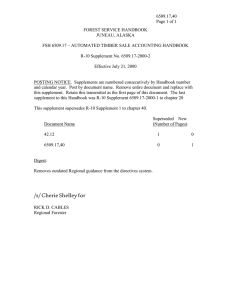

FOREST SERVICE HANDBOOK ALASKA REGION (REGION 10) JUNEAU, ALASKA

advertisement

6509.33_301 Page 1 of 3 FOREST SERVICE HANDBOOK ALASKA REGION (REGION 10) JUNEAU, ALASKA FSH 6509.33 – FEDERAL TRAVEL REGULATION CHAPTER 301 – TEMPORARY DUTY (TDY) TRAVEL ALLOWANCES Supplement No.: R-10 6509.33_301-2016-1 Effective Date: March 23, 2016 Duration: This supplement is effective until superseded or removed. Approved: /s/ Beth G. Pendleton BETH G. PENDLETON Regional Forester Date Approved: March 23, 2016 Posting Instructions: Supplements are numbered consecutively by Handbook number and calendar year. Post by document; remove the entire document and replace it with this supplement. Retain this transmittal as the first page(s) of this document. The last R-10 supplement to this Handbook was 6509.33-2015-2 to chapter 301. New Document 6509.33_301-2016-1 3 Pages Superseded Document(s) by Issuance Number and Effective Date 6509.33_301-2015-1 6509.33_301-2015-2 2 Pages 2 Pages Digest: 11 – Combine supplements in this part. Update Regional policy for reduced per diem rate at remote duty locations to define processing for field rate per diem-meals and field rate per diemincidental expenses. R-10 SUPPLEMENT 6509.33_301-2016-1 EFFECTIVE DATE: 3/23/2016 DURATION: This supplement is effective until superseded or removed. 6509.33_301 Page 2 of 3 FSH 6509.33 – FEDERAL TRAVEL REGULATION CHAPTER 301 – TEMPORARY DUTY (TDY) TRAVEL ALLOWANCES 301-11 - Per Diem Expenses 301-11.12 - How does the type of lodging I select affect my reimbursement? The Forest Service reimburses the cost of different types of lodging differently: Government Quarters. Employees are required to pay for the use of Forest Service quarters in the Alaska Region and are authorized reimbursement on a travel voucher. Invitational travelers, contractors and volunteers whose contract/agreement with the Government authorizes use of quarters are required to pay for use of Forest Service quarters in the Alaska Region. Depending on the terms of the contract/agreement, the nightly fee for use of quarters shall be paid by the contractor/volunteer or charged to the program area that is covering the rental costs. Refer to the Region 10 supplement to FSH 6409.11, chapter 30 for a list of Alaska posts of duty with Forest Service quarters and processes for recording payment of quarters rent. Refer to the Region 10 supplement to FSH 6309.32 Part 4G13 Simplified Acquisition Procedures for instructions regarding the use of a government purchase card. 301-11.200 - Under what circumstances may my agency prescribe a reduced per diem rate lower than the prescribed maximum? 2. Under Article 11 Negotiations between Alaska Region (Management) and National Federation of Federal Employees, Local 251 (Union) resulted in the following agreements, which authorize the following circumstances by which the agency may prescribe a reduced per diem rate lower than the prescribed maximum. The reduced per diem rate (also known as the field subsistence rate) is authorized based on a determination that: a. The work activity is in a remote area where a unit’s capability to transport employees to their official station would take excessive time or would otherwise pose an unacceptable safety hazard; or b. The cost of travel to and from worksites, including lost productive time, exceeds the cost of providing reduced per diem reimbursement, and c. The work activity will last more than 12 hours, regardless of the actual miles from the employee’s duty station. R-10 SUPPLEMENT 6509.33_301-2016-1 EFFECTIVE DATE: 3/23/2016 DURATION: This supplement is effective until superseded or removed. 6509.33_301 Page 3 of 3 FSH 6509.33 – FEDERAL TRAVEL REGULATION CHAPTER 301 – TEMPORARY DUTY (TDY) TRAVEL ALLOWANCES A list of designated field camps where the reduced per diem rate will apply will be updated annually, by March 1 and renegotiated with the Union by October 1. Refer to the forest supplements to FSH 6509.33 section 301.11 for a list of these locations. The reduced per diem rate for remote duty locations in the Alaska Region will be 60% (rounded to the nearest dollar) of the Local Meal and Local Incidental Expense per-diem rate established by Department of Defense. The per-diem rates can be found at: http://www.defensetravel.dod.mil/pdcgi/pd-rates/opdrates4.cgi For example, when the local meals rate is $80 and the local incidental rate is $19, the reduced per diem (meals) rate is $48 ($80 X 60%). The reduced per diem (incidental expenses) rate is $ 11 ($19 X 60%). The proration of first and last day’s per-diem is required by the Federal Travel Regulation and will be applied by the Travel Management System (ETS2). This reduced rate recognizes that start up and replenishment costs for “staple goods” will be procured outside of the Travel Management System. “Staple goods” include, and are not limited to, paper goods and cleaning supplies. Crew supervisors should coordinate with one another to assure that an adequate supply of “staple goods” is in place at remote duty locations. District Rangers should establish procedures that will ensure full utilization of “stable goods” by district field-going personnel. 301-52 – Claiming Reimbursement 301-52.1 – Must I file a travel claim? It depends. If a traveler (employee, volunteer, cooperator, contractor) can create a travel authorization in the Travel Management System (ETS2), they shall use the field per diem rate (meals and incidental expenses). If a traveler cannot create a travel authorization or obtain a travel advance through a travel authorization as required in Travel Management System (ETS2) due to an emergency or administrative barrier, refer to R10 Supplement FSH 6309.32 4G13 Simplified Acquisition Procedures for instructions on purchasing field subsistence items. The field per diem rate (meals) will be used to calculate the amount authorized for field subsistence items. Employees may choose to complete a travel authorization and travel claim for the field per diem (incidental expenses), only once their ETS2 profile is available. If management provides field subsistence as part of a contract or agreement, employees may choose to complete a travel authorization and travel claim for the field per diem (incidental expenses) only.