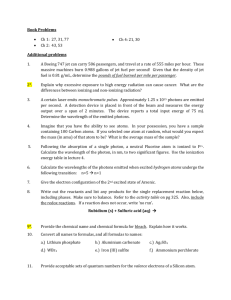

A J F S

advertisement