Action for Children North Carolina UNC Center for Civil Rights

advertisement

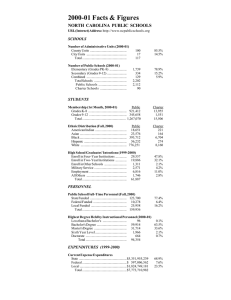

Action for Children North Carolina UNC Center for Civil Rights Alleghany Anson Ashe Avery Beaufort Bertie Bladen Brunswick Buncombe Asheville Cit y Burke Cabarrus Kannapolis City 21,614 59.2% 26.4% 12.6% 0.3% 1.4% 5,680 84.9% 6.7% 5.0% 0.1% 3.3% 1,508 89.6% 2.4% 8.0% 0.1% 0.0% 4,382 34.6% 62.1% 1.5% 0.3% 1.6% 3,208 94.4% 1.6% 3.3% 0.4% 0.2% 2,322 94.4% 0.9% 4.0% 0.3% 0.3% 7,224 51.4% 41.3% 6.9% 0.0% 0.3% 3,349 13.3% 85.1% 0.8% 0.5% 0.2% 5,726 43.2% 49.8% 5.9% 1.0% 0.1% 10,932 70.6% 23.9% 4.6% 0.7% 0.2% 25,255 84.1% 9.2% 5.2% 0.5% 1.0% 3,883 50.3% 43.7% 4.6% 0.2% 1.2% 14,581 77.4% 9.0% 4.8% 0.2% 8.8% 22,446 72.4% 17.4% 8.4% 0.4% 1.3% 4,608 51.6% 31.3% 15.1% 0.3% 1.7% $29,322 $27,016 $25,234 $25,425 $21,845 $24,451 $24,101 $24,401 $22,489 $23,223 $24,805 $28,037 $28,037 $24,591 $30,500 $30,500 16.9% 13.6% 13.9% 20.5% 22.5% 18.2% 17.8% 22.9% 25.5% 24.6% 18.9% 14.6% 27.2% 16.3% 10.7% 23.0% $0.56 $0.51 $0.60 $0.88 $0.61 $0.53 $0.60 $0.78 $0.86 $0.54 $0.59 $0.59 $0.59 $0.63 $0.63 AlamanceBurlington 1,347,177 57.6% 31.4% 7.5% 1.5% 2.0% North Carolina Alexander 1 of 8 School Population Students in Public Schools (average daily membership) White Black Hispanic Native American Asian County Finances 1 Average Per Capita Income (2004) Children Living in Poverty (2004) School District Data 1 varies Property Tax Rate (SY 05-06) 1( Adjusted Property Tax Base in Billions, SY 05-06) County appropriations and Supplemental Taxes for Education (in Millions) $708.3 $9.9 $2.1 $1.3 $1.3 $2.7 $2.9 $3.7 $1.0 $2.1 $14.5 $19.4 $19.4 $5.4 $14.0 $14.0 $1,925.5 $24.5 $4.5 $1.7 $3.3 $3.4 $3.2 $8.2 $2.1 $4.3 $21.6 $35.7 $11.6 $12.4 $28.2 $5.6 $6,922 $6,266 $5,894 $8,594 $7,452 $7,846 $8,997 $7,244 $8,383 $7,901 $7,550 $6,752 $9,800 $6,179 $6,214 $6,569 School Finances Total Per Puil Expenditures Federal Per Pupil Expenditures $562 $461 $383 $620 $1,076 $830 $991 $858 $1,235 $1,367 $568 $463 $814 $516 $336 $573 State Per Pupil Expenditures $4,724 $4,365 $4,541 $6,807 $5,411 $5,831 $6,309 $5,117 $6,040 $5,318 $4,866 $4,624 $5,027 $4,712 $4,370 $4,565 Local Per Pupil Expenditures $1,636 $1,441 $971 $1,168 $965 $1,185 $1,696 $1,269 $1,108 $1,216 $2,116 $1,665 $3,959 $951 $1,507 $1,431 47.7% 42.0% 41.0% 62.8% 70.2% 52.8% 55.8% 63.4% 92.5% 72.6% 58.6% 39.2% 47.2% 51.7% 33.2% 67.8% 13.9% 15.6% 11.5% <5.0% 30.3% 10.6% 8.5% 11.9% 29.2% 22.6% 13.8% 9.4% 12.4% 9.9% 11.4% 18.3% 15.2% 16.1% 15.9% 12.3% 31.9% < 5.0% 16.3% 21.5% 21.1% 23.6% 14.5% 10.0% 20.3% 10.5% 11.7% 15.9% 19.7% 19.2% 9.6% 8.7% 31.2% 11.3% 8.1% 18.5% 33.1% 18.3% 27.4% 6.9% 8.0% 7.5% 15.0% 13.4% 68.1% 66.7% 70.7% 82.2% 60.1% 68.1% 70.2% 59.7% 63.1% 62.6% 56.9% 71.5% 63.1% 60.6% 71.6% 68.4% 32.5% 28.3% 30.4% 41.3% 31.0% 34.3% 33.6% 30.7% 21.4% 29.8% 29.1% 39.7% 45.8% 36.1% 33.9% 27.1% 5.9% 9.2% 5.9% 6.3% 9.6% 5.7% 6.6% 6.0% 2.8% 5.9% 5.1% 5.7% 5.8% 6.5% 6.1% 9.2% 33.0% 28.4% 29.9% 38.8% 32.6% 36.4% 33.6% 30.9% 22.5% 26.8% 30.2% 38.6% 39.8% 35.5% 33.2% 24.6% Students Receiving Free/Reduced Lunch School Performance rd 3 Grade Students Below Proficient on End-of-Grade Math Testing th 8 Grade Students Below Proficient on End-of-Grade Math Testing High School Students Below Grade Level in Alegebra I Graduation Rate (SY 05-06) School Faculty (SY 05-06) Teachers with Graduate 2 Certificate Teachers with No Prior Experience 2 Personnel with Master's Degree 3 Notes: Data are for the 2004-2005 school year unless otherwise noted. 1 2 3 Data for these indicators are county level. For LEAs that are parts of a county, county information is given. Instructional personnel includes principals, assistant principals, classroom teachers, guidance counselors, and librarians/media coordinators. Includes all teachers, guidance counselors, and librarians/media coordinators. Data Sources: Unless otherwise noted, all data from the North Carolina Public Schools Statistical Profile 2006, tables 10, 17, 18, 19, 21, 25, 30. Available online at: http://www.ncpublicschools.org/fbs/resources/data/. Poverty data from the U.S. Census, Small Area Income and Poverty a. Available online at: http://www.census.gov/hhes/www/saipe/index.html. Dat P "Property Tax Rates and Latest Year of Revaluation for North Carolina Counties and Municipalities" Fiscal Year 2005-2006. Available online at: http://www.dor.state.nc.us/publications/propertyrates.html. Adjusted Property Tax Base data from North Carolina Department of Public Instructio .C. DPI), Financial Support n (N Documentation "Low Wealth Funding Allotme http://www.ncpublicschools.org/fbs/allotments/support/. Free and Reduced Price Lunch data from a special request to N.C. DPI Claims Department, October 2005. Graduation Rate data from N.C. DPI, "2006 4-Year Cohort Graduation Rates by LEA." Available online at: http://www.ncpublicschoo rg/newsroom/news/2006-07/20070228-01. ls.o End-of-grade testing d Accountability Services, October 2005. Action for Children North Carolina UNC Center for Civil Rights Camden Carteret Caswell Catawba Hickory City Chatham Cherokee Clay Cleveland Columbus Whiteville City Craven Cumberland Edenton/Chowa n Caldwell Newt on-Conover Cit y 2 of 8 13,029 86.0% 8.9% 4.1% 0.1% 0.8% 1,674 82.4% 15.5% 0.9% 0.1% 1.1% 8,218 85.1% 11.3% 2.5% 0.2% 0.9% 3,346 52.7% 43.2% 3.8% 0.1% 0.2% 16,981 76.9% 9.0% 6.6% 0.3% 7.2% 4,429 51.5% 29.3% 12.1% 0.2% 7.0% 2,815 56.7% 21.6% 14.6% 0.2% 6.9% 7,404 58.5% 21.7% 19.0% 0.3% 0.4% 3,641 93.1% 3.2% 1.7% 1.5% 0.6% 2,436 50.5% 47.6% 1.7% 0.1% 0.1% 1,288 97.6% 1.2% 0.5% 0.2% 0.5% 17,250 66.8% 30.2% 2.1% 0.1% 0.8% 6,917 49.9% 40.2% 4.1% 5.8% 0.1% 2,730 49.2% 46.7% 2.5% 1.1% 0.4% 14,635 58.3% 36.2% 4.2% 0.3% 1.0% 52,521 39.6% 50.8% 6.1% 1.8% 1.7% $25,948 $26,276 $29,177 $22,046 $27,829 $27,829 $27,829 $35,426 $20,549 $26,043 $22,093 $25,006 $23,796 $23,796 $29,456 $29,425 9.6% 15.6% 18.6% 9.7% $0.42 $0.60 School Population Students in Public Schools (average daily membership) White Black Hispanic Native American Asian County Finances 1 Average Per Capita Income (2004) Children Living in Poverty (2004) 15.9% School District Data 1 $0.54 Property Tax Rate (SY 05-06) 1( Adjusted Property Tax Base in Billions, SY 05-06) County appropriations and Supplemental Taxes for Education (in Millions) $0.90 19.7% 24.9% 13.4% 20.1% 22.2% 17.1% 17.6% 24.5% 30.1% 18.1% 19.6% $0.49 $0.49 $0.49 $0.60 $0.52 $0.78 $0.40 $0.58 $0.73 $0.73 $0.61 $0.88 $4.8 $0.6 $8.7 $1.3 $12.9 $12.9 $12.9 $5.3 $2.3 $0.9 $1.3 $5.8 $3.0 $3.0 $5.9 $14.6 $12.2 $1.0 $16.4 $2.5 $18.7 $5.1 $3.4 $15.8 $3.3 $3.4 $0.6 $18.5 $4.1 $1.6 $14.0 $60.9 $6,232 $7,362 $7,730 $7,391 $6,179 $6,770 $7,680 $7,370 $7,501 $8,397 $8,262 $6,799 $7,136 $6,966 $6,679 $6,622 School Finances Total Per Puil Expenditures Federal Per Pupil Expenditures $418 $317 $567 $608 $363 $532 $941 $452 $803 $741 $481 $516 $916 $758 $872 $797 State Per Pupil Expenditures $4,681 $6,402 $4,886 $6,034 $4,527 $4,726 $4,982 $4,649 $5,621 $6,051 $6,620 $4,889 $5,270 $5,302 $4,740 $4,580 Local Per Pupil Expenditures $1,133 $643 $2,276 $749 $1,288 $1,512 $1,758 $2,269 $1,078 $1,605 $1,161 $1,393 $950 $906 $1,067 $1,245 44.3% 28.8% 39.5% 51.9% 35.6% 53.7% 50.0% 40.8% 59.2% 57.7% 47.2% 46.2% 71.6% 65.4% 50.6% 56.6% 8.0% 14.5% 14.9% 14.9% 17.7% 13.2% 8.7% 21.2% 9.0% 9.3% 20.4% 13.6% 9.3% 17.2% Students Receiving Free/Reduced Lunch School Performance rd 3 Grade Students Below Proficient on End-of-Grade Math Testing th 8 Grade Students Below Proficient on End-of-Grade Math Testing High School Students Below Grade Level in Alegebra I Graduation Rate (SY 05-06) School Faculty (SY 05-06) Teachers with Graduate 2 Certificate Teachers with No Prior Experience 2 Personnel with Master's Degree 3 12.0% <5.0% 12.2% 5.1% 10.9% 19.3% 9.9% 16.0% 9.4% 8.6% 8.7% 16.8% 9.2% 13.5% 21.2% 18.6% 14.0% 17.9% 14.8% 10.4% 6.1% 42.1% 7.8% 17.2% 8.0% 18.2% 18.2% 15.2% 5.0% 13.6% 26.6% 17.0% 8.1% 25.3% 65.7% 76.8% 69.2% 64.8% 81.6% 70.4% 67.3% 67.1% 80.9% 67.6% 73.2% 62.5% 62.6% 64.1% 66.9% 64.7% 31.6% 31.1% 37.8% 41.2% 36.1% 36.0% 31.2% 33.7% 41.2% 30.8% 39.2% 37.6% 30.2% 30.9% 31.5% 28.8% 5.2% 3.0% 4.1% 1.2% 3.6% 6.8% 7.3% 8.7% 4.2% 4.1% 2.0% 5.2% 6.0% 8.3% 6.2% 10.2% 30.6% 30.9% 38.5% 39.8% 35.5% 34.9% 34.6% 31.0% 38.0% 30.7% 35.8% 35.9% 31.5% 30.8% 31.5% 30.6% Notes: Data are for the 2004-2005 school year unless otherwise noted. 1 2 3 Data for these indicators are county level. For LEAs that are parts of a county, county information is given. Instructional personnel includes principals, assistant principals, classroom teachers, guidance counselors, and librarians/media coordinators. Includes all teachers, guidance counselors, and librarians/media coordinators. a/. Poverty data from the U.S. Census, Data Small Sources: Area Income Unlessand otherwise Poverty a. noted, Available all data online from at: http://www.census.gov/hhes/www/saipe/index.html. the DatNorth Carolina Public Schools Statistical Profile 2006, Property tables Tax 10, data17, from 18,North 19, 21, Carolina 25, 30.Department Available online of Revenue, at: http://www.ncpublicschools.org/fbs/resources/data/. Poverty data from the U.S. Census, Small Area Income and Poverty a. Available online at: http://www.census.gov/hhes/www/saipe/index.html. Dat P roperty Tax Base data from North Carolina "Property Department Tax Rates of Public and Latest Instructio Year .C. DPI), of Revaluation Financial Support for n North (N Documentation Carolina Counties "Lowand Wealth Municipalities" Funding Allotment, Fiscal Year Formula 2005-2006. Sample Available Calculation." onlineAvailable at: http://www.dor.state.nc.us/publications/propertyrates.html. online at: Adjusted Property Tax Base data from North Carolina Department of Public Instructio .C. DPI), Financial Support n (N Documentation "Low Wealth Funding Allotme r Cohort Graduation Rates by LEA." Available http://www.ncpublicschools.org/fbs/allotments/support/. online at: http://www.ncpublicschoo rg/newsroom/news/2006-07/20070228-01. Free and ls.o Reduced Price Lunch End-of-grade data fromtesting a special data request from atospecial N.C. DPI request Claims to N.C. Department, DPI, Division October of 2005. Graduation Rate data from N.C. DPI, "2006 4-Year Cohort Graduation Rates by LEA." Available online at: http://www.ncpublicschoo rg/newsroom/news/2006-07/20070228-01. ls.o End-of-grade testing d Accountability Services, October 2005. Action for Children North Carolina UNC Center for Civil Rights Currituck Dare Davidson Lexingt on City Thomasville Cit y Davie Duplin Durham Edgecombe Forsyth Franklin Gaston Gat es Graham Granville Greene 3 of 8 3,867 87.1% 10.4% 1.8% 0.3% 0.3% 4,889 89.2% 5.2% 4.7% 0.3% 0.7% 19,608 93.0% 3.2% 2.7% 0.3% 0.8% 3,092 27.4% 46.0% 21.0% 0.2% 5.4% 2,541 30.7% 49.6% 18.5% 0.4% 0.8% 6,229 82.5% 9.7% 7.2% 0.1% 0.4% 8,887 43.4% 33.1% 23.2% 0.2% 0.1% 30,704 26.6% 59.2% 11.7% 0.3% 2.2% 7,625 36.8% 57.7% 5.2% 0.1% 0.2% 48,299 48.7% 37.3% 12.4% 0.2% 1.4% 7,916 51.8% 39.3% 8.2% 0.3% 0.4% 31,695 72.0% 21.1% 5.2% 0.2% 1.4% 1,949 57.3% 41.3% 0.9% 0.2% 0.4% 1,221 87.2% 0.7% 0.2% 11.8% 0.0% 8,674 53.8% 39.8% 5.5% 0.2% 0.7% 3,179 33.3% 50.5% 15.9% 0.0% 0.3% $28,362 $31,401 $27,029 $27,029 $27,029 $30,371 $23,383 $32,649 $23,923 $33,575 $25,191 $28,961 $22,179 $22,230 $22,328 $21,993 12.0% 10.4% 9.2% 34.8% 26.9% 10.9% 21.4% 18.4% 21.5% 16.0% 16.0% 16.6% 15.4% 22.4% 15.6% 22.5% $0.32 $0.25 $0.54 $0.54 $0.61 $0.77 $0.81 $0.93 $0.67 $0.79 $0.89 $0.87 $0.58 $0.70 $0.72 School Population Students in Public Schools (average daily membership) White Black Hispanic Native American Asian County Finances 1 Average Per Capita Income (2004) Children Living in Poverty (2004) School District Data 1 Property Tax Rate (SY 05-06) 1( Adjusted Property Tax Base in Billions, SY 05-06) County appropriations and Supplemental Taxes for Education (in Millions) $0.54 $4.3 $11.7 $9.9 $9.9 $9.9 $3.1 $2.9 $21.6 $2.7 $26.4 $3.2 $12.1 $0.5 $0.8 $3.0 $0.8 $7.4 $14.4 $18.4 $4.9 $3.7 $7.1 $6.1 $77.9 $6.1 $87.7 $9.0 $32.5 $2.3 $0.5 $8.7 $1.9 $7,279 $8,821 $5,767 $8,415 $8,081 $6,184 $6,778 $8,107 $7,348 $7,152 $6,749 $6,086 $8,235 $8,611 $6,426 $8,069 School Finances Total Per Puil Expenditures Federal Per Pupil Expenditures $327 $367 $302 $941 $1,184 $329 $836 $566 $971 $400 $675 $474 $471 $1,156 $423 $1,027 State Per Pupil Expenditures $5,024 $4,798 $4,339 $5,527 $5,097 $4,611 $4,913 $4,796 $5,268 $4,621 $4,708 $4,361 $6,407 $6,853 $4,731 $5,895 Local Per Pupil Expenditures $1,928 $3,655 $1,126 $1,947 $1,799 $1,244 $1,029 $2,745 $1,109 $2,132 $1,366 $1,251 $1,357 $602 $1,272 $1,147 24.4% 21.6% 28.8% 79.8% 82.9% 31.6% 68.3% 47.7% 72.3% 47.1% 54.8% 45.2% 54.4% 52.3% 47.7% 71.5% 7.7% 10.3% 9.4% 9.8% 38.0% 10.8% 17.3% 20.4% 16.2% 15.6% 21.1% 12.4% 16.5% 20.0% 16.5% 22.4% 7.3% 8.9% 11.5% 22.6% 18.6% 9.6% 16.1% 24.5% 23.0% 18.9% 23.4% 15.6% 18.9% 13.0% 16.3% 24.1% 11.1% 10.0% 17.7% 47.7% 23.7% 9.3% 23.3% 34.5% 23.7% 26.6% 27.0% 18.3% 9.7% 10.9% 12.0% 12.6% 72.8% 63.8% 67.1% 43.7% 50.0% 80.0% 70.7% 68.8% 56.3% 73.7% 61.5% 68.1% 69.0% 75.5% 72.4% 60.3% 32.5% 41.7% 28.0% 28.8% 30.0% 37.0% 28.2% 38.8% 26.6% 38.8% 21.6% 29.9% 34.4% 35.1% 22.5% 26.0% 6.8% 4.9% 6.3% 7.2% 17.7% 5.3% 7.1% 8.6% 10.2% 4.5% 8.8% 7.0% 2.5% 4.3% 7.2% 14.0% 32.9% 40.3% 28.3% 28.3% 30.5% 32.3% 28.4% 38.9% 26.5% 36.6% 23.5% 29.1% 32.1% 34.3% 23.9% 27.7% Students Receiving Free/Reduced Lunch School Performance rd 3 Grade Students Below Proficient on End-of-Grade Math Testing th 8 Grade Students Below Proficient on End-of-Grade Math Testing High School Students Below Grade Level in Alegebra I Graduation Rate (SY 05-06) School Faculty (SY 05-06) Teachers with Graduate 2 Certificate Teachers with No Prior Experience 2 Personnel with Master's Degree 3 Notes: Data are for the 2004-2005 school year unless otherwise noted. 1 2 3 Data for these indicators are county level. For LEAs that are parts of a county, county information is given. Instructional personnel includes principals, assistant principals, classroom teachers, guidance counselors, and librarians/media coordinators. Includes all teachers, guidance counselors, and librarians/media coordinators. Data Sources: Unless otherwise noted, all data from the North Carolina Public Schools Statistical Profile 2006, tables 10, 17, 18, 19, 21, 25, 30. Available online at: http://www.ncpublicschools.org/fbs/resources/data/. Poverty data from the U.S. Census, Small Area Income and Poverty a. Available online at: http://www.census.gov/hhes/www/saipe/index.html. Dat P "Property Tax Rates and Latest Year of Revaluation for North Carolina Counties and Municipalities" Fiscal Year 2005-2006. Available online at: http://www.dor.state.nc.us/publications/propertyrates.html. Adjusted Property Tax Base data from North Carolina Department of Public Instructio .C. DPI), Financial Support n (N Documentation "Low Wealth Funding Allotme http://www.ncpublicschools.org/fbs/allotments/support/. Free and Reduced Price Lunch data from a special request to N.C. DPI Claims Department, October 2005. Graduation Rate data from N.C. DPI, "2006 4-Year Cohort Graduation Rates by LEA." Available online at: http://www.ncpublicschoo rg/newsroom/news/2006-07/20070228-01. ls.o End-of-grade testing d Accountability Services, October 2005. Action for Children North Carolina UNC Center for Civil Rights Weldon Cit y Harnett Haywood Henderson Hertford Hoke Hyde Mooresville City Jackson Johnst on Jones Lee 5,139 5.1% 87.9% 1.0% 6.0% 0.1% 2,984 74.3% 21.8% 2.0% 0.5% 1.4% 1,058 2.5% 96.9% 0.3% 0.3% 0.1% 16,988 56.1% 33.0% 9.4% 1.0% 0.4% 7,903 94.0% 2.3% 2.5% 0.7% 0.4% 12,520 79.6% 7.3% 11.6% 0.4% 1.0% 3,522 16.9% 80.7% 1.2% 0.9% 0.3% 6,756 29.7% 46.8% 8.5% 14.1% 0.9% 647 49.1% 44.2% 6.6% 0.0% 0.0% 19,431 72.7% 17.7% 6.7% 0.2% 2.6% 4,452 77.4% 17.1% 3.2% 0.3% 2.0% 3,594 83.2% 2.4% 3.1% 10.7% 0.6% 26,159 65.0% 22.4% 11.8% 0.4% 0.4% 1,367 41.4% 54.7% 3.3% 0.2% 0.4% 9,158 50.9% 27.2% 20.5% 0.5% 0.8% $32,888 $21,497 $21,497 $21,497 $23,659 $25,346 $28,721 $21,736 $18,817 $21,028 $28,832 $28,832 $23,679 $26,907 $23,895 $26,455 17.4% 29.8% 20.4% 33.1% 17.9% 17.5% 14.7% 24.7% 20.3% 23.1% 12.1% 10.2% 17.2% 14.8% 19.9% 16.6% $0.64 $0.87 $0.87 $0.87 $0.74 $0.61 $0.52 $0.91 $0.74 $0.72 $0.44 $0.44 $0.36 $0.78 $0.79 $0.79 IredellSt atesville Halifax 67,130 44.6% 44.4% 6.0% 0.6% 4.4% Roanoke Rapids Cit y Guilf ord 4 of 8 School Population Students in Public Schools (average daily membership) White Black Hispanic Native American Asian County Finances 1 Average Per Capita Income (2004) Children Living in Poverty (2004) School District Data 1 Property Tax Rate (SY 05-06) 1( Adjusted Property Tax Base in Billions, SY 05-06) County appropriations and Supplemental Taxes for Education (in Millions) $39.8 $2.9 $2.9 $2.9 $4.7 $5.2 $9.3 $1.1 $1.6 $0.8 $13.8 $13.8 $5.6 $9.2 $0.6 $3.8 $130.7 $3.3 $3.3 $1.5 $13.0 $12.0 $16.0 $3.2 $3.2 $1.0 $23.8 $6.6 $5.8 $36.0 $0.9 $9.8 $7,152 $8,113 $7,310 $10,033 $6,274 $7,239 $6,750 $8,361 $6,882 $14,439 $6,100 $6,143 $7,689 $6,720 $9,144 $6,552 School Finances Total Per Puil Expenditures Federal Per Pupil Expenditures $446 $1,596 $579 $1,852 $517 $565 $565 $1,146 $986 $1,437 $366 $264 $635 $409 $971 $581 State Per Pupil Expenditures $4,471 $5,695 $4,969 $6,074 $4,641 $4,934 $4,771 $6,124 $5,122 $10,425 $4,394 $4,327 $5,164 $4,597 $7,277 $4,758 Local Per Pupil Expenditures $2,235 $821 $1,762 $2,107 $1,117 $1,740 $1,414 $1,092 $774 $2,577 $1,340 $1,552 $1,891 $1,715 $897 $1,214 46.4% 86.0% 48.3% 88.9% 51.4% 41.5% 40.2% 82.6% 60.9% 63.4% 34.5% 31.1% 45.8% 40.3% 83.8% 51.1% 15.8% 16.4% 18.0% 22.8% 18.2% 6.1% 8.1% 25.7% 27.4% 14.3% 9.3% 6.2% 16.3% 11.0% 10.1% 10.4% 17.8% 28.1% 18.3% 30.8% 16.6% 12.6% 9.3% 21.5% 23.0% 11.8% 10.6% 10.6% 17.3% 11.5% 34.6% 15.5% 36.2% 48.9% 28.7% 44.8% 27.7% 7.9% 7.3% 52.1% 33.0% 9.8% 19.3% 14.2% 17.8% 9.8% 36.9% 27.8% 63.5% 59.4% 60.7% 47.6% 65.5% 68.4% 74.5% 48.9% 47.1% 68.1% 71.6% 64.0% 64.6% 74.5% 64.2% 64.2% 35.0% 25.5% 31.7% 27.1% 28.0% 33.8% 38.6% 24.9% 27.7% 26.3% 33.4% 42.9% 41.0% 27.9% 27.6% 33.0% 8.2% 2.7% 2.3% 6.3% 9.3% 6.3% 4.5% 5.4% 8.7% 15.0% 5.7% 6.5% 7.5% 6.6% 3.9% 7.1% 32.7% 26.8% 32.6% 29.1% 28.9% 32.2% 36.6% 24.0% 25.0% 29.1% 32.9% 43.0% 35.9% 27.1% 31.6% 33.0% Students Receiving Free/Reduced Lunch School Performance rd 3 Grade Students Below Proficient on End-of-Grade Math Testing th 8 Grade Students Below Proficient on End-of-Grade Math Testing High School Students Below Grade Level in Alegebra I Graduation Rate (SY 05-06) School Faculty (SY 05-06) Teachers with Graduate 2 Certificate Teachers with No Prior Experience 2 Personnel with Master's Degree 3 Notes: Data are for the 2004-2005 school year unless otherwise noted. 1 2 3 Data for these indicators are county level. For LEAs that are parts of a county, county information is given. Instructional personnel includes principals, assistant principals, classroom teachers, guidance counselors, and librarians/media coordinators. Includes all teachers, guidance counselors, and librarians/media coordinators. Data Sources: Unless otherwise noted, all data from the North Carolina Public Schools Statistical Profile 2006, tables 10, 17, 18, 19, 21, 25, 30. Available online at: http://www.ncpublicschools.org/fbs/resources/data/. Poverty data from the U.S. Census, Small Area Income and Poverty a. Available online at: http://www.census.gov/hhes/www/saipe/index.html. Dat P "Property Tax Rates and Latest Year of Revaluation for North Carolina Counties and Municipalities" Fiscal Year 2005-2006. Available online at: http://www.dor.state.nc.us/publications/propertyrates.html. Adjusted Property Tax Base data from North Carolina Department of Public Instructio .C. DPI), Financial Support n (N Documentation "Low Wealth Funding Allotme http://www.ncpublicschools.org/fbs/allotments/support/. Free and Reduced Price Lunch data from a special request to N.C. DPI Claims Department, October 2005. Graduation Rate data from N.C. DPI, "2006 4-Year Cohort Graduation Rates by LEA." Available online at: http://www.ncpublicschoo rg/newsroom/news/2006-07/20070228-01. ls.o End-of-grade testing d Accountability Services, October 2005. UNC Center for Civil Rights Macon Madison Mart in McDowell Mitchell Montgomery Moore New Hanover Northampton Onslow Orange 11,454 81.5% 9.8% 8.0% 0.3% 0.4% 4,177 92.5% 2.0% 4.1% 0.5% 1.0% 2,629 96.7% 0.9% 1.8% 0.3% 0.2% 4,443 42.4% 54.9% 2.3% 0.2% 0.2% 6,503 87.3% 5.0% 5.6% 0.3% 1.8% 118,517 39.7% 45.1% 10.4% 0.6% 4.2% 2,296 94.3% 0.5% 5.0% 0.1% 0.2% 4,523 49.1% 27.3% 20.8% 0.0% 2.7% 12,002 67.6% 23.9% 6.8% 1.0% 0.7% 18,233 38.1% 54.3% 5.9% 0.4% 1.2% 23,245 65.1% 29.7% 3.5% 0.4% 1.3% 3,177 17.8% 80.6% 1.3% 0.2% 0.0% 22,212 62.8% 29.6% 5.3% 0.8% 1.5% 6,672 69.6% 24.1% 5.1% 0.4% 0.9% 10,719 61.1% 19.3% 8.3% 0.3% 11.0% $25,812 $24,692 $24,529 $22,295 $23,528 $21,965 $40,416 $20,598 $23,615 $33,447 $27,988 $30,466 $25,074 $28,104 $35,191 $35,191 21.2% 13.6% 17.7% 18.5% 23.4% 16.4% 18.7% 19.7% 15.0% 15.0% 20.5% 16.6% 26.1% 19.9% 9.3% 11.3% $0.79 $0.61 $0.37 $0.51 $0.79 $0.55 $0.84 $0.52 $0.58 $0.46 $0.66 $0.68 $0.88 $0.67 $0.84 Nash-Rocky Mount Lincoln 9,864 43.3% 50.6% 5.5% 0.2% 0.4% Mecklenburg Lenoir 5 of 8 Chapel HillCarrboro City Action for Children North Carolina School Population Students in Public Schools (average daily membership) White Black Hispanic Native American Asian County Finances 1 Average Per Capita Income (2004) Children Living in Poverty (2004) School District Data 1 Property Tax Rate (SY 05-06) 1( Adjusted Property Tax Base in Billions, SY 05-06) County appropriations and Supplemental Taxes for Education (in Millions) $0.84 $3.2 $5.6 $5.6 $1.6 $1.6 $2.6 $85.2 $1.2 $2.1 $7.9 $5.8 $19.1 $1.4 $6.6 $11.4 $11.4 $9.0 $12.5 $5.4 $1.9 $5.2 $5.8 $267.2 $1.5 $5.0 $18.2 $20.5 $50.3 $3.2 $21.2 $17.9 $41.8 $6,654 $6,177 $7,080 $7,659 $8,031 $6,563 $7,116 $7,661 $7,750 $7,084 $6,654 $7,559 $8,547 $6,382 $7,995 $8,893 School Finances Total Per Puil Expenditures Federal Per Pupil Expenditures State Per Pupil Expenditures Local Per Pupil Expenditures Students Receiving Free/Reduced Lunch School Performance rd 3 Grade Students Below Proficient on End-of-Grade Math Testing th 8 Grade Students Below Proficient on End-of-Grade Math Testing High School Students Below Grade Level in Alegebra I Graduation Rate (SY 05-06) School Faculty (SY 05-06) Teachers with Graduate 2 Certificate Teachers with No Prior Experience 2 Personnel with Master's Degree 3 $740 $389 $478 $619 $1,295 $573 $483 $650 $998 $534 $721 $682 $1,226 $540 $405 $367 $4,956 $4,569 $5,084 $6,016 $5,305 $5,006 $4,397 $6,166 $5,322 $4,734 $4,784 $4,470 $6,051 $4,631 $4,701 $4,619 $958 $1,219 $1,518 $1,024 $1,430 $984 $2,236 $845 $1,430 $1,817 $1,149 $2,407 $1,270 $1,211 $2,889 $3,907 56.2% 39.2% 59.2% 51.3% 63.0% 53.1% 47.6% 53.8% 63.6% 45.0% 56.3% 44.5% 82.8% 42.5% 31.7% 21.9% 16.3% 10.8% 6.6% 5.8% 23.5% 12.8% 14.1% 12.0% 19.0% 8.9% 19.0% 8.8% 28.8% 11.8% 13.4% 6.2% 14.6% 12.1% 13.9% 15.7% 11.2% 12.9% 18.9% 11.6% 19.8% 11.3% 18.6% 12.2% 24.7% 11.0% 15.0% 5.1% 18.5% 17.1% 22.5% 9.4% 27.8% 11.4% 30.8% 18.1% 31.8% 12.5% 8.1% 18.4% 24.2% 11.8% 11.0% 12.1% 55.5% 69.4% 66.5% 73.7% 71.2% 64.1% 74.6% 61.9% 72.0% 66.7% 60.1% 60.4% 61.9% 65.2% 66.5% 90.2% 26.8% 33.1% 33.5% 30.8% 28.2% 34.9% 37.7% 27.8% 26.4% 38.1% 26.9% 31.7% 22.5% 30.8% 44.8% 53.6% 4.8% 7.3% 3.9% 6.3% 5.6% 4.1% 9.0% 2.8% 7.1% 3.7% 5.1% 5.2% 6.0% 9.4% 5.1% 5.8% 27.7% 33.0% 32.3% 27.6% 28.3% 34.2% 36.4% 27.9% 25.1% 38.1% 26.4% 32.6% 25.7% 28.6% 44.5% 50.9% Notes: Data are for the 2004-2005 school year unless otherwise noted. 1 2 3 Data for these indicators are county level. For LEAs that are parts of a county, county information is given. Instructional personnel includes principals, assistant principals, classroom teachers, guidance counselors, and librarians/media coordinators. Includes all teachers, guidance counselors, and librarians/media coordinators. Data Sources: Unless otherwise noted, all data from the North Carolina Public Schools Statistical Profile 2006, tables 10, 17, 18, 19, 21, 25, 30. Available online at: http://www.ncpublicschools.org/fbs/resources/data/. Poverty data from the U.S. Census, Small Area Income and Poverty a. Available online at: http://www.census.gov/hhes/www/saipe/index.html. Dat P "Property Tax Rates and Latest Year of Revaluation for North Carolina Counties and Municipalities" Fiscal Year 2005-2006. Available online at: http://www.dor.state.nc.us/publications/propertyrates.html. Adjusted Property Tax Base data from North Carolina Department of Public Instructio .C. DPI), Financial Support n (N Documentation "Low Wealth Funding Allotme http://www.ncpublicschools.org/fbs/allotments/support/. Free and Reduced Price Lunch data from a special request to N.C. DPI Claims Department, October 2005. Graduation Rate data from N.C. DPI, "2006 4-Year Cohort Graduation Rates by LEA." Available online at: http://www.ncpublicschoo rg/newsroom/news/2006-07/20070228-01. ls.o End-of-grade testing d Accountability Services, October 2005. Action for Children North Carolina UNC Center for Civil Rights Pamlico Pasquotank Pender Perquimans Person Pitt Polk Randolph Asheboro City Richmond Robeson Rockingham Rowan-Salisbury Rutherford Sampson Clinton City 6 of 8 1,662 65.3% 32.1% 1.7% 0.5% 0.4% 5,977 46.8% 50.5% 1.9% 0.2% 0.6% 7,160 65.2% 27.8% 6.4% 0.3% 0.3% 1,698 62.7% 35.8% 0.9% 0.2% 0.4% 5,846 57.1% 38.6% 3.5% 0.5% 0.4% 21,593 41.7% 52.0% 4.8% 0.2% 1.3% 2,436 82.4% 10.1% 7.0% 0.3% 0.3% 18,287 84.0% 6.8% 8.0% 0.4% 0.8% 4,522 53.1% 17.5% 27.1% 0.2% 2.2% 8,296 49.6% 41.5% 4.3% 3.8% 0.8% 24,268 20.1% 30.4% 5.9% 43.1% 0.5% 14,667 67.0% 27.2% 5.2% 0.2% 0.4% 20,825 68.8% 23.2% 6.4% 0.3% 1.3% 9,990 78.2% 17.9% 3.4% 0.1% 0.4% 8,287 48.6% 30.5% 19.2% 1.4% 0.3% 2,815 37.8% 46.7% 10.7% 3.8% 1.0% $26,002 $23,256 $22,288 $24,096 $24,695 $26,777 $32,309 $24,639 $24,639 $21,673 $19,621 $24,203 $26,123 $23,486 $23,938 $23,938 19.5% 20.0% 17.3% 22.6% 16.0% 20.2% 13.6% 12.3% 24.2% 23.2% 28.5% 15.9% 14.8% 19.5% 19.7% 24.9% $0.67 $0.84 $0.65 $0.67 $0.65 $0.70 $0.68 $0.53 $0.53 $0.78 $0.80 $0.64 $0.63 $0.62 $0.77 $0.77 School Population Students in Public Schools (average daily membership) White Black Hispanic Native American Asian County Finances 1 Average Per Capita Income (2004) Children Living in Poverty (2004) School District Data 1 Property Tax Rate (SY 05-06) 1( Adjusted Property Tax Base in Billions, SY 05-06) County appropriations and Supplemental Taxes for Education (in Millions) $1.1 $1.9 $4.0 $0.9 $3.3 $8.4 $2.0 $9.2 $9.2 $2.3 $4.1 $5.8 $9.5 $4.3 $3.2 $3.2 $1.8 $7.6 $8.3 $1.6 $6.5 $27.4 $3.6 $15.0 $5.9 $5.6 $12.3 $13.9 $25.0 $10.2 $5.1 $3.0 $8,917 $7,477 $6,691 $8,930 $6,216 $6,886 $7,851 $5,795 $7,002 $6,624 $6,721 $6,844 $6,396 $6,614 $6,384 $7,138 School Finances Total Per Puil Expenditures Federal Per Pupil Expenditures $808 $781 $582 $1,452 $471 $707 $413 $381 $623 $663 $878 $522 $409 $616 $629 $634 State Per Pupil Expenditures $6,884 $5,130 $4,709 $6,387 $4,612 $4,769 $5,747 $4,403 $4,878 $5,087 $5,064 $4,941 $4,568 $4,886 $4,983 $5,178 Local Per Pupil Expenditures $1,224 $1,566 $1,400 $1,091 $1,132 $1,410 $1,691 $1,012 $1,501 $874 $778 $1,380 $1,419 $1,111 $772 $1,327 56.0% 59.8% 55.8% 61.6% 47.4% 52.5% 43.9% 38.8% 54.0% 68.5% 80.5% 50.3% 45.4% 54.6% 69.3% 63.7% 12.0% 21.8% 15.5% 18.6% 17.5% 19.6% <5.0% 13.0% 18.7% 15.1% 19.3% 16.1% 18.5% 12.8% 13.7% 15.0% 16.3% 23.3% 10.5% 21.4% 14.4% 17.1% 7.4% 15.0% 15.6% 22.4% 19.7% 18.2% 14.5% 14.3% 12.5% 14.5% 20.5% 31.8% 8.6% 15.5% 14.4% 14.0% 5.0% 11.8% 12.5% 31.8% 23.7% 24.3% 18.1% 18.2% 12.7% 15.2% 76.2% 48.2% 58.9% 71.3% 75.5% 64.9% 65.9% 73.9% 71.5% 60.0% 55.1% 66.9% 67.6% 66.2% 64.6% 63.1% 28.3% 29.7% 27.0% 31.5% 33.0% 33.3% 45.2% 26.5% 30.3% 26.8% 32.1% 34.6% 29.3% 42.6% 27.4% 25.1% 8.3% 5.8% 6.4% 4.9% 6.2% 6.9% 2.3% 5.8% 7.4% 5.9% 7.4% 6.0% 6.8% 4.3% 6.8% 7.2% 29.7% 28.6% 29.4% 30.9% 31.8% 32.9% 42.9% 26.9% 28.3% 28.4% 32.1% 34.6% 27.8% 41.6% 28.9% 25.2% Students Receiving Free/Reduced Lunch School Performance rd 3 Grade Students Below Proficient on End-of-Grade Math Testing th 8 Grade Students Below Proficient on End-of-Grade Math Testing High School Students Below Grade Level in Alegebra I Graduation Rate (SY 05-06) School Faculty (SY 05-06) Teachers with Graduate 2 Certificate Teachers with No Prior Experience 2 Personnel with Master's Degree 3 Notes: Data are for the 2004-2005 school year unless otherwise noted. 1 2 3 Data for these indicators are county level. For LEAs that are parts of a county, county information is given. Instructional personnel includes principals, assistant principals, classroom teachers, guidance counselors, and librarians/media coordinators. Includes all teachers, guidance counselors, and librarians/media coordinators. Data Sources: Unless otherwise noted, all data from the North Carolina Public Schools Statistical Profile 2006, tables 10, 17, 18, 19, 21, 25, 30. Available online at: http://www.ncpublicschools.org/fbs/resources/data/. Poverty data from the U.S. Census, Small Area Income and Poverty a. Available online at: http://www.census.gov/hhes/www/saipe/index.html. Dat P "Property Tax Rates and Latest Year of Revaluation for North Carolina Counties and Municipalities" Fiscal Year 2005-2006. Available online at: http://www.dor.state.nc.us/publications/propertyrates.html. Adjusted Property Tax Base data from North Carolina Department of Public Instructio .C. DPI), Financial Support n (N Documentation "Low Wealth Funding Allotme http://www.ncpublicschools.org/fbs/allotments/support/. Free and Reduced Price Lunch data from a special request to N.C. DPI Claims Department, October 2005. Graduation Rate data from N.C. DPI, "2006 4-Year Cohort Graduation Rates by LEA." Available online at: http://www.ncpublicschoo rg/newsroom/news/2006-07/20070228-01. ls.o End-of-grade testing d Accountability Services, October 2005. Action for Children North Carolina UNC Center for Civil Rights St anly St okes Surry Elkin City Mount Airy Cit y Swain Transylvania Tyrrell Union Vance Warren Washington Watauga Wayne 6,823 37.7% 47.9% 1.0% 12.5% 0.9% 9,693 75.3% 16.4% 3.9% 0.2% 4.2% 7,316 91.2% 6.7% 1.7% 0.3% 0.2% 8,736 82.4% 4.7% 12.1% 0.1% 0.6% 1,206 80.5% 5.3% 13.5% 0.0% 0.7% 1,832 73.6% 13.8% 8.2% 0.1% 4.2% 1,794 73.6% 0.9% 2.1% 23.1% 0.3% 3,804 88.2% 9.0% 1.7% 0.3% 0.8% 645 48.4% 41.1% 10.2% 0.0% 0.3% 28,608 72.6% 17.0% 9.0% 0.3% 1.0% 8,134 27.5% 65.7% 6.5% 0.1% 0.2% 114,068 56.9% 30.2% 8.2% 0.3% 4.5% 3,081 19.2% 73.3% 3.0% 4.5% 0.0% 2,132 22.1% 75.7% 2.1% 0.0% 0.1% 4,556 94.0% 3.1% 1.8% 0.1% 0.9% 19,306 47.2% 43.3% 8.1% 0.2% 1.3% $21,722 $24,652 $24,526 $25,025 $25,025 $25,025 $21,109 $25,530 $20,242 $27,667 $21,993 $36,685 $19,164 $22,983 $26,033 $24,901 24.7% 15.3% 13.0% 16.8% 15.8% 22.2% 15.9% 17.4% 27.8% 10.9% 24.9% 9.9% 26.4% 26.7% 12.8% 19.0% $1.10 $0.65 $0.60 $0.63 $0.63 $0.63 $0.33 $0.54 $0.70 $0.56 $0.92 $0.61 $0.84 $0.79 $0.40 $0.74 Wake Scotland 7 of 8 School Population Students in Public Schools (average daily membership) White Black Hispanic Native American Asian County Finances 1 Average Per Capita Income (2004) Children Living in Poverty (2004) School District Data 1 Property Tax Rate (SY 05-06) 1( Adjusted Property Tax Base in Billions, SY 05-06) County appropriations and Supplemental Taxes for Education (in Millions) $1.8 $3.9 $2.8 $4.6 $4.6 $4.6 $0.9 $3.9 $0.3 $13.7 $2.4 $76.1 $1.5 $0.6 $6.4 $5.8 $9.2 $9.3 $8.5 $8.4 $1.9 $2.6 $0.6 $6.3 $0.5 $34.3 $6.7 $225.9 $2.5 $1.5 $8.5 $16.6 $8,049 $6,457 $7,019 $6,459 $7,543 $7,384 $8,827 $7,294 $11,836 $6,172 $7,384 $6,976 $8,083 $9,610 $7,533 $6,617 School Finances Total Per Puil Expenditures Federal Per Pupil Expenditures $1,243 $435 $652 $526 $370 $525 $1,222 $486 $996 $373 $1,003 $386 $1,090 $1,615 $445 $643 State Per Pupil Expenditures $5,356 $4,803 $5,110 $4,880 $5,435 $5,061 $6,546 $5,044 $9,768 $4,304 $5,128 $4,411 $5,925 $6,798 $4,922 $4,873 Local Per Pupil Expenditures $1,451 $1,219 $1,257 $1,052 $1,738 $1,798 $1,060 $1,764 $1,072 $1,495 $1,253 $2,179 $1,067 $1,197 $2,166 $1,101 69.4% 43.0% 34.4% 50.0% 27.1% 49.1% 57.4% 44.5% 69.4% 30.3% 80.4% 31.3% 77.2% 86.4% 22.0% 58.1% 13.0% 11.0% 12.5% 7.9% 10.3% 9.7% 21.7% 5.3% 25.6% 8.8% 15.1% 9.7% 27.2% 29.5% 5.5% 16.2% 15.3% 9.4% 12.6% 8.3% <5.0% 10.2% 17.5% 7.5% <5.0% 11.7% 31.2% 11.8% 19.3% 34.9% 5.7% 16.9% 8.8% 7.9% 15.2% 8.5% 5.4% 7.2% 16.4% 12.6% 29.3% 7.9% 30.1% 11.0% 43.9% 30.4% 10.0% 16.1% 55.2% 75.5% 78.1% 79.5% 84.0% 80.7% 66.4% 77.1% 55.8% 71.3% 47.8% 82.6% 68.2% 70.3% 78.5% 61.5% 30.7% 30.4% 32.3% 32.9% 37.4% 29.0% 33.1% 35.6% 35.9% 38.0% 25.7% 38.6% 26.9% 27.0% 48.9% 26.8% 8.1% 5.2% 5.2% 4.9% 5.1% 4.1% 6.9% 3.4% 9.4% 5.9% 13.8% 6.0% 9.3% 3.7% 2.3% 6.0% 28.9% 29.5% 31.5% 33.1% 35.6% 30.7% 29.9% 34.6% 37.0% 33.9% 27.0% 37.4% 29.5% 29.4% 43.7% 27.5% Students Receiving Free/Reduced Lunch School Performance rd 3 Grade Students Below Proficient on End-of-Grade Math Testing th 8 Grade Students Below Proficient on End-of-Grade Math Testing High School Students Below Grade Level in Alegebra I Graduation Rate (SY 05-06) School Faculty (SY 05-06) Teachers with Graduate 2 Certificate Teachers with No Prior Experience 2 Personnel with Master's Degree 3 Notes: Data are for the 2004-2005 school year unless otherwise noted. 1 2 3 Data for these indicators are county level. For LEAs that are parts of a county, county information is given. Instructional personnel includes principals, assistant principals, classroom teachers, guidance counselors, and librarians/media coordinators. Includes all teachers, guidance counselors, and librarians/media coordinators. Data Sources: Unless otherwise noted, all data from the North Carolina Public Schools Statistical Profile 2006, tables 10, 17, 18, 19, 21, 25, 30. Available online at: http://www.ncpublicschools.org/fbs/resources/data/. Poverty data from the U.S. Census, Small Area Income and Poverty a. Available online at: http://www.census.gov/hhes/www/saipe/index.html. Dat P "Property Tax Rates and Latest Year of Revaluation for North Carolina Counties and Municipalities" Fiscal Year 2005-2006. Available online at: http://www.dor.state.nc.us/publications/propertyrates.html. Adjusted Property Tax Base data from North Carolina Department of Public Instructio .C. DPI), Financial Support n (N Documentation "Low Wealth Funding Allotme http://www.ncpublicschools.org/fbs/allotments/support/. Free and Reduced Price Lunch data from a special request to N.C. DPI Claims Department, October 2005. Graduation Rate data from N.C. DPI, "2006 4-Year Cohort Graduation Rates by LEA." Available online at: http://www.ncpublicschoo rg/newsroom/news/2006-07/20070228-01. ls.o End-of-grade testing d Accountability Services, October 2005. Action for Children North Carolina Wilkes Wilson Yadkin Yancey 8 of 8 10,077 86.9% 6.4% 6.0% 0.0% 0.7% 12,557 38.8% 52.3% 7.8% 0.1% 1.0% 6,062 81.5% 4.6% 13.2% 0.2% 0.4% 2,537 92.7% 1.8% 5.0% 0.2% 0.2% $26,753 $26,277 $25,013 $20,267 16.0% 20.4% 13.5% 21.0% $0.61 $0.76 $0.68 $0.50 UNC Center for Civil Rights School Population Students in Public Schools (average daily membership) White Black Hispanic Native American Asian County Finances 1 Average Per Capita Income (2004) Children Living in Poverty (2004) School District Data 1 Property Tax Rate (SY 05-06) 1( Adjusted Property Tax Base in Billions, SY 05-06) County appropriations and Supplemental Taxes for Education (in Millions) $4.5 $5.1 $2.4 $1.7 $10.1 $15.0 $5.6 $2.3 $6,715 $6,642 $6,108 $7,661 School Finances Total Per Puil Expenditures Federal Per Pupil Expenditures $553 $679 $400 $771 State Per Pupil Expenditures $4,900 $4,667 $4,652 $5,865 Local Per Pupil Expenditures $1,262 $1,297 $1,056 $1,024 52.1% 68.6% 38.6% 51.2% 14.5% 15.8% 14.2% 12.8% 9.0% 11.3% 11.4% 6.5% 12.3% 14.0% 13.3% 5.3% 72.1% 55.8% 74.2% 74.6% 30.1% 25.5% 32.5% 24.5% 6.1% 6.1% 5.1% 4.6% 29.5% 25.9% 32.5% 25.5% Students Receiving Free/Reduced Lunch School Performance rd 3 Grade Students Below Proficient on End-of-Grade Math Testing th 8 Grade Students Below Proficient on End-of-Grade Math Testing High School Students Below Grade Level in Alegebra I Graduation Rate (SY 05-06) School Faculty (SY 05-06) Teachers with Graduate 2 Certificate Teachers with No Prior Experience 2 Personnel with Master's Degree 3 Notes: Data are for the 2004-2005 school year unless otherwise noted. 1 2 3 Data for these indicators are county level. For LEAs that are parts of a county, county information is given. Instructional personnel includes principals, assistant principals, classroom teachers, guidance counselors, and librarians/media coordinators. Includes all teachers, guidance counselors, and librarians/media coordinators. Data Sources: Unless otherwise noted, all data from the North Carolina Public Schools Statistical Profile 2006, tables 10, 17, 18, 19, 21, 25, 30. Available online at: http://www.ncpublicschools.org/fbs/resources/data/. Poverty data from the U.S. Census, Small Area Income and Poverty a. Available online at: http://www.census.gov/hhes/www/saipe/index.html. Dat P "Property Tax Rates and Latest Year of Revaluation for North Carolina Counties and Municipalities" Fiscal Year 2005-2006. Available online at: http://www.dor.state.nc.us/publications/propertyrates.html. Adjusted Property Tax Base data from North Carolina Department of Public Instructio .C. DPI), Financial Support n (N Documentation "Low Wealth Funding Allotme http://www.ncpublicschools.org/fbs/allotments/support/. Free and Reduced Price Lunch data from a special request to N.C. DPI Claims Department, October 2005. Graduation Rate data from N.C. DPI, "2006 4-Year Cohort Graduation Rates by LEA." Available online at: http://www.ncpublicschoo rg/newsroom/news/2006-07/20070228-01. ls.o End-of-grade testing d Accountability Services, October 2005.