Policy and program guide May 2013

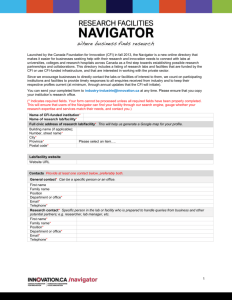

advertisement