Buyer Power in the Clothing ... Footwear Sector in the Netherlands Legitimate fear or Calimero effect?

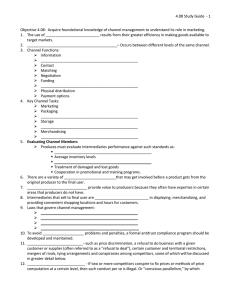

advertisement