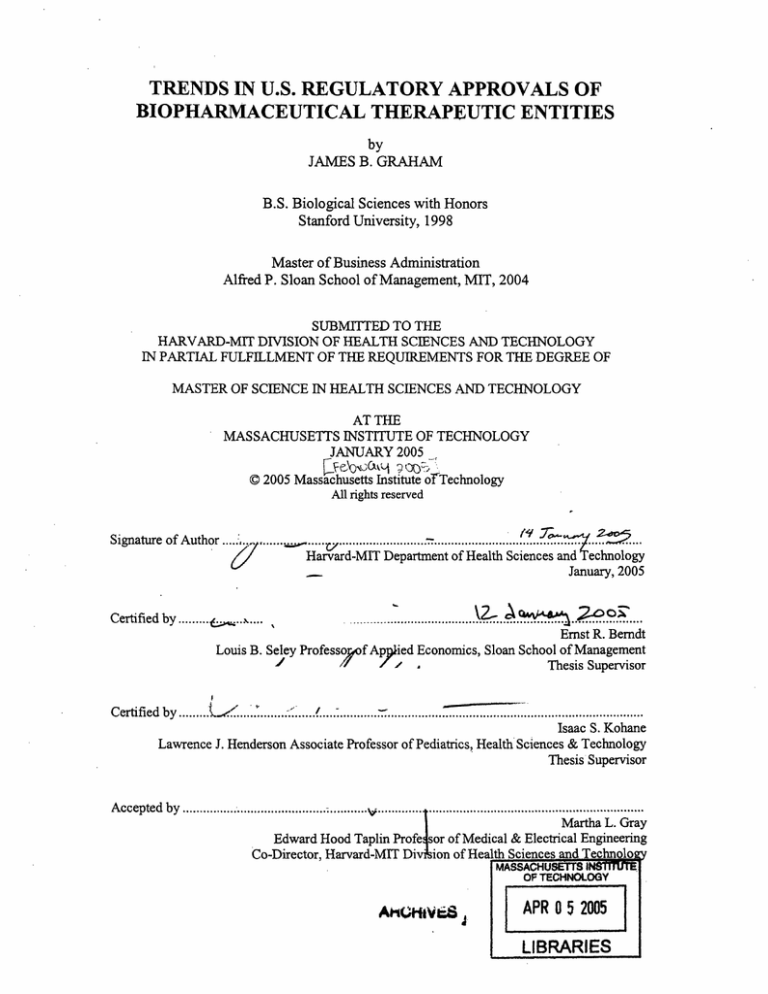

TRENDS IN U.S. REGULATORY APPROVALS OF

BIOPHARMACEUTICAL THERAPEUTIC ENTITIES

by

JAMES B. GRAHAM

B.S. Biological Sciences with Honors

Stanford University, 1998

Master of Business Administration

Alfred P. Sloan School of Management, MIT, 2004

SUBMITTED TO THE

HARVARD-MIT DIVISION OF HEALTH SCIENCES AND TECHNOLOGY

IN PARTIAL FULFILLMENT OF THE REQUIREMENTS FOR THE DEGREE OF

MASTER OF SCIENCE IN HEALTH SCIENCES AND TECHNOLOGY

AT THE

MASSACHUSETTS INSTITUTE OF TECHNOLOGY

JANUARY 2005

© 2005 Massachusetts Institute orTechnology

All rights reserved

Signature of Author

;..

/

;

Harvard-MIT Department of Health Sciences and Technology

2005

_..~~~~~~~_

~January,

Certified by ..........

.

Ernst R. Berndt

Louis B. Seley Professoof Apied Economics, Sloan School of Management

J

Certified by .........

2...A

\2.A....

..........

/

...............

Thesis Supervisor

.........................................

..................................

Isaac S. Kohane

Lawrence J. Henderson Associate Professor of Pediatrics, Health Sciences & Technology

Thesis Supervisor

Accepted by

..

..................................

-

....

...........................................................

Accepte by

Martha L. Gray

Edward Hood Taplin Profe sor of Medical & Electrical Engineering

(rni;reptnr

MThilkinrn

nf

Halth

c.oiepnPs

ndi Tchnnlnnov

v-4

-I

aVI Sv-vv Age -. v-r---nrxvirl-MTT

I.

OF TECHNOLOGY

Ah(WVEd

APR 0 5 2005

An.

I

.BRRE

LIBRARIES

_ _ _____II_

TRENDS IN U.S. REGULATORY APPROVALS OF

BIOPHARMACEUTICAL THERAPEUTIC ENTITIES

JAMES B. GRAHAM

Submitted to the Department of Health Sciences and Technology in partial fulfillment of

the requirements for the degree of Master of Science in Health Sciences and Technology

ABSTRACT

Pharmaceutical productivity, as measured by annual output of new molecular

entities and new therapeutic biologics, has fallen significantly since reaching a peak in

1996. According to Food and Drug Administration (FDA) data, the number of new drug

approvals (new molecular entities and new biologics) fell from 50 in 1996 to 29 in 2003

(FDA-BEP database 2004). Meanwhile, non-inflation adjusted expenditures for research

and development have almost doubled (PhRMA 2004).

This thesis uses time series analysis to characterize historical trends in new drug

introductions. Linear modeling and ARIMA modeling are employed to show that the

large increase in new drug approvals in 1996 is inconsistent with previous trends. The

hypothesis that the 1996 increase in new drug approvals is the consequence of additional

FDA processing capacity pursuant to the implementation of the Prescription Drug User

Fee Act (PDUFA) is considered and rejected, based on an analysis of the underlying

causes of the increase.

Next, approval trends before and after the implementation of PDUFA are

compared. Notably, the percentage of new drug applications resulting in approval has

increased since the implementation of PDUFA while the number of applications reviewed

per year has not changed significantly. The relationship between the success ratio and

drug withdrawal rates is examined, with inconclusive results.

Finally, seasonal trends in new drug application (NDA) submissions and

approvals are described for years preceding and following PDUFA. A significant plurality

of NDA approvals occur in the month of December before and after the implementation

of PDUFA, while December NDA submissions increase in the post-PDUFA period. The

ramifications of these observations on new review guidelines introduced in PDUFA II and

PDUFA III, as well as the implications for NDA submission strategy, are discussed.

Thesis advisors: Dr. Ernst Berndt (MIT Sloan) and Dr. Isaac Kohane (HST)

-3-

Dedication

For Katie, my light and my rock

"We make a living by what we get; we make a life by what we give."

- Winston Churchill

-4-

__

Acknowledgements

The author wishes to thank the following people for their research assistance,

thoughtful discussion, and aid in completing this thesis: Dr. Joseph Bonventre (HST),

Dr. Joseph DiMasi (Tufts CSDD), Bernadette Fendrock (HST), Dr. Howard Golub

(HST), Ed Hass (FDA), Dr. Fiona Murray (MIT Sloan), Dr. Isaac Kohane (HST), and

Marsha Warren (HST).

Professor Ernst Berndt (MIT Sloan) has been an exceptional thesis advisor,

providing guidance, encouragement, and invaluable insights on the nature of the

biopharmaceutical industry. Professor Berndt has generously provided numerous

research materials and many hours of his personal time. Without his help, this thesis

would not have been possible.

Additionally, the author wishes to thank all current students and graduates of the

Biomedical Enterprise Program for their excellent insights on this industry and their

unflagging support. In particular, the author would like to thank Adrian Gottschalk and

Matthew Strobeck, whose research on the biopharmaceutical industry laid the foundation

for many of the analyses presented here. Many of the conclusions presented in this thesis

are the result of discussions with these individuals. All errors are the responsibility of the

author.

-5-

TABLE OF CONTENTS

ABSTRACT

3

......................................................

TABLE OF CONTENTS ................................................................. 6

TABLE OF FIGURES .................................................................................................. 8

1. The significance of productivity in the biopharmaceutical industry .......................... 10

10

1.1

Recent trends in new drug introductions .........................................

1.2

New drug approvals are critical to the biopharmaceutical industry ................. 11

1.3

Balancing profits and productivity in the biopharmaceutical industry ............. 14

1.4

Biopharmaceutical investment in research and development .......................... 17

1.5

Possible explanations for the decline in new drug approvals ........................... 21

1.6

Organizational plan of this thesis ....................................

25

2. Time series analysis of annual new drug introductions 1965-2003 ........................... 27

27

2.1

How should new drug approvals be measured? ........................................

2.2

Rationale for application of time series analyses ..................

2.3

Linear regression on historical observations ....................................

34

2.4

Cyclicality in the biopharmaceutical industry .............................

37

2.5

ARIMA model for NTE approvals ................................................................ 39

2.6

Is the NTE approvals time series mean-reverting? ....................................

2.7

Hypotheses for the decline in NTE approvals since 1996 ............................... 46

3. What factors affect NTE approval volumes

?

.

.................... 33

43

47

..................................

3.1

An inventory model for the NDA approval process ........................................ 47

3.2

Limitations of publicly available data ............................................................. 50

3.3

Population of the NDA inventory model ....................................................... 53

3.4

Calculation of the Success Ratio ................................................................... 57

3.5

Was the increase in NDA approvals in 1996 due to an increase in action

volume, success ratio, or both? .......................................

-6-

____I·_

58

3.6

Dominance of success ratio contradicts the PDUFA hypothesis ..................... 59

3.7

Differences in Action Volume and Success Ratio observed before and after

implementation of PDUFA I .................................................................

3.8

61

Correlation of success ratio and withdrawal rate ............................................ 63

4. Seasonality in NTE Approvals

.

..................................................... 70

4.1

NTE approval volume is elevated in December .........................................

4.2

December effect is driven by a combination of industry submission practices

70

and PDU FA targets ..................................................................................... 71

4.3

December effect was established prior to implementation of PDUFA .......

4.4

NDA submission practices have changed pursuant to PDUFA I ....................78

4.5

PDUFA II review targets have attenuated the December effect for NTE

approvals .........................................

4.6

76

80

Implications of December effect on attainment of PDUFA III targets ............ 81

5. Discussion and conclusions .....................................................

83

5.1

Summary of findings .....................................................

5.2

Future biopharmaceutical industry productivity ............................................. 85

5.3

Better access to NTE filing and approval data is needed ................................ 86

5.4

Towards a systems analysis of the drug development process ......................... 87

83

Bibliography .....................................................

89

Appendix 1: Augmented Dickey-Fuller test ......................................................

93

Appendix 2: ARIMA specification ......................................................

96

Appendix 3: Monthly NTE approvals, 1965-2003 ..................................................... 98

Appendix 4: NDA Flowchart .....................................................

-7 -

100

TABLE OF FIGURES

Figure 1:

FDA NME and therapeutic biological product approvals: 1996-2003 ....................................... 11

Figure 2:

Annual new drug approvals and PhRMA member R&D expenditures 1965-2003 ................... 18

Figure 3:

Exponential curve fit for PhRMA member R&D expenditures, 1965-2003 ............................... 19

Figure 4:

R&D expenditures, total and as a percentage of revenue, 1965-2003 .

Figure 5:

R&D Expenditures by activity type 1999-2002 ............................................................

Figure 6:

Indexed R&D expenditures, Sales and NME introductions 1991-2001 ..................................... 24

Figure 7:

CDER NDA Approvals 1990-2003 ............................................................

30

Figure 8:

NMEs and NCEs by year, 1963-2003 ............................................................

31

Figure 9:

BLA and NME approvals, 1965-2003 ............................................................

33

Figure 10:

New Therapeutic Entity (NTE) introductions, 1965-2003 .......................................................... 34

Figure 11:

New Therapeutic Entity (NTE) introductions with trend line, 1965-1995 ............................... 34

Figure 12:

95% confidence interval for NTE approvals based on 1965-1995 observations ........................ 35

Figure 13:

New Therapeutic Entity (NTE) introductions with trend line, 1996-2003 ............................... 36

Figure 14:

NTE Residuals, 1965-1995 ............................................................

37

Figure 15:

Fourier transform of NTE residuals, 1965-1995 .............................................................

38

Figure 16:

Actual de-trended NTE approvals and fitted model ............................................................

40

Figure 17:

ARIMA (2,1,1) prediction of new NTE approvals, 1996-2003 ................................................... 41

Figure 18:

ARIMA (2,1,1) 95% confidence interval ............................................................

41

Figure 19:

Predicted ARIMA cumulative impulse response .............................................................

42

Figure 20:

Observed NTE approval response, 1996-2003 ............................................................

43

Figure 21:

Three random walk examples with a starting point of 0 and increment of + 0.5 ....................... 44

Figure 22:

Inventory model for NDA flow .............................................................

Figure 23:

Histogram of ratios of NME approvals / NDA approvals by year, 1990-2003 ........................... 51

Figure 24:

Pending NDA volume at beginning of calendar year ............................................................

54

Figure 25:

NDA submissions accepted by calendar year ............................................................

54

Figure 26:

NDA Approvals by calendar year ............................................................

55

Figure 27:

Unsuccessful NDAs - Withdrawals, Non-approvable and Approvable letters ........................... 55

Figure 28:

Comparison of New NDA submissions and NDA exits ............................................................

..............................

20

20

47

56

-8-

__

__

Figure 29:

Net flows in NDA filings under review, 1985-2003 ...................................................

56

Figure 30:

Success Ratio 1985-2003 ....................................................

57

Figure 31:

Action Volume and Success Ratio, pre- and post- PDUFA ...................................................

62

Figure 32:

Safety based NME withdrawals based on year of approval........................................................... 65

Figure 33:

Histogram of drug withdrawals by approval year...................................................

66

Figure 34:

Histogram of years from NDA approval to withdrawal, 1985-2000 .

67

Figure 35:

Success ratio vs. withdrawal rate, 1985-2000 ....................................................

68

Figure 36:

NTE approvals by calendar month, 1965-2003 ...................................................

70

Figure 37:

Review times (in months) for approved NTEs, 1965-1993 ...................................................

72

Figure 38:

Review times (in months) for approved NTEs, 1994-2003 ...................................................

73

Figure 39:

Approved NTE submissions by calendar month, 1965-2003...................................................

74

Figure 40:

NTE approvals by calendar month, 1994-2003 ..............................

Figure 41:

NTE approval percentages by calendar month, 1965-2003 ...................................................

77

Figure 42:

Approved NTE submissions by calendar month, 1965-2003 ...................................................

79

Figure 43:

Approved NTE submissions by calendar month, 2001-2003 ...................................................

80

Figure 44:

NTE approvals by calendar month, 2001-2003 ...................................................

81

...............................

....................................... 75

Table 1:

Upcoming biopharmaceutical product patent expirations ....................................................

13

Table 2:

Biopharmaceutical Mergers and Acquisitions 1988-2000 ....................................................

23

Table 3:

NDA submission type classifications...........................................................................................

28

Table 4:

Percentage of NDA filings designated NME vs. non-NME ....................................................

30

Table 5:

Success ratios, action volumes and NDA approvals 1985-2003 ...................................................

58

Table 6:

Goals of PDUFA I, II, III.....................................................

60

Table 7:

FDA Drug withdrawals 1971-2004 ...................................................

65

-9-

1.

The significance of productivity in the

biopharmaceutical industry

1.1

Recent trends in new drug introductions

The Food, Drug, and Cosmetics Act of 1938 mandated that every new

prescription drug marketed in the United States first receive approval from the U.S. Food

and Drug Administration (FDA). Drug manufacturers must submit to the FDA a New

Drug Application (NDA) comprised of a description of the drug, a statement of its

composition, an analysis of clinical safety data, and a discussion of quality control

protections. The Kefauver-Harris Amendment of 1962 added a requirement for

additional clinical data demonstrating efficacy. NDA approval allows the drug

manufacturer to market and sell the drug in the U.S. market according to labeling

approved by the FDA (Hilts 2003).

According to the FDA Center for Drug Evaluation and Research (CDER), the

NDA process applies to: any new drug molecule, any new salt of a previously approved

drug, any new chemical formulation of a previously approved drug, any therapeutic

combination of two or more previously approved drugs, and any new indication (claimed

use) for a previously approved drug ("NDA approvals" 2003). The FDA uses the term

"new molecular entity" (NME) to denote NDA approvals of the first variety (i.e.,

approvals for new drug molecules). Until recently, NME approvals did not include

biologic drugs, which comprise a growing proportion of marketed therapeutic drugs in the

U.S. (Gosse 1998). Before October 2003, new biological drugs were approved through a

parallel application process called a Biologics License Application (BLA). Since biologic

therapeutics are innovative drugs, the sum of BLA approvals and NME approvals

provides a more accurate measure of the productivity of the biopharmaceutical industry

than NME approvals alone.

From 1996 to 2003, the number of new molecular entities (NMEs) produced

annually by the pharmaceutical industry dropped from 47 to 20, according to FDA data.

When therapeutic biologic products are included, the total number of new therapeutic

drugs dropped from 50 to 29 over this period, a decline of 42 percent (FDA-BEP

database 2004).

-10-

an

Figure 1:

FDA NME and therapeutic biological product approvals: 1996-2003

Source: FDA-BEP database 2004

The recent decline in new therapeutic products presents a significant challenge to

the biopharmaceutical industry. The 2004 Medco Drug Trend Report cites declining

new drug approvals as the primary driver for reduced prescription drug revenue in 2004

compared to 2003 (2004). The observed decline in the output of new drugs prompted

one industry analyst to pose the question, "Is the pharmaceutical business model

broken?" indicating the potential seriousness of declining new drug approvals on

biopharmaceutical industry profitability (Sylvester 2004). Compared to other industries,

the biopharmaceutical industry relies more heavily on new products to sustain profits and

revenues.

1.2

New drug approvals are critical to the biopharmaceutical industry

While innovation of various kinds is important in all industries, the unique

characteristics of the biopharmaceutical industry make product innovation crucial to

maintaining competitiveness in this industry.

First, from the perspective of long-term industry economics, value is created

primarily by product innovation. Biopharmaceutical companies invest heavily in research

and development, at an average rate of almost 16 percent of revenues (PhRMA 2004).

Studies by Scherer (2001) and Grabowski and Vernon (2002) have shown that profits are

-11-

directly related to research and development investment. Additionally, the U.S. Office of

Technology Assessment has shown that profits are tied to introductions of innovative new

products (1995). Innovative products lead to increased profits by allowing

biopharmaceutical firms to enter new disease treatment markets and expand existing

markets. New products also provide opportunities for competitive differentiation based

on the properties of the drug.

Second, pharmaceutical industry revenues are primarily generated from patentprotected products. When patents expire, generic entry significantly reduces the pricing

power of the branded company and revenues fall sharply. Generic competition reduces

the branded company's profits by eroding its market share and by increasing competitive

pricing pressures (Grabowski 2003). A 1993 study by the U.S. Office of Technology

Assessment found an average of 43 percent erosion in branded-company revenues derived

from a particular drug in the three years following the introduction of a generic

competitor (1993). A U.S. Congressional Budget Office study conducted a few years

later showed that market erosion by generic competitors had increased to 44 percent in

the first year of generic competition for drugs introduced between 1991 and 1993 (1998).

The ability of drug companies to generate profits from marketed drugs is largely

determined by the length of patent protection for marketed products.

Given the rapid revenue erosion associated with the introduction of generic

alternatives, successful biopharmaceutical companies must continually introduce new

patent-protected products to replace revenues lost to the expiration of patents for existing

products. Table 2 shows currently marketed drugs with anticipated patent expiry within

the next two years. In aggregate, these drugs currently account for $26.4B in annual

revenues (IMS 2004). Companies facing impending patent expirations for key products

must urgently seek to develop and introduce new patent-protected products to maintain

revenues and profits.

- 12 -

_I___

_

__

_

Possible

patent

expiration

2003 U.S. Retail

sales ($mm)

Brand name (generic name), manufacturer

Use

3Q2004

Diflucan (flucnazole), Pfizer

Cipro (ciprofioxacin), Bayer

Fungal infections

Bacterial infections

$269

$708

2004

Neurontin (gabapentin), Pfizer

OxyContin (oxycodone -controlled release), Purdue

Pharma

Epilepsy

Pain

$2,069

$1,914

1Q 2005

Celexa (citalopram), Forest

Xalatan (latanorost opthalmic solution), Pharmacia

Depression

Glaucoma

$1,220

$378

Duragesic (fentayl transdermal), Janssen

Pain

$1,063

3Q 2005

Zofran (ondansetron), GlaxoSmith Kline

Nausea

$577

4Q 2005

Allegra (fexofenadine) and Allegra-D

(fexofenadine/pseudoepinephrine), Aventis

Allergies

$1,859

1Q 2006

Lexapro (escitalopram), Forest

Prevacid (lansoprazole), Tap

Depression

Gastroesophageal

refulx disease, ulcers

$900

$3,529

Biaxin (clarithromycin), Abbott

Glucovance (glyburide/metformin), Bristol-Myers

Squibb

Bacterial infections

Diabetes Type 2

$285

$440

2Q 2006

Zithromax (azithromycin), Pfizer

Pravachol (pravastatin), Bristol-Myers Squibb

Baterial infections

Hyperlipidemia

$1,717

$1,680

3Q 2006

Zocor (simvastatin), Merck

Provigil (modafinil), Cephalon

Zoloftf (sertraline), Pfizer

Adderall XR (mixed amphetamine salts), Shire

$3,329

$274

$2,531

$583

Sonata (zaleplon), King

Hyperlipidemia

Narcolepsy

Depression

Attention deficit

hyperactivity disorder

Insomnia

Aciphex (rabeprazole), Esai

GERD, peptic ulcers

$1,000

4Q 2006

Table 1:

$115

Upcoming biopharmaceutical product patent expirations

Source: FDA Orange Book, IMS

Third, the critical role of governmental regulation makes public perception

particularly important for the biopharmaceutical industry. In 1961, the Senate

Committee on the Judiciary issued a report analyzing monopoly power in the

pharmaceutical industry. The committee identified four unique economic features of the

pharmaceutical industry: (1) it has a critical bearing on public health and welfare; (2) it

has a unique distribution system, in which physicians act as purchasing agents for patient- 13-

consumers while insurance companies and government agencies provide payment for

pharmaceutical products; (3) it exhibits inelastic demand for prescription medications;

and (4) it has low manufacturing and distribution intensity, resulting in low marginal

costs and high unit margins (U.S. Congress 1961). The 1962 Kefauver-Harris

amendment (which was informed by the 1961 hearings) and subsequent laws have sought

to balance the monopolistic characteristics of the drug industry, the interests of

biopharmaceutical firms and the needs of the American public.

As a result, the U.S. biopharmaceutical industry is highly regulated. As discussed

previously, FDA approval is required to market any prescription drug. Advertising claims

and product labeling must also be approved by the FDA. Marketing practices designed to

influence physicians are regulated by the FTC and FDA and pricing is influenced by

public health programs such as Medicare and Medicaid (DiMasi 1994).

Currently, proposals to allow drug importation from Canada and to allow Federal

Medicare administrators to negotiate volume discounts with drug companies are being

considered in the U.S. Congress. Implementation of either of these measures would lead

to significant downward pressure on U.S. biopharmaceutical revenues. Because public

opinion influences the policy choices of government, maintaining a positive perception

with the American public is vital to the continued success of the biopharmaceutical

industry.

1.3

Balancing profits and productivity in the biopharmaceutical industry

The pharmaceutical industry currently faces a number of public-relations

challenges including: increasing pressure for drug re-importation; damaging fallout from

the high-profile recall of Merck's COX-2 inhibitor, Vioxx (rofecoxib); and persistent

questions about pharmaceutical marketing practices directed towards physicians and

consumers. In another example of negative publicity, the New York Attorney General's

office recently investigated pharmaceutical manufacturer GlaxoSmithKline for fraud for

its decision not to disclose negative information about the off-label use of its antidepression drug, Paxil (paroxetine), in children (AHLA 2004). In response,

GlaxoSmithKline announced plans to make all clinical trial results available to the public

(Whiting 2004). A survey conducted by Harris Interactive in September 2004 found that

- 14-

____

111111111111

66 percent (+ 3 percent margin of error) of Americans felt that the prices of most

prescription drugs were "unreasonably high." Furthermore, 41 percent of survey

respondents cited "profit margin" as the main contributor to the price of pharmaceuticals,

while 33 percent cited "marketing and sales expenses." Only 22 percent cited "research

and development expenditures" (Harris 2004). High-profile safety failures, questionable

competitive tactics and high prices have created a negative public opinion of the

biopharmaceutical industry.

A simplistic glance at pharmaceutical industry profitability provides evidence

supporting the perception voiced in the Harris survey. As a group, the ten drug

companies in the Fortune 500 topped all three measures of accounting profitability in

2001, according to Fortune magazine's annual analysis of America's largest companies.

Pharmaceutical companies reported net margins of 18.5 percent (eight times higher than

the median), return on assets of 16.5 percent (six times the median), and return on

equity of 33.2 percent (more than three times the median) (Public Citizen 2002). In

2003, the pharmaceutical industry relinquished the top position in these categories, but

remained in the top four in each. The pharmaceutical industry ranked third in net

margins at 14.3 percent, second in return on assets with 10.3 percent and fourth in return

on equity with 22.1 percent (Fortune 2004). In terms of accounting profits, the

pharmaceutical industry is consistently more profitable than most other industries.

Biopharmaceutical firms achieve high accounting profits by exercising pricing

power resulting from high barriers to entry. Products are protected by the robust U.S.

patent system. High up-front costs associated with drug discovery and development

present another significant barrier to entry. These barriers provide limited product

exclusivity for biopharmaceutical firms. This exclusivity allows firms to price drugs

significantly above the marginal cost of production. When patents expire and generic

competition is allowed to enter, prices rapidly fall towards the marginal costs of

production and distribution. Biopharmaceutical company pricing power increases the

cost of pharmaceutical products to consumers by prolonging the time that products are

priced in excess of marginal cost. U.S. spending for prescription drugs is forecast to reach

$520 billion (not inflation adjusted) by 2013, more than twice its current level (Porter

2004). The cost of prescription drugs is substantial and the effects of pricing power by

the biopharmaceutical industry will continue to be felt by healthcare payers.

15 -

Industry defenders argue that the true cost of drug development and the economic

returns needed to justify investment require high accounting profits for marketed drugs.

Joseph DiMasi of the Tufts Center for the Study of Drug Development has published an

estimate of $896mm for the cost of developing a single new drug, including the costs of

failed drug development projects, invested capital and post-marketing clinical trial

obligations (2003). Paul Romer of Stanford University has shown that the promise of

temporary monopoly power can provide significant incentive for innovation (1994).

Many in the biopharmaceutical industry argue that only a credible promise of pricing

power can justify the large, risky investments required for drug development (PhRMA

2002).

The Orphan Drug Act of 1983 provides evidence supporting the hypothesis that

pricing power can spur innovation. The Orphan Drug Act was designed to increase

research and development efforts for rare diseases. Previously, few drug company

resources had been dedicated to developing therapies for rare diseases because the

revenue opportunities in these markets were less attractive than those for larger disease

populations. The Orphan Drug Act increased the relative attractiveness of markets for

rare diseases by legislating a temporary market monopoly for the first company to develop

a treatment for a particular orphan indication. The first product to successfully treat an

orphan indication is granted exclusivity for that indication, and a competing drug can only

enter the market if it is shown to be superior to the first drug (U.S. Congress 1983). The

Act has proven to be very successful. According to Kenneth Kaitin of Tufts CSDD,

between 1983 and 2001, 223 drugs and biological products for orphan diseases were

brought to market. In contrast, the nineteen years prior to 1983 saw approximately 40 to

60 such products come to market (Tufts CSDD 2002).

The Orphan Drug Act represents a successful balancing of the costs and benefits

of incentives for drug development. Although the Act results in higher prices for orphan

drugs, patients benefit by having access to drugs that would never have been developed

otherwise. Because the number of patients treated by orphan drugs is small, the

additional costs of exclusivity for orphan drugs is unlikely to significantly effect the overall

U.S. healthcare budget. For the biopharmaceutical industry overall, balancing the costs

of providing incentives for drug development with the benefits of new therapeutic

products is much more difficult.

- 16-

111-··1·11-·111····II

1

-

·-·

Providing beneficial drugs to those who need them is a social goal as well as a

business goal. In order to promote investment in the development of new drugs, the U.S.

supports regulations which enhance pricing power for biopharmaceutical firms. In

exchange, many expect the biopharmaceutical industry to provide innovative new drugs

that significantly lengthen and improve human life. New drugs with novel mechanisms of

action are more likely to provide significant incremental therapeutic benefit over existing

products. They may have superior efficacy or safety compared to existing products, better

side effect profiles, more convenient routes of administration, lower costs, or easier

distribution methods. At the very least, new drugs increase the number of differentiated

treatment options available to patients and their physicians. Despite continued support

for policies promoting innovation in the drug industry, the number of new drugs has

fallen significantly in the recent past. The factors driving approval trends will be a major

topic of this thesis.

1.4

Biopharmaceutical investment in research and development

Critics from the watchdog group Public Citizen have called for increased

investment in research and development by the biopharmaceutical industry (2002).

However, research and development expenditures have maintained a rapid growth

trajectory, even as new drug approvals have fallen. According to the annual reports of the

Pharmaceutical Research and Manufacturers of America (PhRMA), research and

development spending increased from $16.9B in 1996 to $33.2B in 2003, an increase of

96 percent over the seven year period, reflecting a compound annual growth rate of 10.1

percent (2004).

Though the increase in R&D spending is significant, a few weaknesses in the

PhRMA survey should be noted. First, expenditure data are not inflation adjusted.

Additionally, the PhRMA survey includes research and development expenditure data for

member companies only. The PhRMA member list was compared to Pharmaceutical

Executive magazine's list of the top sixteen biopharmaceutical companies by 2003

revenue (Trombetta 2004). Notably, Forest Laboratories, the fifteenth largest

biopharmaceutical firm, is not included in the PhRMA survey. In addition, it is unclear

whether Genentech (fourteenth by revenue) is included. Although Genentech is not itself

a member of PhRMA, Hoffmann-LaRoche, which owns a majority stake in Genentech, is

- 17-

a member. PhRMA representatives were not able to resolve whether Genentech

expenditures were included in the research and development data reported by HoffinannLaRoche. Other large biopharmaceutical companies not included in the PhRMA survey

include: Allergan, Gilead Sciences, and Chiron. Numerous smaller biotechnology firms

are not included in this survey. Finally, PhRMA survey data is self-reported.

Biopharmaceutical companies may employ different expenditure classification systems,

leading to potential non-standard reporting of research and development expenditures

across firms.

Figure 2 includes new drug approvals for comparison purposes. The number of

new drug approvals, in this case, equals the sum of FDA NDA approvals and biologic

drug approvals. A full discussion of various measures of new drug approvals is presented

in Section 2.1 of this thesis.

35

60

30

50

25 in

J. 40

20 a

30

20 =

z 20

10

10

5

0

1965

1969

1973

1977

1981

1985

1989

1993

1997

2001

Year

Figure 2:

Annual new drug approvals and PhRMA member R&D expenditures 1965-2003

Source: FDA, PhRMA

Various curve fit equations were tested for PhRMA reported pharmaceutical

research and development expenditures from 1965 to 2003. The best curve fit equation is

given by Equation 1, where xrepresents the year and yrepresents R&D expenditures in

USD billions. R 2 for this curve fit is 0.995.

- 18-

Equation 1: Curve fit equation for R&D expenditures, 1965-2003

y = (7*

108 )* eO

251

x

Though an exponential growth model best describes these data, expenditures

exceeded the model's predictions consistently from 1990 to 1995. In addition, research

and development expenditures for 2002 and 2003 are lower than those predicted by the

model. In particular, 2003 expenditures of $33.2B fall $13.4B short of the model's

prediction of $46.6B. This observation may indicate that growth in biopharmaceutical

research and development spending may be slowing after years of rapid growth.

1;n

U

45

a

40

Y. 35

e

30

X

25

C

aI

20

uJ

0 15

W

10

5

1960

1965

1970

1975

1980

1985

1990

1995

2000

2005

Year

Figure 3:

Exponential curve fit for PhRMA member R&D expenditures, 1965-2003

Figure 4 compares industry R&D expenditures to R&D spending expressed as a

percentage of total PhRMA member revenues. Since peaking in 1993, R&D spending

rates have actually declined slightly. Therefore, increases in overall industry revenues

must be driving recent growth in R&D investment.

- 19 -

·Jr

30

20%

18%

30 I

a,

e

16%

25

C

S

14% >

12%

20

a

10%

I

a

15

8%

6%

10

,Xs

26

C

S

a.

X

4%

5

2%

0%

1964

1968

1972

1976

1980

1984

1988

1992

1996

2000

Year

Figure 4:

R&D expenditures, total and as a percentage of revenue, 1965-2003

Source: PhRMA Annual Reports

Figure 5 presents a breakdown of R&D expenditures by development phase

(Cohen 2004). This figure indicates that an increasing portion of R&D spending is being

used for clinical development. Assuming uncategorized expenditures are clinical, clinical

spending as a percentage of total R&D expenditures increased from 35 percent in 1976 to

65 percent in 2002. Conversely, the percentage of expenditures dedicated to discovery

research has fallen by half, from 65 percent in 1976 to 35 percent in 2002.

Distribution of R&D Expenditures

Percent of

100%

total R&D

80%

60%

40%

20%

0%

ill

1976

I

I

,,,,,I

/

1977 1978

I

C--......--J

i

1980

I

I

L..........--I

/

1982

IIII

I

L--.......--I

l

1985

l

1987 1988

I

I

II

l

l

1989

p

l

I

1999 2001

I

l

2002

Year

Clinical Ph 1-3

Discovery

Figure 5:

Uncategorized

R&D Expenditures by activity type 1999-2002

Source: Cohen, 2004 (note years are not sequential)

-20-

·-

3Phase 4

[

I

Regulatory

Additionally, Figure 5 illustrates a marked increase in Phase IV commitments

since 1989. Phase IV studies are carried out after regulatory marketing approval, often in

response to FDA requests for additional long-term safety and efficacy data. In practice,

however, some Phase IV post-marketing studies are designed to enhance the marketing

position of the drug, in addition to satisfying regulatory requirements. Therefore,

nominal Phase IV expenditures may include significant marketing costs. A former

research head of a major pharmaceutical company states that up to 20 percent of the

allocated research and development budget of his group was actually controlled by the

company's marketing department (Douglas 2004). Since this portion of the R&D budget

is not used entirely for R&D purposes, it should be discounted when considering true

research and development expenditures.

As this discussion shows, the aggregate level of biopharmaceutical R&D spending

has never been higher and continues to increase rapidly. However, growth in R&D

spending as a percentage of total pharmaceutical revenues has declined slightly over the

past decade. The allocation of R&D expenditure across development phases has shifted,

from predominantly discovery research in the 1970's and 1980's to predominantly clinical

development today. Within clinical development, an increasing portion of nominal

research and development spending may be focused on marketing, not research, goals

(though this effect is likely small.) Overall, trends in research and development spending

are mixed. However, given the continued growth in overall R&D spending, lack of

investment is unlikely to be the major cause of the observed decline in new drug

approvals.

1.5

Possible explanations for the decline in new drug approvals

The multi-factorial nature of biopharmaceutical productivity makes isolating the

specific cause of falling approvals difficult. Three possible explanations for the observed

decline in biopharmaceutical productivity are summarized below.

First, industry analyst C.J. Sylvester of UBS Investment Research claims that the

industry is "midway in the adoption curve for new technologies, which will likely cause a

near-term decline in productivity" (2004). Sylvester identifies advanced research tools

enabled by the human genome project as the main new technology reducing short-term

- 21 -

productivity. Genomic data and complementary technologies in the areas of proteomics,

systems biology, combinatorial chemistry, and structural biology are increasingly

supplanting traditional target identification and compound screening methods in drug

discovery. These new technologies have dramatically increased the rate of discovery for

medically interesting biological targets.

Based on research conducted by McKinsey and Lehman Brothers in 2001, the

investment associated with implementing these new technologies is expected to increase

research and development costs dramatically (Edmunds, Tanio, and Ma 2001).

McKinsey analysis predicts that genomics, along with proteomics, bioinformatics, and

systems biology advances, will yield numerous novel drug targets. Novel drug targets

carry more risk compared with older, more validated, and better understood targets.

Therefore, as biopharmaceutical companies increasingly base drug development projects

on novel targets, failure rates are expected to rise. A McKinsey model of the R&D

process analyzed the consequences of moving from a drug development program

evaluating 50 targets per year with 30 percent novel content to 200 targets with 70

percent novel content. Applying their probability of success and investment assumptions,

this change would lead to an increase of new drug approvals from 2 per year to 3.6 per

year. However, costs associated with new technology implementation and higher attrition

rates were expected to increase research and development expenditures by up to 100

percent.

In reality, biopharmaceutical firm research and development expenditures are

constrained by market expectations and access to capital. Market expectations for

dividends and retained earnings limit reinvestment of firm profits into research and

development. Biopharmaceutical firms with marketed products usually invest

approximately 16 percent to 20 percent of revenues in research and development and

investors generally penalize biopharmaceutical firms from investing much more or much

less than this. The inability to access capital markets presents a hard limit on research

and development investment for companies without profitable products. In the context of

constrained research and development budgets, the McKinsey analysis suggests that the

implementation of new technologies has the potential to cause a short-term declines in

new drug introductions.

Second, some have argued that recent merger and acquisition activity in the

biopharmaceutical industry has temporarily depressed the output of new drugs as post- 22 -

___

merger integration activities have sapped resources and focus from ongoing drug

development projects. J.P. Garnier, CEO of GlaxoSmithKline recently stated, "Low

R&D productivity across the industry as a whole has affected every major

pharmaceutical player. Just getting bigger is not going to help any more." Mr. Garnier

goes on to state that large acquisitions "would simply be a distraction from what should

be the company's sole focus: producing new drugs" (Management Today 2004).

Number

of unique Percent

of firmsinvolved

Merger

values a

in uniquetransforming Totalmaketvalue of percentof indutry's

Numberdfirms transforming

in sample

mergers(ergemm) marketvalue

Year

1988

1989

1990

1991

1992

1993

1994

1995

1996

1997

1998

1999

2000

Total/Average

Table 2:

121

125

134

190

196

212

216

243

267

286

288

302

228

3

12

9

6

3

5

18

12

13

16

21

25

22

165

2.5%

7.2%

5.2%

4.2%

2.6%

1.9%

9.7%

6.2%

5.2%

5.2%

8.3%

9.6%

10.8%

6.5%

1,309

27,971

15,843

1,924

1,325

8,385

37,174

36,732

36,714

20,492

67,741

157,708

100,750

514,068

0.6%

11.8%

5.1%

0.4%

0.2%

1.2%

5.9%

5.2%

4.0%

1.7%

4.5%

7.7%

5.0%

4.4%

Meenmegervalue as a

percentof acquiring

firm'svalue

Meanmergervalue aes

a

percentof tagetfirm's

value

33.2%

44.7%

28.8%

16.7%

32.5%

16.7%

22.8%

19.4%

29.4%

35.7%

27.3%

38.7%

37.2%

29.1%

n/a

121.0%

60.6%

112.0%

92.2%

n/a

110.0%

n/a

88.4%

54.0%

79.1%

118.0%

124.0%

96.9%

Biopharmaceutical Mergers and Acquisitions 1988-2000

Source: Danzon, et al. 2004

In spite of Mr. Garnier's view, the pharmaceutical industry has increasingly

embraced M&A. Table 2 shows that M&A activity has increased in terms of volume and

value. In 2000 (last year of available data), over 10 percent of firms in the

biopharmaceutical industry engaged in some form of M&A. These transactions

accounted for over S$100B in market value (Danzon, et al. 2004). The post-2000 decline

in market valuations of biotechnology and pharmaceutical companies caused market

values of transactions to decline, but transaction volume remains high according to Ernst

& Young's 2003 biotechnology industry report. The distractions associated with business

combinations certainly may have some impact on productivity in the short-term.

A third explanation holds that the decrease in new drug approval volumes can be

attributed to an increased emphasis on blockbuster drugs. Blockbusters, defined as drug

products with over $1B in revenues, accounted for approximately $95B in sales in 2002.

Of the 200 best-selling drugs in 2002, 50 were blockbusters, and they accounted for over

half of the total revenues of the group (Ernst & Young 2003). An increased focus on

- 23 -

blockbuster drugs could result in fewer new drug introductions, albeit with larger value

associated with each introduction.

Managers at Eli Lilly have developed a research and development productivity

model that captures the dynamics of the trend towards blockbusters. The Lilly model

defines biopharmaceutical productivity in two steps: first, R&D efficiency is defined as

the number of new products per unit of input; second, R&D effectiveness is defined as

value (i.e., revenue) created by a particular product (Mason 2004). Figure 6 illustrates

relative trends in R&D efficiency and effectiveness. While R&D expenditures have

continued to increase, the number of NMEs introduced has declined significantly from

1991 levels. Therefore, R&D efficiency has declined. However, sales have continued to

increase, keeping pace with R&D expenditures. By definition, R&D effectiveness (i.e.

revenue per product) has increased substantially.

Indexed growth (1991=100)

50

1991

1992

1993

1994

1995

1996

1997

1998

1999

2000

2001

Year

-4- R&D expenditure

Figure 6:

-41- Sales

--

Number of NMEs

Indexed R&D expenditures, Sales and NME introductions 1991-2001

Source: CMR, IMS, Mason 2004

Increasing revenue per marketed product is consistent with a shift towards the

blockbuster model. However, this observation could also be the result of other changes in

the biopharmaceutical industry, such as lengthier patent protection, more favorable

- 24 -

_

__

reimbursement policies, or increased marketing effectiveness. It is unclear whether the

trends identified in the Lilly analysis are the result of an intentional shift in industry

strategy to pursue blockbusters, or if the effect shown in Figure 6 can be attributed to a

handful of unexpectedly market successes. Nevertheless, this analysis shows that while

output quantity (as measured by NMEs) has declined, output quality (as measured by

revenue per new drug) has increased. As a result, the overall revenue growth of the

industry has remained steady, even while the volume of new drug approvals has declined.

1.6

Organizational plan of this thesis

The recent decline in new drug approvals, if real, presents a significant challenge

to the biopharmaceutical industry. This thesis examines data from 1965 to 2003 to more

fully characterize trends and patterns in new drug approvals. Analysis presented in

Section 2 will show that new drug approvals increased steadily from 1965 to 1995,

experienced an unanticipated jump in 1996, and have declined thereafter. In addition,

periodicity in annual approval volumes will be considered. These analyses will provide

quantitative descriptions of features of the new drug approval time series.

Section 3 of this thesis seeks to explain time series trends described in Section 2.

An inventory model of new drug approvals is constructed to provide additional insight

into the factors influencing drug approval volumes. The impact of the Prescription Drug

User Fee Act (PDUFA) is specifically analyzed. This analysis identifies an increase in the

approval percentage of reviewed NDA filings as the major source of the 1996 increase in

new drug approvals. Implications of approval percentages on withdrawal rates are also

considered.

In Section 4, additional time series analysis reveals a seasonal pattern of elevated

new drug approvals in December. The impact of PDUFA on seasonal approval patterns

is discussed, as well. Seasonal workflow patterns at the FDA may affect the

implementation of future PDUFA review goals and should be included in the NDA

submission strategy of drug companies.

In general, the analysis summarized in this thesis shows that the biopharmaceutical

industry is an exceedingly complex system with many dynamic components. It is difficult

to consider any one aspect of the system in isolation due to the high degree of inter- 25 -

relatedness of the system and the large number of simultaneously changing variables.

Nevertheless, this system shows evidence of ordered behavior at the aggregate level.

Annual new drug approval volumes show sustained trends over time and may show

evidence of multi-year periodicity. These features of the system suggest the existence of

systems-level processes. This thesis represents an initial step towards developing a

systems dynamics analysis of drug development. Access to additional data from the FDA

and from the biopharmaceutical industry would enable the construction of a robust

systems model of the drug development process. Such a model could provide valuable

insights into improving the drug development system - leading to more innovative

therapies, a benefit to industry and society.

- 26 -

__

2.

Time series analysis of annual new drug introductions

1965-2003

2.1

How should new drug approvals be measured?

The biopharmaceutical industry provides an excellent source for the quantitative

study of innovation. Biopharmaceutical innovations almost always arrive in the form of

new molecules, which must go through a detailed regulatory review. In addition,

significant modifications to the formulation or administration of an existing drug must

also undergo review. In other industries, innovations are introduced incrementally and

without regulatory documentation. Multiple innovations may be introduced at the same

time, confounding the analysis of benefits provided by each discrete advance. The very

definition of a discrete product can be confusing. Taking personal computers as an

example, the base 2004 Dell Inspiron 1000 has a faster processor and more memory than

the 2003 Inspiron 1000. Should these models be considered as one product, or two? In

addition, this computer (as sold in 2004) has over 25 hardware, software, and service

configuration options available. Based on the conservative assumption that each

configuration option includes two choices (and assuming that configuration choices are

independent of each other), the 2004 Inspiron 1000 has 225 potential configurations

(Dell, 2004). Should each of the over 33 million configurations be considered a separate

product? Analyzing innovation in most industries is difficult and complex.

The biopharmaceutical industry lacks many of the analytical problems associated

with product definition. Rigorous regulatory review is mandated for every marketed

biopharmaceutical product. Each combination of active ingredient, administration route,

dosage level, etc. requires a distinct regulatory approval. In addition, regulatory filings

provide detailed descriptions of products' attributes. Products are clearly delineated and

their attributes are clearly defined and catalogued. Importantly, the public has access to

this information for all approved and marketed biopharmaceutical products. Clear

product definitions and accessible product data provide the basis for detailed analyses of

industry innovation.

Although biopharmaceutical products are more clearly defined and characterized

than products in many other industries, the terminology describing drug approvals is

moderately complex. Slightly different definitions of what constitutes a "new drug"

- 27 -

coexist in the industry. Definitions of new drugs have become more complex as new

technologies have given rise to new classes of drugs and combination products.

All new drugs, formulations, combinations, and dosages must undergo FDA

review. The review process centers on a regulatory filing document called a new drug

application (NDA). A flow chart of the NDA process is included in Appendix 4. NDA

filings are classified with a code that reflects both the type of drug being submitted and its

intended use or uses. Numbers 1 through 7 are used to describe the type of drug:

1.

New Molecular Entity

2.

New Salt of Previously Approved Drug (not a new molecular entity)

3.

New Formulation of Previously Approved Drug (not a new salt or new molecular

entity)

4.

New Combination of Two or More Drugs

5.

Already Marketed Drug Product - Duplication (i.e., new manufacturer)

6.

7.

New Indication (claim) for Already Marketed Drug (includes switch in marketing

status from prescription to OTC)

Already Marketed Drug Product - No Previously Approved NDA

The letters "S" and "P" are used to describe the review priority of the drug:

S.

Standard review for drugs similar to currently available drugs

P.

Priority review for drugs that represent significant advances over existing treatments

Table 3:

NDA submission type classifications

Source: FDA

Priority review is reserved for drug products which, if approved, would be a

significant improvement compared to marketed products in the treatment, diagnosis, or

prevention of a disease. Improvement can be demonstrated by: (1) evidence of increased

effectiveness in treatment, prevention, or diagnosis of a disease; (2) elimination or

substantial reduction of a treatment-limiting drug reaction; (3) documented enhancement

- 28 -

-11---------~-~1

of patient compliance; or (4) evidence of safety and effectiveness of a new subpopulation

(FDA, "Priority review" 1996). Priority applications are usually reviewed more quickly

than standard applications.

Do all NDA filings represent innovations in the biopharmaceutical industry?

Some types of NDA filings may be more or less innovative than others. For example, a

novel therapeutic molecule (type 1 NDA) that cures a previously untreatable, lethal

disease seems to be a more important innovation than a liquid formulation of a medicine

already available in a pill (type 3 NDA). On the other hand, discovering an unexpected

new use for an existing drug (type 6 NDA) may be more innovative than developing a

new therapeutic molecule that is very similar to an existing approved drug (type 1 NDA).

In short, the relative innovative content of different types of NDA filings is subjective. As

a practical matter, measures of innovation in the pharmaceutical industry have focused on

drugs introduced through type 1 NDA filings. This type of drug is referred to as a New

Molecular Entity (NME).

A new molecular entity (NME) is defined by the FDA as a new drug product

containing, as its active ingredient, a chemical substance marketed for the first time in the

United States (Riley and DeRuiter 2004). NME NDA submissions and approvals are the

responsibility of the Center for Drug Evaluation and Research (CDER), a division of the

FDA. Between 1990 and 2003, CDER approved 1171 NDAs. As illustrated in Figure 7,

of these, 399 (34 percent) were New Molecular Entities and 769 (66 percent) were nonNMEs (FDA, "Report" 2004).

- 29 -

140

120

100

80

60

40

20

0

1990

Figure 7:

1991

1992

1993

1994

1995

1996

1997

1998

1999

2000

2001

2002

2003

CDER NDA Approvals 1990-2003

Source: FDA

Table 4 shows the percentage composition of NME filings compared to non-NME

filings. 1991 had the highest proportion of NME filings, equaling 48% of all NDA filings.

In 2002, NME filings only accounted for 22% of NDA filings, the lowest proportion in

this sample set.

NME

non-NME

Table 4:

1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 Average

37.1% 47.6% 28.6% 35.7% 35.5% 34.1% 40.5% 31.7% 33.3% 42.2% 27.6% 36.4% 21.8% 29.2% 34.4%

62.9% 52.4% 71.4% 64.3% 64.5% 65.9% 59.5% 68.3% 66.7% 57.8% 72.4% 63.6% 78.2% 70.8% 65.6%

Percentage of NDA filings designated NME vs. non-NME

The FDA defines which NDA approvals are, and are not, NMEs. The Tufts

Center for the Study of Drug Development (Tufts CSDD) has defined an alternative to

the NME, the New Chemical Entity (NCE). An NCE is defined to be any new molecular

compound (excluding diagnostic agents, vaccines, and other biologic compounds) not

previously approved for human use by CDER. New salts, esters, and dosage forms of

previously approved compounds are also excluded (Tufts CSDD, "Glossary" 2004). In

practice, compounds that have never been used or tested in human subjects to comprise

NCEs. (Tufts CSDD, "Outlook" 2004).

Figure 8 illustrates the close agreement between FDA-defined NMEs and Tufts

CSDD defined NCEs. The high degree of correlation (correlation = .991) between the

- 30 -

-1-ilIi-----ilil--1-_I______

.

-ii

·_1

1_1__1111_114__1

two measures is reassuring. The difference between NME approval volumes and NCE

volumes is accounted for by a small number of molecules which Tufts CSDD considers to

be diagnostic (and therefore not an NCE), but are counted as NMEs by the FDA

(DiMasi, Interview 2004).

.......

n.....

45

40

35

30

o

25

Z

20

20

15

10

5

0

1963

1967

1971

1975

1979

1983

1987

1991

1995

1999

2003

Year

Figure 8:

NMEs and NCEs by year, 1963-2003

Source: FDA, Parexel Pharmaceutical Industry R&D Sourcebook 2004/2005

Through an ongoing collaboration between the FDA and the Harvard-MIT

Division of Health Sciences (HST), the author has been permitted access to a database

containing detailed information for FDA approved NMEs from 1965 to 2004. Tufts

CSDD does not publish its proprietary list of NCEs. Due to the additional transparency

afforded by the FDA database and the close congruity between FDA and Tufts CSDD

data, this thesis uses NMEs and NME-derived measures for new drug approvals.

Measuring new drug introductions became more complicated with the

introduction of the first therapeutic biologic molecule in 1986. The NME designation

does not include therapeutic biologic entities, an increasingly important drug class.

CDER has historically been responsible for reviewing applications for any new

therapeutic drug. However, due to specific regulatory rules in place in the 1980's, the

first therapeutic biologics were approved not by CDER, but by the Center for Biologics

Evaluation and Research (CBER). Prior to the 1980's, CBER primarily regulated blood

products and vaccines. The first biologic drugs, which were similar to naturally occurring

-31 -

proteins, fell under the purview of CBER. Biologic drugs were approved through the

Biologics License Application (BLA) process, which was similar to the NDA process.

BLA approvals for recombinant protein drugs by CBER increased from a total of 11 for

the period from 1989 to 1996 to a total of 17 from 1997 to 2002. On October 1, 2003,

the FDA transferred product oversight responsibilities for new therapeutic biologics

applications from CBER to CDER (FDA, "Transfer" 2004). As of that date, all new

drugs, regardless of composition, go through the NDA process under the aegis of CDER.

As the biopharmaceutical industry has continued to evolve, the separation of

biologic and small molecule drugs into different classes has become less relevant to the

structure of industry competition. Drug development companies often pursue

development programs in both biologic therapies and small molecule drugs to address a

target or pathway. Large pharmaceutical companies, which traditionally specialized in

small molecule drugs, have expanded into biological drug development by expanding

internal capabilities and by partnering with biotechnology firms. Likewise, some large

biotechnology companies have begun to conduct research on small molecule drugs.

Although some differences between the two classes of therapies persist (particularly with

respect to manufacturing, packaging, route of administration, and side effect profiles), for

the purposes of competitive analysis, small molecule drugs and therapeutic biologic drugs

are close substitutes in practice (M. Porter, 2000).

In this thesis both small molecules and biologics will be included in measures of

innovation. The term "New Therapeutic Entity" (NTE) will be used to denote the sum

of NMEs and new biologic drugs. Figure 9 shows annual NME and biologics approval

volume in a stacked area chart. The sum of approval volumes of NMEs and new biologic

drugs equals NTE approval volume from 1965 to 2003.

- 32 -

_

I

60

50

40

_

E 30

20

10

0

1965

Figure 9:

2.2

1969

1973

1977

1981

1985

Year

1989

1993

1997

2001

BLA and NME approvals, 1965-2003

Source: FDA-BEP database

Rationale for application of time series analyses

Previous analyses have sought to relate the level of new drug approvals to various

explanatory variables, for example R&D expenditures (Jensen 1984) or the presence of a

confirmed FDA Commissioner (Gottschalk 2004). However, the stochastic nature of

drug development, the changing regulatory environment and the changing composition of

the industry have complicated these analyses. In addition, much relevant data on the

drug development process is proprietary and confidential. Biopharmaceutical firms

maintain control over data contained in regulatory filings, making a complete analysis of

unapproved filings impossible. Some filing data is made available at the time of NDA

approval, but information regarding non-approved drug candidates is often impossible to

access. Industry-level statistics are limited to aggregate numbers reported by secondary

sources such as Parexel or Tufts CSDD.

Because granular data is not available, this thesis focuses on a careful analysis of

macro-scale trends and patterns in time series of approval volumes - with few assumptions

about the underlying causes of changes in approval patterns. By characterizing the

historical behavior of NTE approvals since 1965, I will attempt to develop insights into

the underlying dynamics of the biopharmaceutical industry.

- 33 -

Linear regression on historical observations

2.3

Figure 10 depicts NTE approval levels from 1965 to 2003. NTE approvals were

regressed against a time index (1964 = to) to yield a linear trend for NTE approval growth

from 1965 to 2003.

60

50

*

40

f

30

IZ

20

10

-

1965

1970

1980

1975

1985

1990

1995

2000

Year

Figure 10:

New Therapeutic Entity (NTE) introductions, 1965-2003

Source: FDA-BEP database

By inspection, the large number of NTE approvals in 1996 (50) seems

inconsistent with historical trends (i.e. it is an outlier.) The number of NTE approvals in

1996 was 51 percent higher than the 30 approvals in 1996, the next most prolific year.

35

30

25

a

20

X

.

l

15

10

5

1965

1970

1975

1980

1985

1990

Year

Figure 11:

New Therapeutic Entity (NTE) introductions with trend line, 1965-1995

Source: FDA

- 34 -

1995

In the years preceding 1996 (1965 - 1995), NTE approvals grew at a roughly

linear rate of approximately .48 NTEs per year. R2 for the 1965-1995 period is .57. Is

the large number of NTE approvals in 1996 anticipated by prior historical data? Data

from 1965 to 1995 was used to construct a linear model for NTE approvals. A 95

percent confidence interval for the expected approval volume (NTEt) was also

constructed:

Equation 2:

(NTE,) = 0.4762t + 10.316 + e

where t represents the year index (1964=0) and £ represents the variance of the model.

The regression yielded a standard error of 3.8. Under the assumption that e is normally

distributed with a mean equal to 0, Figure 12 depicts the 95 percent confidence interval

for (NTEt) based on observations from 1965 to 1995. Predicted NTE approvals are

estimated by projecting historical trends forward through the 1996-2003 period.

an

OU

50

m 40

g

g

30

U

20

10

1965

1970

1975

1980

1985

1990

1995

2000

Year

Figure 12: 95% confidence interval for NTE approvals based on 1965-1995 observations

Figure 12 shows that the number of NTE approvals in 1996 exceeds the upper

bound of the 95 percent confidence interval. Interestingly, approvals in 1991 also exceed

the upper bound of the 95 percent confidence interval, though by a much smaller margin.

Assuming the standard error calculated from 1965-1995 data, the chance that 1996

approvals would total 50 or more, compared to the expected value of 25.6, is 7.04*10 -1 1.

- 35 -

This simple analysis provides evidence that the high number of NTE approvals in

1996 is not anticipated by historical trends. In addition, the linear trend in NTE

approvals changes significantly after 1996. As shown in Figure 13, the slope of the linear

regression line changes from .57 to -3.05. R2 for this linear curve fit is .84.

UU

*

it

_

an~~~~~~~~~~~~~~~

..........

_

40

CL 30

I

. . .. .

: 20

y = -3.0476x + 48.714

2

R = 0.8407

..

..

10

1996

1997

1998

1999

i~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

2000

2001

2002

2003

Year

Figure 13:

New Therapeutic Entity (NTE) introductions with trend line, 1996-2003

Source: FDA-BEP database

Based on these figures, a simple linear regression model that reasonably describes

the behavior of NTE approvals in the 1965-1995 period fails to describe behavior in 1996

and afterwards. This could be due to at least two causes: either the original model was

incorrect and a more robust model can capture the behavior observed data, or the

underlying dynamics of the time series changed in 1996. If the latter is true, is the

departure from the historical trend permanent or temporary? A prolonged downward

trend in U.S. NTE approvals would likely have negative consequences for the

biopharmaceutical industry.

In order to incorporate cyclicality in this model, additional time series techniques

were applied to NTE approval volumes. Section 2.4 describes the results of Fourier

transform analysis used to characterize industry-level cycles in biopharmaceutical NTE

approvals. Section 2.5 summarizes the results of an ARIMA analysis which incorporates

autocorrelation and moving average terms in the prediction of NTE approvals.

- 36 -

c

I

2.4

Cyclicality in the biopharmaceutical industry

Duncan Moore and Andrew Baum of Morgan Stanley have observed that the

pharmaceutical industry is "much more cyclical than investors have given it credit for"

(2004). They cite macroeconomic cycles, product cycles and intellectual property cycles

as cyclical influences on pharmaceutical productivity.

Charting linear regression residuals reveals some evidence of cyclicality in NTE

approvals. By inspection, relative peaks of approvals occur in 1967, 1970, 1974, 1977,

1981, 1985, 1989, and 1991. Years between these local maxima are 3, 4, 3, 4, 4, and 2,

respectively. Evidence of negative autocorrelation also exists, as local maxima are

generally followed by declines.

12

1 1111~

· -·

·

........

.........

10

8

6

'a

4

nA

2

0

z

·o

A A

-

/K

(2)

(4)

(6)

L

(8)

1965

I

1970

1975

1980

1985

1990

1995

Year

Figure 14: NTE Residuals, 1965-1995

A Fourier transform was conducted to quantitatively analyze observed evidence of

cyclicality. Fourier analysis was conducted using SigView32, version 1.9.1.0 (SigView

2004). Prior to applying the Fourier transform, the following operations were applied to

the time series:

*

Linear trend was removed, resulting in residual plot shown in Figure 14

*

Zeros were expanded by a factor of two

*

Hamming window was applied

- 37 -

Transformation was done using the Cooley-Turkey Fast Fourier Transform

(FFT) algorithm (Harvey 1998). Results are displayed in Figure 15.

--...

CA$

. '

'o

.

......

./

,,,.

....

i,

.

DM

01

.

0t1S

I

0.2

31

Ii

I

i

4

I

44

Cycles per year

Figure 15: Fourier transform of NTE residuals, 1965-1995

Peak magnitude occurs at a frequency of .266 cycles per year, corresponding to a

period of 3.8 years. Using the method described by Koopmans (1974), a 95 percent

confidence interval was constructed for the peak frequency magnitude. The 95 percent

interval for the peak value has a lower bound of 0.349, which is higher than the mean

magnitude of the distribution (0.326).

Therefore, a frequency peak corresponding to a

period of 3.8 years is significantly different from the mean of the sample.

However, this Fourier peak fails to achieve 95 percent significance under Siegel's

more stringent test for spectral peak confidence (SigView 2004). In addition, the peak

shows significant spreading across the spectrum range (i.e. the peak is not crisply

defined.) Two major limitations in source data may reduce the power of this Fourier

analysis. First, the data set contains only 31 observations, too few to provide a high signal

to noise ratio. Second, the data set is divided into discrete annual units, which prevents

analysis at shorter time intervals. Analysis of data on monthly and quarterly bases was not

helpful due to large seasonality in approval patterns (discussed in detail in Section 4.) In

short, this analysis shows qualified evidence of cyclicality. Although this analysis does not

support definitive statements on multi-year cyclicality in NTE approvals from 1965 to

1995, it does provide support for application of ARIMA modeling tools, which can

incorporate cyclicality into the model of approval volumes.

- 38 -

-

-

--

-

----

2.5

ARIMA model for NTE approvals

Given evidence of periodicity discussed in Section 2.4, an attempt was made to

incorporate periodic fluctuations into the model of NTE approvals. In order to more fully

capture the periodic fluctuations of this time series, an Autoregressive Integrated Moving

Average (ARIMA) model was used to predict model behavior in 1996 and years

subsequent based on time series data for the 1965-1995 period. Multiple ARIMA