FINAL ACT AF/ACP/CE/en 1

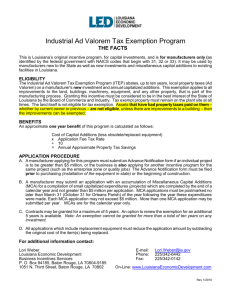

advertisement