1 OBJECTS AND REASONS inter alia (a)

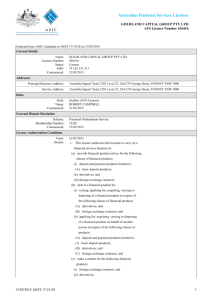

advertisement