G D C S

advertisement

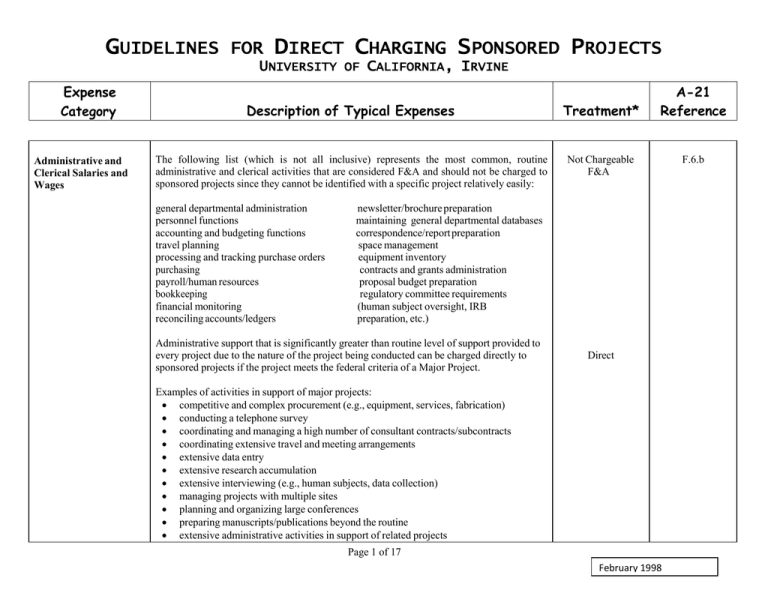

GUIDELINES FOR DIRECT CHARGING SPONSORED PROJECTS UNIVERSITY OF CALIFORNIA, IRVINE Expense Category Administrative and Clerical Salaries and Wages Description of Typical Expenses Treatment* The following list (which is not all inclusive) represents the most common, routine administrative and clerical activities that are considered F&A and should not be charged to sponsored projects since they cannot be identified with a specific project relatively easily: Not Chargeable F&A general departmental administration personnel functions accounting and budgeting functions travel planning processing and tracking purchase orders purchasing payroll/human resources bookkeeping financial monitoring reconciling accounts/ledgers A-21 Reference newsletter/brochure preparation maintaining general departmental databases correspondence/report preparation space management equipment inventory contracts and grants administration proposal budget preparation regulatory committee requirements (human subject oversight, IRB preparation, etc.) Administrative support that is significantly greater than routine level of support provided to every project due to the nature of the project being conducted can be charged directly to sponsored projects if the project meets the federal criteria of a Major Project. Direct Examples of activities in support of major projects: competitive and complex procurement (e.g., equipment, services, fabrication) conducting a telephone survey coordinating and managing a high number of consultant contracts/subcontracts coordinating extensive travel and meeting arrangements extensive data entry extensive research accumulation extensive interviewing (e.g., human subjects, data collection) managing projects with multiple sites planning and organizing large conferences preparing manuscripts/publications beyond the routine extensive administrative activities in support of related projects Page 1 of 17 February 1998 F.6.b GUIDELINES FOR DIRECT CHARGING SPONSORED PROJECTS UNIVERSITY OF CALIFORNIA, IRVINE Expense Category Description of Typical Expenses Treatment* A-21 Reference The following criteria must be met before administrative and/or clerical salaries are charged to a federal project: (1) It is necessary to incur the cost to perform the project’s scope of work; and (2) The cost must be identifiable to the project with a high degree of accuracy; and (3) The proposal resulting in the award describes, in the budget justification, the project activities that satisfy the federal definition of Major Project and the budget explicitly includes administrative or clerical salaries (i.e., the individuals and/or positions providing administrative or clerical support must be specifically identified with the project activities); or (4) The sponsor’s prior approval of rebudgeting is obtained, provided that the prior approval request submitted to, and approved by, the sponsor explicitly includes administrative and clerical salaries (i.e., the individuals and/or positions providing administrative or clerical support must be specifically identified with the project activities); or (5) The terms and conditions of the award transfers certain rebudgeting authority to UCI, provided that any such rebudgeting is approved at the appropriate level within UCI, that the delegated rebudgeting authority is not restricted in such a way as to prohibit the direct charging of administrative or clerical salaries, and that the project activities that satisfy the definition of Major Project are documented in the administering unit’s award file; or (6) The award received by UCI was made in response to a modular grant application, provided that the award terms do not prohibit the direct charging of administrative or clerical salaries and that the project activities that satisfy the definition of Major Project are documented in the administering unit’s award file. Page 2 of 17 February 1998 GUIDELINES FOR DIRECT CHARGING SPONSORED PROJECTS UNIVERSITY OF CALIFORNIA, IRVINE Expense Category Advertising Description of Typical Expenses Treatment* Promoting University activities, e.g., instruction and research, by using coffee mugs, water bottles, pen and pencils, newspaper, radio, and internet advertisements. Not Chargeable Unallowable A-21 Reference J.1 Advertising for the recruitment of sponsored project personnel, procurement of goods and services, or other specific purposes as required by the terms of the sponsored agreement. (See Recruiting) Direct Alcoholic Beverages Alcoholic beverages, even in connection with allowable university hosting costs. Not Chargeable Unallowable J.3 Alumni Activities All departmental costs (salaries, publications, operating costs) in support of alumni activities. Not Chargeable Unallowable J.4 Animals/Animal Care Veterinarian expenses, animal food, cleaning, cages, etc. Direct F.6.b.(1) Commencement and Convocation For F&A cost purposes only. Instruction F&A cost rate). Not Chargeable Unallowable J.8 (As the student services administration portion of the Page 3 of 17 February 1998 GUIDELINES FOR DIRECT CHARGING SPONSORED PROJECTS UNIVERSITY OF CALIFORNIA, IRVINE Expense Category Computer Supplies Description of Typical Expenses Cables, cords, paper, disks, toner, hardware, monitors, printers & CPUs. Treatment* A-21 Reference See Supplies & Materials Category J.31 Hardware CPUs, monitors and printers. [for clarification of equipment threshold, see Increase in Inventorial Equipment Threshold located at snap.uci.edu] See Equipment Category J.18 Software General purpose software such as word processing and special statistical applications. See Supplies & Materials Category J.31 Internet Access Cost of access to the Internet (on-campus and off-campus). Not Chargeable Computing Time CPU time, access fees, storage fees, etc. for research activities Direct F.6.b.(1) Consultants Expertise of a well-defined nature for a fixed period of time. Direct J.37 Contingency Provisions Contingency reserves made for events that cannot be foretold with certainty as to time, intensity, or with an assurance of their happening. Not Chargeable Unallowable J.11 Donations and Contributions to the University The valued of donated services and property. Not Chargeable, but can be used for Cost Sharing and Matching Requirements J.15 Page 4 of 17 February 1998 GUIDELINES FOR DIRECT CHARGING SPONSORED PROJECTS UNIVERSITY OF CALIFORNIA, IRVINE Expense Category Description of Typical Expenses Treatment* A-21 Reference Donations (Charitable) and other contributions made by the University Services, property, or funds donated by UCI to other organizations. Not Chargeable Unallowable J.15 Entertainment Expenditures for recreation, amusement, social activities and any expenditures directly associated with the activity (i.e., tickets to shows or sports events, meals, lodging, rentals, transportation, and gratuities). Not Chargeable Unallowable J.17 Equipment “Equipment” means an article of nonexpendable, tangible personal property having a useful life of more than one year and an acquisition cost which equals or exceeds the lesser of the capitalization level established by the organization for financial statement purposes. Beginning July 1, 2006, F&A will be applied to all expenditures for items below $5,000. [For clarification of equipment threshold, see Increase in Inventorial Equipment Threshold located at snap.uci.edu] “Capital expenditures” means the cost of the asset including the cost to put it in place. Capital expenditures for general purpose equipment, buildings, and land are unallowable as direct charges, except where approved in advance by the sponsoring agency, Expanded Authorities, and/or Federal Demonstration Partnership. Not Chargeable except with advance agency approval J.18 “Special purpose equipment” means equipment, that can be used only for research, medical, scientific, or other technical activities. Examples of special purpose equipment include scintillation counters, centrifuges, spectrographs, and microscopes. Direct with agency approval “General purpose equipment” means equipment, the use of which is not limited only to research, medical, scientific or other technical activities. Examples of general purpose equipment include office equipment and furnishings, air conditioning equipment, reproduction and printing equipment, motor vehicles, and automatic data processing equipment. Not Chargeable except with advance approval from the awarding agency Page 5 of 17 February 1998 J.18 GUIDELINES FOR DIRECT CHARGING SPONSORED PROJECTS UNIVERSITY OF CALIFORNIA, IRVINE Expense Category A-21 Reference Description of Typical Expenses Treatment* Fines and Penalties Payments made because of violations of or failure to comply with federal, state, local, or foreign laws and regulations. Not Chargeable Unallowable J.19 Fund Raising Costs of fund raising, including gift solicitation or capital campaigns, for the sole purpose of raising capital or obtaining contributions. Not Chargeable Unallowable J.20 Goods or Services for Personal Use Costs of goods or services for personal use. Not Chargeable Unallowable J.22 Honoraria An honorarium is a payment for which the primary intent is to confer distinction on, or to symbolize respect, esteem, or admiration for the recipient. (Payment for services rendered is an allowable cost but should not be referred to as an honorarium). Not Chargeable Unallowable Human Subject Compensation Monetary or other items provided to an individual as compensation for their time commitment and/or inconvenience assumed by participating in a research project as a research subject. The fees must be approved by the Institutional Review Board (IRB) in advance as to type and amount of compensation and described in the informed consent form. Subject fees may take many forms, including cash, check, money orders, coupons, gift cards, etc. Subject fees are separate from the reimbursed costs for expenses such as parking, mileage, hotel, airfare, etc.; however, both must be approved by the IRB. Any additional costs associated with the provision of subject compensation (e.g., money order fee, checking account or ATM fee) may be considered part of subject compensation fees. Direct Page 6 of 17 February 1998 J.31 GUIDELINES FOR DIRECT CHARGING SPONSORED PROJECTS UNIVERSITY OF CALIFORNIA, IRVINE Expense Category IRB Application Preparation Lease Agreements Description of Typical Expenses Treatment* Departmental or investigator support costs incurred to prepare and submit an Institutional Review Board application while a new proposal is pending or otherwise unfunded. These costs include salaries, supplies, copying, postage and delivery fees. Not Chargeable F&A Costs related to the preparation and submission of IRB applications and other documents necessary to maintain approval of human subjects research described in a funded project. Theses duties are typically performed by research project staff. Direct The cost of leased space (and associated utilities and maintenance charges) used by a sponsored project. A variety of room types could be used to support the sponsored project, such as: a laboratory, a storage space, a workroom, an office. Direct The cost of leased space (and associated utilities and maintenance charges) used for departmental administration purposes. Not Chargeable F&A Legal Legal and other costs associated with certain court actions and administrative proceedings. Not Chargeable Unallowable Lobbying Lobbying includes: 1) Attempts to influence the outcome of federal, state or local elections, referendums, initiatives or similar procedures, and 2) Specifically requested technical and factual presentations to legislative bodies on topics directly related to sponsored agreements and activities authorized by statute. Not Chargeable Unallowable A-21 Reference Page 7 of 17 February 1998 J.43 J.13 J.28 GUIDELINES FOR DIRECT CHARGING SPONSORED PROJECTS UNIVERSITY OF CALIFORNIA, IRVINE Expense Category Memberships (Subscriptions and Professional Activities) Motor Vehicles Description of Typical Expenses Treatment* Costs of membership in civic, community organizations, country club, or social/dining clubs. Not Chargeable Unallowable Institutional, individual memberships and subscriptions to technical and professional organizations. Not Chargeable F&A Expenses for individual membership, subscriptions to business, professional, and technical periodicals are only chargeable to federal sponsored projects in exceptional circumstances. The expenses must be necessary to carry out the scope of the project and can be identified, with a high degree of accuracy, specifically with a particular sponsored project. Direct Institutional furnished automobiles (Vehicles for personal use) Fleet service costs, renting a car. Network A-21 Reference Not Chargeable Unallowable J.33 J.10.g Direct Network infrastructure costs relating to equipment and wiring generally “behind the wall,” like routers, wiring, conduit, etc. This would include Ethernet and LAN charges. Not Chargeable F&A Network costs that are related to a project’s network and are from “the wall” to the workstation. Project specific upgrades beyond the normal services, but located “behind the wall”. Direct Page 8 of 17 February 1998 J.9 GUIDELINES FOR DIRECT CHARGING SPONSORED PROJECTS UNIVERSITY OF CALIFORNIA, IRVINE Expense Category Description of Typical Expenses Overruns on Sponsored Agreements (Overdrafts) Expenditures that exceed the project budget. Participant Support Stipends Tuition Materials & Supplies Travel/subsistence Health insurance (foreign nationals) Postage: Mail Stop Postage Not Chargeable Unallowable Direct Campus mail services provided on a recharge basis. Direct Postage for routine mailings, including office correspondence and delivery of proposals. Not Chargeable F&A General administrative programming. J.29 NSF Policy and Guidelines Not Chargeable F&A Mail stop charges for mass mailing such as survey collection, patient follow-up letters. Postage for mailing of scientific material related to research projects such as shipping blood supplies or lab supplies; survey collection; patient follow-up letters. Programming Treatment* A-21 Reference F.6.b.(3) Direct Not Chargeable F&A Programming that is necessary to carry out the scope of the project and can be identified specifically with a particular sponsored project with a high degree of accuracy. F.6.b.(3) Direct Page 9 of 17 February 1998 J.47 GUIDELINES FOR DIRECT CHARGING SPONSORED PROJECTS UNIVERSITY OF CALIFORNIA, IRVINE Expense Category A-21 Reference Description of Typical Expenses Treatment* Promoting University activities, e.g., instruction and research, by using coffee mugs, water bottles, pen and pencils, newspaper, radio, and internet advertisements. Not Chargeable Unallowable Advertising for the recruitment of personnel, procurement of goods and services, or other specific purposes as required by the terms of the sponsored agreement. Direct Proposal Preparation Cost incurred for preparing and submitting a proposal, such as salaries, supplies, copying, postage. Proposal costs are the costs of preparing bids or proposals on potential government and non-government sponsored projects, including the development of engineering data and cost data necessary to support the institution’s bids or proposals. Not Chargeable F&A J.38 Publication Costs of communicating with the public and press pertaining to specific activities or accomplishments which result from performance of sponsored agreements, regardless of the media used. Not Chargeable Unallowable J.1.d.(2) Promotional Items Publication costs for dissemination of research results. Public Relations The term public relations includes community relations and means those activities dedicated to maintaining the image of the institution, or maintaining or promoting understanding and favorable relations with the community or public at large or any segment of the public. Public relations expenses only as specifically required by the terms of the agreement. Costs of communicating with the public and press pertaining to specific activities or accomplishments which result from the performance of sponsored agreements. J.1 Direct Not Chargeable Unallowable Direct Not Chargeable F&A Page 10 of 17 February 1998 J.1b GUIDELINES FOR DIRECT CHARGING SPONSORED PROJECTS UNIVERSITY OF CALIFORNIA, IRVINE Expense Category Recruiting Repairs & Maintenance Description of Typical Expenses Treatment* In publications, costs of “help wanted” advertising that includes extravagant advertising (large in size and color), includes advertising material for other than recruitment purposes. Not Chargeable Unallowable Search expenses, including travel costs of employees while engaged in recruiting personnel, travel costs of applicants for interviews for prospective employment, and relocation costs incurred incident to recruitment of new employees. Costs of meals which are a part of the recruitment process. Direct Core service for state supported space in UCI buildings (non-leased). Not Chargeable F&A Special services directly related to project performance for state supported space in UCI buildings (non-leased). Direct Service of equipment installed as part of state funded capital projects or an integral part of a central building service. Not Chargeable F&A Service of equipment bought on a grant or contract. Normal repair and maintenance of general purpose equipment. Costs incurred for necessary maintenance, repair or upkeep of property used in the performance of a sponsored project which neither adds to the permanent value of the property nor appreciably prolongs its intended life but keeps it in an efficient operating condition. A-21 Reference Direct Not Chargeable F&A Direct Page 11 of 17 February 1998 J.42 J.30 GUIDELINES FOR DIRECT CHARGING SPONSORED PROJECTS UNIVERSITY OF CALIFORNIA, IRVINE Expense Category A-21 Reference Description of Typical Expenses Treatment* Copying items related to routine departmental administrative activities such as ledgers, invoices, project proposals, progress reports to agencies, purchase orders, etc. Not Chargeable F&A Copying items directly identified with project performance such as reproduction of publications, manuscripts or survey instruments, scientific data, human subjects, protocols, etc. Direct Reconversion Costs incurred in the restoration or rehabilitation of the institution’s facilities to approximately the same condition existing immediately prior to commencement of a sponsored agreement, fair wear and tear excepted. Direct J.41 Renovation and Alteration Costs incurred for ordinary or normal rearrangement and alteration. Non Chargeable F&A J.40 Reproduction Special Arrangement and alteration costs incurred specifically for the project, when such work has been approved in advance by the sponsoring agency. New utility distribution within the laboratory. Direct Scholarships and Student Aid Costs of scholarships fellowships, and other programs of student aid in training grants, such as T32 and F32. Direct Subaward Subaward established for transference of a portion of the program work to another entity. Direct Subscriptions If the periodical or book is not available via internet or the library, and the content is specifically and solely related to the project. Direct Page 12 of 17 February 1998 J.39 J.45 J.33 GUIDELINES FOR DIRECT CHARGING SPONSORED PROJECTS UNIVERSITY OF CALIFORNIA, IRVINE Expense Category Supplies and Materials Telephone Description of Typical Expenses Treatment* General administrative supplies, such as computer, computer supplies including computer diskettes, general purpose software, printer paper, and toner cartridges, pencils, pens, paper, paper clips, etc. Not Chargeable F&A Supplies such as chemicals, radioisotopes, plastic tubes, columns, vials, animals, and office-type supplies such as lab notebooks, computer, special statistical applications, computer supplies including computer diskettes, printer paper, and toner cartridges stored in the lab, or in space under the control of the lab, and used only in the laboratory or field for the technical work. The cost is necessary to carry out the scope of the project and can be identified specifically with a particular sponsored project, an instructional activity, or any other institutional activity, or that can be directly assigned to such activities relatively easily with a high degree of accuracy. Direct Basic telephone line, equipment, installation and local telephone services. A-21 Reference Not Chargeable F&A J.31 F.6.b.(3) F.6.b.(1) Telephone toll charges. Direct Cellular phones required for field sites and approved by the sponsor. Direct Off-Campus leased space or a special circumstance approved by the sponsor. Direct Page 13 of 17 February 1998 GUIDELINES FOR DIRECT CHARGING SPONSORED PROJECTS UNIVERSITY OF CALIFORNIA, IRVINE Expense Category Travel Utility Description of Typical Expenses Treatment* Airfare costs in excess of the lowest available commercial discount airfare, Federal Government contract airfare, or customary standard (coach or equivalent) airfare. Not Chargeable Unallowable Travel to conferences, symposiums, colloquiums, including registration fees; meetings at awarding agencies; or travel as needed for performance of project and approved by the Sponsor, including dissemination of projects results. Direct Normal utility costs. A-21 Reference J.53 Not Chargeable F&A See Lease Category Waste Disposal (hazardous) Hazardous waste disposal, waste spills, issuing of badges, specialized environmental health and safety training. Direct Page 14 of 17 February 1998 J.47 GUIDELINES FOR DIRECT CHARGING SPONSORED PROJECTS UNIVERSITY OF CALIFORNIA, IRVINE *Treatment. The “Treatment” column contains terms with the following explanations: Direct. Direct means that the described expenses can be charged to federal sponsored projects. Direct expenses are necessary to carry out the scope of the project, and can be identified specifically with a particular sponsored project with a high degree of accuracy. These items of expense are often referred to as direct expenses, direct costs or direct charges. Not Chargeable. These expenses cannot be charged to federal sponsored projects. Other funding sources must be utilized. F&A. F&A stands for Facilities and Administrative, and these expenses cannot be directly charged to federal sponsored projects. F&A costs are those costs that are incurred for common or joint objectives and therefore cannot be identified readily and specifically with a particular sponsored project. Unallowable. The federal government has identified these items as expenses they will not reimburse. Accordingly, they are not chargeable to federal sponsored projects. Cost Sharing. Expenses directly benefiting a sponsored project, but per agreement with the federal government, the university is required to provide funding. ** Special Purpose or Circumstance Justifying the Treatment of F&A (Facilities and Administrative)Costs as Direct Costs When a special circumstance exists, it may be acceptable to propose and charge an F&A cost as a direct cost. The special circumstance that necessitates direct charging costs that are normally treated as F&A costs should be explicitly described and substantiated in the budget justification section of the proposal. Such costs may be directly charged only if they meet the following requirements: (1) The proposal budget includes the costs and the special circumstances necessitating the direct charging of such costs are justified in the proposal. (2) The project has a special need for the item or service that is beyond the level of services normally provided. (3) The costs can be specifically identified with the work conducted under the project. Page 15 of 17 February 1998 GUIDELINES FOR DIRECT CHARGING SPONSORED PROJECTS UNIVERSITY OF CALIFORNIA, IRVINE Examples of Special Purpose or Circumstance Justifying Direct Charges - Following are examples of federal Major Projects that illustrate circumstances where direct charging of administrative and clerical salaries may be appropriate. 1. Projects that are geographically inaccessible to normal departmental administrative services such as research vessels, radio astronomy projects, and other research field sites that are remote from campus (e.g., field projects). 2. Projects that require making travel and meeting arrangements for large numbers of participants, such as conferences and seminars. 3. Large, complex programs, such as General Clinical Research Centers, Primate Centers, Program Projects, environmental research centers, engineering research centers, and other grants and contracts that entail assembling and managing teams of investigators from a number of institutions. 4. Projects which involve extensive data accumulation, analysis and entry, surveying, tabulation, cataloging, searching literature, and reporting (such as epidemiological studies, clinical trials, and retrospective clinical records studies). 5. Projects whose principal focus is the preparation and production of manuals and large reports, books, or monographs (excluding routine progress and technical reports). 6. Individual projects requiring project-specified database management; individualized graphics or manuscript preparation; human or animal protocols; and multiple project- related investigator coordination and communications. 7. Since training grants are for a different purpose (training) than a traditional research project, these project budgets may include costs that are normally treated as F&A (indirect) costs. Training grants permit a budget for an “institutional allowance” which authorizes direct charging of appropriate expenses normally treated as facilities and administrative (indirect) costs if they are reasonable, specifically identified with the project, and budgeted in the award. The following examples are illustrative of circumstances where direct charging of administrative or clerical salaries to non-federal projects may be appropriate if the costs are budgeted and approved by the awarding agency: 1. Private sponsored projects. Industrial/Commercial: Projects performed for these organizations are proposed and awarded to be performed, at least in part, for the benefit of the industrial/commercial sponsor and the University. Total costs of these are the concern of the sponsor, not whether the costs are direct or facilities and administrative (indirect). Page 16 of 17 February 1998 GUIDELINES FOR DIRECT CHARGING SPONSORED PROJECTS UNIVERSITY OF CALIFORNIA, IRVINE 2. Foundations and not-for-profit agencies or associations: Generally the purpose of private foundation funding is to supplement federal research support. Typically, foundations do not support the facilities and administrative (indirect) activities of the research project as indicated by their practice of funding facilities and administrative (indirect) costs at a rate less than the institution’s full indirect cost rate. 3. State sponsored agreements that have defined the types of costs that are direct or facilities and administrative (indirect) would constitute a different circumstance than costs incurred under federal agreements. UCI must comply with State agency regulations and statutory requirements. Consequently, costs normally treated as facilities and administrative (indirect) costs could be treated as direct if they are reasonable, specifically identified with the sponsored agreement, and included in the award budget. Page 17 of 17 February 1998