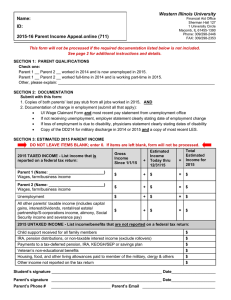

Western Illinois University Name: ID:

Name:

ID:

2016-17 Student Income Appeal.online (718)

Western Illinois University

Financial Aid Office

Sherman Hall 127

1 University Circle

Macomb, IL 61455-1390

Phone: 309/298-2446

FAX: 309/298-2353

This form will not be processed if the required documentation listed below is not included.

See page 2 for additional instructions and details.

SECTION 1: STUDENT QUALIFICATIONS

Check one:

Student __ Spouse __ worked in 2015 and is now unemployed in 2016.

Student __ Spouse __ worked full-time in 2015 and is working part-time in 2016.

Other, please explain: _______________________________________________________________________

SECTION 2: DOCUMENTATION

Submit with this form:

1. Copies of student's (and spouse's, if married) last pay stub from all jobs worked in 2016, AND

2. Documentation of change in employment (submit all that apply):

•

UI Wage Claimant Form and most recent pay statement from unemployment office

•

If not receiving unemployment, employer statement clearly stating date of employment change

•

If loss of employment is due to disability, physicians statement clearly stating dates of disability

•

Copy of the DD214 for military discharge in 2015 or 2016 and a copy of most recent LES.

SECTION 3: ESTIMATED 2016 STUDENT INCOME

DO NOT LEAVE ITEMS BLANK; enter 0. If items are left blank, form will not be processed.

2015 TAXED INCOME - List income that is reported on a federal tax return:

Gross

Income

Since 1/1/16

+

Estimated

Income

Today thru

12/31/16

=

Total

Estimated

Income for

2016

Student's wages, farm/business income $ + $ = $

Spouse's wages, farm/business income

Unemployment

All other student (and spouse) taxable income

(includes capital gains, interest/dividends, rental/real estate/ partnership/S-corporations income, alimony,

Social Security income and severance pay)

$

$

$

+ $

+ $

+ $

= $

= $

= $

2016 UNTAXED INCOME - List income/benefits that are not reported on a federal tax return:

Child support received for all family members $

IRA, pension distributions, or non-taxable interest income (exclude rollovers) $

Payments to a tax-deferred pension, IRA, KEOGH/SEP or savings plan $

Veteran’s non-educational benefits $

Housing, food, and other living allowances paid to member of the military, clergy & others $

Other income not reported on the tax return $

Student’s signature __________________________________________________ Date ____________________

2016-17 STUDENT INCOME APPEAL - ADDITIONAL INSTRUCTIONS

SECTION 1: STUDENT QUALIFICATIONS

•

Estimated 2016 income must be significantly less than 2015 income.

•

Income includes earnings from work, retirement pay, severance pay, lump sum payments, etc.

•

Loss of overtime cannot be considered until the 2015 tax return is filed.

SECTION 2: DOCUMENTATION

•

Student (and spouse) must submit most recent 2016 paystub(s) available for any job worked.

•

Student (and spouse) must submit documentation confirming their change in employment (see page 1 for examples).

•

Student (and spouse) are encouraged to submit a signed statement explaining their circumstances and summarizing the calculations used to determine 2016 Total Estimated Income.

SECTION 3: ESTIMATED 2016 STUDENT INCOME

•

GENERAL DEFINITIONS o Gross Income – income earned during 2016, before taxes. o Estimated Income – anticipated income to be earned during 2016, calculated using current employment information. o Total Estimated Income – add together Gross Income and Estimated Income to provide a total.

•

2016 TAXED INCOME o Student's wages, farm/business income – provide gross income student has earned or will earn from working or from self-employment, including farm or other business income. Submit most recent W-2 or

1099 forms .

o Spouse's wages, farm/business income – provide gross income spouse has earned or will earn from working or from self-employment, including farm or other business income. Submit most recent W-2 or

1099 forms. o Unemployment – provide gross income received from unemployment benefits. Submit UI Wage Claimant

Form and most recent pay statement. o All other student( and spouse) taxable income – provide any other gross income that would be reported on a tax return (see page 1 for examples).

•

2016 UNTAXED INCOME o Child support received for all family members – Don’t include foster care or adoption payments.

o IRA, pension distributions, or non-taxable interest income (exclude rollovers) – Payments to taxdeferred pension and retirement savings plans (paid directly or withheld from earnings), including, but not limited to, amounts reported on the W-2 forms in Boxes 12a through 12d, codes D, E, F, G, H and S. Don’t include amounts reported in code DD (employer contributions toward employee health benefits).

o Payments to a tax-deferred pension, IRA, KEOGH/SEP or savings plan – IRA deductions and payments to self-employed SEP, SIMPLE, Keogh and other qualified plans from IRS Form 1040—line 28 + line 32 or

1040A—line 17.

o Veteran’s non-educational benefits – Includes Disability, Death Pension, or Dependency & Indemnity

Compensation (DIC) and/or VA Educational Work-Study allowances.

o Housing, food, and other living allowances paid to member of the military, clergy & others – Include cash payments and cash value of benefits. Don’t include the value of on-base military housing or the value of a basic military allowance for housing. o Other income not reported on the tax return – Include the cash value of workers’ compensation, disability, etc. Also include the untaxed portions of health savings accounts from IRS Form 1040—line 25. Don't include extended foster care benefits, student aid, earned income credit, additional child tax credit, welfare payments, untaxed Social Security benefits, Supplemental Security Income, Workforce Investment Act educational benefits, on-base military housing or a military housing allowance, combat pay, benefits from flexible spending arrangements (e.g., cafeteria plans), foreign income exclusion or credit for federal tax on special fuels.