Muskegon Community College June 30, 2015 REPORT ON FINANCIAL STATEMENTS

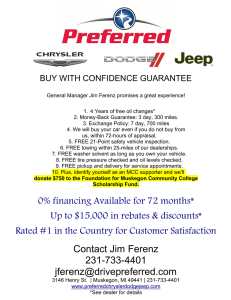

advertisement