the upper a-quantile of w2p distribution. 3. The second-order properties This section considers the accuracy of the chi-square approximation to the distribution of the EL ratio statistic rðy0 Þ and improving this approximation by the Bartlett correction. Author's personal copy ARTICLE IN PRESS S.X. Chen, H. Cui / Journal of Econometrics 141 (2007) 492–516 498 We first introduce some quantities used to define the accuracy of the chi-square approximation. Let 1 lkk omm 7 lkm okm J lo ¼ 14 ðalokk dlo Þ þ 36 a a 36 a a þ alo;pþa;pþa al;pþa;pþb ao;pþa;pþb alk;pþa aok;pþa þ 12 okl gm;pþa;k aom;pþa ½2; l; o þ gpþa;pþb;k ao;pþa;pþb okl ½2; l; o þ 14 gpþa;mn omk onl aok;pþa ½2; l; o 0 0 0 0 þ 14 gpþa;mn gpþa;m n omk onl om k on o 12 gpþa;mn gk;pþa;v omk onl ovo ½2; l; o okl go;pþa;pþa;k ½2; l; o þ ðgpþa;k;pþa;v gpþa;pþb;k gpþa;pþb;v Þokl ovo and ð3:1Þ 5 lkm okm 1 lok kmm a a 72 a a 12 alok ak;pþa;pþa K lo ¼ 18 ðalokk þ dlo Þ 72 12 okm gpþa;k;o alm;pþa 23 okm gpþa;k;pþa alom þ 14 oml onk aok;pþa gpþa;mn þ 12 onl okm ðgpþa;k;o gpþa;n;m gpþa;n;o gpþa;k;m Þ þ 12 okn ovl omo ðgpþa;mv gpþa;k;n gpþa;kv gpþa;m;n Þ þ omo ovl okn ðgpþa;km gpþa;n;v gpþa;kv gpþa;n;m Þ 0 0 0 0 0 0 þ 18 om l omo on k onk ðgpþa;mn gpþa;m n gpþa;mm gpþa;nn Þ. ð3:2Þ P 1 lkk lmm a a Þ where Dll ¼ 2K ll þ J ll ml ml and ml ¼ 16 n1 alkk . Let Bc ¼ p1 ð pl¼1 Dll þ 36 The accuracy of the chi-square approximation is evaluated in the following theorem. Theorem 1. Under Condition (2.1), sup jPfrðy0 Þoxg Pðw2p oxÞ þ n1 Bc xf p ðxÞj ¼ Oðn2 Þ, x2R where f p ðÞ is the density of w2p distribution. Theorem 1 indicates that the coverage error of the EL confidence region I a is Oðn1 Þ, which is the same order as a standard two sided confidence region based on the asymptotic ^ The attractions of the EL confidence region are: (i) there is no need to carry normality of y. out any secondary estimation procedure in formulating the confidence region; and (ii) the shape and the orientation of the region are naturally determined by the likelihood ratio surface, free of any subjective intervention. It can be shown by combining the expressions of EðRli Rlj Þ given in Appendix A.3 that Efrðy0 Þg ¼ pð1 þ Bc n1 Þ þ Oðn2 Þ. (3.3) The rationale of the Bartlett correction is to adjust the mean of the EL ratio rðy0 Þ to make it agreeable with the mean of w2p to the order of n1 . This mean adjustment, originally proposed by Bartlett (1937), improves the chi-square approximation to the distribution of the likelihood ratio to Oðn2 Þ. The following theorem formally establishes the Bartlett correction for the EL ratio rðy0 Þ. Theorem 2. Under Condition (2.1), sup jPfrðy0 Þoxð1 þ Bc n1 Þg Pðw2p oxÞj ¼ Oðn2 Þ. x2R The theorem shows that the Bartlett correction is maintained by the EL for the situa^ has a tion of general moment restrictions, despite that r may be larger than p and ‘ðyÞ rather complex expression. This indicates that the EL is resilient in sharing this delicate Author's personal copy ARTICLE IN PRESS S.X. Chen, H. Cui / Journal of Econometrics 141 (2007) 492–516 499 second-order property with a parametric likelihood and the existence of certain internal mechanism in the EL that resembles that of the parametric likelihood. The Bartlett factor Bc can have a quite involved expression for a general over-identified case of r4p due to the lengthy expressions of Dll . However, it admits simpler expression in two special situations. One is in the situation of just-identified moment restrictions with r ¼ p. It may be easily checked from (A.14) that Bc ¼ p1 ð12 allkk 13 alkm alkm Þ, (3.4) which is the Bartlett factor obtained in DiCiccio et al. (1991) for smooth function of means and Chen (1993) for linear regression. The other situation is when r4p, but (i) Covfgj ðX ; y0 Þ; gpþa ðX ; y0 Þg ¼ 0 for any jpp and apr p and (ii) gj ðx; yÞ ¼ gj ðxÞ does not depend on y for j ¼ p þ 1; . . . ; r. Assumption (i) means that the first p estimating equations are uncorrelated with the last r p estimating equations at y0 and (ii) means that the last r p estimating equations are free of parameters. In this case, Bc ¼ p1 ð12 allkk þ all;pþa;pþa 13 alkm alkm allk akpþa;pþa alf ;pþa alf ;pþa Þ. A special case of the second situation is considered in Cui and Yuan (2001) for a quantile with r ¼ p þ 1. To practically implement the Bartlett correction in a general situation, either Bc or bc ¼:1 þ Bc n1 has to be estimated. It is noted that the direct plug-in estimator of bc can be obtained by substituting all the populations moments involved by their corresponding sample moments. However, considering the rather lengthy forms of bc , we propose using the following bootstrap procedure to estimate bc . Step 1: Generate a bootstrap resample fX i gni¼1 by sampling with replacement from the ^ ¼ ‘ ðyÞ ^ ‘ ðy^ Þ, where ‘ and y^ are, and compute r ðyÞ original sample fX i gn i¼1 respectively, the log EL ratio and the maximum EL estimate based on the resample. ^ . . . ; rB ðyÞ. ^ Step 2: P For a large integer N, repeat Step 1 B times and obtain r1 ðyÞ; B 1 b ^ As B b¼1 r ðyÞ estimates Efrðy0 Þg, a bootstrap estimate of bc is b^ c ¼ ðBpÞ1 B X ^ rb ðyÞ. b¼1 Let Xn ¼ fX 1 ; . . . ; X n g be the original sample. It may be shown by standard bootstrap arguments, for instance, those given in Hall (1992), that Eðb^ c jXn Þ ¼ ð1 þ Bc n1 Þf1 þ Op ðn1=2 Þg (3.5) pffiffiffi which means that the bootstrap estimate of bc is n-consistent. Now a practical Bartlett corrected confidence region is I a;bc ¼ fyjrðyÞpca b^ c g. The above use of the bootstrap to estimate bc naturally leads ones to think of using the bootstrap to calibrate directly on the a-quantile of the EL ratio rðy0 Þ. Let c^a be the ath ^ given Xn , namely, Pfr ðyÞo^ ^ ca jXn g ¼ a. The quantile quantile of the distribution of r ðyÞ ^ B where ½ is the integer can be estimated by the ð½aB þ 1Þth ordered value of frb ðyÞg b¼1 truncation operator. We will ignore the error of the quantile estimation as it can be made as small as possible by increasing the number of bootstrap simulation B. Then a direct bootstrap confidence interval at a nominal level a is I a;bt ¼ fyjrðyÞp^ca g. Author's personal copy ARTICLE IN PRESS 500 S.X. Chen, H. Cui / Journal of Econometrics 141 (2007) 492–516 Theorem 3. Under Condition (2.1), Pfrðy0 Þoca b^ c g ¼ a þ Oðn3=2 Þ and Pfrðy0 Þoc^a g ¼ a þ Oðn3=2 Þ. The theorem indicates that the coverage errors of the two confidence regions I a;bc and I a;bt are at the same order of n3=2 , which is one order of magnitude smaller than the original EL region I a . However, they are both of larger order than Oðn2 Þ when the true Bc is used as conveyed in Theorem 2. The underlying reason for achieving a coverage error at the order of n2 in Theorem 2 is due to a fact that an even/odd order Hermit polynomial is 3=2 an even/odd function, which makes -order term in the Edgeworth expansion pffiffiffi the n vanish. However, when we used a n-consistent estimate of bc in I a;bc , the n3=2 -order term in the Edgeworth expansion involves no longer just Hermite polynomials. The error in the estimation of bc has an effect at the order of n3=2 . 4. Simulation results We report in this section results of two simulation studies which are designed to confirm the theoretical findings of Bartlett correction of the EL by implementing the proposed empirical Bartlett correction. For comparison purposes, the bootstrap confidence regions I a;bt is also evaluated. In the first simulation study, X 1 ; . . . ; X n are independent and identically Nðy; y2 þ 1Þ distributed, as considered in an example of Qin and Lawless (1994). The relationship between the mean and variance leads to moment restrictions: g1 ðX 1 ; yÞ ¼ X 1 y and g2 ðX 1 ; yÞ ¼ X 21 2y2 1. This is an over-identified case as there are two moment restrictions and one parameter of interest, i.e. r ¼ 2 and p ¼ 1. Like Qin and Lawless, the value of y is chosen to be 0 and 1, respectively. The sample size used in the simulation study is n ¼ 20; 30; 40 and 50, respectively. In the second simulation study, we consider the following autoregressive panel data model, which is an example considered in Brown and Newey (2002): X it ¼ yX it1 þ ai þ it ; X i0 ¼ ai þ ei , 1r (4.1) for t ¼ 1; . . . ; 4 and i ¼ 1; . . . ; n, where jyjo1, fit g4t¼1 and ai are mutually independent standard normal random variables, ei Nð0; ð1 y2 Þ1 Þ and independent of fit g4t¼1 and ai . Let X i ¼ ðX i1 ; . . . ; X i4 Þ. The moment restrictions after taking time differencing are g1 ðX i ; yÞ ¼ X i1 ðDX i3 yDX i2 Þ, g2 ðX i ; yÞ ¼ X i1 ðDX i4 yDX i3 Þ and g3 ðX i ; yÞ ¼ X i2 ðDX i3 yDX i2 Þ where DX it ¼ X it X it1 . It is easy to check from model (4.1) that Efgj ðX i ; yÞg ¼ 0. Hence, there are three constraints and one parameter, i.e. r ¼ 3 and p ¼ 1, another overidentified case. The parameter y, the autoregressive coefficient, is assigned values of 0:5 and 0:9 to obtain different levels of correlations. The sample size is chosen at n ¼ 50 and 100, respectively. Three confidence intervals are evaluated. They are I a based on the limiting chi-square distribution, I a;bc via the empirical Bartlett correction and I a;bt based on the direct bootstrap calibration. To gain information on the degree of over-identification in the moment restriction on the confidence intervals, we also carry out simulations for each model with only one estimating equation, which happens to be the first estimating equation, respectively. These Author's personal copy ARTICLE IN PRESS S.X. Chen, H. Cui / Journal of Econometrics 141 (2007) 492–516 501 correspond to just-identified cases, where the Bartlett factor are given explicitly in (3.4). Therefore, in additional to the above three confidence intervals, we also evaluate the theoretical Bartlett corrected interval which replaces b^ c by the real value bc in I a;bc . We are also able to obtain the real Bc value for the over-identified case in the first simulation model, hence the true Bartlett corrected interval is performed for all cases in the first model. In both simulation studies, the empirical coverage and length of the EL, Bartlett corrected EL and the direct bootstrap calibrated intervals are evaluated with nominal coverage levels of 90% and 95%, respectively. The bootstrap resample size B used is 250 and the number of simulation is 1000. Tables 1 and 2 contain the empirical coverage and the averaged length of the confidence intervals, which can be summarized as follows. First of all, the need for carrying out the second-order correction to the EL confidence interval I a is obvious as the original EL interval has quite severe under coverage for all the cases considered even for a sample size of 100 for the panel data model. The under coverage is particularly severe when the sample size is small for the normal mean model Nð1; 2Þ and for the panel data model. These are the situations where the Bartlett correction is needed. In all the cases considered the empirical Bartlett correction (I a;bc ) improves significantly the coverage of I a . The restoration of coverage by the Bartlett correction is impressive when the sample size is small. We also observed that, as anticipated, the direct bootstrap confidence interval has similar performance with the Bartlett corrected intervals in most of the cases. However, in the Table 1 Empirical coverage (in percentage) and averaged length of the EL confidence interval I a , the theoretical Bartlett corrected (TBC) interval I tbc by using the ture Bartlett factors, the empirical Bartlett corrected (EBC) interval I a;bc and the direct Bootstrap (BT) calibrated confidence interval I a;bt with X Nðy; y2 þ 1Þ and y ¼ 0 Nominal level 90% sample size EL 95% TBC EBC BT EL TBC EBC BT ðaÞ With two moment restrictions 20 coverage 84.50 length 0.635 30 coverage 85.75 length 0.543 40 coverage 87.65 length 0.490 60 coverage 87.50 length 0.448 89.50 0.712 89.25 0.602 90.10 0.515 89.50 0.465 90.30 0.835 89.45 0.626 89.80 0.546 89.04 0.425 87.90 0.792 87.32 0.605 88.76 0.542 88.75 0.413 91.20 0.760 91.20 0.672 92.50 0.585 94.00 0.540 94.80 0.847 94.10 0.720 94.80 0.615 95.50 0.560 93.82 0.932 93.50 0.765 95.60 0.627 94.63 0.547 93.40 0.930 93.20 0.761 94.80 0.625 93.87 0.532 ðbÞ With one moment 20 coverage length 30 coverage length 40 coverage length 60 coverage length 88.70 0.753 89.30 0.613 90.20 0.524 89.40 0.472 90.10 0.865 89.32 0.676 90.10 0.563 89.34 0.452 89.50 0.852 88.75 0.662 89.30 0.557 88.90 0.445 92.60 0.878 93.20 0.718 94.0 0.618 94.10 0.552 94.70 0.912 95.10 0.737 94.50 0.630 94.80 0.567 94.30 0.987 94.20 0.794 94.60 0.645 94.60 0.558 93.80 0.983 94.60 0.806 95.20 0.650 94.30 0.550 restriction 86.50 0.723 86.50 0.595 88.10 0.515 87.80 0.464 Author's personal copy ARTICLE IN PRESS 502 S.X. Chen, H. Cui / Journal of Econometrics 141 (2007) 492–516 Table 2 Empirical coverage (in percentage) and averaged length of the EL confidence interval I a , the theoretical Bartlett corrected (TBC) interval I tbc by using the true Bartlett factors, the empirical Bartlett corrected (EBC) interval I a;bc and the direct Bootstrap (BT) calibrated confidence interval I a;bt with X Nðy; y2 þ 1Þ and y ¼ 1 Nominal level 90% sample size EL 95% TBC EBC BT EL TBC EBC BT ðaÞ With two moment restrictions 20 coverage 81.40 length 0.661 30 coverage 82.50 length 0.610 40 coverage 85.50 length 0.462 60 coverage 88.50 length 0.412 87.50 0.807 92.00 0.705 89.50 0.531 89.75 0.443 86.45 0.792 89.15 0.683 88.40 0.523 90.35 0.452 85.48 0.783 88.63 0.677 88.90 0.526 89.23 0.440 87.00 0.789 92.50 0.707 91.25 0.590 92.25 0.492 92.10 0.956 95.25 0.794 94.25 0.657 94.40 0.531 91.80 0.924 94.21 0.782 93.70 0.643 94.25 0.535 90.20 0.917 93.60 0.764 93.20 0.635 94.50 0.540 ðbÞ With one moment 20 coverage length 30 coverage length 40 coverage length 60 coverage length 90.35 1.065 89.20 0.865 89.35 0.734 89.50 0.610 89.75 1.050 89.50 0.869 89.45 0.736 90.15 0.615 90.10 1.063 88.90 0.860 89.90 0.743 90.25 0.619 93.00 1.228 93.50 1.010 94.25 0.862 94.50 0.721 94.20 1.275 94.65 1.036 94.75 0.876 95.15 0.730 94.50 1.283 94.80 1.041 94.60 0.870 95.10 0.726 94.35 1.280 94.40 1.030 94.40 0.867 95.20 0.732 restriction 88.90 1.025 87.80 0.843 88.60 0.720 88.90 0.602 normal mean model, the coverage of the direct bootstrap interval I a;bt is not as good as the Bartlett corrected interval I a;bc in most of the situations. The robust performance of the Bartlett corrected interval may be due to the fact that the estimation of the Bartlett factor bc , which involves simple bootstrap averaging, is less variable than the bootstrap ^ (see also Tables 3 and 4). estimation of an extreme quantile of the distribution of rðyÞ When the number of moment restriction is reduced to one, the lengths of all intervals increase which is expected as the estimation efficiency declines. The theoretical Bartlett correction is slightly better than I a;bc and I a;bt in terms of coverage accuracy and length. However, when n is larger (n ¼ 60 in the first study and n ¼ 100 in the second), the three second-order intervals perform almost the same. It is noticed that the lengths of the confidence intervals for the panel data model is comparable with those given in Brown and Newey (2002). Finally, we observed that as the sample size increases the EL interval I a improves both in its coverage and length, whereas the improvement on the Bartlett intervals and the bootstrap interval is more in reducing the length of the intervals. 5. Discussions The main finding of the paper is that the EL with general moment restrictions are Bartlett correctable. This is a substantial extension of the previously established cases of Bartlett correction of EL, including the case of smoothed functions of means by DiCiccio Author's personal copy ARTICLE IN PRESS S.X. Chen, H. Cui / Journal of Econometrics 141 (2007) 492–516 503 Table 3 Empirical coverage (in percentage) and averaged length of the EL confidence interval I a , the theoretical Bartlett corrected (TBC) interval I tbc by using the true Bartlett factors (with one moment restriction only), the empirical Bartlett corrected (EBC) EL interval I a;bc and the direct Bootstrap (BT) calibrated confidence interval I a;bt for the panel data model (4.1) with y ¼ 0:5 Nominal level 90% sample size EL 95% EBC ðaÞ With two moment restrictions 50 coverage 81.25 length 0.917 100 coverage 84.50 length 0.706 Nominal level 90% sample size EL ðbÞ With one moment 50 coverage length 100 coverage length restriction 85.70 1.382 87.50 1.162 87.30 1.325 89.90 0.875 BT EL 89.20 1.384 89.80 0.894 EBC 87.10 1.088 90.20 0.818 BT 93.40 1.425 93.80 1.065 94.05 1.504 94.30 1.096 95% TBC 88.50 1.457 89.75 1.182 EBC 88.75 1.525 88.90 1.175 BT 90.10 1.534 89.50 1.180 EL TBC 92.25 1.574 89.75 1.302 EBC 94.10 1.631 94.75 1.320 93.82 1.625 94.30 1.335 BT 94.30 1.685 94.50 1.343 Table 4 Empirical coverage (in percentage) and averaged length of the EL confidence interval I a , the theoretical Bartlett corrected (TBC) interval I tbc by using the true Bartlett factors (with one moment restriction only), the empirical Bartlett corrected (EBC) EL interval I a;bc and the direct Bootstrap (BT) calibrated confidence interval I a;bt for the panel data model (4.1) with y ¼ 0:9 Nominal level 90% sample size EL 95% EBC ðaÞ With two moment restrictions 50 coverage 80.50 length 1.596 100 coverage 81.40 length 1.540 Nominal level 90% sample size EL ðbÞ With one moment 50 coverage length 100 coverage length restriction 86.50 1.849 87.25 1.808 88.45 1.819 89.20 1.623 BT EL 89.30 1.823 88.80 1.656 EBC 87.30 1.765 89.20 1.726 BT 93.80 1.950 93.50 1.905 94.40 1.936 94.60 1.913 95% TBC 90.20 1.889 90.20 1.829 EBC 90.30 1.894 90.10 1.820 BT 89.40 1.876 89.40 1.813 EL 92.30 1.923 93.00 1.910 TBC 95.10 1.940 94.80 1.928 EBC 94.70 1.934 94.30 1.920 BT 94.80 1.939 94.70 1.925 Author's personal copy ARTICLE IN PRESS 504 S.X. Chen, H. Cui / Journal of Econometrics 141 (2007) 492–516 et al. (1991) and the linear regression by Chen (1993). It shows that the Bartlett property of the EL is still preserved even in the case of over-identification. Although the Bartlett factor can admit a rather involved expression with over-identified moment restrictions, proving that the EL is Bartlett correctable provides the theoretical foundation to the proposed easily implementable empirical Bartlett correction and bootstrap calibration of the EL ratio. Although we have focused on the coverage accuracy of the EL confidence regions, the results of this paper have implications on hypothesis tests. For testing the simple hypothesis, H0 : y ¼ y0 , a size a EL test rejects H0 if rðy0 ÞXca . The Bartlett corrected EL test rejects H 0 if rðy0 ÞXb^ c ca . The latter test has more accurate size approximation than the ^ can be used to test over-identification original EL test. The maximum EL ratio ‘ðyÞ restrictions EfgðX ; yÞg ¼ 0, as proposed in Qin and Lawless (1994) and Kitamura (2001), which mirrors the GMM test of Hansen (1982). The expansion given in (2.8) would be useful in studying the second-order properties of the EL over-identification restrictions test. The use of the bootstrap to carry out the Bartlett correction empirically is due to a rather involved expression for the Bartlett factor. Although it may be expected that the direct bootstrap calibration would give the same effect as the Bartlett correction, the justification of the direct bootstrap method inevitably needs those cumulants and the Edgeworth expansions established in this paper. The results established in Theorems 1 and 2 can be extended to independent but not identically distributed samples, for instance, those arisen in a regression study. We need to modify a, b and g as follows: ! n n k j X X q G ð0; y0 Þ j j aj1 ...j k ¼ n1 E½wi1 ðy0 Þ . . . wi k ðy0 Þ; bj;j1 ...j k ¼ n1 E and qZj1 . . . qZjk i¼1 i¼1 ! n l j m k t p X 1 q w ðy Þ q w ðy Þ q w ðy Þ 0 0 i 0 i E . . . : p1 i gj;j1 ...j l ;k;k1 ...km ;...;p;p1 ...pt ¼ pt . j1 jl k1 km n i¼1 qy . . . qy qy . . . qy qy . . . qy P We need also to re-define V n as n1 ni¼1 VarfgðX i ; y0 Þg. These forms of a and V n were employed in Chen (1993) to establish Bartlett correction for linear regression where r ¼ p. Conditions (2.1) should be modified to reflect the independent but not identically distributed nature of data. Similar conditions as those given in Theorem 20.6 of Bhattacharya and Rao (1976) are required. Then, it may be shown that Theorem 1 is true by employing Skovgaard (1981) on transformation of Edgeworth expansions. Theorem 2 is then a consequence of Theorem 1 as the calculation of the cumulants follows the same spirits given in Appendix A for independent and identically distributed samples. Acknowledgments The authors thank two referees, Professor Gautam Tripathi and the Editor, Professor Takeshi Amemiya, for valuable comments and suggestions which improve the presentation of the paper. The research was supported by a National University of Singapore Academic Research Grant, a National Science Foundation Grant (SES-0518904) and a RFDP of China Grant (20020027010). Author's personal copy ARTICLE IN PRESS S.X. Chen, H. Cui / Journal of Econometrics 141 (2007) 492–516 505 Appendix A We provide some technical details on the log EL ratio rðy0 Þ in Appendix A.2, the sign root decomposition in Appendix A.3, and the proofs of the two theorems in Appendix A.4. More details on these derivations can be found in Chen and Cui (2005). A.1. Basic formulae We first present some basic formulae which will be used throughout the derivations. 1 Recall that O ¼ ðokl Þpp ¼:UL1 where okl ¼ ukl l1 l . Since GðZÞ ¼ S QðZÞ where 0 1 ! 0 0 OT 1 T 1 T T I þ S 12 ðS12 S 12 Þ S12 S 12 ðS 12 S 12 Þ B C S1 ¼ ¼ @ 0 I rp 0 A, 1 T 1 T T ðS 12 S 12 Þ S 12 ðS 12 S 12 Þ O 0 OOT it can be checked that bj;k j qG ð0; y0 Þ ¼E ¼ djk qZk 0 B1 1 A B C B ¼: @ A ¼ S 1 0 Br and 0 1 0 B C ¼ @ A2 A. OA1 Here AT ¼ ðA1 ; . . . Ar ÞT ¼:ðAT1 ; AT2 ÞT , where A1 ¼ ðA1 ; . . . ; Ap ÞT and A2 ¼ ðApþ1 ; . . . ; Ar ÞT constitute a partition of A. Therefore for positive integers k and a, Bk ¼ 0 for kpp; Brþk ¼ okl Al Bpþa ¼ Apþa for apr p and for kpp. ðA:1Þ Let B1 ¼ ðB1 ; . . . ; Br ÞT and B2 ¼ ðBrþ1 ; . . . Brþp ÞT . Since SB ¼ ðAT ; 0Tp1 ÞT , it means that B1 þ S 12 B2 ¼ A. As S12 ¼ ðgj;k Þrp and from (A.1) we have gj;k Brþk ¼ Aj IðjppÞ, (A.2) where I is the indicator function. Since ðBp;q ÞðrþpÞðrþpÞ ¼ S1 ðAij Þ ðC i;l Þ ðC i;l ÞT 0 ! , (A.3) we have S 21 ðBj;k Þrp ¼ ðC k;m ÞTpr and S21 ðBj;rþa Þrp ¼ 0: As S21 ¼ ðgj;k ÞT , these mean gj;k Bj;l ¼ C l;k for lpr and kpp and gj;k Bj;rþa ¼ 0. (A.4) Furthermore, (A.3) also implies the following which links the Bs;t system with the Ajm - and the C j;m -systems: 0 1 ðBk;pþb Þ ðBk;rþl Þ ðBk;l Þ B pþa;l C B ðB Þ ðBpþa;pþb Þ ðBpþa;rþl Þ C @ A rþk;l rþk;pþb rþk;rþl ðB Þ ðB Þ ðB Þ 0 1 ðomk C pþb;m Þ 0 ðomk C l;m Þ B C pþa;l pþa;pþb pþa;l C ðA Þ ðA Þ ðC Þ ¼B ðA:5Þ @ A. ðokm ½onm C l;n Aml Þ ðokm ½onm C pþb;n Am;pþb Þ ðokm C m;l Þ Author's personal copy ARTICLE IN PRESS S.X. Chen, H. Cui / Journal of Econometrics 141 (2007) 492–516 506 In a similar fashion, we can establish the following links between bs;t and ðaj i ; gj;i Þ systems where t and i contains either single or double superscripts: bl;pþa;pþc ¼ ool ½gpþc;pþa;o þ gpþa;pþc;o ; bpþa;pþb;pþc ¼ 2apþa;pþb;pþc ; bl;pþa;pþn ¼ ool gpþa;on ; bl;pþm;pþc ¼ ool gpþc;om , bpþa;pþm;pþc ¼ gpþc;pþa;m þ gpþa;pþc;m , bl;pþm;pþn ¼ 0, bpþa;pþb;pþn ¼ gpþa;n;pþb þ gpþa;pþb;n ; bpþa;pþm;pþn ¼ gpþa;mn , brþk;pþa;pþc ¼ 2oko aopþa;pþc oko ono ½gpþc;pþa;n þ gpþa;pþc;n , brþk;pþa;pþn ¼ oko omo gpþa;mn oko ½go;n;pþa þ go;pþa;n , brþk;pþm;pþc ¼ oko ono gpþc;nm oko ½gpþc;o;m þ go;pþc;m ; brþk;pþm;pþn ¼ oko go;mn . ðA:6Þ See Chen and Cui (2005) for details. A.2. Derivations of (2.8) and (2.9) We shall expand each term on the right of (2.7). By ignoring terms of Op ðn5=2 Þ, the first term " # j n n 2 j 3 j T 1 X j 1 X k k l k l m qw ðy Þ 1 q w ðy Þ 1 q w ðy Þ 0 i 0 ^ ^ i 0 ^ ¼ l^ n l^ n y y þ y^ y^ y^ wi ðyÞ wji ðy0 Þ þ i k y^ þ k l k l m 2 6 qy qy qy qy qy qy i¼1 i¼1 j j k j k j k l j k l j k l m ¼ l^ Aj þ gj;k l^ y^ þ l^ y^ C j;k þ 12 gj;kl l^ y^ y^ þ 12 l^ y^ y^ C j;kl þ 16 gj;klm l^ y^ y^ y^ . Similarly, the second term n X T l^ n1 ^ i ðyÞ ^ T l^ wi ðyÞw i¼1 ^ j ^ h 1 ¼ll n n X i¼1 ( ) j 2 h l qw ðy Þ 1 q w ðy Þ 0 0 i wji ðy0 Þwhi ðy0 Þ þ whi ðy0 Þ i l y^ ½2; j; h þ wji ðy0 Þ l 2 qy qy qyk j i j i l 1 j i l k ¼ l^ l^ ðAji þ dji Þ þ l^ l^ y^ fðC j;i;l þ gj;i;l Þ½2; j; ig þ l^ l^ y^ y^ fðC j;i;lk þ gj;i;lk Þ½2; j; ig 2 j i l k j;l;i;k j;l;i;k þ l^ l^ y^ y^ fðC þg g j j j i j i l j i l j i l k ¼ l^ l^ þ l^ l^ Aji þ 2gj;i;l l^ l^ y^ þ 2C j;i;l l^ l^ y^ þ ðgj;i;lk þ gj;l;i;k Þl^ l^ y^ y^ þ Op ðn5=2 Þ. For the third term n T 2 1 X ^ 3 ¼ 2 l^ j l^ i l^ h ðAjih þ ajih Þ þ 2l^ j l^ i l^ h y^ k gj;i;h;k þ Op ðn5=2 Þ. n ½l^ wi ðyÞ 3 3 i¼1 Finally, n1 Pn i¼1 T ^ 4 ¼ l^ j l^ i l^ h l^ g ajihg þ Op ðn5=2 Þ. ½l^ wi ðyÞ Author's personal copy ARTICLE IN PRESS S.X. Chen, H. Cui / Journal of Econometrics 141 (2007) 492–516 507 We then have for a; b; c; d 2 f1; 2; . . . ; r pg, f ; g; h; i; j 2 f1; 2; . . . ; rg, k; l; m; n; o 2 f1; 2; . . . ; pg and q; s; t; u 2 f1; 2; . . . ; r þ pg that ^ ¼ 2Bj Aj Bj Bj þ 2Bj;q Bq ðAj þ Bj Þ bj;uq Bu Bq ðAj þ Bj Þ n1 lðyÞ 2Bj;u Bu;q Bq ðAj þ Bj Þ þ bu;qs Bj;u Bq Bs ðAj þ Bj Þ bj;uq bu;st Bq Bs Bt ðAj þ Bj Þ Bj;uq Bu Bq ðAj þ Bj Þ þ 13 bj;uqs Bu Bq Bs ðAj þ Bj Þ þ 2bj;uq Bu;s Bs Bq ðAj þ Bj Þ þ 2gj;k fBj;q Bq Brþk þ ½12 bj;uq Bu Bq Brþk þ Bj;u Bu;q Bq Brþk 12 bu;qs Bj;u Bq Bs Brþk bj;uq Bu;s Bq Bs Brþk þ 12 bj;uq bu;st Bq Bs Bt Brþk þ 12 Bj;uq Bu Bq Brþk 16 bj;uqs Bu Bq Bs Brþk 12 bj;uq Bu Bq Brþk;s Bs ½2; j; r þ k þ Bj;u Bu Brþk;q Bq þ 14 bj;uq brþk;st Bu Bq Bs Bt g þ 2C j;k fBj Brþk Bj;q Bq Brþk ½2; j; r þ k þ 12 bj;uq Bu Bq Brþk ½2; j; r þ kg þ gj;kl fBj Brþk Brþl þ Brþk Brþl Bj;q Bq ½3; j; r þ k; r þ l 12 Bj Brþk brþl;uq Bu Bq ½3; j; r þ k; r þ lg C j;kl Bj Brþk Brþl þ 13 gj;klm Bj Brþk Brþl Brþm Bj;u Bu Bj;q Bq 14 bj;uq bj;st Bu Bq Bs Bt þ bj;uq Bu Bq Bj;s Bs Bj Bi Aji þ Bj Bi;q Bq Aji ½2; j; i 12 bj;uq Bu Bq Bi Aji ½2; j; i þ 2gj;i;l fBj Bi Brþl Bj Bi Brþl;q Bq þ 12 brþl;uq Bj Bi Bu Bq Brþl Bi Bj;q Bq ½2; j; i þ 12 bj;uq Bu Bq Bi Brþl ½2; j; ig þ 2Bj Bi Brþl C j;i;l ðgj;i;lk þ gj;l;i;k ÞBj Bi Brþl Brþk 23 ajih Bj Bi Bh þ 2ajih Bj Bi Bh;q Bq ajih bj;uq Bu Bq Bi Bh 23 Ajih Bj Bi Bh þ 2gj;i;h;k Bj Bi Bh Brþk 12 ajihg Bj Bi Bh Bg þ Op ðn5=2 Þ. Applying (A.1) and (A.4), it may be shown that the third to the 18th terms on the righthand side cancel each other and the application of (A.4) simplifies the 20th term. Keeping all the other terms, we have (2.8). Now bringing in the expansion for ‘ðy0 Þ in (2.5) we have n1 rðy0 Þ ¼ ðAj þ Bj ÞðAj þ Bj Þ Aji ðAj Ai Bj Bi Þ 2C j;k Bj Brþk 2gj;i;l Bj Bi Brþl þ 23 ajih ½Aj Ai Ah þ Bj Bi Bh þ gj;kl Bj Brþk Brþl þ Aji ðAhi Aj Ah Bi;q Bq Bj ½2; i; jÞ bj;uq ½C j;k Brþk Brþk;s Bs gj;k þ Bj;s Bs Aji Bi Bu Bq 2ajih Bj Bi Bh;q Bq þ Bj;u Bj;q Bu Bq þ 2C j;k Bj;q Brþk Bq gj;kl Brþk Brþl Bj;q Bq 2gj;kl Bj Brþl Brþk;q Bq þ 2gj;i;l ðBj Bi Brþl;q Bq þ Brþl Bi Bj;q Bq ½2; j; iÞ þ ð14 bj;uq bj;st 12 bj;uq brþk;st gj;k ÞBu Bq Bs Bt þ 12 gj;kl bj;uq Bu Bq Brþl Brþk þ ðgj;kl brþl;uq gi;j;k bi;uq gj;i;k bi;uq ÞBu Bq Bj Brþk 2gj;i;h;k Bj Bi Bh Brþk þ ðgj;i;lk þ gj;l;i;k ÞBj Bi Brþl Brþk 13 gj;klm Bj Brþk Brþl Brþm þ 12 ajihg Bj Bi Bh Bg þ ðajih bh;uq gj;i;l brþl;uq ÞBj Bi Bu Bq þ C j;kl Bj Brþk Brþl 2C j;i;l Bj Bi Brþl þ 23 Ajih ðBj Bi Bh þ Aj Ai Ah Þ 2ajih Agh Aj Ai Ag þ ajgf aihf Aj Ai Ah Ag 12 ajihg Aj Ai Ah Ag þ Op ðn5=2 Þ. ðA:7Þ Author's personal copy ARTICLE IN PRESS 508 S.X. Chen, H. Cui / Journal of Econometrics 141 (2007) 492–516 Now the terms appeared on the third line of the above equation cancel each other. To appropriate this, by applying the relationships implied by (A.5) together with (A.1) and (A.4), bj;uq ½C j;k Brþk Brþk;s Bs gj;k þ Bj;s Bs Aji Bi Bu Bq ¼ ½bj;uq C j;k Brþk bl;uq gl;k Brþk;pþa Bpþa bl;uq gl;k Brþk;rþm Brþm bl;uq Alpþa Bpþa bpþb;uq Apþbpþa Bpþa þ bl;uq Bl;pþa Bpþa þ bpþb;uq Bpþb;pþa Bpþa þ bpþa;uq Bpþa;rþm Brþm Bp Bq ¼ ½bj;uq C j;k Brþk bl;uq ðBl;pþa Al;pþa ÞBpþa bl;uq C l;m Brþm þ bl;uq ðBl;pþa Al;pþa ÞBpþa bpþb;uq Apþbpþa Bpþa þ bpþa;uq Bpþb;pþa Bpþa bpþa;uq C pþa;m Brþm Bu Bq ¼ 0. Applying again (A.5), we can express the terms appeared in the first two lines of (A.7) by Al Al Akl Ak Al 2Al;pþa Apþa Al þ 23 aklm Ak Am Al þ 2okl C pþa;k Apþa Al þ ½2akl;pþa gpþa;mn omk onl Apþa Ak Al þ 2½al;pþa;pþb gpþa;pþb;k okl Apþa Apþb Al which leads us to (2.9). A.3. Expansion for R3 We subtract Rl2 Rl2 from all the terms appeared in line 4 and below in (2.9). Fortunately all the terms which do not have Al appeared cancel out with those appeared in Rl2 Rl2 . Hence, the remaining terms can be written as 2Rl1 Rl3 . The pursuit for an expression of R3 is done by repeatedly employing formulae (A.5) and (A.6) as well as (A.1), (A.2) and (A.4). For instance, the terms appeared in the fourth line of (2.9) Aji Ahi Aj Ah þ Bj;u Bj;q Bu Bq 2Aji Bi;q Bq Bj þ 2C j;k Bj;q Brþk Bq ¼ Akl Akm Am Al þ 2Akl Ak;pþa Apþa Al þ 2Al;pþa Apþa;pþb Apþb Al þ Ak;pþa Al;pþa Ak Al þ Apþal Apþbl Apþa Apþb þ oml onl C pþa;m C pþb;n Apþa Apþb þ onl okm C pþa;n C pþa;k Am Al 2omk C pþb;m Apþa;k Apþb Apþa 2omn okl C n;k C pþa;m Apþa Al 2okl C pþa;k Apþa;pþb Apþb Al 2oml okn C pþa;k C pþa;m An Al , and the terms in the fifth line gj;kl Brþk Brþl Bj;q Bq 2gj;kl Bj Brþl Brþk;q Bq ¼ gm;kl Bpþa Brþk Brþl Bm;pþa gpþb;kl Bpþa Brþk Brþl Bpþb;pþa gpþb;kl Brþk Brþl Brþn Bpþb;rþn 2gpþb;kl Bpþa Bpþb Brþl Brþk;pþa 2gpþa;kl Bpþa Brþl Brþm Brþk;rþm ¼ gm;kl okn olo ovm C pþa;v Apþa An Ao þ gpþb;kl okn olo Apþb;pþa Apþa An Ao þ gpþb;kl okn olo omv C pþb;m An Ao Av 2gpþb;kl okn olo ovn C pþa;v Apþa Apþb Ao þ 2gpþb;kl okn olo An;pþa Apþa Apþb Ao þ 2gpþa;kl okv oln omo C v;m Apþa An Ao , and so on for the other terms. Author's personal copy ARTICLE IN PRESS S.X. Chen, H. Cui / Journal of Econometrics 141 (2007) 492–516 509 Let us define 5 lkm nm k n Rl31 ¼ 38 Alm Akm Ak þ 13 Alkm Ak Am 12 a A A A 5 knm lm k n 12 a A A A þ 49 alkn aomn Am Ak Ao 14 alknm Am Ak An , Rl32 ¼ Alk;pþa Apþa Ak þ Al;pþa;pþb Apþa Apþb 12 okn oml C pþa;km Apþa An okl C pþa;pþb;k Apþa Apþb þ 12 okm C pþa;k Alm Apþa þ 12 Alk Ak;pþa Apþa þ Alpþa Apþa;pþb Apþb þ 12 Alpþa Apþak Ak 12 okm onl C pþa;n C pþa;k Am okl omn C n;k C pþa;m Apþa okl C pþa;k Apþa;pþb Apþb , Rl33 ¼ 12 ½gm;vo ovn ool okm 23 anml okm C pþa;k Apþa An þ 12 gpþb;ko okn ool omv C pþb;m An Av þ ½12 gpþb;ko okn ool alnpþb Apþb;pþa Apþa An þ ovk ½onl ðgk;pþa;n þ gpþa;k;n Þ alkpþb 12 gpþb;mn oml onk C pþa;v Apþa Apþb þ gpþa;ko oon oml okv C v;m Apþa An þ ½12 gpþb;mk oml okn alnpþb An;pþa Apþa Apþb , Rl34 ¼ gpþa;pþb;n ono oml C o;m Apþa Apþb apþa;pþb;pþc Al;pþc Apþa Apþb þ ½ðgpþc;pþa;n þ gpþa;pþc;n Þonl 2al;pþa;pþc Apþc;pþb Apþa Apþb þ ðgpþc;pþa;o þ gpþa;pþc;o Þoon okl C pþc;k Apþa An alk;pþa Am;pþa Ak Am þ apþa;pþb;pþc oml C pþc;m Apþa Apþb 23 alkm Am;pþa Apþa Ak ½32 ako;pþa þ 14 gpþa;mn omk ono Alo Apþa Ak 2ak;pþa;pþb Alpþb Apþa Ak ½am;pþa;pþb þ gpþa;pþb;k okm Alm Apþa Apþb , 0 0 0 0 0 0 0 0 Rl35 ¼ ½12 alk;pþa amn;pþa 18 ol l om m on n ok k gpþa;l m gpþa;n k Am An Ak 0 0 0 0 þ ½2apþa;kf almf alkm;pþa 13 almn ðakn;pþa 12 gpþa;m n om k on n Þ 0 0 0 0 0 0 0 0 0 0 0 12 om m ok k ol l ðol v gpþa;m l gv;l k 13 gpþa;m k l ÞApþa Ak Am 12 ½3alk;pþa;pþb þ 23 aklv ðav;pþa;pþb 12 gpþa;pþb;n onv Þ 0 0 0 0 þ ðakvpþa 12 gpþa;mn omk onv Þðalvpþb 12 gpþb;m n om l on v ÞApþa Apþb Ak þ ½al;pþa;f apþb;pþc;f al;pþa;pþb;pþc ðalk;pþc 12 gpþc;mn oml onk Þ ðak;pþa;pþb gpþa;pþb;v Þovk Apþa Apþb Apþc and 0 0 0 Rl36 ¼ f2al;pþa;f ampþbf þ almf apþa;pþb;f þ om m on l ½12 ook ovk gpþa;om gpþb;vn 0 0 0 0 0 12 ðgpþc;pþa;m þ gpþa;pþc;m Þðgpþc;pþb;n þ gpþb;pþc;n Þ 0 0 0 0 0 oko gpþb;n k ðgo;m ;pþa þ go;pþa;m Þ 12 apþa;pþb;pþc gpþc;m n 0 0 0 0 0 12 oko go;m n gpþa;pþb;k þ 12 gpþa;pþb;m n þ 12 gpþa;n;pþb;m gApþa Apþb Am . It may be shown after some algebra that Rl3 ¼ P6 l i¼1 R3i . Author's personal copy ARTICLE IN PRESS S.X. Chen, H. Cui / Journal of Econometrics 141 (2007) 492–516 510 A.4. Proof of the Theorems The proof p offfiffiffi Theorem 1 is divided into two parts. In the first part, we derive the cumulants of nR. In the second part, we establish an Edgeworth expansion for the signed root which then leads to an Edgeworth expansion for the EL ratio rðy0 Þ. Cumulants of the signed root R: Since the cumulants of order higher than four are of Oðn2 Þ or smaller, we only need to derive the first four cumulants. As the first and the third cumulants are easier to derive than the second and the fourth, we present them first. From (2.10) and (2.11), and the fact that Rj3 is the product of four zero-mean averages, we have EðRl1 Þ ¼ 0; EðRl2 Þ ¼ n1 ml and EðRj3 Þ ¼ Oðn2 Þ, where ml ¼ 16 n1 alkk . Therefore, the first-order cumulant is cumðRl Þ ¼ n1 ml þ Oðn2 Þ. (A.8) The joint third-order cumulants cumðRl ; Ro ; Rv Þ ¼ EðRl Ro Rv Þ EðRl ÞEðRo Rv Þ½3; l; o; v þ 2EðRl ÞEðRo ÞEðRv Þ ¼ EðRl1 Ro1 Rv1 Þ þ EðRl2 Ro1 Rv1 Þ½3; l; o; v EðRl2 ÞEðRo1 Rv1 Þ½3; l; o; v þ Oðn3 Þ. We note that EðRl1 Ro1 Þ ¼ n1 dlo and EðRl2 Ro1 Þ ¼ n2 ½12 ðalokk dlo Þ alo;pþa;pþa þ 13 alkm aokm þ okl gpþa;o;pþa;k þ ðalk;pþa 12 omk onl gpþa;mn Þaok;pþa þ ðal;pþa;pþb okl gpþa;pþb;k Þao;pþa;pþb . Write Rl2 ¼ Rl21 þ Rl22 where Rl21 ¼ 12 Akl Ak þ 13 aklm Ak Am and Rl22 contains the rest of the terms appeared in (2.11). We have EðRl21 Þ ¼ 16 n1 alkk , EðRl22 Ro1 Rv1 Þ ¼ EðRl22 Þdov þ Oðn3 Þ ¼ Oðn3 Þ and EðRl21 Ro1 Rv1 Þ ¼ n2 ð16 alkk dov 13 alov Þ þ Oðn3 Þ. Thus, EðRl2 Ro1 Rv1 Þ ¼ EðRl2 ÞEðRo1 Rv1 Þ 13 EðRl1 Ro1 Rv1 Þ þ Oðn3 Þ, (A.9) which means that cumðRl ; Ro ; Rv Þ ¼ Oðn3 Þ. (A.10) To compute the second cumulants, we have to derive the expectation Rl2 Rl2 which involves 21 terms. After deriving the expectation of each term and combine them as given in Chen and Cui (2005), we have EðRl2 Ro2 Þ ¼ n2 J lo þ Oðn3 Þ, where J lo is defined in (3.1). (A.11) Author's personal copy ARTICLE IN PRESS S.X. Chen, H. Cui / Journal of Econometrics 141 (2007) 492–516 511 We also need to compute EðRl2 Ro1 Þ þ EðRl3 Ro1 Þ. It may be shown that, with the remaining terms of Oðn1 Þ, lkm okm 1 lok kmm n2 E½Rl31 Ro1 ¼ 58 alokk 38 dlo 29 a 72 a a , 72 a n2 EðRl32 Ro1 Þ ¼ 52 alo;pþa;pþa þ alk;pþa aok;pþa þ 12 alok ak;pþa;pþa þ al;pþa;pþb ao;pþa;pþb þ 12 alo;pþa akk;pþa 12 oko oml gpþa;km;pþa okl gpþa;pþa;k;o þ 12 okm ðgpþa;k;o alm;pþa þ gpþa;k;pþa alom Þ 12 onl oko gpþa;n;pþa;k 12 okm onl ðgpþa;n;m gpþa;k;o þ gpþa;n;o gpþa;k;m Þ þ alo;pþa apþa;pþb;pþb okl omn ðgn;k;pþa gpþa;m;o þ gn;k;o gpþa;m;pþa Þ okl ðgpþa;k;pþb ao;pþa;pþb þ gpþa;k;o apþa;pþb;pþb Þ, n2 EðRl33 Ro1 Þ ¼ alk;pþa aok;pþa alopþb apþa;pþa;pþb þ 12 ovo onl okm gm;vn gpþa;k;pþa 13 okm gpþa;k;pþa aoml þ 12 oko onl gpþb;kn apþa;pþa;pþb þ 12 okn ovl omo gpþb;kv gpþb;m;n þ 12 oko onl omv gpþb;kn gpþb;m;v ovk alk;pþa gpþa;v;o þ ovk onl ðgk;pþa;n þ gpþa;k;n Þgpþa;v;o þ 12 oml okn gpþa;mk aon;pþa þ ono oml okv gpþa;kn gv;m;pþa , n2 EðRl34 Ro1 Þ ¼ 4al;pþa;pþb ao;pþa;pþb 53 alom am;pþa;pþa 72 alk;pþa aok;pþa alo;pþa akk;pþa alo;pþa apþa;pþb;pþb þ oml onk gk;m;o gpþa;pþa;n þ onl ðgpþb;pþa;n þ gpþa;pþb;n Þao;pþa;pþb þ ono okl ðgpþb;pþa;n þ gpþa;pþb;n Þgpþb;k;pþa þ oml gpþb;m;o apþa;pþa;pþb 14 omo onk gpþa;mn alk;pþa okm gpþa;pþa;k alom , n2 EðRl35 Ro1 Þ ¼ 12 alo;pþa akk;pþa þ alk;pþa aok;pþa 32 alo;pþa;pþa 13 alok ak;pþa;pþa þ 16 onv alov gpþa;pþa;n 12 alk;pþa aok;pþa þ 14 omo onv alvpþa gpþa;mn 0 0 0 0 0 0 0 0 18 ol l om o on k ok k gpþa;l m gpþa;n k 0 0 0 0 38 omo onv om l on v gpþa;mn gpþa;m n , n2 EðRl36 Ro1 Þ ¼ 2alk;pþa aok;pþa þ 2al;pþa;pþb ao;pþa;pþb þ alok ak;pþa;pþb 0 0 0 0 þ alo;pþa apþa;pþb;pþb þ 12 om o on l omk ovk gpþa;mm gpþa;vn 0 0 0 0 0 0 12 om o on l ðgpþb;pþa;m þ gpþa;pþb;m Þðgpþb;pþa;n þ gpþa;pþb;n Þ 0 0 0 0 0 om o on l okm ðgm;m ;pþa þ gm;pþa;m Þgpþa;n k 0 0 0 0 0 0 0 0 0 0 12 om o on l apþa;pþa;pþb gpþb;m n 12 om o on l okm gm;m n gpþa;pþa;k 0 0 0 þ 12 om o on l ðgpþa;pþa;m n þ gpþa;n;pþa;m Þ, n2 EðRl2 Ro1 Þ ¼ 12 ðalokk dlo Þ alo;pþa;pþa þ 13 alkm aokm þ al;pþa;pþb ao;pþa;pþb þ alk;pþa aok;pþa þ okl gpþa;o;pþa;k 12 omk onl gpþa;mn aok;pþa okl gpþa;pþb;k ao;pþa;pþb . Author's personal copy ARTICLE IN PRESS S.X. Chen, H. Cui / Journal of Econometrics 141 (2007) 492–516 512 In summary, EðRl2 Ro1 Þ þ EðRl3 Ro1 Þ ¼ n2 K lo þ Oðn3 Þ; ðA:12Þ where K lo is defined in (3.2). In light of (A.11) and (A.12), we have cumðRl ; Ro Þ ¼ n1 dlo þ n2 Dlo þ Oðn3 Þ, (A.13) where Dlo ¼ K lo ½2; l; o þ J lo ml mo . (A.14) The joint fourth-order cumulants of R is cumðRl ; Rk ; Rm ; Rt Þ ¼ EðRl Rk Rm Rt Þ EðRl Rk ÞEðRm Rt Þ½3; l; k; m; t EðRl ÞEðRk Rm Rt Þ½4; l; k; m; t þ 2EðRl ÞEðRk ÞEðRm Rt Þ½6 6EðRl ÞEðRk ÞEðRm ÞEðRt Þ t l k m t l k m t ¼ EðRl1 Rk1 Rm 1 R1 Þ þ EðR2 R1 R1 R1 Þ þ EðR3 R1 R1 R1 Þ t l k m t þ EðRl2 Rk2 Rm 1 R1 Þ½6 EðR1 R1 EðR1 R1 Þ½3; l; k; m; t t l k m t EðRl2 Rk1 ÞEðRm 1 R1 Þ½12 EðR3 R1 ÞEðR1 R1 Þ½12 t l k m t EðRl2 Rk2 ÞEðRm 1 R1 Þ½6 EðR2 ÞEðR1 R1 R1 Þ½4 t l k m t EðRl2 ÞEðRk2 Rm 1 R1 Þ½12 þ 2EðR2 ÞEðR2 ÞEðR1 R1 Þ½6 þ Oðn4 Þ. ðA:15Þ In the above, ½6 means six terms by choosing two superscripts from a total of four; and ½12 implies 12 terms by choosing l from the four superscripts first and then choosing k from the rest of the three. From now on, we will just use, say, ½6 without the details of the superscript rotations to save space. From (A.9), we immediately have t k m t k m t 4 EðRl2 ÞfEðRk1 Rm 1 R1 Þ½4 þ EðR2 R1 R1 Þ½12 2EðR2 ÞEðR1 R1 Þ½6g ¼ Oðn Þ which means the sum of the last three terms in (A.15) is negligible. To facilitate easy expressions, let us define t1 ¼ alkmn ; t2 ¼ dlk dmn þ dlm dkn þ dln dkm , t3 ¼ alkm anoo þ alkn amoo þ almn akoo þ akmn aloo , t4 ¼ alko amno þ almo akno þ alno akmo , t5 ¼ akmn al;pþa;pþa þ almn ak;pþa;pþa þ alkn am;pþa;pþa þ alkm an;pþa;pþa , t6 ¼ alk;pþa amn;pþa þ almo;pþa akn;pþa þ aln;pþa akm;pþa . It is relatively easy to show that t l k m t 3 4 EðRl1 Rk1 Rm 1 R1 Þ EðR1 R1 ÞEðR1 R1 Þ½3; l; k; m; t ¼ n ðt1 t2 Þ þ Oðn Þ. (A.16) Author's personal copy ARTICLE IN PRESS S.X. Chen, H. Cui / Journal of Econometrics 141 (2007) 492–516 513 Derivations in Chen and Cui (2005) show that t l k m t EðRl2 Rk1 Rm 1 R1 Þ½4 EðR2 R1 ÞEðR1 R1 Þ½12 ¼ n3 fool ðgpþa;o;k amn;pþa þ gpþa;o;m akn;pþa þ gpþa;o;n akm;pþa Þ½4 0 0 0 0 6t1 þ 2t2 16 t3 þ 23 t4 ½om l on k gpþa;m n amn;pþa ½6g þ Oðn4 Þ, ðA:17Þ t l k m t EðRl2 Rk2 Rm 1 R1 Þ½6 EðR2 R2 ÞEðR1 R1 Þ½6 0 0 0 0 ¼ n3 f3t1 t2 þ 16 t3 59 t4 þ ½om m on l gpþa;m n akn;pþa ½6 12 ½ool ðgpþa;o;m akn;pþa þ gpþa;o;n akm;pþa Þ þ ook ðgpþa;o;m aln;pþa þ gpþa;o;n alm;pþa Þ½6 0 0 0 0 0 0 þ ½ok l om k ðgpþa;m ;n gpþa;k ;m þ gpþa;k ;n gpþa;m ;m Þ½6 0 0 0 0 0 0 12 gpþa;m n ½ðool on k þ ook on l Þðom n gpþa;o;m þ om m gpþa;o;n Þ½6 0 0 0 0 0 0 0 0 0 0 þ 14 ½ol l om m ðon k ok n þ on n ok k Þgpþa;l m gpþa;n k ½6g þ Oðn4 Þ ðA:18Þ and t l k m t EðRl3 Rk1 Rm 1 R1 Þ½4 EðR3 R1 ÞEðR1 R1 Þ½12 0 0 0 0 0 0 ¼ n3 f2t1 19 t4 þ ½on l ok k ðgpþa;k ;n gpþa;n ;m þ gpþa;n ;n gpþa;k ;m Þ½6 0 0 0 0 0 0 þ 12 ½gpþa;m n ðool on k þ ook on l Þðom n gpþa;o;m þ om m gpþa;o;n Þ½6 0 0 0 0 0 0 0 0 0 0 14 ½ol l om m ðon k ok n þ on n ok k Þgpþa;l m gpþa;n k ½6g þ Oðn4 Þ. ðA:19Þ Combining (A.16)–(A.19) it may be shown that cumðRl ; Rk ; Rm ; Rt Þ ¼ Oðn4 Þ. (A.20) Edgeworth expansion for rðy0 Þ: We first derive an Edgeworth expansion for the distribution of n1=2 R. Let kj be the jth order joint cumulant of n1=2 R. From (A.8), (A.13), (A.10) and (A.20), k1 ¼ n1=2 m þ Oðn3=2 Þ; k3 ¼ Oðn3=2 Þ; k2 ¼ I p þ n1 D þ Oðn3 Þ, k4 ¼ Oðn2 Þ, where I p is the p p identity matrix, m ¼ ðm1 ; . . . ; mp ÞT with ml ¼ 16 alkk and D ¼ ðDlo Þpp . Let Ū A ¼ ðA1 ; . . . ; Ar ; A11 ; . . . ; Arr ; A111 ; . . . ; Arrr ÞT , Ū C ¼ ðC 1;1 ; . . . ; C 1;p ; . . . ; C r;1 ; . . . ; C r;p ; C 1;1;1 ; . . . ; C r;r;p ÞT and Ū ¼ ðU TA ; U TC ÞT is a vector of centralized means. From (2.10), (2.11) and the expansion for R3 given in Appendix A.3, the signed square root n1=2 R can be expressed as a smooth function of U, namely there exists a smooth function h such that n1=2 R ¼ hðŪÞ. We can then use the results given in Bhattacharya and Ghosh (1978) to formally establish Edgeworth expansion for the distribution of n1=2 R under Condition (2.1). In particular, let B be a class of Boreal sets in Rp satisfying Z fðvÞ dv ¼ OðÞ; # 0, sup B2B ðqBÞ Author's personal copy ARTICLE IN PRESS S.X. Chen, H. Cui / Journal of Econometrics 141 (2007) 492–516 514 where qB and ðqBÞ are the boundary of B and -neighborhood of qB, respectively. A formal Edgeworth expansion for the distribution function of n1=2 R is Z 1=2 supPðn R 2 BÞ pðvÞfðvÞ dv ¼ Oðn3=2 Þ, B2B B where pðvÞ ¼ 1 þ n1=2 mT v þ 12 n1 fvT ðmmT þ DÞv trðmmT þ DÞg, fðvÞ is the p-dimensional standard normal density, and trðÞ is the trace operation for square matrices. Let H ¼ ðhij Þpp ¼:mmT þ D. By the symmetry of fðvÞ we have Pf‘ðbÞoca g ¼ Pfðn1=2 RÞT ðn1=2 RÞoca g þ Oðn2 Þ Z ¼ pðvÞfðvÞ dv þ Oðn2 Þ 1=2 kvkoca ( ) Z p X X 1 ¼ Pðw2p oca Þ þ n1 hii ðv2i 1Þ þ hij vi vj fðvÞ dv 1=2 2 kvkoca iaj i¼1 þ Oðn2 Þ ðA:21Þ ¼ a Bc ca f p ðca Þn1 þ Oðn2 Þ, Pp Pp where Bc ¼ i¼1 hii ¼ l¼1 ðml ml þ Dll Þ. We note in particular that the remainder term in (A.21) is Oðn2 Þ rather than Oðn3=2 Þ. This is due to a fact that an even/odd order Hermit polynomial is an even/odd function. This completes the proof. Proof of Theorem 2. Based on the Edgeworth expansion given in (A.21), Pf‘ðbÞoca ð1 þ n1 Bc Þg ¼ Pfw2p oca ð1 þ n1 Bc Þg Bc ca f p fca ð1 þ n1 Bc Þgn1 þ Oðn2 Þ ¼ a þ Oðn2 Þ since the chi-square distribution satisfies Pfw2p oca ð1 þ n1 Bc Þg ¼ Pðw2p oca Þ þ Bc ca f p ðca Þn1 þ Oðn2 Þ and f p fca ð1 þ n1 Bc Þg ¼ f p ðca Þ þ Oðn1 Þ. This proves the theorem. & pffiffiffi Proof of Theorem 3. Note that the bootstrap estimate for bc ¼ 1 þ Bc n1 is n-consistent. Applying the delta method (Bhattacharya and Ghosh, 1978) on top of the derivation in the proof of Theorem 2, we have Pf‘ðbÞoca b^ c g ¼ Pf‘ðbÞoca ð1 þ Bc n1 Þg þ Oðn3=2 Þ ¼ a þ Oðn2 Þ þ Oðn3=2 Þ ¼ a þ Oðn3=2 Þ. ðA:22Þ p ffiffi ffi We note here that the Oðn3=2 Þ term is entirely due to using a n-consistent estimator of bc . This completes the first part of the theorem. ^ It can be shown that its expression is Let R be the sign root decomposition of r ðyÞ. given by replacing in R, the sign root of rðyÞ: (i) all the population moments by their sample averages based on wn and (ii) all A, B and C’s by their corresponding quantities based on the bootstrap resample fX i gni¼1 . As shown in Hall (1992), the cumulants of R have forms Author's personal copy ARTICLE IN PRESS S.X. Chen, H. Cui / Journal of Econometrics 141 (2007) 492–516 515 which essentially replace all those population moments by their sample counterparts based on the original sample w. These lead to, for any x 2 R, ^ jwn g ¼ Pðw2p ox Þ p1 B^ c x f p ðx Þ þ Op ðn2 Þ, Pfr ðyÞox (A.23) where B^ c is a version of Bc by replacing all the population moments by their sample counterparts. It may be shown that under the conditions of the theorem, B^ c ¼ Bc þ Op ðn1=2 Þ. ^ ca jw g ¼ a, we can carry out a Cornish–Fisher type expansion of As c^a satisfies Pfr ðyÞo^ n c^a based on (A.23) and obtain c^a ¼ ca ð1 þ Bc n1 Þ þ Op ðn3=2 Þ. This together with the Edgeworth expansion for rðyÞ given in the proof of Theorem 1 implies that PfrðyÞo^ca g ¼ PfrðyÞoca ð1 þ Bc n1 Þg þ Op ðn3=2 Þ ¼ a þ Oðn3=2 Þ by repeating the derivation of (A.22). In the first equation above, we use again the delta method whose validity is given in Bhattacharya and Ghosh (1978). & References Andrews, D.W.K., 2002. Generalized method of moments estimation when a parameter is on a boundary. Journal of Business and Economic Statistics 20, 530–544. Baggerly, K.A., 1998. Empirical likelihood as a goodness-of-fit measure. Biometrika 85, 535–547. Bartlett, M.S., 1937. Properties of sufficiency and statistical tests. Proceeding of the Royal Society A 160, 268–282. Bhattacharya, R.N., Ghosh, J.K., 1978. On the validity of the formal Edgeworth expansion. Annals of Statistics 6, 434–451. Bhattacharya, R.N., Rao, R.R., 1976. Normal Approximation and Asymptotic Expansions. Wiley, New York. Brown, B.W., Newey, W.K., 2002. Generalized method of moments, efficient bootstrapping, and improved inference. Journal of Business and Economic Statistics 20, 507–517. Chen, S.X., 1993. On the coverage accuracy of empirical likelihood regions for linear regression model. Annals of the Institute of Statistical Mathematics 45, 621–637. Chen, S.X., 1994. Empirical likelihood confidence intervals for linear regression coefficients. Journal of Multivariate Analysis 49, 24–40. Chen, S.X., Cui, H.J., 2005. On the Bartlett properties of empirical likelihood with moment restrictions. Technical Report, Department of Statistics, Iowa State University, Iowa. hhttp://www.public.iastate.edu/songchen/ workingpapers.html/i. Chen, S.X., Cui, H.J., 2006. On Bartlett correction of empirical likelihood in the presence of nuisance parameters. Biometrika 93, 215–220. Chen, S.X., Gao, J., 2006. An adaptive empirical likelihood test for parametric time series regression models. Working Paper, Iowa State University, Iowa. Cui, H.J., Yuan, X.J., 2001. Smoothed empirical likelihood confidence intervals for quantile in the partial symmetric auxiliary information. Journal of System Science and Mathematical Sciences 21, 172–181. DiCiccio, T.J., Hall, P., Romano, J.P., 1991. Empirical likelihood is Bartlett correctable. Annals of Statistics 19, 1053–1061. Donald, S.G., Imbens, G.W., Newey, W.K., 2003. Empirical likelihood estimation and consistent tests with conditional moment restrictions. Journal of Econometrics 117, 55–93. Hansen, B.E., West, K.D., 2002. Generalized method of moments and macroeconomics. Journal of Business and Economic Statistics 20, 460–469. Hansen, L.P., 1982. Large sample properties of generalized method of moments estimators. Econometrica 50, 1029–1054. Author's personal copy ARTICLE IN PRESS 516 S.X. Chen, H. Cui / Journal of Econometrics 141 (2007) 492–516 Hall, P., 1992. The Bootstrap and Edgeworth Expansions. Springer, New York. Hall, P., La Scala, B., 1990. Methodology and algorithms of empirical likelihood. International Statistical Reviews 58, 109–127. Imbens, G.W., 1997. One-step estimators for over-identified generalized method of moments models. Review of Economic Studies 64, 359–383. Imbens, G.W., 2002. Generalized method of moments and empirical likelihood equations. Journal of Business and Economic Statistics 20, 493–506. Jing, B.Y., Wood, A.T.A., 1996. Exponential empirical likelihood is not Bartlett correctable. Annals of Statistics 24, 365–369. Kitamura, Y., 1997. Empirical likelihood methods with weakly dependent processes. Annals of Statistics 25, 2084–2102. Kitamura, Y., 2001. Asymptotic optimality of empirical likelihood for testing moment restrictions. Econometrica 69, 1661–1672. Kitamura, Y., Stutzer, S.M., 1997. An information-theoretic alternative to generalized method of moments estimation. Econometrica 65, 861–874. Kitamura, Y., Tripathi, G., Ahn, H., 2004. Empirical likelihood-based inference in conditional moment restriction models. Econometrica 72, 1667–1714. Newey, W.K., Smith, R.J., 2004. Higher order properties of GMM and generalized empirical likelihood estimators. Econometrica 72, 219–255. Owen, A.B., 1988. Empirical likelihood ratio confidence intervals for a single functional. Biometrika 75, 237–249. Owen, A.B., 2001. Empirical Likelihood. Chapman & Hall, London. Qin, J., Lawless, J., 1994. Empirical likelihood and general estimation equations. Annals of Statistics 22, 300–325. Skovgaard, I.B.M., 1981. Transformation of an Edgeworth expansion by a sequence of smooth functions. Scandinavian Journal of Statistics 8, 207–217. Smith, R.J., 1997. Alternative semi-parametric likelihood approaches to generalized method of moments estimation. Economic Journal 107, 503–519. Tripathi, G., Kitamura, Y., 2004. Testing conditional moment restrictions. Annals of Statistics 31, 2059–2095.