IT&C Market Pulse Bi Annual poll IT&C Infrastructure Professionals August 2009

IT&C Market Pulse

Bi Annual poll IT&C Infrastructure Professionals

August 2009

© 2009 Emerson Network Power russell.perry@emerson.com

Market Pulse: #3 August 09

17/09/2009

Enabling Business-Critical Continuity

- 1 -

IT&C Market Pulse

Bi Annual poll IT&C Infrastructure Professionals

August 2009

Survey shows positive sentiment returning to data centre infrastructure market

Executive summary

Positive sentiment has returned to pre-recession levels according to a new survey of IT&C executives in Asia. The August Market Pulse survey, conducted by Emerson Network

Power, points towards improved conditions for infrastructure investment in the New Year, based on four key findings:

1. Confidence in the improvement in local economic conditions, and the knock-on effect on business performance has been reversed in August compared to the negative sentiment expressed in the last survey conducted in March.

2. The mix of current and future projects has shifted to favor IT&C infrastructure projects, which is in line with anecdotal evidence that capacity continues to be soaked up.

3. Energy efficiency tops the list of concerns for the first time, with markets making a clear link to OPEX reduction opportunities from energy savings.

4. This shift to positive sentiment is yet to be reflected in the project pipeline, however, with a further decline in project volume being recorded.

Timeframe: Starting with an initial deployment in April 2008, the current survey (the fourth of its kind) draws its sample exclusively from users, project influencers and resellers of IT&C infrastructure products and services.

Demographic: The August Market Pulse sample size increased by 34 per cent from March, with a final demographic of users (53 per cent), influencers (35 per cent, up from 26 per cent in March), and the remainder (12 per cent) resellers of IT&C infrastructure products and services.

Lagging Indicators: Consistent with general market trends, namely a further reduction in

Capex spending and a further period of decline in the project pipeline.

Leading Indicators: In contrast to this, forward-looking attributes are the reverse of the

March negative results. Sentiment relating to economic impact (up 22 points) and business performance (up 44 points) are both sharply up.

Trends: The August survey is also notable for highlighting changing attitudes towards energy efficiency, from 'corporate and green' initiatives in 07/08 to a means to reducing operating costs today. The combined impact of the credit crunch, the spike in energy costs and the impact of the business slowdown have fundamentally changed how business relates to energy. Energy efficiency is now a lever for cost reduction and is the primary concern across the Asia region, ahead of heat density (cooling) and availability (uptime) issues (the latter having been the number one priority in times of economic boom).

This will present a challenge for IT&C infrastructure professionals as they work to meet these

OPEX expectations, but to do so in a way that does not compromise core SLA's in terms of availability and cooling.

Next steps: To help markets address this challenge, Emerson is launching the "NextGen

IT&C Infra 2010" program which is structured around these top three concerns. The clear objective of this initiative is to provide new cooling, power, enclosure, monitoring and service solutions that directly address these issues, weighed against the need to reduce energy costs.

For more information on the NextGen IT&C Infra series or the August Market Pulse, visit www.

NextGenITCinfra.com.com

© 2009 Emerson Network Power russell.perry@emerson.com

Market Pulse: #3 August 09

17/09/2009

Enabling Business-Critical Continuity

- 2 -

IT&C Market Pulse

Bi Annual poll IT&C Infrastructure Professionals

August 2009

Table of Contents

Executive summary ...................................................................................................2

Table of Contents.......................................................................................................3

Introduction ................................................................................................................4

Demographics ............................................................................................................5

o By

Projects .......................................................................................................................6

o Projects Past 6 / Next 6 Delta All Respondents ...................................6

Economic Outlook: Confidence................................................................................7

o Confidence

Business Performance ..............................................................................................8

o Performance by Geography .................................................................8 o Performance by Role............................................................................8

CAPEX.........................................................................................................................9

o Past CAPEX by Geography..................................................................9 o Past CAPEX by Role ............................................................................9

IT&C Concerns .........................................................................................................10

o Concerns by Role ...............................................................................10

© 2009 Emerson Network Power russell.perry@emerson.com

Market Pulse: #3 August 09

17/09/2009

Enabling Business-Critical Continuity

- 3 -

IT&C Market Pulse

Bi Annual poll IT&C Infrastructure Professionals

August 2009

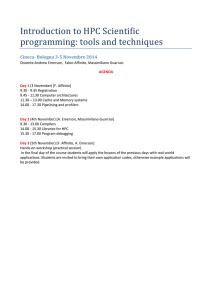

Introduction

The August deployment of the Market Pulse survey marks the 4 th

round of this industry poll.

The genesis for this program lies in the previous economic downturn in 2001 when the tech sector went through a major shakeout following years of steady and seemingly endless growth. Early signs and markers of that adjustment were missed in the period of intense activity that preceded the crash.

Post 2001, the discussion at Emerson turned to how we might better understand the nature of these early warnings, which parts of the market might see them first and how that might in turn help us better understand what you, our customers are thinking and facing in your core business.

With close to a thousand surveys completed and over 60,000 data points to analyze, we are now getting to the point where the program is yielding interesting insights into how our market “works” and how the different functional roles combine to create the overall picture.

The ultimate question speaks to the future. What lies ahead not just in terms of market growth and intensity, but direction and emphasis? The August report is set against the background of close to 12 months of turmoil in our markets and comment from some quarters that the market has finally turned towards the positive.

I’d like to thank the ever increasing number of respondents from around the region who have taken some time out of their busy day to complete this brief survey. I hope that you find the report as interesting as I have and that it provides insight into the road ahead for your business as part of the IT&C Infrastructure community.

Best Regards & Thanks

Russell Perry

Director Marketing & Customer Insight

Emerson Network Power

© 2009 Emerson Network Power russell.perry@emerson.com

Market Pulse: #3 August 09

17/09/2009

Enabling Business-Critical Continuity

- 4 -

Demographics o

Geography

IT&C Market Pulse

Bi Annual poll IT&C Infrastructure Professionals

August 2009 o

Role

Respondents are grouped according to their relationship with Emerson. The three categories are respondents as;

1. Users of Emerson services or equipment,

2. Designers and influencers associated with specification and recommendation of Emerson services or products and who Emerson services or products. o

Industry

© 2009 Emerson Network Power russell.perry@emerson.com

Market Pulse: #3 August 09

17/09/2009

Enabling Business-Critical Continuity

- 5 -

IT&C Market Pulse

Bi Annual poll IT&C Infrastructure Professionals

August 2009

Projects

Respondents were asked to list projects that have been deployed in the past 6 months and those scheduled for deployment in the next period. This has been a consistent feature of the Market Pulse survey from the start of the program. It offers insight project pipeline trends as well as the correlation between forecast and actual deployments.

Respondents select from a menu of project descriptions (x13), which in turn are consolidated into the categories listed below.

P2P refers to “Period to Period”. Within the actual survey deployment it refers to

“Projects deployed” vs. “Projects planned” i.e.. (A). Forecast vs. Actual (i.e. from one survey to the next, is derived by comparing “Next 6” with the following survey’s “Past

6” i.e. (B). o

Projects Past 6 / Next 6 Delta All Respondents

Several points are worth noting here;

- The number of respondents to the survey has increased by 34% from March to August

- The raw number suggests that March Forecast Vs August Actual was an increase (i.e. August Subtotal Infrastructure “past 6” exceeded March forecast) of 8%

- Normalize this number to take the increased sample into account and the delta becomes; o October Next 6 / March Past 6 o March Next 6 / August Past 6

-44%

-19%

This decline in the project pipeline is at odds with the general sense of optimism found throughout other survey attributes. Project pipeline attributes do vary across audience groups as the following pages illustrate.

© 2009 Emerson Network Power russell.perry@emerson.com

Market Pulse: #3 August 09

17/09/2009

Enabling Business-Critical Continuity

- 6 -

Economic Outlook: Confidence

IT&C Market Pulse

Bi Annual poll IT&C Infrastructure Professionals

August 2009

Respondents were asked to rate their confidence in terms of the local economy's performance in the next 6 months. The marked swing from a negative sentiment in

March to a positive sentiment in August is recorded in all areas.

Respondents were asked to rate their confidence; Very positive, Somewhat positive,

Neutral, Somewhat negative, Very negative. This is then converted into a Top 2 Box /

Bottom 2 Box score. o

Confidence by Geography

o

Confidence by Role

© 2009 Emerson Network Power russell.perry@emerson.com

Market Pulse: #3 August 09

17/09/2009

Enabling Business-Critical Continuity

- 7 -

IT&C Market Pulse

Bi Annual poll IT&C Infrastructure Professionals

August 2009

Business Performance

Respondents were asked to indicate how over the next 6 months, they expect their company's overall performance will change, i.e. improve, worsen or remain the same?

All regions / Roles / Industries reflect the expectation that performance will improve going forward.

Special note re BFSI with the August response recording the highest survey to survey delta and the highest separation between Top and Bottom 2 box scores. o

Performance by Geography

o

Performance by Role

© 2009 Emerson Network Power russell.perry@emerson.com

Market Pulse: #3 August 09

17/09/2009

Enabling Business-Critical Continuity

- 8 -

IT&C Market Pulse

Bi Annual poll IT&C Infrastructure Professionals

August 2009

CAPEX

Respondents were asked to indicate how over the past 6 months they have managed

CAPEX activity. As a lagging index, the feedback is consistent with the decline in projects in the past 6 months as well as per general market conditions. o

Past CAPEX by Geography

o

Past CAPEX by Role

© 2009 Emerson Network Power russell.perry@emerson.com

Market Pulse: #3 August 09

17/09/2009

Enabling Business-Critical Continuity

- 9 -

IT&C Market Pulse

Bi Annual poll IT&C Infrastructure Professionals

August 2009

IT&C Concerns

In August a question with respect to IT&C concerns was introduced where respondents were are asked to indicate their top three worries / concerns / challenges. o

Concerns by Role

Top 3 are indicated by color;

© 2009 Emerson Network Power russell.perry@emerson.com

Market Pulse: #3 August 09

17/09/2009

Enabling Business-Critical Continuity

- 10 -