SAINT LUCIA

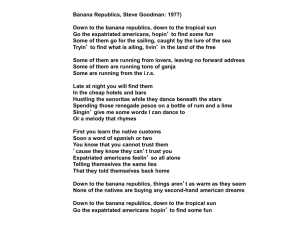

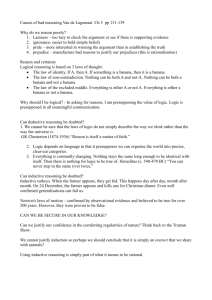

advertisement