FOREST SERVICE HANDBOOK NATIONAL HEADQUARTERS (WO) WASHINGTON, DC

advertisement

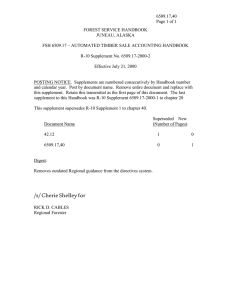

6509.33_301-50 Page 1 of 7 FOREST SERVICE HANDBOOK NATIONAL HEADQUARTERS (WO) WASHINGTON, DC FSH 6509.33 - FEDERAL TRAVEL REGULATION CHAPTER 301 - TEMPORARY DUTY (TDY) TRAVEL ALLOWANCES SUBCHAPTER C - ARRANGING FOR TRAVEL SERVICES, PAYING TRAVEL EXPENSES, AND CLAIMING REIMBURSEMENT PART 301-50 - ARRANGING FOR TRAVEL SERVICES Supplement No.: 6509.33-2007-1 Effective Date: January 18, 2007 Duration: This supplement is effective until superseded or removed. Approved: JESSE L. KING Chief Financial Officer (CFO) Date Approved: 01/08/2007 Posting Instructions: Supplements are numbered consecutively by handbook number and calendar year. Post by document; remove the entire document and replace it with this supplement. Retain this transmittal as the first page(s) of this document. The last supplement to this Handbook was 6509.33-2006-6 to chapter 301. New Document 6509.33_301-50 Superseded Document(s) by Issuance Number and Effective Date None 7 Pages Digest: 301-50.3 - Incorporates direction previously issued in a letter signed by Mary S. Matiella, dated May 13, 2002, 6540/6100 on agency policy regarding Travel Gainsharing Program. WO SUPPLEMENT 6509.33-2007-1 EFFECTIVE DATE: 01/18/2007 DURATION: This supplement is effective until superseded or removed. 6509.33_301-50 Page 2 of 7 FSH 6509.33 - FEDERAL TRAVEL REGULATION CHAPTER 301 - TEMPORARY DUTY (TDY) TRAVEL ALLOWANCES SUBCHAPTER C - ARRANGING FOR TRAVEL SERVICES, PAYING TRAVEL EXPENSES, AND CLAIMING REIMBURSEMENT PART 301-50 - ARRANGING FOR TRAVEL SERVICES STANDARD POSTING INSTRUCTIONS FOR THE FEDERAL TRAVEL REGULATION, FSH 6509.33 (For further direction on organization and posting of parent text (white pages) see the Foreword to the Federal Travel Regulation beginning on page i.) ORGANIZATION. The Federal Travel Regulation (FTR) is divided into chapters, parts, subparts (if applicable), sections, and paragraphs. The numbers 301, 302, 303, and 304 connote specific chapters of Title 41 of the Code of Federal Regulations (CFR). The number before the decimal point indicates the part within each chapter; the number after the decimal point indicates the section. For example 301-1.1 refers to: Chapter 301- Part 1. Section 1 Pages within each part are consecutively numbered beginning with Arabic number 1. Each page number is preceded by the part number; for example, the third page of Part 301-2 is numbered 2-3. Individual pages are identified by chapter in the running header. TRANSMITTALS. Transmittals accompany parent text, Department supplements, and Forest Service supplements. File transmittals at the front of the Handbook in numerical sequence with the highest amendment or supplement number first. Group the transmittals in the following order by issuing Agency and unit level: - Federal Travel Regulation (FTR) (white transmittals); - Agriculture Travel Regulations (ATR) supplements (yellow transmittals); - Forest Service Travel Regulations (FSTR) supplements (buff transmittals); - Region, Station, or Area Supplements (blue transmittals); and - Forest Supplements (green transmittals). SUPPLEMENTS AND INTERIM DIRECTIVES. Post supplements to the parent text of the Federal Travel Regulation (white pages) at the end of each part (for example, at the end of part 301-1, 301-2, and so on) by color in the following order: - Agriculture Travel Regulations (ATR) supplements (yellow pages); - Forest Service Travel Regulations (FSTR) supplements (buff pages); - Washington Office ID's (pink pages); - Region, Station, or Area Supplements (blue pages); - Region, Station, or Area ID's (pink pages); - Forest Supplements (green pages); and - Forest ID's (pink pages). WO SUPPLEMENT 6509.33-2007-1 EFFECTIVE DATE: 01/18/2007 DURATION: This supplement is effective until superseded or removed. 6509.33_301-50 Page 3 of 7 FSH 6509.33 - FEDERAL TRAVEL REGULATION CHAPTER 301 - TEMPORARY DUTY (TDY) TRAVEL ALLOWANCES SUBCHAPTER C - ARRANGING FOR TRAVEL SERVICES, PAYING TRAVEL EXPENSES, AND CLAIMING REIMBURSEMENT PART 301-50 - ARRANGING FOR TRAVEL SERVICES Table of Contents 301-50.3 Must I use the ETS or TMS to arrange my Travel? ................................................ 4 WO SUPPLEMENT 6509.33-2007-1 EFFECTIVE DATE: 01/18/2007 DURATION: This supplement is effective until superseded or removed. 6509.33_301-50 Page 4 of 7 FSH 6509.33 - FEDERAL TRAVEL REGULATION CHAPTER 301 - TEMPORARY DUTY (TDY) TRAVEL ALLOWANCES SUBCHAPTER C - ARRANGING FOR TRAVEL SERVICES, PAYING TRAVEL EXPENSES, AND CLAIMING REIMBURSEMENT PART 301-50 - ARRANGING FOR TRAVEL SERVICES 301-50.3 Must I use the ETS or TMS to arrange my Travel? Yes, unless an exception is granted to the required use of the Travel Management Service/ETravel Service (TMS/ETS) under FTR 301-50.4, 301-73.102, or 301-73.104. This directive sets forth the Forest Service policy on its Travel Savings Shared Benefits Program, also referred to as the Travel Gainsharing Program. The Government Employees Incentive Awards Act, Title 5, United States Code, section 4501-4507 (5 U.S.C. 4501-4507), authorizes an agency to pay a cash award for “efficiency” or “economy”. This program rewards employees who save Forest Service money while on temporary duty (TDY) travel. These savings come from the use of less expensive lodging or from use of Frequent Flyer benefits to purchase airline tickets for official travel. Employee participation in the program is optional and applies only to reservations for air and/or lodging made through the Travel Management Service. Taxes are withheld (Federal, State, local, FICA) on the award amount. Awards are processed once an employee accumulates a minimum of $200 in savings. However, if at the end of the current fiscal year, the employee has not accumulated a minimum of $200 in savings, then and only then the employee may submit the dollar amount that has been accumulated for the current fiscal year for processing. Savings can be accumulated over multiple trips, but may not be accumulated over multiple fiscal years. 1. Types of Travel Covered. All TDY requiring lodging, foreign and domestic, is covered under this program. Only the first 30 days of extended TDY travel can be counted as eligible for savings in this program. 2. Lodging Savings. Employees who participate in the program can receive cash awards for incurring lodging expenses at a daily rate which is less than the maximum lodging rate for the locality under the lodgings plus method. Transportation costs to the TDY site and return to the hotel must be factored into computing the savings. a. Awards must not be made to individual employees on travel where lodging savings were the result of being prearranged, for example, lodging for a conference, seminar, and so forth, where the sponsoring organization arranged for lodging or prepaid by contract with the hotel. However, any savings resulting from shared accommodations under such arrangements does qualify for the travel savings award. WO SUPPLEMENT 6509.33-2007-1 EFFECTIVE DATE: 01/18/2007 DURATION: This supplement is effective until superseded or removed. 6509.33_301-50 Page 5 of 7 FSH 6509.33 - FEDERAL TRAVEL REGULATION CHAPTER 301 - TEMPORARY DUTY (TDY) TRAVEL ALLOWANCES SUBCHAPTER C - ARRANGING FOR TRAVEL SERVICES, PAYING TRAVEL EXPENSES, AND CLAIMING REIMBURSEMENT PART 301-50 - ARRANGING FOR TRAVEL SERVICES b. Lodging savings resulting from GSA sponsored FedRooms program must not be counted as lodging savings in the travel savings program. This Program offers hotels that have agreed to provide lodging at or below the per diem rate. The program and affiliated hotels can be found on the internet at FEDROOMS. c. Employees should not incur additional expenses in transportation or other miscellaneous costs in an effort to reduce lodging expenses. Employees who incur additional transportation expenses must have those expenses deducted from their lodging savings. Examples of excess transportation cost include, but are not limited to, renting a vehicle (when one would not normally be rented) at a TDY site to travel to a place of free or reduced lodging; when driving a privately owned vehicle (POV), driving more miles than would normally be traveled to/from the TDY site to obtain free or reduced lodging; or where a taxi fare is incurred which would not normally have been incurred to obtain free or reduced lodging. d. The Government travel card must be used for payment of all hotel-lodging costs to qualify as lodging savings under this program. The only exceptions to this are when the hotel or other facility does not accept the travel card, or where an employee stays with friends or relatives to avoid payment of any lodging costs or under the requirements of Federal Travel Regulations (FTR) 301-51.2. e. When a room is shared while on official travel there can be a lodging savings. The employees should arrange to be billed separately. If this is not possible, a daily rate must be determined for each employee. To determine amount eligible for the travel savings program for each employee: (1) Divide the actual lodging rate by the number of employees that shared the room. This gives an actual daily rate for each employee. (2) Divide the maximum lodging locality rate by the number of employees to get a daily maximum rate for each employee. (3) Subtract the actual daily rate from the daily maximum rate for each employee. The results will be each employee's eligible savings toward the minimum savings of $200. WO SUPPLEMENT 6509.33-2007-1 EFFECTIVE DATE: 01/18/2007 DURATION: This supplement is effective until superseded or removed. 6509.33_301-50 Page 6 of 7 FSH 6509.33 - FEDERAL TRAVEL REGULATION CHAPTER 301 - TEMPORARY DUTY (TDY) TRAVEL ALLOWANCES SUBCHAPTER C - ARRANGING FOR TRAVEL SERVICES, PAYING TRAVEL EXPENSES, AND CLAIMING REIMBURSEMENT PART 301-50 - ARRANGING FOR TRAVEL SERVICES For example, two employees find a room for $80. The maximum locality rate is $100. The actual daily rate for each employee is $40 ($80/2). The daily maximum locality rate for each employee is $50 ($100/2). Subtract $40 from $50 to get savings of $10 for each employee. However, each employee receives 50% of the total savings, which is $5 (50% of $10) (see para. 5) to count toward the minimum savings of $200. The savings are cumulative on a fiscal year basis. f. All lodging must be at facilities which meet the requirements of the Hotel/Motel Fire Safety Act of 1990 (P.L. 101-391). Lodging with friends or relatives exempts the employee from this requirement. Hotels in compliance can be found on at USFA: Hotel/Motel Fire-Safe List. g. Lodging costs incurred on personal time (annual leave) during official travel must not be counted as lodging savings under this program. h. Employees who incur no costs for lodging while on official travel can receive credit for one half of the lodging rate for the locality toward the minimum savings of $200 to become eligible for a travel savings cash award. 3. Redemption of Frequent Flyer Benefits. Employees who use a free ticket obtained through frequent flyer benefits earned on official or personal travel are eligible for the travel savings award. Savings on transportation costs are measured by the contract city pair rate in effect at the time of the flight. If no contract fare is available, then the lowest available non-restricted coach fare must be used as a basis for determining the savings. 4. Amount of Award. The amount of the award for each employee is 50 percent of the combined savings on lodging and contract carrier airfare expenses. Taxes are withheld (Federal, State, FICA) from the total award amount. The minimum savings is $200 and the cash award that can be received is half of the savings ($100). 5. Claiming the Reward. Form FS 6500-4, Forest Service Travel Savings Form must be completed and submitted by each employee for all trips, which show lodging savings or redemption of Frequent Flyer benefits. Each trip must be submitted with the appropriate voucher to the appropriate approving official, who in most cases is the employee’s immediate supervisor. The employee and the approving official must initial each trip and sign each completed Travel Savings Form. WO SUPPLEMENT 6509.33-2007-1 EFFECTIVE DATE: 01/18/2007 DURATION: This supplement is effective until superseded or removed. 6509.33_301-50 Page 7 of 7 FSH 6509.33 - FEDERAL TRAVEL REGULATION CHAPTER 301 - TEMPORARY DUTY (TDY) TRAVEL ALLOWANCES SUBCHAPTER C - ARRANGING FOR TRAVEL SERVICES, PAYING TRAVEL EXPENSES, AND CLAIMING REIMBURSEMENT PART 301-50 - ARRANGING FOR TRAVEL SERVICES Employees can apply for the award as soon as they meet the minimum eligibility requirement of $200 in savings. All completed Travel Savings Forms with total cumulative savings of $200 or more must be submitted to the approving official, who must then complete form AD-287-2, Recommendation & Approval of Awards. Select Gainsharing Award as the type of recognition recommended, in block 12 of the AD-287-2. The Approving Official in Block 22 has approval authority up to $1,000. The Secretary of the Department of Agriculture approves incentive awards for SES and for award amounts greater than $1,000. The AD-287-2 shall be submitted to the Albuquerque Service Center (ASC), Human Capital Management for employees at the GS-13 and below level and to the Washington Office (WO), Human Capital Management for employees at the GS-14 and above level for processing.