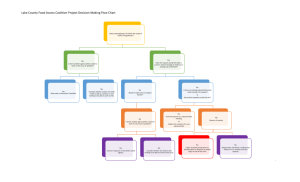

STATEMENT OF THE MILITARY COALITION SUBCOMMITTEE ON PERSONNEL,

advertisement