Monday 7 July, 2008 RESPONSIVE AND RESPONSIBLE FINANCIAL STATEMENT

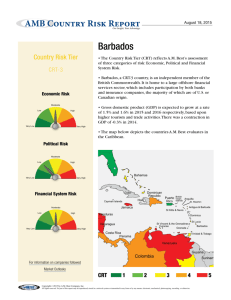

advertisement