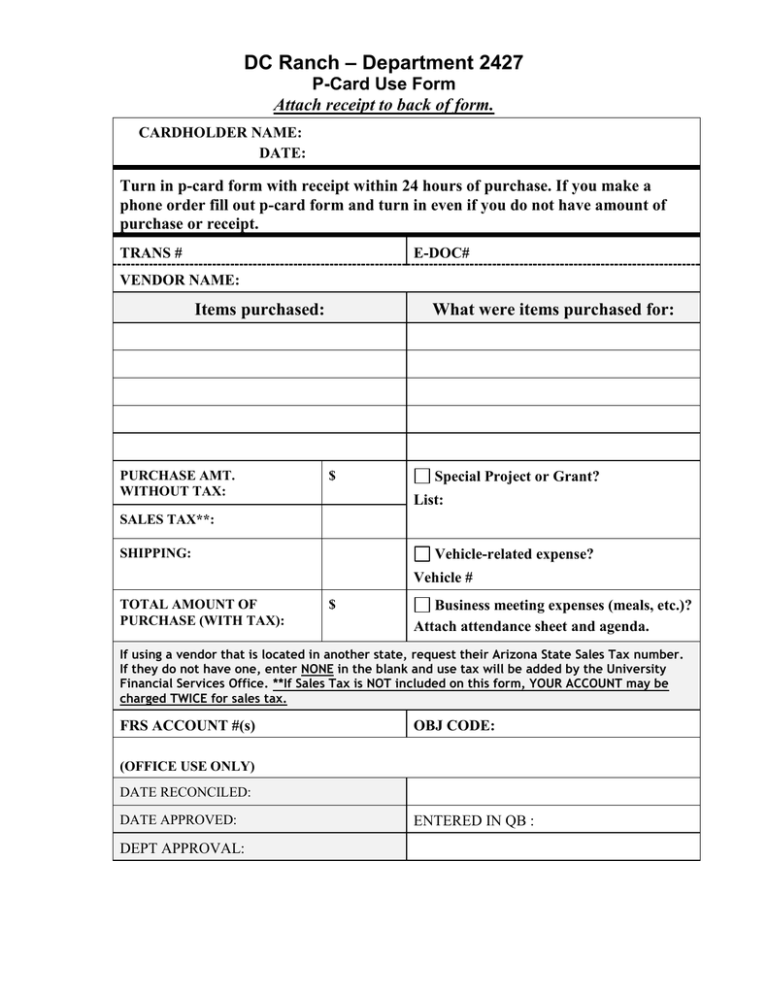

– Department 2427 DC Ranch P-Card Use Form

advertisement

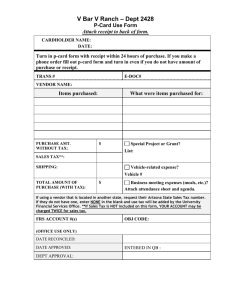

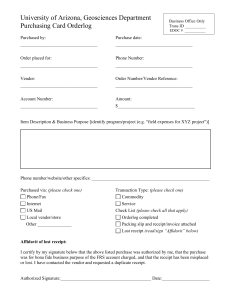

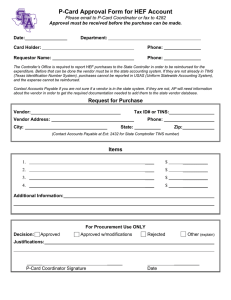

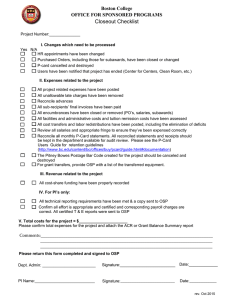

DC Ranch – Department 2427 P-Card Use Form Attach receipt to back of form. CARDHOLDER NAME: DATE: Turn in p-card form with receipt within 24 hours of purchase. If you make a phone order fill out p-card form and turn in even if you do not have amount of purchase or receipt. TRANS # E-DOC# VENDOR NAME: Items purchased: PURCHASE AMT. WITHOUT TAX: What were items purchased for: $ Special Project or Grant? List: SALES TAX**: SHIPPING: Vehicle-related expense? Vehicle # TOTAL AMOUNT OF PURCHASE (WITH TAX): $ Business meeting expenses (meals, etc.)? Attach attendance sheet and agenda. If using a vendor that is located in another state, request their Arizona State Sales Tax number. If they do not have one, enter NONE in the blank and use tax will be added by the University Financial Services Office. **If Sales Tax is NOT included on this form, YOUR ACCOUNT may be charged TWICE for sales tax. FRS ACCOUNT #(s) OBJ CODE: (OFFICE USE ONLY) DATE RECONCILED: DATE APPROVED: DEPT APPROVAL: ENTERED IN QB :