FOREST SERVICE HANDBOOK NATIONAL HEADQUARTERS (WO) WASHINGTON, DC

6509.33_301

Page 1 of 37

FOREST SERVICE HANDBOOK

NATIONAL HEADQUARTERS (WO)

WASHINGTON, DC

FSH 6509.33 - FEDERAL TRAVEL REGULATION

CHAPTER 301 - TEMPORARY DUTY (TDY) TRAVEL ALLOWANCES

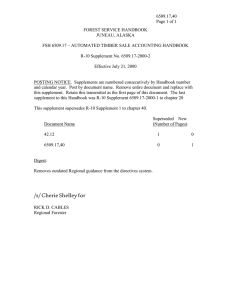

Supplement No.: 6509.33-2011-2

Effective Date: December 8, 2011

Duration: This supplement is effective until superseded or removed.

Approved: DONNA M. CARMICAL

Chief Financial Officer (CFO)

Date Approved: 11/16/2011

Posting Instructions: Supplements are numbered consecutively by handbook number and calendar year. Post by document; remove the entire document and replace it with this supplement. Retain this transmittal as the first page(s) of this document. The last supplement to this handbook was 6509.33-2011-1 to chapter 302-12.

New Document 6509.33_301 36 Pages

Superseded Document(s) by Issuance Number and

Effective Date

Digest:

6509.33_301

(Supplement 6509.33-2009-2, 3/12/2009)

41 Pages

301 - Makes minor technical and editorial changes throughout chapter.

301-2.1 - In paragraph 5, removes and obsolete direction on named resorts or other recreational establishments.

301-10.8 - Sets forth new direction on mixing business and personal and business travel.

301-10.303 - Removes paragraph 3 and obsolete direction on POV-Committed Government

Vehicle.

WO SUPPLEMENT 6509.33-2011-2

EFFECTIVE DATE: 12/08/2011

DURATION: This supplement is effective until superseded or removed.

6509.33_301

Page 2 of 37

FSH 6509.33 - FEDERAL TRAVEL REGULATION

CHAPTER 301 - TEMPORARY DUTY (TDY) TRAVEL ALLOWANCES

STANDARD POSTING INSTRUCTIONS

FOR THE FEDERAL TRAVEL REGULATION, FSH 6509.33

(For further direction on organization and posting of parent text (white pages) see the Foreword to the Federal Travel Regulation beginning on pages i.)

ORGANIZATION. The Federal Travel Regulation (FTR) is divided into chapters, parts, subparts (if applicable), sections, and paragraphs. The numbers 301, 302, 303, and 304 connote specific chapters of Title 41 of the Code of Federal Regulations (CFR). The number before the decimal point indicates the part within each chapter; the number after the decimal point indicates the section. For example 301-1.1 refers to:

Chapter

301-

Part

1.

Section

1

Pages within each part are consecutively numbered beginning with Arabic number 1. Each page number is preceded by the part number; for example, the third page of Part 301-2 is numbered

2-3. Individual pages are identified by chapter in the running header.

TRANSMITTALS. Transmittals accompany parent text, Department supplements, and Forest

Service supplements. File transmittals at the front of the handbook in numerical sequence with the highest amendment or supplement number first. Group the transmittals in the following order by issuing Agency and unit level:

- Federal Travel Regulation (FTR) (white transmittals);

- Agriculture Travel Regulations (ATR) supplements (yellow transmittals);

- Forest Service Travel Regulations (FSTR) supplements (buff transmittals);

- Region, Station, or Area Supplements (blue transmittals); and

- Forest Supplements (green transmittals).

SUPPLEMENTS AND INTERIM DIRECTIVES. Post supplements to the parent text of the

Federal Travel Regulation (white pages) at the end of each part (for example, at the end of part

301-1, 301-2, and so on) by color in the following order:

- Agriculture Travel Regulations (ATR) supplements (yellow pages);

- Forest Service Travel Regulations (FSTR) supplements (buff pages);

- Washington Office IDs (pink pages);

- Region, Station, or Area Supplements (blue pages);

- Region, Station, or Area IDs (pink pages);

- Forest Supplements (green pages); and

- Forest IDs (pink pages).

WO SUPPLEMENT 6509.33-2011-2

EFFECTIVE DATE: 12/08/2011

DURATION: This supplement is effective until superseded or removed.

6509.33_301

Page 3 of 37

FSH 6509.33 - FEDERAL TRAVEL REGULATION

CHAPTER 301 - TEMPORARY DUTY (TDY) TRAVEL ALLOWANCES

Table of Contents

301-10.124 - When may I use business-class airline accommodations? .............................. 14

301-10.200 - What types of Government vehicles may my agency authorize me to use? ... 17

301-53 - Using Promotional Materials and Frequent Traveler Programs ............... 27

301-54 - Collection of Undisputed Delinquent Amounts Owed to the Contractor Issuing the

301-70.708 - What can we do to reduce travel charge card delinquencies? ......................... 33

WO SUPPLEMENT 6509.33-2011-2

EFFECTIVE DATE: 12/08/2011

DURATION: This supplement is effective until superseded or removed.

6509.33_301

Page 4 of 37

FSH 6509.33 - FEDERAL TRAVEL REGULATION

CHAPTER 301 - TEMPORARY DUTY (TDY) TRAVEL ALLOWANCES

301-71 - Agency Travel Accountability Requirements ............................................. 34

301-71.205 - Under what circumstances may we disallow a claim for an expense? ............ 34

301-71.304 - Are we responsible for ensuring the collection of outstanding travel advances?

WO SUPPLEMENT 6509.33-2011-2

EFFECTIVE DATE: 12/08/2011

DURATION: This supplement is effective until superseded or removed.

6509.33_301

Page 5 of 37

FSH 6509.33 - FEDERAL TRAVEL REGULATION

CHAPTER 301 - TEMPORARY DUTY (TDY) TRAVEL ALLOWANCES

301-1 - APPLICABILITY

These Agency directions supplement the Federal Travel Regulations (FTR), are in line with corresponding sections in the FTR, and addresses agency policy which gives more detail than the

FTR direction. Use this handbook in conjunction with the FTR to obtain the most complete understanding of the travel regulations. Additionally, incorporate the Agriculture Travel

Regulations (ATR) with these two references for the most complete understanding of all aspects of official travel.

This handbook contains items which have been negotiated between the Forest Service and the

National Federation of Federal Employees (NFFE) Forest Service Council (FSC). It is not to be altered or supplemented below the National level by units covered by NFFE except as provided in the Master Agreement between the parties. National level changes must not be made without notice, and bargaining between the parties, as appropriate.

301-1.3 - Who is eligible for TDY allowances?

This Forest Service policy covers the following individuals traveling on official business:

1. Forest Service employees.

2. Invitational Travelers - (Non-Employee). Acting in a capacity directly connected with official Forest Service activities.

All of the non-employees listed below are eligible to travel using City Pair fares while on official Forest Service business. a. Speakers at Forest Service events, program experts, and advisors. b. Interns, fellows, and research associates. c. Employees of Federal agencies whose travel is solely for Forest Service business. d. Persons providing personal assistance to employees with special needs who are authorized to travel. e. Employment applicants traveling at the request of Forest Service.

3. Contractors are subject to the FTR and Forest Service travel policy. Contractors are not authorized to use the City Pair Program to obtain discounted airfares. In addition, contractors are not allowed to claim travel reimbursement using GovTrip.

4. Volunteers - The Volunteers in the National Forests Act of 1972, as amended, authorizes reimbursement to a volunteer for transportation, lodging, and meals and

WO SUPPLEMENT 6509.33-2011-2

EFFECTIVE DATE: 12/08/2011

DURATION: This supplement is effective until superseded or removed.

6509.33_301

Page 6 of 37

FSH 6509.33 - FEDERAL TRAVEL REGULATION

CHAPTER 301 - TEMPORARY DUTY (TDY) TRAVEL ALLOWANCES incidental expenses (M&IE) at the volunteer's official duty station. Include a provision for and the method of reimbursement in the volunteer's agreement, form OF-301a

Volunteer Services Agreement for Natural Resources Agencies. a. Reimburse expenses at the volunteer's duty station using form FS-6500-229,

Request for Reimbursement Form. Use GovTrip for temporary duty travel. b. It is common practice to authorize and pay for transportation and meals of local volunteers which are necessary, reasonable, and arise as a result of the performance of the voluntary work. Allow reimbursement for expenses incurred at the volunteer's official duty station within the following guidelines, using administrative judgment to decide amounts to be reimbursed:

(1) The volunteer's official duty station is the site(s) stated in the volunteer's agreement where the volunteer work is performed. It may or may not be the volunteer's place of residence.

(2) Reimburse local common carrier transportation on an actual-cost-incurred basis.

(3) Reimburse privately-owned auto at the advantageous-to-the-Government rate for authorized mileage, plus actual costs of tolls and parking fees.

(4) The Forest Service should reimburse the volunteer for actual costs incurred for lodging, subject to the limitation under applicable per diem or actual subsistence rates.

(5) Forest Service may approve reimbursement of actual meal(s) cost incurred by the volunteer in conjunction with performing work for the Forest Service.

Reimbursement must not exceed the maximum M&IE rate for the location. The agreement with the volunteer should specify a lesser maximum per day if the local conditions warrant.

(6) Forest Service may reimburse those incidental expenses to the volunteer, based upon actual and necessary costs incurred in conjunction with performing work for the

Forest Service. FTR 301-11.18

(7) Forest Service may use a fixed-rate method instead of the actual expense method.

Do not construe a fixed rate as a uniform rate or stipend. Use a fixed rate for any volunteer only when arrived at through a case-by-case determination. Consider the volunteer's personal needs, individual schedule, and any other pertinent factors to determine covered expenses. The volunteer shall be fully aware that the fixed rate covers subsistence expenses only and should not be considered pay. The computed

WO SUPPLEMENT 6509.33-2011-2

EFFECTIVE DATE: 12/08/2011

DURATION: This supplement is effective until superseded or removed.

6509.33_301

Page 7 of 37

FSH 6509.33 - FEDERAL TRAVEL REGULATION

CHAPTER 301 - TEMPORARY DUTY (TDY) TRAVEL ALLOWANCES fixed rate must not exceed the applicable per diem rate. Review the fixed rate and, if necessary, adjust it at least annually.

301-2 - GENERAL RULES

301-2.1 - Must I have authorization to travel?

1. All employees must have a travel authorization for any official travel. Generally, travel authorizations should be prepared in advance of travel. An invitational traveler using Forest Service funds to procure ticketed transportation shall also have a preapproved travel authorization. Use one of the following trip types, when creating an authorization: a. Trip By Trip. An authorization allowing an individual to take one or more specific official business trips, which must include specific purpose, itinerary, and estimated cost. b. Sponsored. An authorization where an outside source is paying for all or part of the travel. c. Invitational. An authorization of individuals either not employed or employed

(under 5 U.S.C. 5703) intermittently in the Government service as consultants or experts. Travel allowances authorized for such persons are the same as those normally authorized for employees in connection with TDY. d. Open. An authorization allowing an employee to travel on official business without further authorization under certain specific conditions. For example, travel to specific geographic area(s) for specific purpose(s), subject to trip cost ceilings, or for specific periods of time. Use for employees traveling six or more times per year and incident team members. Open authorizations should not be used for foreign travel.

FTR 301-2.5 provides listing of travel types requiring trip-by-trip authorizations.

2. The traveler/Travel Arranger is required to attach appropriate supporting documentation to the GovTrip travel authorization.

3. The approving official for a travel authorization or voucher is the traveler’s immediate supervisor (or the supervisor of the organization providing travel for an invitational traveler). The immediate supervisor may delegate the approval authority to a peer of the immediate supervisor or an acting delegated in writing (FSM 1231.3). The approving official shall never be a subordinate of the traveler. The approving official designated to electronically stamp the document “APPROVED” in GovTrip is responsible for confirming the hard-copy documentation is properly completed.

4. Post travel authorizations may be created in GovTrip for the following:

WO SUPPLEMENT 6509.33-2011-2

EFFECTIVE DATE: 12/08/2011

DURATION: This supplement is effective until superseded or removed.

6509.33_301

Page 8 of 37

FSH 6509.33 - FEDERAL TRAVEL REGULATION

CHAPTER 301 - TEMPORARY DUTY (TDY) TRAVEL ALLOWANCES a. Travel expenses related to incident business or disaster recovery. b. Travel expenses related to threatened law enforcement/investigative employees and members of their families. c. Travel expenses related to last minute travel when there is inadequate time to complete the authorization prior to departure.

301-10 - Transportation Expenses

Subpart A - General

301-10.1 - Am I eligible for payment of transportation expenses?

Yes, when performing official travel. Transportation is defined as a means of arriving from one place to another.

1. The traveler shall use GovTrip to make reservations and purchase airline tickets, including restricted fare tickets.

2. Forest Service is contractually obligated to use Travel Management Centers (TMCs) for official travel airline reservations and ticketing. A traveler may purchase airline tickets outside GovTrip only for emergency travel and/or last minute changes if GovTrip is not available and calling TMC’s is not feasible or practical. For example, the traveler is in a remote location where there is limited access to the Internet and phone service.

Emergency travel does not include incident business or disaster recovery.

3. The traveler must use the contract city-pair fares when available unless there is a significantly lower priced fare from a non-contract carrier. A non-contract carrier may be used, but any travel on a non-contract carrier must be approved in advance and must be justified by one of the exceptions listed in the FTR 301-10.108.

4. Normally a traveler should select coach class unless a premium (business or first) class accommodation is specifically authorized. A higher class of service may be justified due to the length of an overseas flight, a medical condition certified by a physician or specific requirements of a donor of artifacts or exhibits. The medical condition must be re-certified annually. Business or first class travel must also be approved in advance by the Under Secretary and approved documentation must be attached to the authorization. Approval document must be uploaded to the GovTrip travel authorization.

5. The traveler is required to use U.S. carriers in accordance with the FTR. The FTR lists some conditions that permit a traveler to use a non-U.S. flag carrier. Requests for use of a non-U.S. flag carrier will be evaluated on a case by case basis and must be

WO SUPPLEMENT 6509.33-2011-2

EFFECTIVE DATE: 12/08/2011

DURATION: This supplement is effective until superseded or removed.

6509.33_301

Page 9 of 37

FSH 6509.33 - FEDERAL TRAVEL REGULATION

CHAPTER 301 - TEMPORARY DUTY (TDY) TRAVEL ALLOWANCES approved in advance. Traveler shall submit a memo/letter with a detailed explanation describing the requirement to use a non-U.S. flag carrier to the TMC. If the travel is approved, the approved memo/letter must be electronically attached to the authorization.

6. Train tickets may be purchased directly from Amtrak with an individually billed travel charge card or personal funds. Government discounts on Acela trains are not available if tickets are purchased with personal funds. If the traveler does not have a travel charge card, the Acela ticket must be purchased through TMC’s to receive the Government discount.

7. To purchase ship tickets the traveler shall use a U.S. flag ship unless the necessity of the mission requires a foreign ship.

8. A traveler may also use a Government car or plane, ferry, personal vehicle (with reimbursement based on mileage), rental car, or taxi.

9. The traveler shall not be reimbursed for any costs incurred solely for the convenience of the traveler.

10. Travelers are responsible for obtaining credit for unused tickets, deposits, or for reporting a loss to the carrier. Failure to obtain a credit from the carrier will result in the employee being financially liable for the entire amount of the ticket. Employees should not submit the unused ticket, charged to the individually billed travel charge card account, to a Forest Service payment office with the travel voucher. The unused ticket must be returned to the Travel Management Center (TMC). Employees may seek advice from ASC-B&F Travel Branch for assistance.

11. The FTR permits a traveler to use a taxi from home to the duty station when the traveler is leaving on official travel from the duty station. Similarly, a traveler may take a taxi from the duty station to home the day they return to the duty station from official travel.

301-10.7 - How should I route my travel?

Forest Service travelers should- travel to the destination by the most efficient and commonly traveled route. Deviation from this route must be approved in advance of the travel. See

FSH 6109.11, chapter 30 for leave charges during travel status.

Use the following guidelines to route travel during non-duty hours. The Forest Service must adhere to prescribed policy on compensatory time off under Title 5, Code of Federal

Regulations, section 550.1404, for time spent by an employee in travel status away from the employee’s official duty station, when such time is not otherwise compensable.

WO SUPPLEMENT 6509.33-2011-2

EFFECTIVE DATE: 12/08/2011

DURATION: This supplement is effective until superseded or removed.

6509.33_301

Page 10 of 37

FSH 6509.33 - FEDERAL TRAVEL REGULATION

CHAPTER 301 - TEMPORARY DUTY (TDY) TRAVEL ALLOWANCES

WO SUPPLEMENT 6509.33-2011-2

EFFECTIVE DATE: 12/08/2011

DURATION: This supplement is effective until superseded or removed.

6509.33_301

Page 11 of 37

FSH 6509.33 - FEDERAL TRAVEL REGULATION

CHAPTER 301 - TEMPORARY DUTY (TDY) TRAVEL ALLOWANCES

To qualify for compensatory time off, one or more of the following conditions must exist:

1. The travel must have been for work purposes and officially approved by an authorized agency official.

2. For the purpose of compensatory time off for travel, time in a travel status includes: a. Time spent traveling between the official duty station and a temporary duty station; b. Time spent traveling between two temporary duty stations; and c. The "usual waiting time" preceding or interrupting such travel, for example, waiting at an airport or train station prior to departure. The employing agency has the sole and exclusive discretion to determine what is creditable as "usual waiting time.”

An "extended" waiting period for example, unusually long wait during which the employee is free to rest, sleep, or otherwise use the time for their own purposes is not considered time in a travel status.

3. An employee in travel status is caught in a delay situation that is outside the employees’ regular working hours where the airline advises passengers to stay within the boarding area since departure could be any minute, the time is compensable; even if the time stretches into several hours. However, if the flight is cancelled and the employee has to book, or the airline has booked the employee, on the next available flight that is several hours wait time, the employee is now free to rest, sleep, or otherwise use the time for their own purpose, the employee is entitled to a maximum of 4 hours of compensatory time for the extended waiting time spent at the airport.

4. If an employee experiences an unusually long wait prior to their initial departure or between actual periods of travel during which the employee is free to rest, sleep, or otherwise use the time for their own purposes, the extended waiting time that is outside the employee’s regular working hours is not creditable time in travel status. In addition, employees may not earn compensatory time off for bona fide meal periods during travel or claim time spent traveling to or from an airport that is within the limits of their official duty station.

The National Finance Center (NFC) has established two transaction/prefix codes to be used on time and attendance reports to distinguish this type of compensatory time. Record compensatory time off earned for travel as Transaction Code 32, Prefix 78. Record as Transaction Code 64,

Prefix 78 when the compensatory time off is used.

WO SUPPLEMENT 6509.33-2011-2

EFFECTIVE DATE: 12/08/2011

DURATION: This supplement is effective until superseded or removed.

6509.33_301

Page 12 of 37

FSH 6509.33 - FEDERAL TRAVEL REGULATION

CHAPTER 301 - TEMPORARY DUTY (TDY) TRAVEL ALLOWANCES

Compensatory time off for travel may be earned in 15-minute increments. Compensatory time off for travel must be used by the end of the 26 th

pay period after it was earned or be forfeited, except when the employee is performing active military duties for the armed service or is on leave without pay due to an on-the-job injury.

301-10.8 - What is my liability if, for personal convenience, I travel by an indirect route or interrupt travel by a direct route?

When mixing personal travel with official travel, the following procedures must be used:

1. Book the official travel using GovTrip using normal processes.

2. To assist with the approval requirement, complete form FS-6500-5 Constructive

Travel Using Privately Owned Cost Comparative Stmt, or FS-6500-6 Constructive Travel

Using Common Carrier Cost Comparative Stmt. These forms are available electronically at http://fsweb.wo.fs.fed.us/im/forms/fs_forms/index.htm

. The approved form with proper documentation (screen prints of the comparable rates) must be attached to the travel authorization.

3. Annual leave taken during an official trip. Employees' supervisors are required to complete section B of both forms FS-6500-5 and FS-6500-6 as applicable to approve annual leave taken in conjunction with official travel. Travelers need justification when they stop enroute to, from, or between points of official business for personal preference.

This is true whether leave is involved or not. The traveler should prepare a memorandum or email to the approving official with the official's approval annotated on the document.

The employee shall justify and receive approval for these travel situations regardless of the type of travel authorization issued for the official trip.

4. Modify the official travel arrangements outside of the official Forest Service travel system. For example, the traveler may contact their TMC’s public reservation number , the number available to the general public to modify their itinerary, or take their ticket to the airline and have it reissued to accommodate the leisure (personal) travel portion. The traveler is responsible for all risks related to deviating from the official travel authorization.

5. Government fares must not be used for personal (leisure) travel.

6. Per diem must not be paid for personal days taken in conjunction with official travel.

Per diem is not allowed on any day where more than one-half the prescribed workday is charged to annual leave.

7. Government rental cars may not be used for personal (leisure) travel.

WO SUPPLEMENT 6509.33-2011-2

EFFECTIVE DATE: 12/08/2011

DURATION: This supplement is effective until superseded or removed.

6509.33_301

Page 13 of 37

FSH 6509.33 - FEDERAL TRAVEL REGULATION

CHAPTER 301 - TEMPORARY DUTY (TDY) TRAVEL ALLOWANCES

8. Any fees and costs resulting from personal travel must be paid by the traveler and must not be reimbursed by Forest Service.

9. Any additional costs including change fees must not be paid by the Forest Service.

10. Any other additional costs for personal travel due to the official travel being canceled must not be paid by the Forest Service.

11. Any cost savings resulting from modified travel, such as exchanged tickets, must be reflected on the travel voucher and returned to the Forest Service.

301-10.108 - What requirements must be met to use a non-contract fare?

Exceptions to the use of the contract city-pair fare must be approved in advance of the tickets being purchased. Approval must be obtained from the approving official prior to booking travel.

Exceptions to the use of the contract city pair are listed in FTR 301-10.107. Employees shall know or reasonably anticipate, based on the planned trip, that they will use the ticket.

Associated fees of changing or canceling the arrangements associated with a non-refundable fare must be taken in consideration prior to purchase.

If a non-refundable fare is approved and purchased and the travel is cancelled, the traveler shall claim the cost of the ticket and associated fees using GovTrip by filing a travel voucher. When the travel voucher is digitally signed in GovTrip, in the “Additional Remarks” box enter “Nonrefundable ticket not used on (give dates and reason(s)). Non-refundable ticket (include ticket number) will be used on the next travel voucher.”

When the deferred ticket is used for official travel at a later date, the employee does not claim the cost of the ticket on the travel voucher, but may claim any change fee or additional costs on the new travel voucher as a miscellaneous expense. When the travel voucher is digitally signed in GovTrip, in the “Additional Remarks” box enter: “Used a non-refundable ticket) include ticket number) claimed on travel voucher dated, mm/dd/yyyy.”

301-10.109 - What is my liability for unauthorized use of a non-contract carrier when contract service is available and I do not meet one of the exceptions for required use?

If a non-refundable ticket is purchased without approval, and the travel is cancelled for other than official reasons, the traveler owns the ticket. Examples include personal leave taken, illness, or any other non-job related reason. The traveler shall not be reimbursed unless or until used for official travel.

Any costs or penalties incurred from unauthorized purchase of a non-refundable ticket are borne by the traveler.

WO SUPPLEMENT 6509.33-2011-2

EFFECTIVE DATE: 12/08/2011

DURATION: This supplement is effective until superseded or removed.

6509.33_301

Page 14 of 37

FSH 6509.33 - FEDERAL TRAVEL REGULATION

CHAPTER 301 - TEMPORARY DUTY (TDY) TRAVEL ALLOWANCES

Subpart B - Common Carrier Transportation

301-10.124 - When may I use business-class airline accommodations?

First class and business class airline accommodations are considered “premium class” travel.

Advance approval for the use of premium class travel is required when conditions meet those outlined in Forest Service Travel Handbook as well as the Agriculture Travel Regulations,

DM-2300-001, Agriculture Travel Regulation. Employees performing premium class travel, which has not been properly approved, will be held liable for the related costs. Authorization is not needed when frequent travel benefits are used to upgrade from coach to premium/business class or for business class service on AMTRAK, Acela, or Metro liner trains .

The Under Secretary, Natural Resources and Environment, is the only U.S. Department of

Agriculture (USDA) official authorized to approve the purchase of a premium class ticket for the

Forest Service. The employee shall request approval for premium class travel tickets via their immediate supervisor, who shall forward the appropriate documentation, through the chain of command for the Chief’s approval. Approval must be received in advance of purchasing the travel ticket. Use the following to request a premium class ticket:

1. Employee completes FS-6500-262, Approval Form for Premium (First and Business)

Class Travel and forward with appropriate documentation to supervisor for approval.

This should be done via the correspondence database.

2. Supervisor completes and attaches an informal memo to the employee’s request, via the correspondence database, and request approval for premium class travel. See exhibit 01 for a sample letter. Preparing the document in the correspondence database must show all concurrences/nonoccurrence’s and comments in the document summary.

Decisions from the Under Secretary Natural Resources and Environment are returned to the

ASC-B&F Travel Branch Chief. The ASC-B&F Travel Branch Chief or designee shall contact

OCFO at least 72 hours before the commencement of travel to authorize the travel agents to issue tickets to the traveler. Documentation must be electronically attached to the travel authorization

Annually, an employee may request via their supervisor premium class travel to accommodate permanent or long-term disabilities. Indicate the period of time for the request in the letter

(see exhibit 01).

WO SUPPLEMENT 6509.33-2011-2

EFFECTIVE DATE: 12/08/2011

DURATION: This supplement is effective until superseded or removed.

6509.33_301

Page 15 of 37

FSH 6509.33 - FEDERAL TRAVEL REGULATION

CHAPTER 301 - TEMPORARY DUTY (TDY) TRAVEL ALLOWANCES

301-10.124 - Exhibit 01

Request for Premium Class Travel

DECISION MEMORANDUM FOR THE UNDER SECRETARY, NATURAL RESOURCES

AND ENVIRONMENT

THROUGH:

FROM:

Name,

Under Secretary, NRE

Thomas L. Tidwell

SUBJECT:

Chief

Request Approval for Premium Class Travel

FILE CODE: 6500

ISSUE:

[Traveler’s name] from the Forest Service is requesting approval to purchase premium class common carrier tickets. The following supporting documentation is included:

Approval Form for Premium (First and Business) Class Travel FS-6500-262, with required documentation.

If you have any questions, please contact [point of contact, e-mail address, and telephone number].

BACKGROUND:

First class and business class airline accommodations are considered “premium class” travel.

Advance approval for the use of premium class travel is required when conditions meet those outlined in Forest Service Travel Handbook as well as the Agriculture Travel Regulations, DM-

2300-001, Agriculture Travel Regulation.

WO SUPPLEMENT 6509.33-2011-2

EFFECTIVE DATE: 12/08/2011

DURATION: This supplement is effective until superseded or removed.

6509.33_301

Page 16 of 37

FSH 6509.33 - FEDERAL TRAVEL REGULATION

CHAPTER 301 - TEMPORARY DUTY (TDY) TRAVEL ALLOWANCES

301-10.124 - Exhibit 01--Continued

Request for Premium Class Travel

DECISION MEMORANDUM FOR THE UNDER SECRETARY, NATURAL RESOURCES

AND ENVIRONMENT 2

OPTIONS:

1. Sign the Decision Document and forward.

2. Disapprove the Recommendation

RECOMMENDATION:

I recommend that the Secretary approve/disapprove and sign the Decision Document.

DECISION BY THE SECRETARY:

Approve

Disapprove

Date

Discuss with me

Reviewed by:

Enclosures cc: USDA-OCFO, ASC B&F Travel Branch, Traveler

WO SUPPLEMENT 6509.33-2011-2

EFFECTIVE DATE: 12/08/2011

DURATION: This supplement is effective until superseded or removed.

6509.33_301

Page 17 of 37

FSH 6509.33 - FEDERAL TRAVEL REGULATION

CHAPTER 301 - TEMPORARY DUTY (TDY) TRAVEL ALLOWANCES

301-10.125 What are coach-class Seating Upgrade Programs?

For an additional fee, airline programs allow a passenger to obtain a more desirable seat choice within the coach-class cabin. Coach upgrade options are not considered a new or higher class of accommodation since the seating is still in the coach cabin. However, the use of upgraded/preferred coach seating options is generally a traveler’s personal choice and therefore is at the traveler’s personal expense. An employee may request the need for reimbursement of these fees by submitting a written justification to their supervisor or approving officer. Requests will be reviewed and evaluated by the supervisor or approving officer based on what is considered reasonable and prudent for government travel and not just the traveler’s personal preference. Request for reimbursement of fees that allow only for early boarding, free beverages, and other items that do not guarantee a specific seat assignment will not be approved for reimbursement. Approved justifications must be attached to the GovTrip document and the fee is claimed as part of the airfare cost.

Subpart C - Government Vehicle

301-10.200 - What types of Government vehicles may my agency authorize me to use?

1. An employee should use a Government-owned vehicle when available and ordinarily may not be authorized the use of a privately-owned vehicle (POV). The Forest Service may occasionally permit the employee to use a privately-owned conveyance when

Government equipment is available. The supervisor shall authorize the use of a POV in advance.

2. An employee must use a Government vehicle when: a. Government-furnished vehicle is needed for a continuing assignment basis and is expected to be driven by the employee more than 1,000 miles monthly; or b. A Forest Service or General Services Administration (GSA) vehicle is assigned to the employee or the employee's unit or division and such assignment is based partially or wholly on the employee's anticipated use, and c. Assigned vehicle is available, and d. Vehicle is suitable for the employee's needs.

3. The Forest Service may authorize brief or overnight storage of a Government vehicle at an employee's residence when necessary for the proper performance of official duties under the direction in FSM 7132.1 and FSH 6409.31 - AGPMR 104-38.5003 and 5004.

WO SUPPLEMENT 6509.33-2011-2

EFFECTIVE DATE: 12/08/2011

DURATION: This supplement is effective until superseded or removed.

6509.33_301

Page 18 of 37

FSH 6509.33 - FEDERAL TRAVEL REGULATION

CHAPTER 301 - TEMPORARY DUTY (TDY) TRAVEL ALLOWANCES

4. Examples of vehicle use for official purposes are: a. The carrying of passengers in emergencies threatening loss of life or property. b. Transporting persons on official business, including contractors, collaborators, cooperators, grantees, permittees, prospective bidders, volunteers, and enrollees.

Subpart D - Privately-Owned Vehicle (POV)

301-10.303 - What am I reimbursed when use of a POV is determined by my agency to be advantageous to the Government?

The Forest Service must adhere to the established GSA mileage reimbursement rates for Federal employees, who use privately-owned vehicles while on official travel.

The rate of reimbursement when you use your privately-owned vehicle (POV) for Government business is dependent upon the availability of Government-owned vehicles (GOV). The rates for the use of these modes of transportation are subject to change at any time, therefore, current POV rates are posted in GovTrip, and apply accordingly as categorized below:

1. POV-Temporary Duty (No Government-Owned Vehicle Available). When it has been determined by your supervisor/approving official that the use of a POV is advantageous to the Government or when there is no suitable GOV available.

2. POV-Available Government Vehicle. When it has been determined by your supervisor/approving official that the use of a GOV is advantageous to the government, a

GOV is available and the use a POV is a matter of personal preference.

301-10.306 - What will I be reimbursed if authorized to use a POV between my residence and office and then from my office to a common carrier terminal, or from my residence directly to a common carrier terminal?

If the traveler stops at their office or duty station enroute to the TDY location or common carrier terminal, mileage reimbursement begins from the office or duty station. The reason or duration of time for stopping is not a factor.

WO SUPPLEMENT 6509.33-2011-2

EFFECTIVE DATE: 12/08/2011

DURATION: This supplement is effective until superseded or removed.

6509.33_301

Page 19 of 37

FSH 6509.33 - FEDERAL TRAVEL REGULATION

CHAPTER 301 - TEMPORARY DUTY (TDY) TRAVEL ALLOWANCES

Subpart E - Special Conveyances

301-10.450 - When can I use a rental vehicle?

Travelers should use a rental vehicle when it is most advantageous to the Government. The determination of most advantageous to the Government is determined by discussions between the traveler and authorizing official after considering factors such as cost, number of passengers, security and location of rental facilities, office hours, and wait times. The Forest Service preferred class of car is economy using the lowest cost vendor.

Travelers must provide a justification for all rental cars larger than an economy size.

A global positioning system (GPS) in a rental vehicle is not reimbursable when its inclusion is at additional cost.

Employees shall not engage in talking and/or text messaging (a) when driving GOV, or when driving POV while on official Government business, or (b) when using electronic equipment supplied by the Government while driving.

Employees in travel status who, while driving a rented vehicle, normally for official business, but need transportation for personal travel or intermixed personal and Government travel, shall use the following guidelines:

1. When feasible, the employee should make arrangements with the company for personal use of a rented vehicle either before or after the Government use is completed, and make arrangements to have a separate billing rendered for the personal use.

Employees are not covered by Government vehicle insurance when using a rental car for personal reasons.

2. When the primary need for the rented vehicle is for official business, but the employee intermixes personal use of the vehicle, the employee shall claim reimbursement of the daily rate, plus only that mileage and fuel use that were directly attributable to the official use.

3. If the use is intermixed, and the official use is not the primary purpose for which the vehicle is used, the employee may claim reimbursement for only that mileage for which the vehicle was used for official business at the appropriate mileage reimbursement rate.

The U.S. Government Car Rental Agreement may be accessed via the Internet at http://www.sddc.army.mil/public/Passenger . It may also be found on the ASC-B&F Claims

Management website at http://fsweb.r3.fs.fed.us/asc/bfm/programs/financialoperations/claims/UsefulLinks.php

WO SUPPLEMENT 6509.33-2011-2

EFFECTIVE DATE: 12/08/2011

DURATION: This supplement is effective until superseded or removed.

6509.33_301

Page 20 of 37

FSH 6509.33 - FEDERAL TRAVEL REGULATION

CHAPTER 301 - TEMPORARY DUTY (TDY) TRAVEL ALLOWANCES

301-11 - PER DIEM EXPENSES

Subpart A - General Rules

301-11.1 - When am I eligible for an allowance (per diem or actual expense)?

Travelers are eligible for an allowance when performing official travel away from the official station, incurring per diem expenses while performing official travel, and traveling for more than

12 hours.

Actual subsistence is the payment of authorized actual costs of lodging and meals. Actual subsistence must be authorized in advance of travel on a trip-by-trip authorization. An authorization request for actual subsistence reimbursement must be made, to the fullest extent possible, in advance of travel. Employees should make every effort to obtain lodging at the per diem rate. Take any of the following actions as necessary if actual subsistence applies:

1. If the request is up to 150 percent of the established per diem rate, the employee will request approval in GovTrip. The employee will enter the lodging rate paid under the

“per diem entitlement” tab. They will complete the justification under the Pre-Audit screen by providing detailed reasons for their request and explain steps taken to find lodging within the per diem rate. Additional, documentation may be attached to the document

2. If the request is greater than 150 percent of the established per diem rate, the approving official will send a decision memorandum requesting approval through the chain of command, for approval or disapproval by the Chief. The chain of command includes for example, regional foresters, station directors, Area Director, IITF Director,

Forest Product Lab Director, and deputy chiefs. See exhibit 01. Submit the completed decision memorandum to actualsubtravel@fs.fed.us.

3. Prior to approval being received the employee may file a travel voucher based on the local per diem rate.

4. Once an approval decision memorandum is signed by the Chief, the traveler will upload the approval in GovTrip and prepare either a final voucher or an amended voucher to claim the difference between the local per diem rate and actual subsistence requested; if completing an amended voucher claim the amount using the Expenses/Non-Mileage screen on the GovTrip toolbar.

Actual subsistence reimbursement may also be approved after travel is completed (“postapproval”). Examples of travel assignments or situations that may warrant post approval of actual and necessary expenses include but are not limited to the following:

WO SUPPLEMENT 6509.33-2011-2

EFFECTIVE DATE: 12/08/2011

DURATION: This supplement is effective until superseded or removed.

6509.33_301

Page 21 of 37

FSH 6509.33 - FEDERAL TRAVEL REGULATION

CHAPTER 301 - TEMPORARY DUTY (TDY) TRAVEL ALLOWANCES

1. Emergency situations in which requests for prior travel authorization were not possible; or unanticipated, and unusual. For example, short notice to employee for travel to a disaster area.

2. Locations are remote or unsafe.

3. Conference/Training Events

For further explanation of per diem expenses, see FTR Part 301-11, Subpart A.

WO SUPPLEMENT 6509.33-2011-2

EFFECTIVE DATE: 12/08/2011

DURATION: This supplement is effective until superseded or removed.

6509.33_301

Page 22 of 37

FSH 6509.33 - FEDERAL TRAVEL REGULATION

CHAPTER 301 - TEMPORARY DUTY (TDY) TRAVEL ALLOWANCES

301-11.1 –Exhibit 01

Request for Actual Subsistence above 150%

Date:

DECISION MEMORANDUM FOR THOMAS L. TIDWELL, CHIEF

FROM:

SUBJECT:

FILE CODE:

Deputy Chiefs, CFO, Washington Office Staff Directors, Regional Foresters,

Station, and Area Directors, IITF Director, Forest Product Lab Director

Approval of Actual Subsistence Over 150 Percent

6500

ISSUE:

Smokey Bear, Regional Forester, Region 1, is requesting approval of actual subsistence expense up to

200 percent of the maximum per diem rate. The travel dates are September 19 – 21, 2011, and the temporary duty location is Washington, D.C. Smokey Bear will represent the Forest Service on Capitol

Hill.

Maximum lodging for area:

Actual rate being requested:

$209.00

$418.00

Provide specific explanation that one of the following has occurred:

Locations are remote or unsafe.

Emergency or declared disaster incidents, including fires, where traveler is unable to obtain lodging at per diem, due to short notice to employee for travel to a disaster area

Please review and indicate your decision below.

If you have additional questions, please contact Cub Smokey at (123) 456-7890.

CONCURANCES:

Approve: ____ Disapprove: ____ Signature: ______________ Title: ________ Date: ____

Approve: ____ Disapprove: ____ Signature: ______________ Title: ________ Date: ____

Approve: ____ Disapprove: ____ Signature: ______________ Title: ________ Date: ____

DECISION BY THE CHIEF:

Approve

Disapprove

Date

Discuss with me

Reviewed by: cc: Smokey Bear, Cub Smokey

WO SUPPLEMENT 6509.33-2011-2

EFFECTIVE DATE: 12/08/2011

DURATION: This supplement is effective until superseded or removed.

6509.33_301

Page 23 of 37

FSH 6509.33 - FEDERAL TRAVEL REGULATION

CHAPTER 301 - TEMPORARY DUTY (TDY) TRAVEL ALLOWANCES

Subpart C - Reduced Per Diem

301-11.200 - Under what circumstances may my agency prescribe a reduced per diem rate lower than the prescribed maximum?

1. A reduced per diem rate of 55 percent will be established for extended stays greater than 30 days. a. Miscellaneous and incidental Expenses (M&IE). For the first 30-calendar days of an extended stay assignment, the applicable GSA M&IE rate of the temporary duty location may be authorized. A reduced M&IE rate of 55 percent will be applied on day 31 until the end of the extended stay assignment. Interruption of travel will not restart the allowance of full M&IE. This includes such things as an authorized trip home. It does not include travel to a different TDY location during the extended stay assignment. b. Lodging. Prior to reporting for the extended stay assignment, or during the first 30day period, the employee shall seek long-term residence accommodations. The extended stay travel must be documented on a trip-by-trip travel authorization and must document the reduced lodging rate. See 41 CFR 301-7.12 and General Services Board of Contact

Appeals (GSBCA) 14033-Trav.

If reduced lodging cannot be obtained, the employee may request a higher rate from their approving official via GovTrip as justified by the anticipated costs. The justification can either be attached as additional documentation or the information can be included on the digital signature page.

An employee who is receiving lodging reimbursement at the extended stay location may be authorized receipt of an additional lodging allowance while on official temporary duty at another location. The additional lodging is allowed only if the assignee is occupying long-term residence accommodations and is limited to the increased expenses resulting from the temporary duty travel. For example, an employee is renting an apartment at the extended stay location and needs to travel to another location for official business. The employee may claim the nightly cost of the apartment rental and the applicable lodging rate at the temporary duty location.

2. Line officers may develop and authorize a reduced per diem rate for remote duty assignments subject to provisions of any applicable collective bargaining agreement.

Based on a determination that operations of the agency may be accomplished more efficiently through the use of "spike camps," the reduced per diem rate must be authorized for any remote duty lasting more than 12 hours, regardless of actual miles from an employee's duty station. The field rates should be revisited annually by the intermediate or local area. At least one or more of the following circumstances must exist in order to authorize use of the reduced per diem rate:

WO SUPPLEMENT 6509.33-2011-2

EFFECTIVE DATE: 12/08/2011

DURATION: This supplement is effective until superseded or removed.

6509.33_301

Page 24 of 37

FSH 6509.33 - FEDERAL TRAVEL REGULATION

CHAPTER 301 - TEMPORARY DUTY (TDY) TRAVEL ALLOWANCES a. When it is advantageous to keep employees at fire camps or other emergency locations. b. When the work activity is in a remote area where a unit's capability to transport employees to their official station would take excessive time or otherwise pose an unacceptable safety hazard. c. When field managers determine that the cost of travel to and from worksites, including lost productive time, exceeds the cost of providing a reduced per diem reimbursement. d. For activities such as prescribed burns, when employees are under close control and are not allowed the opportunity to leave the area to obtain meals. This may extend to other operational situations but not to administrative activities such as meetings or training.

301-12 - MISCELLANEOUS EXPENSES

301-12.1 - What miscellaneous expenses are reimbursable?

Personal telecommunications. Personal telecommunications may be authorized for travel lasting more than 1 night. Actual expenses for use of an employee’s personal cell phone may be reimbursed. The reimbursement may not be made on a $5.00 per day flat rate basis. The flat rate basis raises the risk of improperly reimbursing employees for personal use. Setting a flat fee tends to result in either a gain or a loss to the reimbursed employee. Employees may be reimbursed for additional costs that may arise from any official/personal calls actually made or received on the employee’s cell phone. This requires monthly, itemized service provider invoices, (limiting claims to the expense the agency would otherwise pay for such services and adjusting claims to exclude hidden costs of “free” services included in the service provider’s plan). This provides adequate assurance that the reimbursements are limited to Government related and/or authorized personal calls. (GAO-04-261SP Appropriation Law)

For additional miscellaneous expenses see FTR 301-12 general items and baggage and 301-13 for accommodation of special needs.

301-51 - PAYING TRAVEL EXPENSES

1. Local Travel Expenses. Employees may be reimbursed for travel expenses incurred in performing official duties in and around their duty station. This is referred to as reimbursement for "Local Travel”. Local travel expenses must be reasonable and necessary to conduct business. Local travel may include the cost of subway, bus, train, taxi, tolls, and parking. If employees use their privately owned vehicle (POV) mileage may be reimbursed. Local travel expenses may be incurred in a variety of work related situations including, but not limited to, required attendance at meetings, conferences, or

WO SUPPLEMENT 6509.33-2011-2

EFFECTIVE DATE: 12/08/2011

DURATION: This supplement is effective until superseded or removed.

6509.33_301

Page 25 of 37

FSH 6509.33 - FEDERAL TRAVEL REGULATION

CHAPTER 301 - TEMPORARY DUTY (TDY) TRAVEL ALLOWANCES other official functions; training; periodic work assignments at alternate duty locations in or around the duty station; and so forth. Approval of individual local travel claims is the responsibility of the employee's supervisor or designee.

There is one situation where the agency is precluded from providing local travel reimbursement to employees. A Federal agency, per Comptroller General ruling, may not reimburse (or give the appearance that they are reimbursing) employees for local travel costs incurred solely from the employee’s residence to their permanent duty station unless the employee is participating in the Public Transportation Benefit Program sponsored by the Federal Government. The authority under this program is unique and should not be interpreted as a basis for reimbursing employees for home to work travel costs.

2. Local Travel is defined as: a. Travel within 1 calendar day, occurs within a 25 mile radius of the employee’s duty station or residence and is 12 hours or less. b. Consecutive day travel within a 35 mile radius of the employee’s duty station (not residence) and is 12 hours or less.

3. Local travel reimbursement is claimed by submitting FS 6500-229 Request for

Reimbursement Form. Receipts for expenses less than $75 are not required.

Reimbursement is limited to transportation and miscellaneous expenses only.

4.Temporary Duty (TDY) Travel is defined as: a. Travel within 1 calendar day that exceeds a 25 mile radius of the employee’s duty station or residence, or is 12 hours or more. b. Consecutive day travel exceeding a 35 mile radius of the employee’s duty station (not residence) or is 12 hours or more.

5. Temporary Duty (TDY) Travel reimbursement can only be claimed in GovTrip. Per diem is authorized as long as the travel is greater than 12 hours.

Subpart B - Paying for Common Carrier Transportation

301-51.100 - What method of payment must I use to procure common carrier transportation?

You must use a Government contractor-issued individually billed travel charge card or centrally billed account (CBA) to procure contract passenger transportation services. The CBA must only be used in the following instances:

WO SUPPLEMENT 6509.33-2011-2

EFFECTIVE DATE: 12/08/2011

DURATION: This supplement is effective until superseded or removed.

6509.33_301

Page 26 of 37

FSH 6509.33 - FEDERAL TRAVEL REGULATION

CHAPTER 301 - TEMPORARY DUTY (TDY) TRAVEL ALLOWANCES

1. Incident travel,

2. Employees without a travel charge card,

3. Foreign travel,

4. Ferry services, and

5. Non-government travelers.

301-52.1 - Must I file a travel claim?

Yes, if the traveler is seeking reimbursement for travel expenses, they must file a travel claim

(voucher) in the GovTrip system.

1. A travel voucher must be submitted, with receipts electronically attached, within 5 business days after completion of travel, or every 2 weeks if on long-term or continuous travel unless incident business or disaster recovery related.

2. If the traveler does not digitally sign the voucher in GovTrip, they must sign in ink a printout of the voucher. This signed travel voucher must be electronically attached to the

GovTrip record. The travel arranger may then (and only then) digitally “sign” the travel voucher on behalf of the employee.

3. A voucher for expenses associated with an illness, injury, or natural disaster while in travel status requires approval from an approving official. A post authorization or travel authorization amendment must be prepared.

4. For local travel reimbursement see 301-51.

301-52.2 - What must I provide with my travel claim?

1. The traveler/arranger must electronically attach the following documentation to the

GovTrip voucher: a. Ink-signed voucher, if the traveler does not digitally sign it. b. Ticketed transportation invoice showing the commercial carrier name, fare code, and charges (do not include boarding passes). c. Vehicle rental receipts including receipts for gasoline. d. Lodging receipts. e. Receipt for any single expense $75 and over.

WO SUPPLEMENT 6509.33-2011-2

EFFECTIVE DATE: 12/08/2011

DURATION: This supplement is effective until superseded or removed.

6509.33_301

Page 27 of 37

FSH 6509.33 - FEDERAL TRAVEL REGULATION

CHAPTER 301 - TEMPORARY DUTY (TDY) TRAVEL ALLOWANCES f. Offer of sponsorship if one was received during travel. g. Resource Order(s) if applicable.

2. Receipts of expenses for less than $75 are not required for reimbursement.

3. The GovTrip system will retain all electronic records (including those faxed or scanned/uploaded into a travel authorization or voucher) for 6 years and 3 months, and will be the system of record for travel. See U.S. National Archives and Records

Administration, General Records Schedule 7 Expenditure Accounting Records.

4. A travel voucher is proper or complete when all applicable receipts are attached for review and approval.

301-52.7 - When must I submit my travel claim?

1. Traveler shall prepare travel vouchers within 5 working days of return or every 2 weeks if on continuous travel.

2. If the traveler has not submitted a travel voucher within 5 days, the Federal Agency

Travel Administrator (FATA) shall run the GovTrip Unsubmitted Voucher report and send email notification to the traveler.

301-53 - USING PROMOTIONAL MATERIALS AND FREQUENT TRAVELER

PROGRAMS

The Forest Service policy on Travel Savings Shared Benefits Program is also referred to as the

Travel Gainsharing Program. The Government Employees Incentive Awards Act, Title 5,

United States Code, section 4501-4507 (5 U.S.C. 4501-4507), authorizes an agency to pay a cash award for “efficiency” or “economy.” This program rewards employees who save Forest Service money while on temporary duty (TDY) travel. These savings come from the use of less expensive lodging or from use of Frequent Flyer benefits to purchase airline tickets for official travel. Employee participation in the program is optional and applies only to reservations for air and/or lodging made through the Travel Management Service if applicable.

Taxes are withheld

(Federal, State, local, FICA) on the award amount. Awards are processed once an employee accumulates a minimum of $200 in savings. However, if at the end of the current fiscal year, the employee has not accumulated a minimum of $200 in savings, then and only then the employee may submit the dollar amount that has been accumulated for the current fiscal year for processing. Savings can be accumulated over multiple trips, but may not be accumulated over multiple fiscal years.

WO SUPPLEMENT 6509.33-2011-2

EFFECTIVE DATE: 12/08/2011

DURATION: This supplement is effective until superseded or removed.

6509.33_301

Page 28 of 37

FSH 6509.33 - FEDERAL TRAVEL REGULATION

CHAPTER 301 - TEMPORARY DUTY (TDY) TRAVEL ALLOWANCES

1. Types of Travel Covered.

All TDY requiring lodging, foreign and domestic, is covered under this program. Only the first 30 days of extended TDY travel can be counted as eligible for savings in this program.

2. Lodging Savings.

Employees who participate in the program may receive cash awards for incurring lodging expenses at a daily rate which is less than the maximum lodging rate for the locality under the lodgings plus method. Transportation costs to the TDY site and return to the hotel must be factored into computing the savings. a. Awards must not be made to individual employees on travel where lodging savings were the result of being prearranged, for example, lodging for a conference, seminar, and so forth, where the sponsoring organization arranged for lodging or prepaid by contract with the hotel. However, any savings resulting from shared accommodations under such arrangements does qualify for the travel savings award. b. Lodging savings resulting from GSA sponsored FedRooms program must not be counted as lodging savings in the travel savings program. This program offers hotels that have agreed to provide lodging at or below the per diem rate. The program and affiliated hotels can be found on the internet at FEDROOMS . c. Employees should not incur additional expenses in transportation or other miscellaneous costs in an effort to reduce lodging expenses. Employees who incur additional transportation expenses must have those expenses deducted from their lodging savings. Examples of excess transportation cost include, but are not limited to, renting a vehicle (when one would not normally be rented) at a TDY site to travel to a place of free or reduced lodging; when driving a privately-owned vehicle (POV), driving more miles than would normally be traveled to/from the TDY site to obtain free or reduced lodging; or where a taxi fare is incurred which would not normally have been incurred to obtain free or reduced lodging. d. The Government travel charge card must be used for payment of all hotel-lodging costs to qualify as lodging savings under this program. The only exceptions to this are when the hotel or other facility does not accept the travel charge card, or where an employee stays with friends or relatives to avoid payment of any lodging costs or under the requirements of Federal Travel Regulations (FTR) 301-51.2. e. When a room is shared while on official travel there can be a lodging savings. The employees should arrange to be billed separately. If this is not possible, a daily rate

WO SUPPLEMENT 6509.33-2011-2

EFFECTIVE DATE: 12/08/2011

DURATION: This supplement is effective until superseded or removed.

6509.33_301

Page 29 of 37

FSH 6509.33 - FEDERAL TRAVEL REGULATION

CHAPTER 301 - TEMPORARY DUTY (TDY) TRAVEL ALLOWANCES must be determined for each employee. To determine amount eligible for the travel savings program for each employee:

(1) Divide the actual lodging rate by the number of employees that shared the room.

This gives an actual daily rate for each employee.

(2) Divide the maximum lodging locality rate by the number of employees to get a daily maximum rate for each employee.

(3) Subtract the actual daily rate from the daily maximum rate for each employee.

The results will be each employee's eligible savings toward the minimum savings of

$200.

For example, two employees find a room for $80. The maximum locality rate is

$100. The actual daily rate for each employee is $40 ($80/2). The daily maximum locality rate for each employee is $50 ($100/2). Subtract $40 from $50 to get savings of $10 for each employee. However, each employee receives 50 percent of the total savings, which is $5 (50 percent of $10) (see paragraph 5) to count toward the minimum savings of $200. The savings are cumulative on a fiscal year basis. f. All lodging must be at facilities which meet the requirements of the Hotel/Motel

Fire Safety Act of 1990 (P.L. 101-391). Lodging with friends or relatives exempts the employee from this requirement. Hotels in compliance can be found on at USFA:

Hotel/Motel Fire-Safe List . g. Lodging costs incurred on personal time (annual leave) during official travel must not be counted as lodging savings under this program. h. Employees who incur no costs for lodging while on official travel may receive credit for one half of the lodging rate for the locality toward the minimum savings of

$200 to become eligible for a travel savings cash award.

3. Redemption of Frequent Flyer Benefits.

Employees who use a free ticket obtained through frequent flyer benefits are eligible for the travel savings award.

Savings on transportation costs are measured by the contract city-pair rate in effect at the time of the flight. If no contract fare is available, then the lowest available non-restricted coach fare must be used as a basis for determining the savings.

4. Amount of Award.

WO SUPPLEMENT 6509.33-2011-2

EFFECTIVE DATE: 12/08/2011

DURATION: This supplement is effective until superseded or removed.

6509.33_301

Page 30 of 37

FSH 6509.33 - FEDERAL TRAVEL REGULATION

CHAPTER 301 - TEMPORARY DUTY (TDY) TRAVEL ALLOWANCES

The amount of the award for each employee is 50 percent of the combined savings on lodging and contract carrier airfare expenses. Taxes are withheld (Federal, State, FICA) from the total award amount. The minimum savings is $200 and the cash award that can be received is half of the savings ($100).

5. Claiming the Reward.

Forest Service Travel Savings Form, FS-6500-4 , must be completed and submitted by each employee for all trips, which show lodging savings or redemption of Frequent Flyer benefits. Each trip must be submitted with the appropriate voucher to the appropriate approving official, who in most cases is the employee’s immediate supervisor. The employee and the approving official shall initial each trip and sign each completed Travel

Savings Form.

Employees can apply for the award as soon as they meet the minimum eligibility requirement of $200 in savings. All completed Travel Savings Forms with total cumulative savings of $200 or more must be submitted to the approving official, who shall then complete form AD-287-2 , Recommendation & Approval of Awards. Select

Gainsharing Award as the type of recognition recommended, in block 12 of the

AD-287-2. The approving official in Block 22 has approval authority for up to $1,000.

The Secretary of the Department of Agriculture approves incentive awards for SES and for award amounts greater than $1,000. The AD-287-2 must be submitted to the

Albuquerque Service Center (ASC), Human Resources Management for employees at the

GS-13 and below level and to the Washington Office, Human Resources Management for employees at the GS-14 and above level for processing.

301-54 - Collection of Undisputed Delinquent Amounts Owed to the Contractor

Issuing the Individually Billed Travel Charge Card

In accordance with their cardholder agreement, employees are obligated to pay the undisputed balance within 30 days of the statement date. Unpaid balances become delinquent 61 days after the original statement date. On all delinquent amounts, employees are expected to immediately settle their debts with the contractor. Individual travel charge card account balances that are still delinquent past 90 days are subject to collection action by the bank.

For bargaining unit employee, due process includes adjudication via negotiated grievance procedures, and if invoked, arbitration. After due process, including final adjudication of grievance and arbitration the delinquent undisputed balance is eligible for the Forest Service travel charge card salary offset program, and may be deducted from the employee’s pay. Section

2(d) of the Travel and Transportation Reform Act of 1998 ( TTRA) authorizes Federal agencies to deduct from an employee’s pay any undisputed amount for which the employee is delinquent

(41 CFR part 301-54.1), under regulations issued by the General Services Administration (GSA), and at the request of the travel charge card contractor. Administrative offset may not exceed 15 percent of the employee’s disposable pay unless a higher amount is authorized by the cardholder.

WO SUPPLEMENT 6509.33-2011-2

EFFECTIVE DATE: 12/08/2011

DURATION: This supplement is effective until superseded or removed.

6509.33_301

Page 31 of 37

FSH 6509.33 - FEDERAL TRAVEL REGULATION

CHAPTER 301 - TEMPORARY DUTY (TDY) TRAVEL ALLOWANCES

In addition to the amount owed the charge card issuer, a processing fee is charged to the employee by the National Finance Center (NFC) to recover its processing costs.

For those employees who are non-bargaining unit employees, salary offset may begin immediately as authorized by "Pay Administration; Collection by Offset From Indebted

Government Employees," 5 CFR Part 550 RIN 3206-AH63.

The Forest Service may offset an employee’s final pay to recover delinquent amounts due the contractor. Salary offset may apply to an employee’s final payment, provided due process is followed.

The Forest Service shall not initiate a salary offset request if the employee has filed a timely voucher which has not been paid. Upon receipt of written notice by NFC of the intent to administer salary offset, employees shall inform NFC in writing within 5 business days if they were not reimbursed and follow NFC's instructions to resolve the matter.

Subpart H – Policies and Procedures Relating to Mandatory use of the

Government Issued Travel Charge Card for Official Travel

A Government issued Travel Charge Card is issued by the Government contract bank as either an individually billed (IBA) or centrally billed (CBA), and is used to pay for official travel and transportation-related expenses. For the purposes of Forest Service travel policy, the terms

“contractor issued charge card,” “travel charge card,” “travel card,” “charge card,” or “card” all refer to the “Government travel card.”

These are charge accounts, not credit accounts. Therefore, the purpose is not to carry an account balance. Any undisputed amount charged to the account during a billing period is due per the billing statement. Misuse or abuse may result in disciplinary actions against the cardholder

(FTR 301-51.7). The bank retains financial liability for fraudulent transactions.

301-70.700 - Must our employees use a Government contractor- issued travel charge card for official travel expenses?

All Forest Service employees, issued a travel charge card shall use the card for official travel expenses.

The card must be used where accepted for payment of airline and other common carrier transportation services, hotel/motel, restaurant, automobile rental, gasoline, and other expenses incurred incident to official travel, where accepted.

1. Airline reservations should not be ticketed more than 1 week in advance of a trip unless your organization has a waiver.

WO SUPPLEMENT 6509.33-2011-2

EFFECTIVE DATE: 12/08/2011

DURATION: This supplement is effective until superseded or removed.

6509.33_301

Page 32 of 37

FSH 6509.33 - FEDERAL TRAVEL REGULATION

CHAPTER 301 - TEMPORARY DUTY (TDY) TRAVEL ALLOWANCES

2. Cash advances are monies received from an ATM via the travel charge card. This advance is limited to meals and incidental expenses rate (M&IE) at the location of the temporary duty location and for other cash expenses identified in Exemptions to the Use of the Travel Charge Card. ATM cash needs should not exceed $50 per day, multiplied by the number of calendar days in domestic travel status. In addition, the Forest Service shall reimburse travelers for service fees incurred for ATM advances. Cash obtained from the ATM in amounts greater than the limit specified for the travel duration are considered excessive and may be reported to Human Resources Management-Employee

Relations for possible disciplinary action.

4. Payment of an advance room deposit when required by the lodging facilities is allowed under FTR 301-71.301. An interim travel voucher may be completed when the advance payment is made to allow timely reimbursement of the expense. For example, if an employee is required to make a room deposit, to secure the room, 3 months prior to making a trip.

5. The travel charge card must not be used to procure travel and transportation services from commercial travel agencies that are not under a Government contract.

6. The travel charge card must not be used for personal trips or for family member(s).

See DR 2300-001.

7. The travel charge card must not be used to purchase fuel and procure minor maintenance services on GSA fleet or Forest Service-owned vehicles. Use of the Forest

Service fleet card is the appropriate payment method for purchases incurred while operating Government-owned vehicles.

8. In certain travel situations such as lost luggage, if the travel charge card is used (either directly or indirectly via cash advance) to purchase otherwise unauthorized items (such as clothing); the approving official shall consider the mitigating circumstances before any potential administrative action is initiated against the cardholder. Regardless of how such matters are addressed administratively, the cardholder is not entitled to reimbursement for such purchases.

9. The approving official or immediate supervisor shall sign the employee’s USDA

Acknowledgement and Acceptance Statement. Employees who apply for the card shall: a. Complete AgLearn training requirement. b. Complete the travel charge card account application. http://fsweb.r3.fs.fed.us/asc/bfm/programs/financial-operations/travel/GovTrip

/NewTravelCardUSBank.php

WO SUPPLEMENT 6509.33-2011-2

EFFECTIVE DATE: 12/08/2011

DURATION: This supplement is effective until superseded or removed.

6509.33_301

Page 33 of 37

FSH 6509.33 - FEDERAL TRAVEL REGULATION

CHAPTER 301 - TEMPORARY DUTY (TDY) TRAVEL ALLOWANCES c. Complete and sign the Employee Acknowledgment Statement recognizing receipt and understanding of the policies and procedures related to the use of the travel charge card. This form may be obtained from the Travel Branch, ASC-B&F

301-70.704 - What expenses and or classes of employees are exempt from the mandatory use of the Government contractor-issued travel charge card?

The FTR requires employees to have a travel charge card, except as follows:

1. Employees who travel 5 times or less a year.

2. New employees who may be required to perform temporary duty travel enroute to their first post of duty.

3. An employee appointment to a (Temporary) position for work of an expected duration of less than 1 year FSH 6109.12, section 61.

4. Appointment to a position for work of an expected duration of more than 1 year but not more than 4 years (Term Appointment) FSH 6109.12, section 60.5

5. Annually recurring work requiring less than 12 months each year. (Seasonal work could occur on a part-time or on a full-time basis.) 5 CFR 340, subpart D and

FSH 6109.12 section 61.33.

6. Work occurs at sporadic or irregular intervals (Intermittent) so that an employee's hours of duty cannot be scheduled in advance of the administrative workweek.

FSH 6109.12, section 60.5.

7. Employees who have had their Government travel card cancelled for cause.

8. Employees with credit issues for example, low credit scores.

Travelers who do not have a travel charge card should refer to 301-71.300 to apply for a travel advance for per diem and lodging.

301-70.708 - What can we do to reduce travel charge card delinquencies?

1. Each cardholder shall complete the travel charge card policy training in AgLearn annually. The purpose of the training is to ensure that the cardholder understands the regulations and procedures, and know the consequences of inappropriate actions.

2. If an approving official is not a travel charge cardholder, it is required that this individual take the same training as travel charge cardholders.

WO SUPPLEMENT 6509.33-2011-2

EFFECTIVE DATE: 12/08/2011

DURATION: This supplement is effective until superseded or removed.

6509.33_301

Page 34 of 37

FSH 6509.33 - FEDERAL TRAVEL REGULATION

CHAPTER 301 - TEMPORARY DUTY (TDY) TRAVEL ALLOWANCES

3. Travelers should become familiar with Federal and Departmental travel policies and procedures.

301-71 - AGENCY TRAVEL ACCOUNTABILITY REQUIREMENTS

Subpart C - Travel Claims for Reimbursement

301-71.200 - Who must review and sign travel claims?

Traveler’s immediate supervisor or delegated individual shall approve travel authorizations and vouchers. In the absence of an immediate supervisor, a peer of the immediate supervisor or a delegated acting may review and approve the travel voucher. This delegation must be in writing

(FSM 1231.3).

The approving official shall be knowledgeable of the employee’s travel plans and ensure that the travel expenses claimed on the voucher are prudent and necessary. A travel voucher is proper or complete for approval when all applicable documentation and receipts are attached.

301-71.205 - Under what circumstances may we disallow a claim for an expense?

1. A travel expense may be disallowed, if the traveler submits a voucher that: a. Does not properly itemize expenses; b. Does not provide required receipts or other documentation to support the claim.

2. If either condition occurs, the approving official shall attempt to resolve the disputed expense(s) within the 5-day approval period by notifying the traveler of the questionable expense with an explanation. If it is not be resolved in this timeframe, the approving official shall: a. Request the traveler to submit an interim voucher for the timely reimbursement of:

(1) The total expense(s) which is not in dispute, or

(2) Any portion of an expense(s) which is not in dispute. For example, lodging expense exceeds the per diem allowance. The traveler may be reimbursed up to the amount of the per diem allowance. The difference is disallowed. b. Inform the traveler of their grievance rights regarding the disallowed travel expense(s).

WO SUPPLEMENT 6509.33-2011-2

EFFECTIVE DATE: 12/08/2011

DURATION: This supplement is effective until superseded or removed.

6509.33_301

Page 35 of 37

FSH 6509.33 - FEDERAL TRAVEL REGULATION

CHAPTER 301 - TEMPORARY DUTY (TDY) TRAVEL ALLOWANCES

Subpart D - Accounting for Travel Advances

301-71.300 - What is the policy governing the use of travel advances?

1.

Employees issued a travel charge card are not permitted a travel advance unless foreign travel is authorized for an extended period or on a transfer of station.

2. A cancelled travel card account can reflect unfavorable past performance, employees with these accounts are considered high risk in the repayment of travel advances. In the case of extreme hardship, employees who lost their charge card privileges may request written approval by the Chief Financial Officer for a travel advance for per diem on a trip-by-trip basis. Consideration of such requests is made on a case-by-case basis, and approval should not be assumed. In addition to the employee’s first line supervisor, the employee shall also obtain approval from their line officer or at a minimum, two supervisory levels above the employee submitting request, before submitting to the Forest

Service Chief Financial Officer.

3.

Travelers who do not have a travel charge card may receive a travel advance for per diem and lodging. Also see FTR 301-71.300.

4. Complete form FS-6500-233, Request for Travel Advance to the Travel

Authorization, in GovTrip. The procedures may be found on the ASC-B&F travel Web site.

5. The traveler is responsible for ensuring any outstanding travel advance amounts are paid after the official travel has been completed.

6. No advances will be approved if the following conditions exist: a. Prior outstanding travel advance(s). b. Outstanding debts to the Government. c. Prior debt write-offs. d. Delinquency on a closed government travel charge card.