Spinal Disorders Claims in Long Term Care Insurance

advertisement

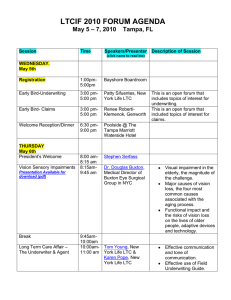

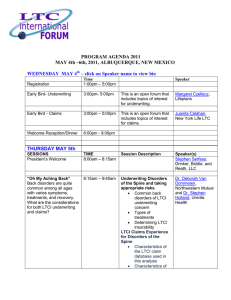

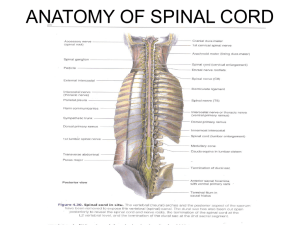

Spinal Disorders Claims in Long Term Care Insurance It’s such a pain, why bother? Stephen K. Holland, MD Chief Medical Officer Univita Health, Inc. Long Term Care International Forum, May 2011 Albuquerque, New Mexico 1 Agenda • Amen to underwriting • How common are LTCI claims for spinal disorders? • LTCI claims experience • Compression of morbidity and recovery • Can we manage spinal disorder claims ? • Conclusions Spinal Disorders and Disability UNUM Long Term Disability Claims 1. Cancer 12.1% 2. Complications of pregnancy 11.7% 3. Joint/muscle/connective tissue 10.1% 4. Back Injuries 8.1% 5. Cardiovascular disease 8.0% UNUM Corporate Disability Data Base, 2010 3 Spinal Disorders Understanding LTCI Claims Experience 4 LTCI Claims Experience Carrier A - TQ Group LTCI policy 73% Comprehensive, 22% Facility only, 4% Partnership Active members: 156,104 Average age of active members: 69.3 years Gender: 60% Female, 40% Male Average policy duration: 10.7 years (max 17+ years) Total exposure: More than 24.2 million member months Univita LTCI Underwriting and Claims Data Base 2011 5 LTCI Claims Experience Carrier A’s Claims Experience 23,089 Requests for LTCI Benefits 17,927 Approved LTCI Claims 13,325 Paid LTCI Claims $810 million in Benefits Paid to Date Average Paid Claim: $60,796 Median Paid Claim: $37,376 Claim Closure - 3,961 Recoveries; 8,613 Deaths, 399 Exhausted Benefits Univita LTCI Underwriting and Claims Data Base 2011 6 LTCI Claims Experience Risk Pool Disability profile • 25% Cognitive Impairment (CI) • 45% 2+ ADL deficits • 30% Combined ADL & CI Setting of Care • 48.8% Home Health Care • 32.5% Assisted Living • 18.5% Nursing Home Univita LTCI Underwriting and Claims Data Base 2011 7 LTCI Claims Experience Most frequent paid claimed events* 1. Pure Dementia 2. Cancer 3. Stroke 4. Fractures/Injuries/Falls/Gait issues 5. Arthritis and other Rheumatic diseases 6. Parkinson’s disease 7. Respiratory disease 8. CHF, Cardiomyopathy 9. Spinal disorders 10.Diabetic complications 24% 14% 11% 7% 5% 5% 4% 4% 4% 2% *Accounts for 80% of Paid Claims Univita LTCI Underwriting and Claims Data Base 2011 8 LTCI Claims Experience As of 12/31/2010: 17,927 Approved; 13,325 Paid Claims 771 Spinal disorders claims • • • • Age at issue: 69.4 years Age at time of claims: 78.2 years $39,748,200 paid to date $51,554 average claim payment 17,146 Claims from all others • • • • Spinal Disorders 4.3% Other than Spinal Disorders 95.7% Age at issue: 71.1 years Age at time of claims: 77.6 years $770,361,424 paid to date $45,082 average claim payment Univita LTCI Underwriting and Claims Data Base 2011 9 LTCI Claims Experience Most frequent paid claimed events 1. Pure Dementia 2. Cancer 3. Stroke 4. Fractures/Injuries/Falls/Gait issues 5. Arthritis &other Rheumatic diseases 6. Parkinson’s disease 7. Respiratory disease 8. CHF, Cardiomyopathy 9. Spinal disorders 10.Diabetic complications Mean $78,315 $15,874 $79,679 $56,588 $67,857 $76,830 $38,852 $43,658 $69,532 $34,766 Univita LTCI Underwriting and Claims Data Base 2011 10 LTCI Claims Experience Most frequent paid claimed events 1. Pure Dementia 2. Cancer 3. Stroke 4. Fractures/Injuries/Falls/Gait issues 5. Arthritis &other Rheumatic diseases 6. Parkinson’s disease 7. Respiratory disease 8. CHF, Cardiomyopathy 9. Spinal disorders 10.Diabetic complications Mean Median $78,315 $15,874 $79,679 $56,588 $67,857 $76,830 $38,852 $43,658 $69,532 $34,766 $54,899 $4,024 $51,854 $26,406 $49,050 $53,119 $16,866 $23,575 $41,921 $21,699 Univita LTCI Underwriting and Claims Data Base 2011 11 LTCI Claims Experience Typical Spinal Disorder Diagnoses • Spinal compression fracture • Osteoarthritis, degenerative disc disease (DDD) • Spondylolisthesis, spinal stenosis • Failed back surgery • Spinal cord injury, traumatic vertebral fracture • Ankylosing Spondylitis • Radiculopathy • Myelopathy • Diffuse Idiopathic Skeletal Hyperostosis (DISH) Univita LTCI Underwriting and Claims Data Base 2011 12 LTCI Claims Experience Age Distribution 60% Spinal Disorders versus All Other Diagnoses 50% 40% Spinal Disorders 30% All Others 20% 10% 0% ≤69 years 70-79 years ≥80 years Univita LTCI Underwriting and Claims Data Base 2011 13 LTCI Claims Experience Gender Distribution 90% Spinal Disorders versus All Other Diagnoses 80% Spinal Disorders 70% All Others 60% 50% 40% 30% 20% 10% 0% Female Male Univita LTCI Underwriting and Claims Data Base 2011 14 LTCI Claims Experience Spinal Disorders Location of Care Assisted Living 28.6% Nursing Home 8.9% Home Health Care 62.4% Univita LTCI Underwriting and Claims Data Base 2011 15 LTCI Claims Experience 70% Spinal Disorders versus All Other Location of Care 60% Spinal Disorders 50% All Others 40% 30% 20% 10% 0% Home Health ALF SNF Univita LTCI Underwriting and Claims Data Base 2011 16 LTCI Claims Experience Spinal Disorders – Claim Closure 100% 90% 70% Closure Rate 80% 70% 60% 50% Deceased Recovered 40% 30% 20% 10% 0% ≤69 years 70-79 years ≥80 years Univita LTCI Underwriting and Claims Data Base 2011 17 LTCI Claims Experience Claim Closure 60% Spinal Disorders versus All Other Diagnoses 50% Spinal Disorders 40% All Others 30% 20% 10% 0% Recovered Deceased Exhausted Univita LTCI Underwriting and Claims Data Base 2011 18 LTCI Claims Experience Claim Closure 80% Spinal Disorders versus All Other Diagnoses 70% 60% Spinal Disorders 50% All Others 40% 30% 20% 10% 0% Recovered Deceased Exhausted Univita LTCI Underwriting and Claims Data Base 2011 19 LTCI Claims Experience Age at Recovery 45% 40% 35% 30% Spinal Disorders versus All Other Diagnoses Spinal Disorders All Others 25% 20% 15% 10% 5% 0% ≤69 years 70-79 years ≥80 years Univita LTCI Underwriting and Claims Data Base 2011 20 LTCI Claims Experience Age at Recovery 45% 40% 35% 30% Spinal Disorders versus All Other Diagnoses Spinal Disorders All Others 25% 20% 15% 10% 5% 0% ≤69 years 70-79 years ≥80 years Univita LTCI Underwriting and Claims Data Base 2011 21 LTCI Claims Experience Timing of Recovery 60% Spinal Disorders versus All Other Diagnoses 50% Spinal Disorders 40% All Others 30% 20% 10% 0% In Deductible ≤12 months 12-24 months Univita LTCI Underwriting and Claims Data Base 2011 22 LTCI Claims Experience Typical Spinal Disorder claim: 73 years of age, multiple spinal compression fractures 2+ ADL dependencies Home Health Care, 13 months, $41,921 paid Most costly claim to date: 64 years of age, spinal cord injury (quadriplegia) 5 ADL dependencies Assisted Living, 10.9 years, $666,347 Univita LTCI Underwriting and Claims Data Base 2011 23 Spinal Disorder Claims in LTCI Can LTCI Claims for Spinal Disorders be Managed? 24 The Spectrum of Benefit Eligibility Benefit Eligible Grey Zone 6/6 ADL Three or More Two Dependencies ADL ADL Dependencies; Dependencies Cognitively Intact Coma Severely Cognitively Impaired Moderately Cognitively Impaired; ADL’s Intact Ineligible for Benefits ADL Independent Mild Cognitive Impairment 25 The Spectrum of Benefit Eligibility Ineligible for Benefits Grey Zone Benefit Eligible 6/6 ADL Three or More Two Dependencies ADL ADL Dependencies Dependencies ADL Independent Careful Benefit Eligibility Determination is Critical Spinal Disorder Approval Rate: 72.4% All Other Approval Rate: 89.1% Spinal Disorders 26 Active LTCI Claims Management Higher non-approval rates at claim submission Claimed event heavily biased towards IADL dependencies Significant early claims closure More than 56% of closed claims close via recovery More than 48% recover during deductible period An additional 51% recovery during the next 12 months There will be obstacles to recovery IADL abilities slow to recover; reinstatement of deductible Potential for fraud Symptoms are subjective LTC Insurance as a means of qualifying for SSI or DI Beware of requests for Independent Providers and informal care 27 Active LTCI Claims Management What Can We Learn from Acute Care Mechanical back pain rarely causes long term disability Pain and limitations from compression fractures are usually self limited Early mobilization and continued activities are critical Mode of therapy is less critical Active care management is effective Adequate analgesia Early mobilization Home Physical Therapy as bridge to outpatient therapy Coaching and self management 28 LTCI Spinal Disorder Claims Conclusions 29 Conclusions Spinal disorders are a fairly common LTCI claimed event Most claims for disorders of the spine are shorter than others Early intervention is important – active claims management Many will recover during their deductible period A large number will recover during the first 12 months of claim Care Management can be very effective Encourage close medical follow-up Reach out to insured’s PCP and care manager; coordinate efforts Encourage rehabilitation Recognize and focus on mitigating obstacles to recovery 30 Questions and Discussion LTCIF Albuquerque, NM May 2011 31