Barbados: Statistical Appendix

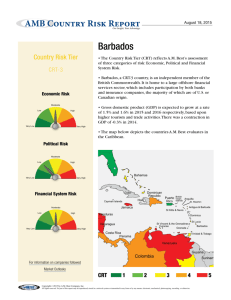

advertisement