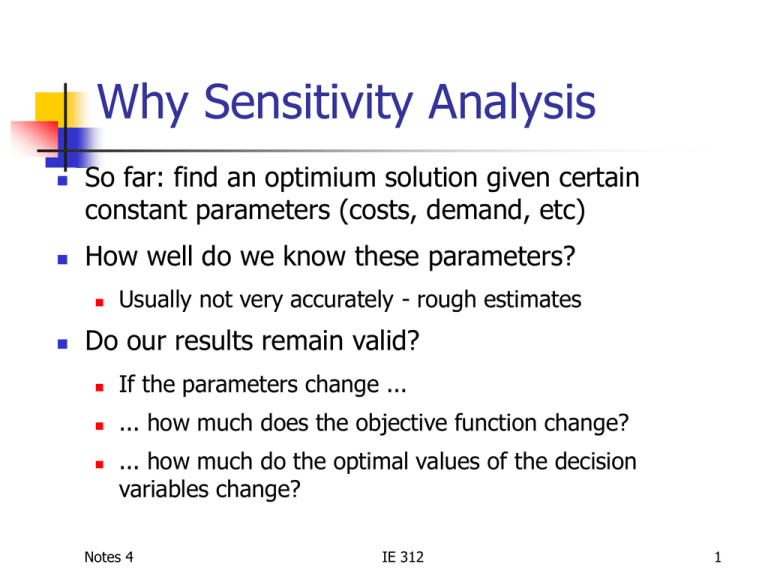

Why Sensitivity Analysis

advertisement

Why Sensitivity Analysis So far: find an optimium solution given certain constant parameters (costs, demand, etc) How well do we know these parameters? Usually not very accurately - rough estimates Do our results remain valid? If the parameters change ... ... how much does the objective function change? ... how much do the optimal values of the decision variables change? Notes 4 IE 312 1 General Optimization Problem Minimize some cost or maximize benefit Constraints: £ Restrictions on supply of some resource ³ Restriction on satisfying demand for some resource = Both supply restriction and demand requirement Variable-type constraints Decision variable determine the levels of some activity Coefficients = per unit impact of activities Notes 4 IE 312 2 Changing Constraints Relaxing constraints: Optimal value same or better Tightening constraints: Optimal value same or worse Original Notes 4 Relaxed IE 312 Tightened 3 Crude Oil Model min 20 x1 15x2 s.t. 0.3 x1 0.4 x2 2.0 (gasoline) 0.4 x1 0.2 x2 1.5 (jet fuel) 0.2 x1 0.3 x2 0.5 (lubricant s) x1 9 x2 6 Satisfy Demand Supply Restriction x1 , x2 2 Notes 4 IE 312 4 Solution (LINDO) LP OPTIMUM FOUND AT STEP 1 OBJECTIVE FUNCTION VALUE 1) VARIABLE X1 X2 Notes 4 ROW 2) 3) 4) 5) 6) 7) 8) 112.5000 VALUE 2.000000 3.500000 SLACK OR SURPLUS 0.000000 0.000000 0.950000 7.000000 2.500000 0.000000 1.500000 IE 312 REDUCED COST 0.000000 0.000000 DUAL PRICES -37.500000 0.000000 0.000000 0.000000 0.000000 -18.750000 0.000000 5 160 Sensitivity 140 120 80 60 ‘Plenty’ of this crude 40 20 6 75 5. 5 5. 25 5. 5 75 4. 5 4. 25 4. 4 75 3. 5 3. 25 3. 3 75 2. 5 2. 2. 25 0 2 Cost 100 Crude Supply Notes 4 IE 312 6 RHS Coefficients Constraint RHS RHS Type Increase Decrease Supply (<) Relax Tighten Demand (>) Tighten Relax Notes 4 IE 312 7 LHS Coefficients Constraint LHS LHS Type Increase Decrease Supply (<) Tighten Relax Demand (>) Relax Tighten Notes 4 IE 312 8 New Constraints Adding constraints tightens the feasible set Removing constraints relaxes the feasible set What about unmodeled constraints? Notes 4 IE 312 9 Rate of Change Supply Demand Optimal Value Optimal Value Maximize RHS RHS Optimal Value Optimal Value Minimize RHS Notes 4 IE 312 RHS 10 Objective Function Changes Model Coefficient Coefficient Form Increase Decrease Maximize Same or better Same or worse Minimze Same or worse Same or better Notes 4 IE 312 11 Crude Oil: Changing x1 Coefficient 140 120 100 Cost 80 60 40 20 0 0 5 10 15 20 25 30 35 Coefficient Notes 4 IE 312 12 Rate of Change Maximize Minimize Optimal Value Optimal Value Coefficient. Coefficient. Notes 4 IE 312 13 New Activities Adding activities Optimal value same or better Removing activities Notes 4 Optimal value same or worse IE 312 14 Quantifying Effects Now know the qualitative effects of Notes 4 Changing RHS coefficients Changing LHS coefficients Changing objective function coefficients Adding/deleting constraints Adding/deleting activities How much does the objective change? Quantitative change IE 312 15 Back to Crude Oil Example min 20 x1 15x2 s.t. 0.3 x1 0.4 x2 2.0 (gasoline) 0.4 x1 0.2 x2 1.5 (jet fuel) 0.2 x1 0.3 x2 0.5 (lubricant s) x1 9 x2 6 x1 , x2 2 Decreasing RHS will make objective better or no worse, but by how much? How much are we willing to pay to have one more barrel available? Notes 4 IE 312 16 Answer using the Dual max 2v1 1.5v2 0.5v3 9v4 6v5 s.t. 0.3v1 0.4v2 0.2v3 1v4 20 0.4v1 0.2v2 0.3v3 1v5 15 v1 , v2 , v3 0 v4 , v5 0 Notes 4 IE 312 17 LINDO Solution LP OPTIMUM FOUND AT STEP 4 OBJECTIVE FUNCTION VALUE 1) VARIABLE V1 V2 V3 V4 V5 Notes 4 92.50000 VALUE 20.000000 35.000000 0.000000 0.000000 0.000000 IE 312 REDUCED COST 0.000000 0.000000 0.950000 0.000000 0.000000 18 Interpretation Notes 4 Our cost will be reduced by $20 or $ 35, respectively, if the demand for gasoline or jet fuel is one unit less. Smaller demand for lubricants has no effect on the objective We are not willing to pay anything for availability of more crude! IE 312 19 What is the Dual? The primal is the original optimization problem The dual is an LP defined on the same input parameters but characterizing the sensitivities of the primal There is one dual variable for each main constraint Primal < constraint > constraint = constraint vi 0 vi 0 Minimize objective Unrestricted vi 0 Maximize objective vi 0 Unrestricted Notes 4 IE 312 20 Interpretation The dual variables provide implicit prices for marginal units of the resource modeled by the constraint Notes 4 Zero unless active How much we are willing to pay for more of a resource (supply constraint) How much we benefit from not having to satisfy a requirement (demand constraint) IE 312 21 What to Optimize? Implicit marginal value (minimization primal) or price (maximization primal) is a i, j vj All activitiesi Notes 4 Maximize value or minimize price! IE 312 22 Dual Constraints For each activity xj in a minimization primal there is a main dual constraint a v cj i, j i i For a maximization primal, each xj 0 has a main dual constraint ai, j vi c j i Notes 4 IE 312 23 Optimal Solution If primal has optimal solution c x b v j * j * i i j Notes 4 i Either the primal optimal makes a main inequality active or the corresponding dual is zero Either a nonnegative primal variable has optimal value xj = 0 or the corresponding dual price vj must make the j-th dual constraint active IE 312 24 Dual of a Min Primal b v max i i i s.t. a v cj i, j i i vi 0 vi 0 vi URS Notes 4 IE 312 for all activities j for all primal ' s i for all primal ' s i for all primal ' s i 25 Dual of a Max Primal b v min i i i s.t. a v cj i, j i i vi 0 vi 0 vi URS Notes 4 for all activities j for all primal ' s i for all primal ' s i for all primal ' s i IE 312 26 Top Brass max 12 x1 9 x2 x1 1000 (brass footballs) s.t. x2 1500 (brass soccer balls) x1 x2 1750 (brass plaques) 4 x1 2 x2 4800 (feet of wood) x1 , x2 0 Notes 4 IE 312 27 Graphical Solution 4 x1 2 x2 4800 2000 x1 1000 x2 1500 1500 Optimal Solution 1000 x1 0 x1 x2 1750 500 x2 0 Notes 4 500 1000 1500 IE 312 2000 28 Dual min s.t. 1000v1 1500v2 1750v3 4800v4 v1 v3 4v4 12 v2 v3 2v4 9 v1 , v2 , v3 , v4 0 Notes 4 IE 312 29 Lindo Solution OBJECTIVE FUNCTION VALUE 1) VARIABLE V1 V2 V3 V4 Notes 4 17700.00 VALUE 0.000000 0.000000 6.000000 1.500000 IE 312 REDUCED COST 350.000000 400.000000 0.000000 0.000000 30 Interpretation Notes 4 We are willing to pay up to $6/each for additional brass Our objective is sensitive to these plaques estimates! We are willing to pay up to $1.5/foot for more wood We don’t need any more brass footballs or soccer balls IE 312 31 Formulating Duals max s.t. 6 x1 x2 13x3 3x1 x2 2 x3 7 5 x1 x2 6 x2 x3 2 x1 0 x2 0 Notes 4 IE 312 32 Formulating Duals min s.t. 7 x1 44 x3 2 x1 4 x2 x3 15 x1 4 x2 5 5 x1 x2 3x3 11 x1 0 x2 0 Notes 4 IE 312 33