A Skeptic’s Guide to Computer Models by John D. Sterman

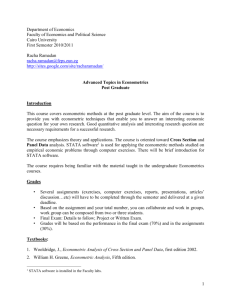

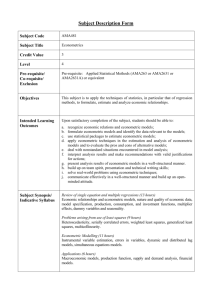

advertisement