Document 10761179

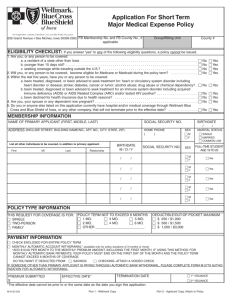

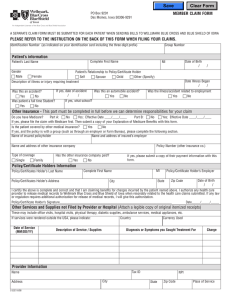

advertisement