Document 10571244

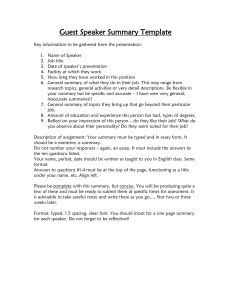

advertisement