6509.11k, 51.22-51.24 Page 1 of 27 FOREST SERVICE HANDBOOK

advertisement

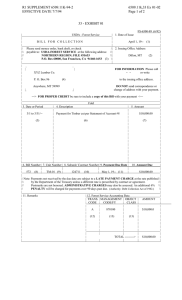

6509.11k, 51.22-51.24 Page 1 of 27 FOREST SERVICE HANDBOOK Portland, Oregon 6509.11k - SERVICE-WIDE FINANCE AND ACCOUNTING HANDBOOK R6 Supplement No. 6509.11k-94-5 Effective April 22, 1994 POSTING NOTICE. Supplements are numbered consecutively by title and calendar year. Post by document name. Remove entire document, if one exists, and replace with this supplement. The last R-6 Supplement to this handbook was 6509.11k-94-4. This supplement supersedes Supplement 6509.11k-92-2. (Header mistakenly says 6509.11k-92-1). Document Name Superseded New (Number of Sheets) 6509.11k,51.22-51.24 29 27 Digest: 51.22 - Updates the latest TSPIRS developments that occurred in Fiscal Year 1993. Extensive changes were made to the adjustment process. /s/ John E. Lowe JOHN E. LOWE Regional Forester R6 SUPPLEMENT 6509.11k-94-5 EFFECTIVE 04/22/94 6509.11k,51.22-51.24 Page 2 of 27 FSH 6509.11k - SERVICE-WIDE FINANCE AND ACCOUNTING HANDBOOK R6 SUPPLEMENT 6509.11k-94-5 EFFECTIVE 04/22/94 CHAPTER 50 - ACCOUNTING 51 - NATIONAL FINANCE CENTER (NFC) PRODUCED ACCOUNTING REPORTS. 51.2 - Monthly Accounting Reports. 51.22 - Unit Level Reports. TSPIRS has been implemented on a Service-wide basis. This direction is for Regional use to help monitor and assist with yearend reports published by the National Finance Center. Specifically this supplement provides instruction to ensure that the data is collected consistently and correctly for the Statement of Revenues and Expenditures, one of three tables in TSPIRS. Additional instructions can be found in the new TSPIRS Desk Guide. R6 SUPPLEMENT 6509.11k-94-5 EFFECTIVE 04/22/94 6509.11k,51.22-51.24 Page 3 of 27 1. CROSSWALK. Listed below are crosswalks for FY 1993 and FY 1994. a. Select criteria for the report "TPIR 01" Worksheet: By Line Number LN DESCRIPTION 01 02 REVENUES TIMBER SALES 03 FUND CODE WK-ACT NOTES 5008,5896, CWKV,SSSS, 5882,PDPD SEE NOTE 1 PURCHASER ROAD CREDIT PUCR SEE NOTE 1 04 ASSOCIATED CHARGES BCBC,BDBD, CWFS,RIRI, SDSD,3221 SEE NOTE 1 05 INTEREST AND PENALTIES 1099,3220, 1435 SEE NOTE 1 06 TOTAL REVENUES 08 DIRECT TIMBER SALE EXPENSES 09 HARVEST ADMIN COSTS /1 10 TIMBER COMMODITY SALES NFHA,CWFS, RIRI,SSSS, TTTT,TTSA, QAQA ET12XXXX W/ TM IN XXXX SEE NOTE 1 11 FOREST STEWARDSHIP SALES NFHA,CWFS, RIRI,SSSS, TTTT,TTSA, QAQA ET12XXXX W/ NT IN XXXX SEE NOTE 2 12 PERSONAL USE SALES NFHA,CWFS, RIRI,SSSS, TTTT,TTSA, QAQA ET12XXXX W/ PP IN XXXX SEE NOTE 3 13 TOTAL HARVEST ADMIN COSTS 15 GENERAL ADMIN - SALES /1 BDBD,PEPE, RTRT, TG3XXXXX, TG4XXXXX SEE NOTE 4 NFGA,CWKV, CWFS,TTTT, TTSA,SSSS NFSP,TTTT, SSSS,TTSA RMTR,QAQA TG3XXXXX, TG4XXXXX SEE NOTE 5 ET114XXX, EXCEPT ET1141XX, SEE NOTE 6 16 SALE PREPARATION /2 R6 SUPPLEMENT 6509.11k-94-5 EFFECTIVE 04/22/94 6509.11k,51.22-51.24 Page 4 of 27 AND ET1142XX R6 SUPPLEMENT 6509.11k-94-5 EFFECTIVE 04/22/94 LN DESCRIPTION 6509.11k,51.22-51.24 Page 5 of 27 FUND CODE WK-ACT NOTES NFSP,TTTT, SSSS,TTSA, RMTR,QAQA ET1141XX, AND ET1142XX SEE NOTE 6 17 ANALYSIS/DOCUMENTATION /2 18 APPEALS/LITIGATION - SALES /2 NFSP,TTTT, SSSS,TTSA, RMTR,QAQA, NFRM,NFCR, NFWM,NFSI, NFSO,NFSV, NFAF,NFIF, NFTE,NFWL, NFVM,NFIP, NFHB,NFMG, CNWK,BDBD, FFFP,NFHA, NFSE,NFTP, ET173XXX SEE NOTE 6 19 OTHER RESOURCE SUPPORT /2 NFSP,TTTT, SSSS,TTSA, RMTR,FFFP, QAQA,NFAA, NFRM,NFCR, NFWM,NFSI, NFSO,NFSV, NFAF,NFIF, NFTE,NFWL NFVM,NFIP, NFHB,NFMG, CNWK,BDBD ET113XXX SEE NOTE 6 20 BRUSH DISPOSAL FUND /2 BDBD PFXXXXXX SEE NOTE 6 21 COOP ROAD MAINTENANCE /2 CWFS LT23XXXX SEE NOTE 6 22 ROAD DEPRECIATION EXPENSES /3 CNTM,TTTT, SSSS,PEPE, TTSA,RMTR, NFSP JL25XXXX LT1XXXXX LT21XXXX LT22XXXX SEE NOTE 7 23 SURFACEDESIGN/CONSTRUCTION % OF LINE 27, LT2222XX, LT2232XX SEE NOTE 6 CULVERTSDESIGN/CONSTRUCTION % OF LINE 27, LT2222XX, LT2232XX SEE NOTE 6 24 R6 SUPPLEMENT 6509.11k-94-5 EFFECTIVE 04/22/94 LN 25 26 DESCRIPTION 6509.11k,51.22-51.24 Page 6 of 27 FUND CODE WK-ACT BRIDGESDESIGN/CONSTRUCTION % OF LINE 27, LT2224XX, LT2234XX LT21414X, LT21424X LT22114X, LT22124X LT224, LT225 PRISM-DESIGN/CONSTRUCTION % OF LINE 27, JL25XXXX, LT2221XX LT2231XX NOTES SEE NOTE 6 SEE NOTE 6 27 TOTAL RD DESIGN AND CONSTR 29 SURFACE-PURCHASER RD CREDIT PCC2, PCR2 SEE NOTE 9 30 CULVERTS-PURCHASER RD CREDIT PCC3, PCR3 SEE NOTE 9 31 BRIDGES-PURCHASER RD CREDIT PCC4, PCR4 SEE NOTE 9 32 PRISM-PURCHASER RD CREDIT PCC1, PCR1 SEE NOTE 9 33 TOTAL PURCHASER ROAD CREDIT 35 SURFACE-APP & LIT REWORK 36 CULVERTS-APP & LIT REWORK 37 BRIDGES-APP & LIT REWORK 38 PRISM-APP & LIT REWORK 39 TOTAL APPEALS/LITIGATION RDS 41 TOTAL TIMBER SALE EXPENSES 43 1/ANNUAL EXPENSE 44 2/SALE ACTIVITY POOL COST, AMORTIZED ON THE BASIS OF ANNUAL HARVEST CNTM,TTTT, SSSS,PEPE, TTSA,RMTR, NFSP LT273XXX SEE NOTE 8 SEE NOTE 20 R6 SUPPLEMENT 6509.11k-94-5 EFFECTIVE 04/22/94 45 3/DEPRECIATION ON THE BASIS OF USEFUL LIVES 6509.11k,51.22-51.24 Page 7 of 27 SEE NOTE 21 R6 SUPPLEMENT 6509.11k-94-5 EFFECTIVE 04/22/94 LN DESCRIPTION 46 4/GROWTH ACTIVITY POOL COST, AMORTIZED ON THE BASIS OF GROWTH STOCK INVENTORY 6509.11k,51.22-51.24 Page 8 of 27 FUND CODE WK-ACT NOTES SEE NOTE 22 ...begin page 2 of TPIR 01... 47 TIMBER PROGRAM EXPENSES 48 TIMBER PLANNING /1 NFTP,SSSS, TTTT,TTSA, RMTR,QAQA ET112XXX SEE NOTE 6 49 TRANSPORTATION PLANNING /1 SSSS,NFSP, CNTM,TTTT, TTSA,RMTR LT21XXXX SEE NOTE 10 50 SILVICULTURAL EXAMINATIONS NFSE,TTTT, /2 SSSS,TTSA, RMTR,QAQA, NFTP ET111XXX SEE NOTE 6 51 GENETIC TREE IMPROVEMENT /4 NFGT,TTTT, RTRT,CWKV, TTSA ET27XXXX SEE NOTE 6 52 APPROPRIATED REFORESTATION NFRF,TTTT, /4 RTRT,TTSA, RMTR,RIRI ET24XXXX SEE NOTE 6 53 KV REFORESTATION /4 CWKV ET24XXXX SEE NOTE 6 54 APPROPRIATED STAND IMPROV /4 NFTI,TTTT, RTRT,TTSA, RMTR ET25XXXX SEE NOTE 6 55 KV STAND IMPROVEMENT /4 CWKV ET25XXXX SEE NOTE 6 56 FACILITIES DEPRECIATION /3 BDBD,CNTM, CWKV,SSSS, NFTI,NFHA, NFSP,NFSE, NFTP,NFGT, NFRF LF2XXXXX ALL FUND CODES AND WORK ACTIVITY ON LINES 10-12, 16-66 58 TOTAL TIMBER PROGRAM EXPENSE SEE NOTE 11 R6 SUPPLEMENT 6509.11k-94-5 EFFECTIVE 04/22/94 60 LN 6509.11k,51.22-51.24 Page 9 of 27 TOTAL DIRECT EXPENSES DESCRIPTION FUND CODE WK-ACT NOTES NFSP,TTTT, SSSS,TTSA, RMTR,QAQA, NFHA,NFSE, NFTP ET171XXX SEE NOTE 6 62 INDIRECT EXPENSES 63 TIMBER SALE EXPENSES 64 APPEALS AND LITIGATION /1 (PROGRAM) 65 R-10 APPROPRIATED RD MTCE /2 TTTT LT23 SEE NOTE 12 66 R-10 LAND LINE LOCATION /2 JL24 SEE NOTE 12 67 TOTAL TIMBER SALE INDIRECT 68 TIMBER PROGRAM GEN ADMIN /1 BDBD,PEPE, RTRT, TG3XXXXX TG4XXXXX SEE NOTE 4 NFGA, CWKV, CWFS, TTTT, TTSA, SSSS TG3XXXXX TG4XXXXX SEE NOTE 5 NFSE, NFGT, NFRF, CWKV, NFTI, CNTM, PCC1-4, PCR1-4 BLANK WORK ACTIVITY SEE NOTE 19 TTTT 69 TOTAL TIMBER PROG INDIRECT 71 TOTAL INDIRECT EXPENSES 73 TOTAL TIMBER EXPENSES 75 GAIN/LOSS BEFORE EXTRAORD. EXP 77 EXTRAORDINARY EXPENSE 79 NET GAIN OR LOSS 81 TIMBER VOLUME (MBF) INFORMATION 82 VOLUME HARVESTED SEE NOTE 9 83 VOLUME UNDER CONTRACT SEE NOTE 9 84 GROWING STOCK INVENTORY SEE NOTE 9 R6 SUPPLEMENT 6509.11k-94-5 EFFECTIVE 04/22/94 6509.11k,51.22-51.24 Page 10 of 27 86 PAYMENTS TO STATES 88 SALE ACTIVITY POOL BALANCE SEE NOTE 14 89 GROWTH ACTIVITY POOL BALANCE SEE NOTE 15 LN DESCRIPTION 5201, 5213 FUND CODE SEE NOTE 13 WK-ACT NOTES 90 FACILITIES ASSET BALANCE SEE NOTE 16 91 ROAD ASSETS BEING DEPRECIATED BALANCE SEE NOTE 17 ROAD ASSETS CAPITALIZED, NOT DEPRECIATED SEE NOTE 18 92 NOTES - Worksheet select Criteria 1/Timber Commodity Sales. Select records with "TM" in first significant characters denoted by "XXXX." 2/Forest Stewardship Sales. Select records with "NT" in first significant characters denoted by "XXXX." 3/Personal Use Sales. Select records with "PP" in first significant characters denoted by "XXXX." 4/"General Admin - Sales" (line 15) and "Timber Program Gen Admin" (line 68). Select all direct charges for these funds. Total will be prorated to line 15 and line 68 based on formula. Line 15 Factor: (Sum of column 1, lines 13, 16-21, 23-26, 29-32, 35-38) divided by (sum of column 1, lines 13, 16-21, 23-26, 29-32, 35-38, 48-56, 64-66). Line 68 Factor: (Sum of column 1, Lines 48-56, 64-66) divided by (sum of column 1, lines 13, 16-21, 2326, 29-32, 35-38, 48-56, 64-66). 5/"General Admin - Sales" (line 15) and "Timber Program Gen Admin" (line 68). Charges will be accumulated and factored by percentages provided by Forest Service. The factored amount will be prorated to line 15 and line 68 based on formula. Line 15 Factor: (Sum of column 1, lines 13, 16-21, 23-26, 29-32, 35-38) divided by (sum of column 1, lines 13, 16-21, 23-26, 29-32, 35-38, 48-56, 64-66). Line 68 Factor: (Sum of column 1, Lines 48-56, 64-66) divided by (sum of column 1, lines 13, 16-21, 2326, 29-32, 35-38, 48-56, 64-66). 6/Select significant characters regardless of "X's". R6 SUPPLEMENT 6509.11k-94-5 EFFECTIVE 04/22/94 6509.11k,51.22-51.24 Page 11 of 27 7/Charges will be accumulated and factored by percentages provided by Forest Service. Use the "Road Construction Percentages" which are transmitted in the GA percent file from Kansas City (TSA). - Select significant characters regardless of "XXXX" for the charges for records LT1XXXXX, and LT22XXXX. - For record LT21XXXX select those significant characters regardless of "XXXX" that have a code 9, 19, or 29 in the "Other" field positions 7/8. Allocate the records to lines of data by specific codes and then allocate the remaining costs based on percentages provided by Forest Service. Use Road Other Percentages for LT1XXXXX and LT21XXXX. Use Road Construction Percentages for LT22XXXX. Line 23, Surface: specific codes LT2222XX, LT2232XX, and a percentage of remaining costs. Line 24, Culverts: specific codes LT2223XX, LT2233XX, and a percentage of remaining costs. Line 25, Bridges: specific codes LT2224XX, LT2234XX, LT21414X, LT21424X, LT22114X, LT22124X, LT224XXX, LT225XXX, and a percentage of remaining costs. Line 26, Prism: specific codes JL25XXXX, LT2221XX, LT2231XX, and a percentage of remaining costs. If no percentage available, default to prism (line 26). 8/Appeals and Litigation Roads. Factor to lines 35, 36, 37,and 38 using the "Road Other Percentages" transmitted from TSA each month. 9/Amounts will be provided by Forest Service monthly through their data transmission (revenue/volume transmission from TSA). 10/Transportation Planning. Select records with work activity "LT21XXXX" and coding in positions 7 and 8 of the "Other" field that is not included in the specific select criteria for lines 23-26 (See Note 7) and line 56 (see Note 11). From the monthend and yearend files, select records with the depreciation indicator equal to "T" because there is no "Other" field in the record. 11/Facilities Depreciation. Select asset codes 01-08, 10, 11 and 13-15 in position 7/8 of the "Other" field for all Fund and Work Activity combinations on lines 10-12, 16-66. 12/Obtain amounts from the Adjustments File only. 13/Amounts will be provided by Forest Service annually through their data transmission. 14/Sale Activity Pool Balance. Obtain amount from TPIR01 Ending Balance figures, Column 7, lines 16-21 and 50, 65, 66. Includes Pool Balance Forward amount for the following lines: Line 16 - Sale Preparation 17 - Analysis and Documentation 18 - Appeals and Litigation 19 - Other Resource Support R6 SUPPLEMENT 6509.11k-94-5 EFFECTIVE 04/22/94 6509.11k,51.22-51.24 Page 12 of 27 20 - Brush Disposal Fund 21 - Coop Road Maintenance 50 - Silvicultural Examinations 65 - R-10 Appropriated Road Mtce 66 - R-10 Land Line Location 15/Growth Activity Pool Balance. Obtain amount from TPIR01 Ending Balance figures, Column 7, lines 51-55. Includes Pool Balance Forward amount for the following lines: Line 51 - Genetic Tree Improvement 52 - Appropriated Reforestation 53 - KV Reforestation 54 - Appropriated Stand Improvement 55 - KV Stand Improvement 16/Facilities Asset Balance. Obtain amount from TPIR01 Ending Balance figures, Column 7, line 56. 17/Road Assets Being Depreciated Balance. Obtain amount from TPIR01 Ending Balance figures, Column 7, lines 23, 24, 25, 29, 30, 31, 35, 36, 37. 18/Road Assets Capitalized, Not Depreciated. Obtain amount from TPIR01 Ending Balance figures, Column 7, lines 26, 32, 38. 19/Extraordinary Expense. This amount will accrue from adjustments which are coded with an "E" indicator. It represents costs being removed from any of the TSPIRS line items when a catastrophic loss is incurred as a result of fire, insects, disease, or other natural disaster. The costs will be adjusted (subtracted) from the pool balance with a negative adjustment ("L" indicator). The offset or contra entry will be an adjustment line coded with "E". This is an annual expense and will be subtracted from the Gain/Loss Before Payments to States. Work activity code is not needed and there is no edit on work activity. 20/Sale Activity Pool amortization formula is: Volume Harvested Current Year ---------------* Pool Balance = Volume Harvested + Volume Under Contract (Column 5) FY Expense (Column 6) Column 7 equals Column 5 minus Column 6. 21/Depreciation Expense: For Road Design and Construction, Purchaser Road Credits, and Appeals and Litigation: Surface Culverts Bridges 10 years 30 years 50 years Facilities Depreciation is 30 years. For all depreciation accounts - do not subtract current year depreciation expense from the current year pool balance to determine the pool balance forward. Column 5 and Column 7 should be equal at all times. 22/Growth Activity Pool amortization formula is: R6 SUPPLEMENT 6509.11k-94-5 EFFECTIVE 04/22/94 Volume Harvested ---------------Growing Stock Inventory 6509.11k,51.22-51.24 Page 13 of 27 Current Year *Pool Balance (Column 5) FY Expense = (Column 6) 23/Reclassified Assets - This amount will be provided from adjustments which are coded with an "S" indicator. It represents growth pool and road assets being reclassified due to a land use designation change. Use the appropriate fund and work activity for the asset which is being reclassified. R6 SUPPLEMENT 6509.11k-94-5 EFFECTIVE 04/22/94 6509.11k,51.22-51.24 Page 14 of 27 b. Select Criteria for "TPIR 02, 03, 06" reports: By Line Number Report 1 LN DESCRIPTION 01 02 REVENUE TIMBER SALES 03 PURCHASER ROAD CREDITS ASSOCIATED CHARGES 04 05 07 09 10 11 12 INTEREST AND PENALTIES TOTAL REVENUES DIRECT EXPENSES TIMBER SALE EXPENSES HARVEST ADMIN /1 GENERAL ADMINSALES /1 13 SALE PREPARATION /2 14 ANALYSIS/ DOCUMENTATION /2 15 APPEALS/LITIGATIONSALES /2 FUND CODE WK-ACT NOTES 5008,5896 CWKV,SSSS 5882,PDPD PUCR SEE NOTE 1 BCBC,BDBD, CWFS,RIRI, SDSD,3221 1099,3220, 1435 SEE NOTE 1 SEE NOTE 1 SEE NOTE 1 NFHA,CWFS, RIRI,SSSS, TTTT,TTSA, QAQA BDBD,PEPE, RTRT, ET12XXXX WITH TM,NT,PP IN XXXX TG3XXXXX, TG4XXXXX NFGA,CWKV, CWFS,TTTT, TTSA,SSSS NFSP,TTTT, SSSS,TTSA, RMTR,QAQA TG3XXXXX, TG4XXXXX NFSP,TTTT, SSSS,TTSA, RMTR,QAQA NFSP,TTTT, SSSS,TTSA, RMTR,QAQA, NFRM,NFCR, NFWM,NFSI, NFSO,NFSV, NFAF,NFIF, NFTE,NFWL, NFVM,NFIP, NFHB,NFMG, CNWK,BDBD, FFFP,NFHA, NFSE,NFTP ET114XXX, EXCEPT ET1141XX, AND ET1142XX ET1141XX, AND ET1142XX ET173XXX SEE NOTE 1 SEE NOTE 2 SEE NOTE 2 SEE NOTE 2 SEE NOTE 2 R6 SUPPLEMENT 6509.11k-94-5 EFFECTIVE 04/22/94 6509.11k,51.22-51.24 Page 15 of 27 LN DESCRIPTION FUND CODE WK-ACT NOTES 16 OTHER RESOURCE SUPPORT /2 ET113XXX SEE NOTE 2 17 BRUSH DISPOSAL FUND /2 COOP ROAD MAINTENANCE /2 DEPRECIATION EXPENSE /3 ROAD DESIGN AND CONSTRUCTION NFSP TTTT, SSSS,TTSA, RMTR,FFFP, QAQA,NFAA, NFRM,NFCR, NFWM,NFSI, NFSO,NFSV, NFAF,NFIF, NFTE,NFWL, NFVM,NFIP, NFHB,NFMG, CNWK,BDBD BDBD PFXXXXXX SEE NOTE 2 CWFS LT23XXXX SEE NOTE 2 CNTM,TTTT SSSS,PEPE, TTSA,RMTR, NFSP JL25XXXX LT1XXXXX LT21XXXX LT22XXXX LT2222XX, LT2232XX LT2223XX, LT2233XX LT2224XX, LT2234XX LT21414X, LT21424X LT22114X, LT22124X LT224, LT225 SEE NOTE 2 18 19 20 21 PURCHASER ROAD CREDITS 22 APPEALS/LITIGATIONROADS 24 TOTAL TIMBER SALE EXPENSES TIMBER PROGRAM EXPENSES TIMBER PLANNING /1 26 27 28 TRANSPORTATION PLANNING /1 29 SILVICULTURAL EXAMINATIONS /2 PCC1,PCR1, PCC2,PCR2, PCC3,PCR3, PCC4,PCR4 CNTM,TTTT, SSSS,PEPE, TTSA,RMTR, NFSP NFTP,SSSS, TTTT,TTSA, RMTR,QAQA SSSS,NFSP, CNTM,TTTT, TTSA,RMTR NFSE,TTTT, SSSS,TTSA, SEE NOTE 2 LT273XXX SEE NOTE 2 ET112XXX SEE NOTE 2 LT21XXXX SEE NOTE 2 ET111XXX SEE NOTE 2 R6 SUPPLEMENT 6509.11k-94-5 EFFECTIVE 04/22/94 6509.11k,51.22-51.24 Page 16 of 27 RMTR,QAQA, NFTP LN DESCRIPTION FUND CODE WK-ACT NOTES 30 GENETIC TREE IMPROVEMENT /4 ET27XXXX SEE NOTE 2 31 APPROPRIATED REFORESTATION /4 ET24XXXX SEE NOTE 2 32 KV REFORESTATION /4 APPROPRIATED STAND IMPROV /4 NFGT TTTT, RTRT,CWKV, TTSA NFRF,TTTT, RTRT,TTSA, RMTR,RIRI CWKV ET24XXXX SEE NOTE 2 NFRI,TTTT, RTRT,TTSA, RMTR CWKV ET25XXXX SEE NOTE 2 ET25XXXX SEE NOTE 2 33 34 35 36 38 40 46 47 48 49 50 52 54 55 57 59 61 63 KV STAND IMPROVEMENT /4 DEPRECIATION /3 FACILITIES DEPRECIATION /3 TOTAL TIMBER PROGRAM EXPENSE TOTAL DIRECT EXPENSES (...begin page 2...) INDIRECT EXPENSES TIMBER SALE EXPENSES APPEALS/ LITIGATION /1 R-10 APPROPRIATED RD MTCE /2 R-10 LAND LINE LOCATION /2 TOTAL TIMBER SALE INDIRECT TIMBER PROGRAM EXPENSES GENERAL ADMINPROG /1 (PROGRAM) TOTAL TIMBER PROG INDIRECT TOTAL INDIRECT EXPENSES TOTAL TIMBER EXPENSES GAIN/LOSS BEFORE SEE NOTE 2 NFSP,TTTT, SSSS,TTSA, RMTR,QAQA, NFHA,NFSE, NFTP TTTT ET171XXX SEE NOTE 2 LT23 SEE NOTE 2 TTTT JL24 SEE NOTE 2 BDBD,PEPE RTRT ,,TG3XXXXX TG4XXXXX SEE NOTE 2 NFGA,CWKV CWFS,TTTT TTSA,SSSS TG3XXXXX TG4XXXXX R6 SUPPLEMENT 6509.11k-94-5 EFFECTIVE 04/22/94 EXTRAORD. EXP 6509.11k,51.22-51.24 Page 17 of 27 R6 SUPPLEMENT 6509.11k-94-5 EFFECTIVE 04/22/94 LN DESCRIPTION FUND CODE 65 EXTRAORDINARY EXPENSE NFSE,NFGT, NFRF,CWKV, NFTI,CNTM PCC1-4, PCR1-4 67 69 NET GAIN OR LOSS TIMBER VOLUME (MBF) INFORMATION VOLUME HARVESTED VOLUME UNDER CONTRACT ENDING GROWING STOCK INVENTORY PAYMENTS TO STATES RECLASSIFIED ASSETS SALE ACTIVITY POOL BALANCE GROWTH ACTIVITY POOL BALANCE FACILITIES ASSET BALANCE ROAD ASSETS BEING DEPRECIATED BALANCE ROAD ASSETS CAPITALIZED, NOT DEPRECIATED 72 73 74 76 77 78 79 80 81 82 84 85 86 87 1/ANNUAL EXPENSE 2/SALE ACTIVITY POOL COST, AMORTIZED ON THE BASIS OF ANNUAL HARVEST 3/DEPRECIATION ON THE BASIS OF USEFUL LIVES 4/GROWTH ACTIVITY POOL COST, AMORTIZED ON THE BASIS OF GROWING STOCK INVENTORY 6509.11k,51.22-51.24 Page 18 of 27 WK-ACT NOTES SEE NOTE 3 SEE NOTE 10 SEE NOTE 2 SEE NOTE 2 SEE NOTE 3 SEE NOTE 3 SEE NOTE 3 5201,5213 SEE NOTE 5 SEE NOTE 6 SEE NOTE 7 SEE NOTE 8 PCC1, PCR1 CNTM,TTTT SSSS,PEPE, TTSA,RMTR, NFSP SEE NOTE 9 JL25XXXX LT1XXXXX LT21XXXX LT2221XX, LT2231XX R6 SUPPLEMENT 6509.11k-94-5 EFFECTIVE 04/22/94 6509.11k,51.22-51.24 Page 19 of 27 c. Select Criteria for "TPIR 04, 05, 07" reports: By Line Number Report 1 LN DESCRIPTION 01 02 REVENUE TIMBER SALES 03 PURCHASER ROAD CREDITS ASSOCIATED CHARGES 04 05 07 09 10 11 12 INTEREST AND PENALTIES TOTAL REVENUES DIRECT EXPENSES TIMBER SALE EXPENSES HARVEST ADMIN /1 GENERAL ADMINSALES /1 FUND CODE WK-ACT NOTES 5008,5896, CWKV,SSSS, PUCR 5882,PDPD SEE NOTE 1 SEE NOTE 1 BCBC,BDBD CWFS,RIRI, SDSD,3221 1099,3220, 1435 NFHA,CWFS, RIRI,SSSS, TTTT,TTSA, QAQA BDBD,PEPE, RTRT 13 SALE PREPARATION /2 NFSP,TTTT, SSSS,TTSA, RMTR,QAQA 14 ANALYSIS/ DOCUMENTATION /2 15 APPEALS/ LITIGATION-SALES /2 NFSP,TTTT, SSSS,TTSA, RMTR,QAQA NFSP,TTTT, SSSS,TTSA, RMTR,QAQA, NFRM,NFCR, NFWM,NFSI, NFSO,NFSV, NFAF,NFIF, NFTE,NFWL, NFVM,NFIP, NFHB,NFMG, CNWK,BDBD, FFFP,NFHA, NFSE,NFPT SEE NOTE 1 SEE NOTE 1 ET12XXXX WITH TM,NT,PP IN XXXX NFGA,CWKV, CWFS,TTTT, TTSA,SSSS TG3XXXXX TG4XXXXX TG3XXXXX, TG4XXXXX ET114XXX, EXCEPT ET1141XX,AND ET1142XX ET1141XX, AND ET1142XX ET173XXX SEE NOTE 1 SEE NOTE 2 SEE NOTE 2 SEE NOTE 2 SEE NOTE 2 R6 SUPPLEMENT 6509.11k-94-5 EFFECTIVE 04/22/94 6509.11k,51.22-51.24 Page 20 of 27 LN DESCRIPTION FUND CODE WK-ACT NOTES 16 OTHER RESOURCE SUPPORT /2 ET113XXX SEE NOTE 2 17 BRUSH DISPOSAL FUND /2 COOP ROAD MAINTENANCE /2 DEPRECIATION EXPENSE /3 ROAD DESIGN AND CONSTRUCTION NFSP,TTTT, SSSS,TTSA, RMTR,FFFP, QAQA,NFAA, NFRM,NFCR, NFWM,NFSI, NFSO,NFSV, NFAF,NFIF, NFTE,NFWL, NFVM,NFIP, NFHB,NFMG, CNWK,BDBD BDBD PFXXXXXX SEE NOTE 2 CWFS LT23XXXX SEE NOTE 2 CNTM,TTTT, SSSS,PEPE, TTSA,RMTR, NFSP JL25XXXX LT1XXXXX LT21XXXX LT22XXXX LT2222XX, LT2232XX, LT2223XX, LT2233XX, LT2224XX, LT2234XX, LT21414X, LT21424X, LT22114X, LT22124X, LT224, LT225 SEE NOTE 2 18 19 20 21 PURCHASER ROAD CREDITS 22 APPEALS/ LITIGATION-ROADS 24 TOTAL TIMBER SALE EXPENSES TIMBER PROGRAM EXPENSES TIMBER PLANNING /1 26 27 28 TRANSPORTATION PLANNING /1 PCC1,PCR1, PCC2,PCR2, PCC3,PCR3, PCC4,PCR4 CNTM,TTTT, SSSS,PEPE, TTSA,RMTR, NFSP NFTP,SSSS, TTTT,TTSA, RMTR,QAQA SSSS,NFSP, CNTM,TTTT, TTSA,RMTR SEE NOTE 2 LT273XXX SEE NOTE 2 ET112XXX SEE NOTE 2 LT21XXXX SEE NOTE 2 R6 SUPPLEMENT 6509.11k-94-5 EFFECTIVE 04/22/94 6509.11k,51.22-51.24 Page 21 of 27 LN DESCRIPTION FUND CODE WK-ACT NOTES 29 SILVICULTURAL EXAMINATIONS /2 NFSE,TTTT, SSSS,TTSA, RMTR,QAQA, NFTP ET111XXX SEE NOTE 2 30 GENETIC TREE IMPROVEMENT /4 ET27XXXX SEE NOTE 2 31 APPROPRIATED REFORESTTATION/4 ET24XXXX SEE NOTE 2 32 33 KV REFORESTATION /4 APPROPRIATED STAND IMPROV /4 ET24XXXX ET25XXXX SEE NOTE 2 SEE NOTE 2 34 KV STAND IMPROVEMENT /4 DEPRECIATION /3 FACILITIES DEPRECIATION /3 TOTAL TIMBER PROGRAM EXPENSE TOTAL DIRECT EXPENSES NFGT TTTT, RTRT,CWKV, TTSA NFRF,TTTT, RTRT,TTSA, RMTR,RIRI CWKV NFTI,TTTT, RTRT,TTSA, RMTR CWKV ET25XXXX SEE NOTE 2 35 36 38 40 SEE NOTE 2 (...begin page 2...) 46 47 48 49 50 52 54 55 57 59 INDIRECT EXPENSES TIMBER SALE EXPENSES APPEALS/ LITIGATION /1 R-10 APPROPRIATED RD MTCE /2 R-10 LAND LINE LOCATION /2 TOTAL TIMBER SALE INDIRECT TIMBER PROGRAM EXPENSES GENERAL ADMIN-PROG /1 (PROGRAM) TOTAL TIMBER PROG INDIRECT TOTAL INDIRECT NFSP,TTTT, SSSS,TTSA, RMTR,QAQA, NFHA,NFSE, NFTP TTTT ET171XXX SEE NOTE 2 LT23 SEE NOTE 2 TTTT JL24 SEE NOTE 2 BDBD,PEPE, RTRT, TG3XXXXX TG4XXXXX SEE NOTE 2 NFGA,CWKV, CWFS,TTTT TTSA,SSSS TG3XXXXX TG4XXXXX R6 SUPPLEMENT 6509.11k-94-5 EFFECTIVE 04/22/94 6509.11k,51.22-51.24 Page 22 of 27 EXPENSES LN DESCRIPTION FUND CODE WK-ACT NOTES 61 TOTAL TIMBER EXPENSES GAIN/LOSS BEFORE EXTRAORD. EXP EXTRAORDINARY EXPENSE NFSE,NFGT, NFRF,CWKV, BLANK WORK ACTIVITY SEE NOTE 3 SEE NOTE 10 63 65 NFTI,CNTM, PCC1-4, PCR1-4 SEE NO TE 267 NET GAIN OR LOSS 70 TIMBER VOLUME (MBF) INFORMATION VOLUME HARVESTED 1/ANNUAL EXPENSE 2/SALE ACTIVITY POOL COST, AMORTIZED ON THE BASIS OF ANNUAL HARVEST 3/DEPRECIATION ON THE BASIS OF USEFUL LIVES 4/GROWTH ACTIVITY POOL COST, AMORTIZED ON THE BASIS OF GROWING STOCK INVENTORY 72 74 75 76 77 SEE NOTE 2 SEE NOTE 3 NOTES - Report Select Criteria for TPIR 02 - 07 1/Select records with "TM", "NT", or "PP" in the first significant characters denoted by "XXXX." Timber Commodity Sales is defined as "TM". Forest Stewardship is defined as "NT". Personal Use is defined as "PP" records. 2/For TPIR 02 and TPIR 06. Prorate TPIR 01, column 6 amount to Timber Commodity, Forest Stewardship, and Personal Use columns based on volume harvested percentage. For example, Volume Harvested "TM" --------------------Total Volume Harvested * Expense Column 6 Volume Harvested "TM" = Timber Commodity Volume Harvested "NT" = Forest Stewardship Volume Harvested "PP" = Personal Use) = Timber Commodity R6 SUPPLEMENT 6509.11k-94-5 EFFECTIVE 04/22/94 6509.11k,51.22-51.24 Page 23 of 27 3/Amounts shall be provided by Forest Service monthly through their data transmission. 4/Amounts shall be provided by Forest Service annually through their data transmission. (Payments to States are not included on TPIR 04,05, and 07). 5/Sale Activity Pool Balance. Obtain amount from TPIR01 Ending Balance figures, line 88. 6/Growth Activity Pool Balance. Obtain amount from TPIR01 Ending Balance figures, line 89. 7/Facilities Asset Balance. Obtain amount from TPIR01 Ending Balance figures, line 90. 8/Road Assets Being Depreciated Balance. Obtain amount from TPIR01 Ending Balance figures, line 91. 9/Road Assets Capitalized, Not Depreciated. Obtain amount from TPIR01 Ending Balance figures, line 92. 10/Extraordinary Expense. This amount will accrue from adjustments which are coded with an "E" indicator. It represents costs being removed from any of the TSPIRS line items when a catastrophic loss is incurred as a result of fire, insects, disease, or other natural disaster. The costs shall be adjusted (subtracted) from the pool balance with a negative adjustment ("L" indicator). The offset or contra entry will be an adjustment line coded with "E". This is an annual expense and shall be subtracted from the Gain/Loss Before Extraordinary Expenses line. 11/Reclassified Assets - This amount shall be provided from adjustments which are coded with an "S" indicator. It represents Growth Pool and Road Assets being reclassified by a land use designation change. Use the appropriate fund and work activity codes for the asset which is being reclassified. (This item is not reported on TPIR 04, 05, and 07). R6 SUPPLEMENT 6509.11k-94-5 EFFECTIVE 04/22/94 6509.11k,51.22-51.24 Page 24 of 27 2. REVIEW PROCEDURES. It is critical that forests validate the data that is reflected in the TSPIRS reports so corrections and adjustments can be made before the yearend reports are produced. TPIR 01 from the NFC is the report that contains information to be validated. TPIR 02 includes summarized data from TPIR 01 and organizes it into the three timber categories. The distribution of data needs to be reviewed to determine if it is proper. a. Revenues (1) Timber Sales - Obtained from the TSA477-01 report, Transfer of Earned Timber Sale Receipts (National Forest Summary - Charge Distribution Worksheet) and TSA572-01, Buyout File 5008 and 5882. Using the ATSA crosswalk in the R-6 draft FSH 6509.17 Automated Timber Sale Accounting Handbook, section 21.7, those revenue classes going to this line are identified in the TSPIRS column as "TM SALES". These include Fund ID's 02, 03, 04, 05, and 88. Totaling the "Distribution Amount" column located on the left side of the report by month should provide the correct figure to match the same line on the TPIR reports. Do not attempt to use TSA 477-02 for this process as minus cash balances from the previous year affect the report. (2) Purchaser Road Credits - Obtained from "TSPIRS REV RPT" column of the Yearend TSPIRS report, TSA 900-26. (3) Associated Charges - Obtained from the TSA477-01 report, Transfer of Earned Timber Sale Receipts. Using the ATSA crosswalk, those revenue classes for TSPIRS going to this line are identified as "ASSOC CHRG". These include Fund ID'S 06, 17, 20, 21, 25, 30-37, and 53-55. Totaling these by month should give you the correct figure to match the same line on the TPIR reports. (4) Interest and Penalties - This is where most of the problems occur. Interest and penalties are also obtained from TSA477-01, Transfer of Earned Timber Sale Receipts and TSA572-01, Buyout File 1435 and 3220. Using the ATSA crosswalk, these revenue classes are identified by an "AC" and fund codes 50-52. b. Volume (1) Volume Under Contract - Review quarterly reports TSA900-07 and TSA900-08, Remaining Timber Sales Volume (MBF) and Values by Purchaser for contracts and permits respectively. (a) Sales Past Termination - It is important that the above reports be reviewed for sales that are past the termination date and have remaining volume. If they have been extended or are in default, those TSA status codes need to be entered into TSA so that the records are correct. Any remaining sales should be closed as soon as feasible or modified so that the current quantity in ATSA is equal to the quantity cut to date by species. R6 SUPPLEMENT 6509.11k-94-5 EFFECTIVE 04/22/94 6509.11k,51.22-51.24 Page 25 of 27 (b) Sales Without Award Dates - Any sale that does not have an award date entered into TSA will not be reflected in the volume under contract at yearend. Pending sales should be reviewed to determine if any should have an award date entered. (2) Volume Harvested - The volumes can be validated using TSA478-01, Timber Cut and Sold Worksheet, adding all the quarters together. c. Controllable Expenses The CAS System provides most of the costs used by the TPIR System. FOCUS macros are available to assist in the validation of costs. These are located in the Regional Office, Region 6. As changes are made, the units will be advised. The areas that should be validated follow: (1) "Beginning Pool Balances" should be compared with previous year's balances for correctness. (2) All entries in the "Accounting Adjustment" column should be compared with the prior yearend adjustments for correctness (the amount should be the same but the sign reversed). Also, the adjustment should be reviewed for propriety. (In other words, did the transaction actually come through in the current year as anticipated by the TPIR yearend adjustment process? Otherwise, the adjustment may need to be taken off the current statements.) (3) All costs in the first column of the TPIR 01 should be reviewed for propriety and compared with the previous year's statement. (4) Using the above referenced macros, validate current year costs and be alert to common problem areas: (a) No Sale Administration costs in the Other Purpose or Personal Use categories, but forests have collected a substantial amount of revenues in these areas, and volume harvested is also reflected. (b) No costs in Cooperative Road Maintenance. (c) Excessive costs in Transportation Planning. This is caused by not entering a 09, 19, or 29 asset code with Preconstruction engineering which causes the costs to end up under Transportation Planning. (d) Small amounts (less than $1000) or large amounts in Facility Depreciation. Small amounts are generally caused by asset codes used in multi-line common service management codes. Inappropriate large amounts are again generally caused by incorrect asset codes. (e) TS11's are both transferred to and obligated by the benefiting forest which causes the costs to be doubled. R6 SUPPLEMENT 6509.11k-94-5 EFFECTIVE 04/22/94 6509.11k,51.22-51.24 Page 26 of 27 d. Review Periods Units shall complete reviews to validate TPIR data as of June 30 and September 30. Units shall also review the revised preliminary TPIR reports issued on or about October 25. Corrections to the CAS or ATSA must be made or, if after yearend, see Section 4, TPIR Adjustment Process. 3. INPUT TO NFC REQUIRED. The following items will need to be input to the NFC before correct reports can be expected at the end of the year. Input shall be developed by the Regional Office (RO) for submission to NCC-KC, who shall then transmit the Forest Service file to NFC. a. General Administration - The percent of general administration in support of the timber program for NFGA, CWKV, SSSS, and CWFS will be obtained from a spreadsheet which shall be calculated annually. This shall be done in late October or early November by the Region. b. GSI - Growing Stock Inventory shall be calculated annually by the Regional Office Timber and Strategic Planning units in cooperation with Financial Management (FM). c. Buyout, Default and Deferred Collections - Collections that are made by the RO for buyouts or defaults, and any deferred collections will be submitted by the Region. If any forests have collections for defaults and thefts that were not processed through ATSA, they need to be reported to the RO by September 30 annually. d. Road percentages for construction and preconstruction must be developed in order that expenses incurred for other than the contracts can be distributed to the correct component. Until automated, the Region will do this after the close of the year. 4. TPIR ADJUSTMENT PROCESS. A process exists to allow units to make adjustments to TPIR statements (the automated system that produces the TSPIRS Table 1, Statement of Revenues and Expenses). The region will be using a data entry package to forward the adjustments to the Washington Office (WO). Each unit should submit their TPIR adjustments via Data General (DG) to FM by the due date established annually. a. Purpose and Overview There are numerous situations that could give rise to an adjustment to TPIR data. The purpose of TSPIRS is to match revenues, costs, and volume. If revenues are included in TPIR, the costs and volume associated with that revenue need to be included. The contra is true also. Adjust only if revenues and costs involved are significant. Examples of potential adjustments follow. R6 SUPPLEMENT 6509.11k-94-5 EFFECTIVE 04/22/94 6509.11k,51.22-51.24 Page 27 of 27 (1) Revenues - All revenues on the TPIR Statements come from the TSA System. Situations that could require an adjustment are: (a) Joint timber sales with other agencies. The Forest Service generally collects the revenues for the other agency's portion (such as the Bureau of Land Management) of the timber. This causes the revenues to be overstated since the collection of monies is recorded on TPIR thru TSA. The later transfer of these monies (via an SF-1081) to the other agency is recorded on the CAS System but is not picked up by TPIR. Hence, revenues are overstated. Also, if the unit adjusts out the "other" agency's revenues for joint sales, the unit must also adjust out any associated costs and volume. O&C revenues and expenses will be reflected. (b) Default Sales. In some cases, revenues for default sales have been incorrectly deposited to interest and penalties. This can be corrected through TSA if the sales are still open and the error is corrected before yearend. Otherwise, it will need to be input to the TSA unit through the buyout file adjustment process. This is essential to keep the revenues and 25 percent fund correct. (2) Costs - All costs on the TPIR System originate from the CAS System. Some of the situations that could require adjustments are: (a) Incorrect pool balance forward. Errors in prior year data that have not been corrected. (b) Joint timber sales with other agencies. If the Forest Service is administering joint sales and not charging the "other" agency its portion of the administration costs, the Forest Service harvest administration costs are overstated. (The Forest Service cannot legally administer other agency sales with NFS appropriations. The correct method is to charge NFNF TS12 for the other agency's portion of the harvest administration cost. If this is done, the costs will not be picked up by TPIR.) (c) Zone costs. These costs may be adjusted to another unit. It is the responsibility of the performing unit to agree with the benefiting unit about the transfer of these costs. The benefiting unit must also pick up this adjustment on their TPIR Reports. There are two methods of budgeting for zone costs: 1) where all of the allocation from the RO goes to one forest. 2) where the benefiting forest(s) send funds to the performing forest. In the situation where one forest receives all funds from the RO, such as a tree orchard or a logging engineer, that unit shall reach agreement with the benefiting forests on the dollar amount. The performing unit will show a subtraction in the adjustment column in the TPIR data table and the benefiting unit will show an addition in the adjustment column. This is a permanent adjustment, not to be done through CAS, so all of these types of adjustments must be done using the monthly TPIR adjustment process. R6 SUPPLEMENT 6509.11k-94-5 EFFECTIVE 04/22/94 6509.11k,51.22-51.24 Page 28 of 27 In the situation where each forest sends spending authority to the performing unit through an Authorization for In-Service Expenditures, 6500-46, some accounting adjustments will be made after the September 30 CAS statements are produced. No adjustments are needed if the performing unit used TS11's and the benefiting unit obligated the correct resource funding. If there are other expenses that need to be adjusted and they will be done through the CAS in the succeeding year, do not use the Monthly TPIR Adjustment process. The Yearend Adjustment process shall be used and this shall be reversed the following fiscal year. This means the units will have to adjust the CAS System in the following year in order to offset the automatic reversal of the Yearend Adjustment process. (d) Cooperative Road Maintenance - Units that incur a major portion of their CWFS road maintenance LT23 costs for maintenance of recreation roads and so forth, and not generally for timber roads, can adjust this line of coding to remove portion not related to timber. Until the WO changes the current policy on the use of LT12 with CWFS-Other, it will be necessary to adjust those costs into TSPIRS, since they are not currently picked up from CAS. (e) Coding errors in CAS. This could cause TPIR costs to be over or under stated. These errors should be corrected in CAS before yearend if possible. If not, they could cause offsetting or a one-sided adjustment to TPIR. The correct process to use is the yearend adjustment to TPIR. (3) Volume - Volume information comes from the TSA System. Adjustments can be made by contacting the RO TSA unit (do not use the data table). Joint timber sales with other agencies: If the revenue and costs associated with the other agency are removed from TPIR, the associated volume should also be removed. (See 4a (1)(a).) b. Adjustments Adjustments can be made to the TPIR (Timber Program Information Reporting) Data Base by entering corrections into the CAS, ATSA, and using the TPIR Adjustment Data Entry package. Units should use the TPIR Adjustment Data Entry process to make adjustments to handle: (1) Non cash asset transactions. (a) Adding the value of donated assets. (b) Writing off fully depreciated assets. (c) Writing off catastrophic losses. (2) Coding error adjustments that cannot be processed through the CAS and ATSA systems. R6 SUPPLEMENT 6509.11k-94-5 EFFECTIVE 04/22/94 6509.11k,51.22-51.24 Page 29 of 27 (3) Yearend reporting changes and adjustments to the data in the TPIR data base to reflect what should have happened to data but; (a) Were not aware of the errors until the preliminary reports were produced. (b) Were unable to accomplish before the year's end. (c) Adjustments for zone operations, where unit wants TSPIRS to reflect costs on benefiting unit, but for CAS and budgetary reasons does not want to transfer costs. Adjustments made using the TPIR Adjustment Data Entry process will appear in the Adjustments Column of TPIR01, Source and Application of Funds Worksheet. Transmission of adjustments to NFC shall be done from the WO, Fiscal & Accounting Services. A data entry program has been developed. The regional files are summarized and sent to NFC as one Service-wide data file. Monthly adjustments by the Region shall be transmitted to the WO for inclusion in the TPIR data base on the 14th, following the end of the month. The yearend adjustments file will be transmitted after publication of the September 30 preliminary TPIR reports and prior to submission by the WO of Payments to States information (approximately November 20), exact date to be determined. c. Adjustment Record Format. The adjustment record format allows for units to specifically identify adjustments to each line of data in TPIR01. The line identifiers are: ID Description R Revenue T Transportation Planning Y Depreciation S Reclassified Assets TPIR Effect Adjustment to the appropriate Revenue line based on the fund code and sale purpose category. Expense reflected on the Transportation Planning line if the fund code/work activity combination is valid as defined in the select criteria. Expense reflected on the Facilities Depreciation line. Adjustment for the undepreciated balance of an asset which has been reclassified by a land use designation change. The amount will be reflected on the information line "Reclassified Assets." R6 SUPPLEMENT 6509.11k-94-5 EFFECTIVE 04/22/94 ID Description E Extraordinary Loss L Extraordinary Loss/ Reclassified Asset F Fully Depreciated M General Adjustment 6509.11k,51.22-51.24 Page 30 of 27 TPIR Effect Undepreciated assets expense due to an extraordinary loss. Adjustment shall be reflected on the "Extraordinary Expense" line. Adjustment to remove the capitalized costs of an asset due to an extraordinary loss or reclassification. These adjustments will be reflected on various lines based on the fund code/work activity combination. Adjustment will remove the capitalized cost of a fully depreciated asset from the pool balance. Note: The determination that an asset has been fully depreciated will be made by FS personnel based on spreadsheets maintained by the field. Any other adjustment which is not defined will be reflected on the appropriate line as defined by the fund code/work activity combination. (Same as the blank used in FY 1992). Note: Any adjustment record that does not have one of the alpha indicators defined above will be rejected. Forest / Unit requirements: Data tables are no longer required. Information that is necessary to make the adjustment for each forest or unit follows: Unit Subunit Adjustment Idenifier Fund Code Activity Code Sale Purpose Code Amount XX (the two digit number) XX (optional) X (required, either R,T,Y,S,E,L,F, or M XXXX (required with T,Y,S,E,L,F, or M XXXX (required with T,Y,S,E,L,F, or M XXXX (required with R) Dollars and cents with either negative or positive sign. For every line given, there must be a contra entry. There are no single line adjustments in TSPIRS. R6 SUPPLEMENT 6509.11k-94-5 EFFECTIVE 04/22/94 6509.11k,51.22-51.24 Page 31 of 27 Due Dates: For the monthly adjustments file, all adjustments are to be sent to the Fiscal TSPIRS Coordinator by the 12th of the month. At year end, dates will be established for the final monthly adjustment files and the year-end adjustment files.