Document 10571238

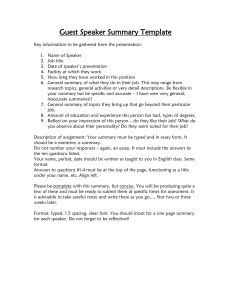

advertisement