Document 10747178

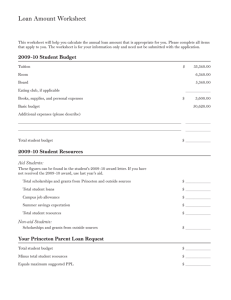

advertisement