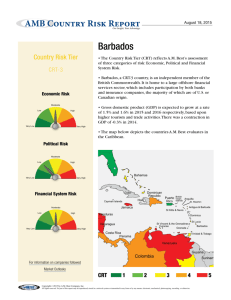

ECONOMIC AND FINANCIAL POLICIES OF THE GOVERNMENT OF BARBADOS

advertisement