The Product Development Process Carleton University (1984)

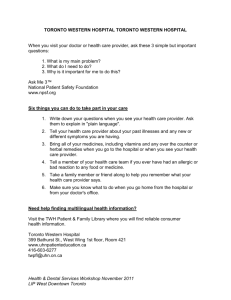

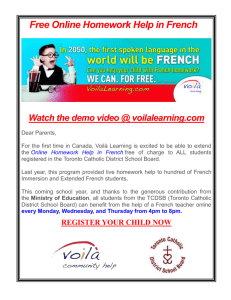

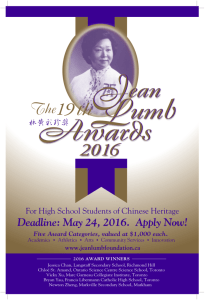

advertisement