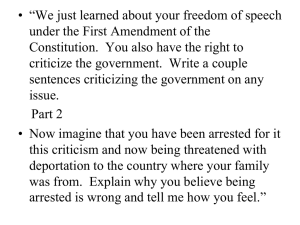

IMPORTANT NOTE:

advertisement