LAND ECONOMICS Traditional Von Thunen model of land uses & values

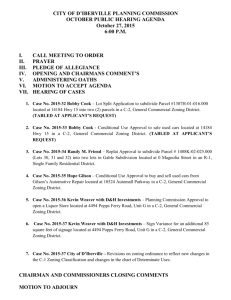

advertisement

LAND ECONOMICS Traditional Von Thunen model of land uses & values Land prices decline as distance from the market center (town) increase. Products that are high-value, or require quick market access, or are costly to transport are produced adjacent to town. A forest belt further out supplies firewood. Products that are storable or easy to move to market can be produced far away. The land beyond is unused. Territorial behavior is not limited to humans Transition from hunter-gatherer to agrarian societies intensifies the imperative of property rights Feudalism: lord owns the land, serfs are bound to it (more consistent with stationary bandit theory of government than with social contract theory) Share-cropping incentivizes peasants to be more productive; It also engages them in the market economy when they sell their share surpluses. The primary resource driving US economic development has been land. The Louisiana Purchase (1803) doubled the land area of the US, created a strategic imperative to get it settled with US citizens Homestead Act (1862): File a claim, improve the land, and file for deed of title. Converted 420,000 sq mi from federal to private ownership Not discontinued until 1976! Conestoga wagon (named for Conestoga, PA, in Lancaster Co.) Eastern states’ metes-and-bounds property boundaries vs. western states’ rectangular “Public Land Survey System” 6 x 6-mile Township such as “Township 2 North Range 1 East” (left) is divided into 1 x 1-mile Sections (right). 1 square mile = 640 acres. Each Section is divided into Quarters of 160 acres each, the unit of land for which a settler could file a homestead claim. Land Grant Act (1850) gave 3.75 million acres to finance trans-continental railroads: every other Section in each Township along the planned rail line. Morrill Act (1862) gave land grants to the states to establish colleges “to teach such branches of learning as are related to agriculture and the mechanic arts.” UD’s original Land Grant college building, now Elliott Hall (north side of Main St.) Henry George (1839-1897): "With the growth of population, land grows in value, and the men who work it must pay more for the privilege." George observed that land is the source and repository of the economic surplus of society In Progress and Poverty (1879) George argued that the economic rents from land should be shared by society. He proposed a "single tax" on land to achieve this distribution of rent. Ideally all land would be collectively owned, and rented to the people who use it. The villages of Arden and Ardencroft in Delaware were created on this model: you own a house on community-owned land, and your land rent pays for local services. Constitutional protections of private property: 5th Amendment "takings" clause: "Private property shall not be taken for a public use, without just compensation." 14th Amendment "due process" clause: "No State shall make or enforce any law which shall abridge the privileges or immunities of citizens of the United States; nor shall any State deprive any person of life, liberty, or property, without due process of law; nor deny to any person within its jurisdiction the ual protection of the laws." Pennsylvania Coal Co. v. Mahon (1922). In 1878 the Pennsylvania Coal Co. granted to Mahon the surface rights to a parcel of land, but retained the mining rights and Mahon assumed risks of mining. In 1921 the state's Kohler Act prohibited mining that caused land subsidence of houses; Mahon cited the Kohler Act to block PA Coal from mining. The US Supreme Court ruled this use of the Kohler Act was an exercise of eminent domain requiring compensation based on the diminution of PA Coal's property value. This case established modern legal doctrine of a regulatory taking; previously a taking had to be physical. Justice Holmes: "If regulation goes too far it will be recognized as a taking." Village of Euclid, Ohio v. Ambler Realty Co. (1926). Ambler challenged Euclid's zoning ordinance (6 classes of use, 3 classes of height and 4 classes of area) restricting its industrial development of 68 acres "without due process." The Supreme Court upheld Euclid's zoning as reasonable police power (nuisance control). (Failed land speculation is not a valid basis for a claim under takings doctrine.) Penn Central v. NYC (1978). New York's Landmark Preservation law required the company to maintain the historic character of Grand Central Station. The Court struck this down. Justice Brennan: "It is exactly this imposition of general costs on a few individuals at which the "taking" protection is directed." Lucas v. South Caroline Coastal Council (1992). In 1986 Lucas paid $975,000 for two residential lots on the Isle of Palms. SC's Beachfront Management Act (1988) barred Lucas from erecting any permanent habitable structures on his parcels--a total loss in value. The Supreme Court (7-2) established a "total takings" test in striking down this restriction. (SC paid Lucas $850,000 in compensation for the lots, then sold them to another developer who built houses on them.) Dolan v. City of Tigard (1994). Part of Dolan's retail property was in a 100-year floodplain. When she sought a permit to expand her store, the city required her to dedicate the portion of her property in the floodplain to public greenway and bike path. The Supreme Court (5-4) found the floodplain restriction was OK, but struck down the public use requirement. Tahoe-Sierra Preservation Council, Inc. v. Tahoe Regional Planning Agency (2002). The Court upheld (6-3) a 3-yr moratorium on development around Lake Tahoe while the Agency developed its comprehensive land-use plans; the temporary delay did not constitute a taking. Kelo v. City of New London (2005). Kelo's house was condemned by New London CT for inclusion in a comprehensive redevelopment plan by a private development company which promised 3,169 new jobs and $1.2 million a year in tax revenues. The Supreme Court ruled (5-4) that the expected public benefits of New London’s redevelopment plan justified its use of eminent domain as a permissible "public use" under the 5th Amendment's takings clause. (Unfortunately the redeveloper was unable to obtain financing and abandoned the redevelopment project; the site is now a dump.) Zoning A zoning ordinance should promote compatibility of land uses in guiding future development of land. An economically efficient zoning map clusters synergistic land uses (residential, parks, retailing) and isolates conflicting uses (heavy industry from residential). It establishes allowable densities for different zones. Typical residential zoning categories might include: R2A (min. 2 acres per house lot), R40 (40,000 sq. feet), R20 (20,000 sq. feet), etc. Central Newark, DE zoning map Protest and counter-protest over proposed The Data Center on UD’s STAR Campus Developers routinely seek variances, exceptions and zoning amendments from the local politicians who control the zoning process (e.g., County Council). A zoning ordinance usually creates economic rent-seeking. Because of this, zoning maps often evolve in ad hoc manner. Over time, inefficient zoning depresses land values. Rent-seeking by local developers explains a lot of the inefficient landuse patterns and congestion problems in New Castle County. An FBI sting in 1989 resulted in criminal convictions of New Castle County councilman Harry Roberts and DE Secretary of Transportation Kermit Justice for extorting illegal campaign contributions from developer Louis Capano in exchange for favorable zoning votes and transportation support for Capano's projects. Methods of preserving farmland (1) preferential taxation via current-use assessment Land is ordinarily taxed based on the value of its “highest and best” use rather than its current use. DE’s current-use assessment formula generally yields zero valuations for farmland use, so farmland pays no property taxes. The county collects a multi-year re-capture (“rollback”) of foregone taxes if an owner does develop his farmland. Farmland assessment actually benefits developers by reducing the speculative carrying costs of land; the developer simply rents his land to a farmer to qualify for the tax break--even if the parcel is already subdivided on the tax map. Common justification: “Farmland doesn't send kids to school." But property taxes are not user fees. Land is a natural target for taxation because it can't get away! (2) Agricultural zoning “Down-zoning” means reducing the number of allowable houses per acre. Aggressive down-zoning may be challenged as an uncompensated government “taking.” (3) Agricultural districts In DE, farmers can enroll their land agricultural districts (totaling at least 200 acres), foregoing development for at least 10 years in exchange for exemption from nuisance complaints arising from ordinary farm operations. DE now has >500 agricultural districts containing >130,000 acres. (4) Purchase of development rights (PDR) In DE, owners of farmland in an agricultural district may submit bids to the DE Ag Lands Preservation Foundation to sell the development rights on their land. The Foundation appraises the value of a parcel’s development rights (DR) as the difference between its market value and its agricultural use value. It then buys the DR’s that are offered at the largest discount. (The average discount is typically over 50%.) After PDR, the owner still retains possession of the land, but it must remain in farming or open space forever. (The owner can build a house or two for family members, but no more than one house per 40 acres.) DALPF spends up to $9 million/year buying farmland DR’s. In the last 10 years it has purchased DR’s on >300 parcels comprising about 65,000 acres, at an average price of about $1,040/acre. (5) Transfer of development rights (TDR) Since PDR programs are expensive, some local governments use their zoning power to take the DR’s from farmland in designated preservation areas (“sending zones”), compensating farmland owners with equivalent DR’s to be used in designated development areas (“receiving zones”). These DR’s are typically bought by developers, who use them to build in receiving zones at higher densities than the zoning ordinance would normally allow. A TDR program is supposed to create a market in DR’s that provides adequate compensation to landowners in sending zones who lose the right to develop their own land. But this market can’t function well if elected officials keep modifying the rules of the market. Burlington Co. NJ example: voters in receiving zone resented the higher densities and got the transfer formula changed. Now an extra housing unit requires 6 DR’s instead of 1—the farmland owners got ripped off!