TUITION WAIVER POLICY

advertisement

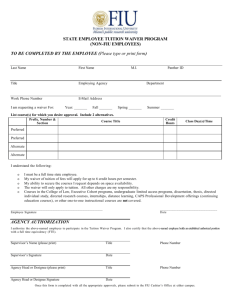

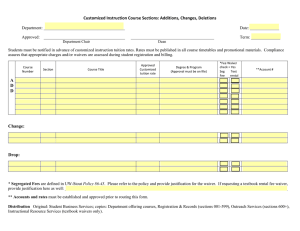

Page 1 of 4 * - indicates a required field. TUITION WAIVER POLICY * POLICY NAME: * POLICY TYPE: Presidential Policy - University Administrative Policy POLICY #: E.3.9.2. *STATUS: Active *CONTACT OFFICE: Administration and Finance – Human Resources *OVERSIGHT EXECUTIVE: Vice President for Administration and Finance *APPLIES TO: Classified, wage, administrative faculty, professional faculty, and other nonfaculty part time employees *PURPOSE: The Office of Human Resources, in conjunction with the Finance Office, administers a tuition waiver program, which allows the University of Mary Washington employee to complete credit and non-credit courses at the University of Mary Washington. The employee must have been continuously employed by the University for a minimum of one year prior to being eligible to receive a tuition waiver and must remain employed during the term of the course. In order to be eligible for tuition waiver, the employee’s job performance needs to be satisfactory or at least at the “partially achieved” or the “contributor” level. DEFINITIONS: *POLICY STATEMENT: A tuition waiver program allows classified, wage, administrative faculty, professional faculty, and other non-faculty part-time employees at the University of Mary Washington to complete credit and non-credit courses at the University of Mary Washington. PROCEDURES: * General Procedures for Implementation: Tuition Waiver for Full-Time Employees For purposes of this section, full-time employees include all full-time classified employees and administrative/professional faculty. 1) The University will waive the costs not to exceed the in-state tuition cost of four UMW undergraduate or graduate courses (16 credit hours) per calendar year. (Please note that should the amount paid in a single calendar year exceed the IRS limit of $5,250 the employee will be responsible for income tax on the difference between the amount paid by UMW and $5250, to be paid by payroll deduction.) Page 2 of 4 2) Tuition waiver applies to part-time study for credit or non-credit courses. Audited courses are excluded from this policy. Waiver may be made for in-state tuition, comprehensive fees, and laboratory fees associated with coursework. All other fees, including books, application fees, processing fees and/or material costs are not eligible costs. 3) Computer technology and special certification courses offered by the University may be waived at the UMW undergraduate in-state rate equal to a single four credit undergraduate course. Individual departments may elect to pay costs in excess of this rate for job related or required courses. Release Time for Full-Time Employees It is expected that employees will make every effort to schedule courses before or after the workday. When courses must be taken during the workday, full-time employees may request up to four hours per week for actual class time (on-the-job time to attend class). This release time does not include travel time to and from class. Release time is at the discretion of the immediate supervisor and appropriate vice president. At no time will the granting of release time be allowed to interfere with the proper completion of the employee’s daily assigned duties. At the discretion of the immediate supervisor, employees who request to take courses during the workday may be allowed, as operations permit, to adjust their work hours to fulfill their normal work hours per week. Schedule adjustments should be documented in the supervisor’s file. Tuition Waiver for Wage (Hourly) and Non-teaching Part time Employees For purposes of this section, an employee must work a minimum average of 24 hours per week to be eligible under this policy. It is expected that employees will make every effort to schedule courses before or after the workday. There is no release time (on-the-job time to attend class) available for wage employees. At the discretion of the immediate supervisor, employees who request to take courses during the workday may be allowed to adjust their work hours to fulfill their normal work hours per week. Schedule adjustments should be documented in the supervisor’s file. Requests for Tuition Waiver must be approved before implementation of work schedule changes. 1) The University will waive the costs not to exceed the in-state tuition cost of four UMW undergraduate or graduate courses (16 credit hours) per calendar year. (Please note that should the amount paid in a single calendar year exceed the IRS limit of $5,250 the employee will be responsible for income tax on the difference between the amount paid by UMW and Page 3 of 4 $5,250, to be paid by payroll deduction.) 2) Tuition waiver applies to part-time study for credit or non-credit courses. Audited courses are excluded from this policy. Waiver may be made for in-state tuition, comprehensive fees, and laboratory fees associated with coursework. All other fees, including books, application fees, processing fees and/or material costs are not eligible costs. 3) Computer technology and special certification courses offered by the University may be waived at the UMW undergraduate in-state rate equal to a single four credit undergraduate course. Individual departments may elect to pay costs in excess of this rate for job related or required courses. Procedure for Tuition Waiver 1) The employee must complete the Tuition Waiver Request Form and ensure all three signatory approvals are obtained. 2) The Finance Office will notify the employee when the Tuition Waiver Request Form has been approved and prepare a check request for the approved amount. 3) Once the employee has registered and the charges have been applied to the employee’s student account, the waiver for the approved course(s) will be applied to the employee’s student account. Proof of Completion Employees are required to submit evidence of course completion with a minimum grade of “C” or “PASS” if a Pass/Fail course, to the Finance Office within 30 days of semester end. If documentation is not received, the employee will be required to repay the University for the tuition and fees paid under this policy. In the case of withdrawal before course completion, employees will be required to pay the full cost of courses taken. Failure to comply with this provision may result in collection proceedings including wage garnishment. * Process for Developing, Approving, and Amending Procedures: * Publication and Communication: * Monitoring, Review, and Reporting: (How will compliance be monitored, reviewed and reported?) Suggestions for change will be brought to the attention of the Office of Human Resources and/or the Finance Department for review and approval. Policy will be published in Board Docs and posted on the Human Resources website. This policy will be reviewed annually by the Office of Human Resources and the Finance Department. Page 4 of 4 RELATED INFORMATION: Policy Background: * Policy Category: Administration and Finance Category Cross Reference: Related Policies: HISTORY: * Origination Date: * Approved by: January 1, 1997 Richard Pearce, V.P. for Administration and Finance * Approval Date: January 1, 1997 * Effective Date: January 1, 1997 * Review Process: * Next Scheduled Review: Revision History: Reviewed at least annually and as needed by the Offices of Human Resources and Finance. October 31, 2016 Revision 1 – September 2007 Revision 2 – September 2008 Revision 3 – July 2011 Revision 4 – June 2012 Revision 5 – December 3, 2012 Revision 6 – October 24, 2014