Document 10761181

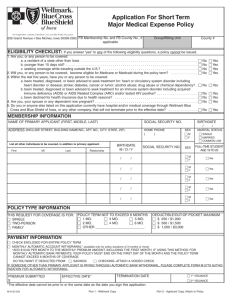

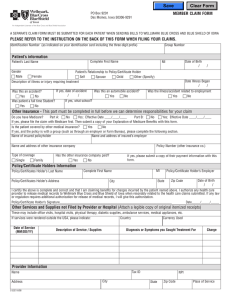

advertisement