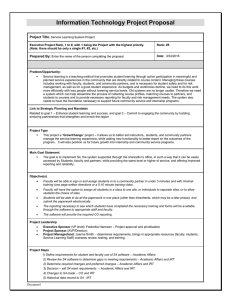

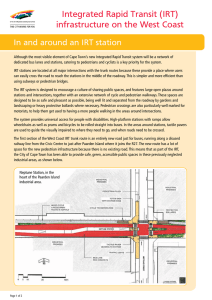

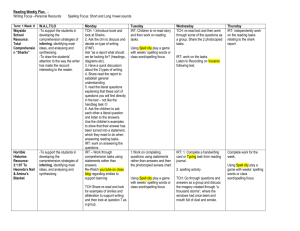

Integrated Rapid Transit Project C

advertisement