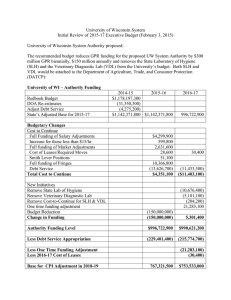

BUDGET IN BRIEF STATE OF WISCONSIN SCOTT WALKER, GOVERNOR

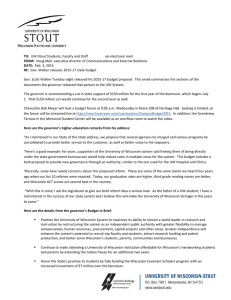

advertisement