6509.11k, 33 Page 1 of 28 FOREST SERVICE HANDBOOK

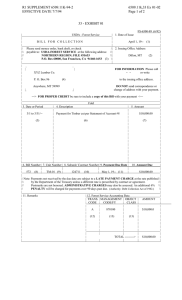

advertisement

6509.11k, 33 Page 1 of 28 FOREST SERVICE HANDBOOK Portland, Oregon FSH 6509.11k - SERVICE-WIDE FINANCE AND ACCOUNTING HANDBOOK R6 Supplement No. 6509.11k-97-1 Effective February 7, 1997 POSTING NOTICE. Supplements are numbered consecutively by title and calendar year. Post by document name. Remove entire document, if one exists, and replace with this supplement. The last R-6 Supplement to this handbook was 6509.11k-9 This supplement supersedes Supplement 6509.11k-94-4 Document Name 6509.11k,33 Superseded New (Number of Sheets) 20 28 Digest: 33.11 - Expands direction on billing due dates. 33.13 - Adds instructions on billing timber purchasers for the costs of suppressing negligently caused fires. Adds instructions on collections for Christmas Tree Permits, Forest Products Sale Permits, Firewood Permits, Rogue River Raft Permits, Special-Use Billings, and Timber Sale Contract Billings. Expands instructions on installment billings. 33.14 - Adds direction on follow-up billings. /s/ Robert W. Williams ROBERT W. WILLIAMS Regional Forester R6 SUPPLEMENT 6509.11k-97-1 EFFECTIVE 02/07/97 6509.11k, 33 Page 2 of 28 FSH 6509.11k - SERVICE-WIDE FINANCE AND ACCOUNTING HANDBOOK R6 SUPPLEMENT 6509.11k-97-1 EFFECTIVE 02/07/97 CHAPTER 30 - COLLECTIONS 33 - COLLECTION DOCUMENTS. 33.1 - Bill for Collection, Form FS-6500-89. Electronic form R6-FS-6500-89 may be used in lieu of form FS-6500-89. Units should place bill numbers on all billings before mailing them to the payer. This will aid in the proper processing of remittances by the lockbox bank and subsequently when units have to match paid lockbox information to their bill for collection files. 33.11 - Preparation. Follow instructions in parent text except for the following items: 2. Issue Date: When issuing follow-up billings, reference the original issue date in the description block, and retain the original issue date in the WILBARC file when inputting the new follow-up billing. 3. Remittance address: Region 6 billings should contain the following lockbox address: USDA - Forest Service File No. 71652 P.O. Box 60,000 San Francisco, CA 94160-1652 However, billings issued for claims cases should require payment to be sent to the Unit Collection Clerk rather than directly to the lockbox bank so appropriate action may be taken if the payment is made for less than the amount billed. 8. Bill Number: The bill number should be assigned when the billing is issued. However, when issuing follow-up billings, do not assign a new billing number, but add an alpha character to the original bill number (beginning with "A", "B", and so forth), and retain the original bill number in the WILBARC file when inputting the new follow-up billing. 9. Region/Station Number: The number for Region 6 is TS, and for the PNW Station, it is T3. 11. Due Date: All billings issued must contain a due date. Billings with a due date that falls on a weekend, holiday, or other non-workday, are not considered delinquent if payment is received on the first workday following the due date. However, if payment is received late, interest is calculated from the due date, not the workday following the due date. R6 SUPPLEMENT 6509.11k-97-1 EFFECTIVE 02/07/97 6509.11k, 33 Page 3 of 28 The due date is normally 30 days after the issue date except in the following situations: a. Special use billings issued more than 30 days before the due dat e. b. Grazing billings where the dates of use are uncertain. c. Timber sale billings which are normally due within 15 days unless specified differently in the contract. Such an exception would be where the contract provides 30 days from receipt of billing for making timely payment. d. Other billings where agreements, permits, or contracts contain nonstandard provisions for billings and due dates. 33.13 - Special Instructions for Selected Types of Billings. 1. Senior Community Service Employment Program. Forests receive no actual allocation of dollars to offset expenditures in this program (fund code NFSA and NFSD). Instead, the forests operate against an authorized spending level established by the Regional Office, Financial Management (RO, FM) and subsequently are reimbursed by the RO, FM for their paid expenditures. Forests should insure that the appropriate program year has been charged with operating expenses so that the RO can reimburse the forest with the correct amount, and not have to make a series of adjustments to offset a forest transferring expenditures between program years. The RO, FM reimburses forests by preparing an AD-742, Transfer and Adjustment Voucher, TC 81R. The debit is coded to TC 2 and one of the codes that the forest has spent against. The credit is to TC 2 against the RO code. Once the RO has made its final reimbursement adjustment, it becomes the forest's responsibility to see that each individual line of accounting zeroes out on the financial statement, that is, the balance should be zero for each work activity that a forest has expenditures against. This is because the National Finance Center (NFC) carries forward the balance in each line item of accounting at year-end since it is treated as a reimbursement fund code. 2. Billings for Installment Payments. Refer to FSH 6509.11h, section 21.3, for information on entering into installment repayment agreements when the debtor is unable to pay in one lump sum. The interest rate used at the beginning of the installment period is to apply for the life of the installment agreement. The exception is where the debtor defaults on an installment payment agreement. In this case, charges that accrued but were not collected under the defaulted agreement (including interest and late charges) shall be added to the principal and are subject to interest (at the current rate), when paid under a new installment agreement. Installment payments received shall be applied first against accrued R6 SUPPLEMENT 6509.11k-97-1 EFFECTIVE 02/07/97 6509.11k, 33 Page 4 of 28 interest and then to principal. Bills for Collection must include information as to interest to be charged. In cases where the Forest Service enters into an installment payment agreement with a debtor who is unable to pay the full amount of a debt, billings for monthly installment payments should be handled as follows: a. Prepare the first billing with the total amount due in the "description" block, and enter the amount due for the current installment payment in the "amount" block of the Bill for Collection. b. Prepare subsequent billings by showing the original issue date and total amount due, less the payment(s) received, and the net remaining amount due in the "description" block. Show the amount of the next installment payment due in the "amount" block. If interest is being collected on the outstanding debt, add the interest due for the month to the total amount due before deducting the payment for the month in order to reflect the proper balance. Use the original bill number with a letter suffix as provided in section 33.11. c. Continue step 2 until the debt is satisfied. d. Issue installment billings on a fixed cycle rather than waiting for a late payment before issuing the next billing. If the installment payment is late, interest is to be charged on the overdue billing at the applicable rate. Refer to FSM 6534.22a. e. Establish and maintain an amortization record which lists the beginning amount of the debt, interest added if appropriate, less payments received by date and bill number for a net remaining balance due. f. Report the current outstanding billing and remaining amount of principal due on the monthly accounts receivable report. 3. Reimbursement Billings. Overhead and other indirect costs are considered part of the "actual costs" involved in performing reimbursable work and should be billed for under reimbursable agreements unless prohibited by the terms of the agreement (Comptroller General Decision B-136318 of 1/21/77). 4. Fire Billings to Other Federal Agencies. Refer to FSM 6512.31 and FSM 5171 for direction concerning fire activities between the Forest Service and agencies in the U.S. Department of Interior (USDI) including the Bureau of Land Management (BLM), Bureau of Indian Affairs (BIA), and National Park Service (NPS). The Forest Service should not bill nor be billed by other agencies for fire suppression costs, although in fire trespass actions, the other agencies' costs should be included in the overall recovery cost. Continue to bill for activities covered in the Regional Reimbursable Fire Agreement with the BLM when presuppression costs are incurred for the USDI. The amount of the billing should be based on the R6 SUPPLEMENT 6509.11k-97-1 EFFECTIVE 02/07/97 6509.11k, 33 Page 5 of 28 protection services the units agree to provide, and should not include indirect costs (overhead). Fire-suppression costs incurred for agencies on their land (other than USDI agencies) are reimbursable, but suppression costs to fight fire caused by other agencies on Forest Service land is not reimbursable (31 Comp. Gen. 329). 5. Fire Billings to Cooperating State Agencies. Billings to recover firesuppression costs as a result of services provided under the terms of cooperative fire agreements with the States should be issued by the Fire Forest within 120 days according to the current terms of the master agreement, unless otherwise agreed to by the party being billed. Forest Service cooperative agreements with the States of Oregon and Washington require the Forest Service to provide an estimate of the amount of fire-suppression costs involved for each reimbursable action within 60 days, and a final billing within 120 days. It is important to meet these timeframes, and although it is not necessary for the estimate to be precise, make sure to include all major cost elements. The Fire Forest responsible for billing is to be determined by identifying in which area the fire is located, and then by referring to the Northwest Area Interagency Mobilization Guide, which lists the Fire Forest for that area. If a forest other than the designated Fire Forest is the only unit incurring fire costs, they should notify the Fire Forest of their costs and come to a mutual agreement as to which forest should actually bill for the costs incurred. Contact the RO, FM if there is any doubt who should consolidate and issue any given billing. The Fremont, Siskiyou, Winema, and Rogue River National Forests (NF's) shall consolidate fire billings to the California Department of Forestry. Special efforts are needed at June 30 of each odd-numbered calendar year (1991, 1993, and so forth) to provide the States of Oregon and Washington with billings at the end of their biennium. The State of Washington needs to receive billings by July 15 so that they may be paid prior to the July 31 cutoff. The State of Oregon needs to receive billings for the current year biennium by September 15 to meet its payment cutoff. These billings should be issued on an estimated basis, if necessary, and followed up with an actual billing when all costs are known. This is necessary since any billings not paid by the State of Washington by July 31, or by the State of Oregon by September 30, require special legislation before they can legally be paid. The estimated or partial billings should be clearly marked "PARTIAL BILLING Final billing will be presented by (date) when total costs are determined." The Fire Forest issuing the bill should identify the fire by name, project number assigned according to R-6 supplement to section 55.4, and the State fire number. Transmit it with a cover letter explaining the partial billing process and the name of a person to contact for questions. 6. Billings to Trespassers. Billings issued to recover the costs of negligently caused fires, within the forest's authority, should be issued by the Fire Forest within a reasonable amount of time after suppression is completed, and the proper determination made as to actual liability. See FSH 6509.11h, section 21, for information on making these determinations. The forest responsible for issuing the R6 SUPPLEMENT 6509.11k-97-1 EFFECTIVE 02/07/97 6509.11k, 33 Page 6 of 28 billing is the forest in which the actual trespass occurred. For example, if the Siskiyou NF had a trespass fire, yet only Rogue River NF resources were used on the fire, the Siskiyou NF would still be the billing forest. 7. Consolidation of Costs for Billing Purposes. Fire billings, as well as the 60-day estimates to the States, are to be consolidated by the Fire Forest when suppression costs are generated by more than one forest. The Fire Forest is responsible for obtaining the total costs from other forests involved in the suppression action, and summarizing them on one billing. Fire Forests may determine which forests throughout the nation incurred costs on any fire by either obtaining: a. A CADI Fire transaction register from NFC (Exhibit 01 contains the instructions for requesting this report), or b. A fire suppression cost summary for the fire using the FOCUS macro shown in Exhibit 02. The FOCUS report must include all fire costs by object class for any given fire requested, including any costs for employees who are funded out of presuppression dollars (assuming the management code for their time has been updated to include the "P" code in the other field). The CADI Fire transaction register can be obtained in various sequences, and a cost itemization form can be generated from the file using PRESENT. Units may "RIS" the dump file for this program from: R06A:STAFF:CAS:TR.HIST.FIRE.DMP The information from the CADI Fire and FOCUS reports may reveal a difference in values, so units need to keep this in mind when developing costs, and so forth. In addition, Fire Forests shall review resource orders for the fire, and make sure to request costs from those units who participated but did not have costs show on the CADI Fire data base. In this manner all applicable costs can be gathered for billing purposes. Fire Forests are also responsible for notifying participating forests of the exact documentation they need to support their fire-cost summaries. For example, if the Fire Forest needs Project Managers Statements and Transaction Registers, as well as a fire cost summary or CADI created report, they must state this when asking the participating forests for costs. Do not leave it up to the participating forests to decide this. Also state the information needed in order to complete the billing within the necessary time limitations, as well as where and to whom the information is to be sent. See Exhibit 03 for a sample format for requesting costs. Use the following guidelines when deciding to request actual source documents to support the fire cost summary information: R6 SUPPLEMENT 6509.11k-97-1 EFFECTIVE 02/07/97 6509.11k, 33 Page 7 of 28 --The Fire Forest should only pull source documents and request other units to furnish source documents when it is specifically requested to do so by the Regional Forester or Forest Supervisor of the Fire Forest. Units furnishing source documents must maintain a copy of the fire cost summary in front of the paid voucher file for future reference. When source documents are pulled, furnish originals if available. If originals are not available, furnish the unit file copy. Do not request NFC to furnish documents unless specifically requested by the Forest Supervisor of the Fire Forest or the Regional Forester. NFC shall furnish copies of original documents, if requested appropriately, provided they are given adequate information that enables them to locate the requested documents. --The Fire Forest should retain the source documents to support fire trespass billings that are within their authority to issue. Send source documents to the RO, FM with cost summary for retention in fire trespass cases in which FM is the billing office. When Fire Forests need cost itemization/information from other regions, request such from other Regional Offices directly (requests should be signed by the forest Administrative Officer), rather than going through the RO, FM. Once all costs and related itemizations (approved jointly by fire and fiscal personnel from the participating forests, as well as the Fire Forest), have been gathered from all participating forests, the billing must be prepared and sent to the applicable party. 8. Fire Billings to Timber Purchasers. For collections to be reimbursable, there must be an advance agreement that specifically provides for the Forest Service to perform the fire suppression and for the cooperator or purchaser to reimburse the Forest Service for such costs. Section B7.42 of the Timber Sale Contract, which provides for the purchaser to bear the cost of suppressing negligently caused fires, does not qualify as a eimbursement agreement. Form FS6300-38, General Provisions included in planting, thinning, and other contracts also does not qualify as a reimbursable agreement. When the Forest Service incurs costs in suppressing a timber purchaser's negligently caused fire and collects the fire and resource damage costs, apply the amount received in the following priority: a. Fire suppression costs - Treasury Account 3220, Management Code 899015. b. Single Stumpage - Timber Sale Deposit Fund (TDTD), Management Code 870NNN or directly to the National Forest Fund (5008, Class 1 - Management Code 898NNN) if the sale is already closed. c. Double and Triple Stumpage - Treasury Account 3220, Management Code 899015. Refer to FSM 6512.32 for additional information on recoveries of costs and damages. R6 SUPPLEMENT 6509.11k-97-1 EFFECTIVE 02/07/97 6509.11k, 33 Page 8 of 28 9. Costs to be Included in Billings. When preparing billings for fire trespass actions, include the full direct costs of fire-suppression incurred by all agencies. Do not include indirect costs. Include the cost of the Liaison Office Coordinators or Regional Liaison Officers. When billing States for costs under reimbursement agreements, include only the full direct costs of fire-suppression, unless the services are being performed under the cooperative portion of the agreement, in which case indirect costs should be added. If the reimbursement services are being performed under the reciprocal portion of the agreements, no indirect expense should be added. In addition, do not bill for indirect expense if any of the language in the formal agreements prohibit doing so. a. Direct Costs. Bill for all costs that are directly related to the actual suppression of the fire, and which the Incident Commander considered necessary to control the fire under the conditions existing or anticipated at the time of ordering. Base the determination on whether an expense is reasonable and necessary, and if good judgment was exercised in ordering it. Do not exclude costs solely for the reason that anticipated conditions did not develop and the personnel or equipment was not used. Direct costs do not include the dispatching, administrative, or other indirect costs associated with the suppression activity. Direct costs do include, but are not limited to: (1) Tanker Aircraft Availability. Include the proportionate share of tanker aircraft availability costs in the fire billings to those who do not pay a share of the aircraft availability costs in advance (includes trespassers). To develop the proportionate share, calculate the hourly availability rate to apply as follows: (a) Divide the daily availability cost by nine to obtain an hourly availability rate. (b) Use the hourly availability rate plus the regular hourly flight rate to determine the total hourly rate to be charged. (2) Fire Retardant and Aircraft Costs. Costs of fire retardant dropped on trespass and reimbursable fires shall be included in billings using a regional retardant rate. This rate is developed early each fire season by the RO and distributed to all forests. It includes the cost of purchasing, transporting, mixing, and loading the retardant. This rate, which excludes indirect costs, should be charged for retardant dropped for the States on reciprocal areas. A separate rate that includes overhead should be used in all other cases. Also include the costs for lead planes, retardant planes, aircraft fuel, and so forth, as these costs are not included in the retardant rate. (3) Personnel, Equipment, Supplies and Other Costs. The Forest Service should collect all reasonable costs for personnel, equipment, supplies, travel, and R6 SUPPLEMENT 6509.11k-97-1 EFFECTIVE 02/07/97 6509.11k, 33 Page 9 of 28 other direct costs. The value of reasonable amounts of destroyed perishable supplies, unused because the fire was controlled earlier than anticipated, should be included. The total cost to the Government of Forest Service employees engaged in suppressing the fire should be included irrespective of the appropriation from which it is paid. This includes the estimated cost of compensatory time earned in lieu of overtime, but not yet taken by firefighters. Suppression work is fighting the fire and performing other support work in the fire suppression organization. This does not include management supervision, such as that performed by the District Ranger in overall management of the district, or the Forest Supervisor in managing the forest, unless the officer actually occupies a position in the fire suppression organization. Costs shall not be included for work of trespass appraisals, going to and from a fire that is found to be adequately staffed, or inspecting the work of a privately financed crew and advising these crew members on suppression techniques when the crew is adequate to staff the fire. b. Indirect Costs. These are general administrative and other costs that are not directly tied to a fire suppression effort. This could include fire dispatching, administrative costs in procuring supplies, paying bills, settling claims, adjusting accounting errors, and so forth. Since the indirect costs cannot be readily identifiable to any one incident, they are calculated by applying a percentage factor, or cost for each gallon of retardant, and adding them to the direct costs when seeking reimbursement. In accordance with the cooperative agreements with the States of Oregon and Washington, indirect costs should not be billed for fire suppression work within the reciprocal areas. When a State requests Forest Service assistance with other fire suppression work, it is usually subject to indirect costs and may be covered by a supplemental agreement. Refer to the appropriate agreement to determine if indirect costs are appropriate. When billing for indirect costs, Fire Forests should apply a 16.8 percent factor to all of their direct costs, except for retardant. Use the rate that includes overhead when billing for retardant use. Only Fire Forests are to bill for indirect expense (participating forests should not add an indirect assessment to their cost itemizations). Fire Forests should accumulate all direct expenses, add the indirect assessment by multiplying the indirect rate by the entire direct costs from all forests, plus the appropriate retardant costs, and bill the applicable State for the total direct and indirect costs. The Fire Forest receives the benefit of the indirect assessment by crediting fund code NFGA for these costs. Refer to section 56.41 for basic instructions to follow in accounting for the indirect expense collections and adjustments. An example of the transactions involved to record the overhead assessment as well as the adjustment for the direct expenditures from the P6XXXX management code to the R6XXXX management code follows. Assume direct costs of $30,000 and indirect costs of $5,040 (16.8 percent of $30,000). R6 SUPPLEMENT 6509.11k-97-1 EFFECTIVE 02/07/97 6509.11k, 33 Page 10 of 28 Accounting Transactions for Fire Forest Fund Code Acct. Work Act. Other Obj. Class WFSU 6XXXX PF12 P6XXXX WFSU 6XXXX TS13 NFGA WFSU 6XXXX Expenditure adj. needed (mgt. code involved 0210 -30000.00 1/ (P6XXXX) R6XXXX 0210 35040.00 1/ (R6XXXX) TS411 969 0210 -5040.00 1/ (Unit estab.) TS13 R6XXXX 0250 2/ (R6XXXX) Reimb 35040 1/ Adjustment via transaction code 81E or 02B. 2/ Bill for Collection, reimbursement transaction code C. 10. Coding Procedures for Billings. a. For State fire billings, the management code used on the billing should begin with the letter "R", even though all costs were incurred in a management code beginning with the letter "P" (see R-6 supp. to section 55.4). The second digit of the management code is "6" (for Region 6). The last four digits of the management code shall equate to the four-digit number that the Fire Forest originally assigned under the "P6" series. At the time of the billing, only the Fire Forest should make an expenditure adjustment for the entire amount of the billing, within its own unit records (that is, do not adjust other unit's records). This adjustment is made to transfer costs from the original "P6" management code that was used to accumulate costs, to the "R6" management code that the Fire Forest is using on the billing. Make the adjustment using object class 0210. This step establishes the receivable and an offsetting expenditure against the TS13 work activity. All other participating forests should make NO expenditure adjustments to convert costs to the "R" series, or to transfer receivables to the Fire Forest. Accordingly, when payment is received, the Fire Forest should deposit the entire collection into their own reimbursement account ("R" management code). Also see item 5. b. Fire trespass billings are not a reimbursement collection, but instead are a recovery of costs and damages incurred by the Government. Therefore, do not bill using management codes that are in the "P" or "R" code series; instead, use the management codes referred to in the parent text of section 34 (miscellaneous receipts = management code 899015). Costs for these types of fires are still coded to the "P" management code for the entire incident, but collections do not go to the "R" codes as they do for State reimbursement fires. 11. Disputed Billings. Occasionally, the States of Oregon, Washington, or California may disagree with costs that have been included on a billing to them. It is the responsibility of the Fire Forest to include all costs directly attributable to that fire, and include them on the billing. Certain direct costs can be omitted from R6 SUPPLEMENT 6509.11k-97-1 EFFECTIVE 02/07/97 6509.11k, 33 Page 11 of 28 billings, including review team members or specialists (such as Comptrollers) that arrive at fire camps for special reviews or assistance. These costs are properly charged to that fire but are to be excluded because they are part of the indirect expense assessment. In addition, costs for trainees backing up established positions assigned to the fire should be excluded. Other exclusions of direct costs that are determined to be inappropriate, unreasonable, or unnecessary are to be agreed upon by both the State involved and the Fire Forest. Indirect assessments cannot be removed from billings, as they are not a "negotiable" item. Any unresolved amounts, other than those above, that are billed for can be settled under the Forest Supervisor's authority to compromise billings. 12. Map Sales. Procedures for handling map sale billings are in FSM 6532.7. 13. Sale of Other Permits. Forests shall transfer, safeguard, maintain accountability control records, and perform audits on all accountable permits in accordance with instructions in FSM 6530.4, section 31.11 of this chapter, and R-6 Supplement to FSH 1409.11, section 070. Separate Bills for Collection which identify the appropriate permit, and/or contract numbers, shall be prepared for each type of permit. Refunds shall not be made unless provided for in the Forest Service Directive System. When possible, sale of permits shall be isolated from the other activities of an office and the area designated for the sale of permits shall be so configured as to limit the sale of permits to one person at a time. In order to facilitate internal controls, separate duties of permit issuance, sales, data entry, and so forth, between two or more employees to the extent practical, . a. Christmas Tree Permit, FS-2400-7. In the RO, Natural Resources (NR) consolidates one requisition to Procurement and Property Management (PPM) for the forests' orders for Christmas tree tags. Upon submission of the order to the printer, PPM shall send each forest two copies of a delivery list showing the quantity ordered for the forest. The printer sends the tags directly to the forest. It is not necessary to open each box when received to count all tags if they are received unopened and boxes contain inclusive serial numbers. Based on the number of boxes received, plus an actual tag count of opened boxes, the property custodian shall promptly receipt a copy of the delivery list, write in the inclusive serial numbers, and forward it to the RO, FM to facilitate a consolidated payment to the printer. Units shall notify the RO, NR if they received more than ordered or if they will need additional tags. As boxes are later opened and used, verify that the number of tags the box should contain are actually in the box and use form AD-112, Report of Unserviceable, Lost, Stolen, Damaged, or Destroyed Property, to write-off missing tag numbers. Christmas tree sales must be deposited into the Timber Sale Deposit Fund, management code 870xxx (xxx = Proclaimed Unit Number) separated from other permit sales by identifying them with a contract number in the 900000 to 999999 series. R6 SUPPLEMENT 6509.11k-97-1 EFFECTIVE 02/07/97 6509.11k, 33 Page 12 of 28 Audits are to be conducted annually by January 31, for activity through December 31, and must contain a verification that the total number of tags sold agrees with the amount shown as Christmas tree sales in the Timber Sale Accounting (TSA) System. The audit shall include a review of at least 10 percent of the volume of collection records by comparing with Bills for Collection (FS-6500-89), during the audit period. The auditor shall also determine for the audit period if there have been Christmas tree permits lost, unaccounted for, or missing. This analysis shall be made by (1) determining the total number of permits received by each Collection Officer, (2) subtracting the number of permits sold or transferred, and (3) comparing to the actual number of permits each Collection Officer has left. Differences shall be documented by the auditor and handled as follows: (1) Differences under 2 percent of permits sold, in which there is no appearance of fraud or questionable mishandling of permits, may be considered the result of human error and need not be pursued further but should be documented on an AD-112. (2) Any differences which appear to be the result of improper handling of permits shall be investigated further and, in the absence of fiscal liability or fraud, should be resolved at the forest level. This may involve training, more frequent audits, revoking the Collection Officer's authority, disciplinary action, or appropriate action and documented on form AD-112. (3) Any differences which appear to involve fiscal liability and/or fraud, shall be reported immediately to the RO, Director of FM. Copies of audits performed and related information shall be forwarded to the RO, FM for review and final determination. b. Timber Sale Permit, FS-2400-4 (Greensheets). In order to provide some control over revenue from greensheet sales the following Region 6 procedure shall be used. (1) A block of permit numbers is assigned to each ranger district. (2) Each ranger district (and any other office in which FS-2400-4's are sold) shall maintain a register of permit numbers issued which also identifies the date sold and the number of the Bill for Collection issued to account for each permit sold. A separate permit number must be used for each permit. (3) The Bill for Collection shall be prepared to show the permit number(s) covered by the bill. List the permit number(s) in the description block of the Bill for Collection. R6 SUPPLEMENT 6509.11k-97-1 EFFECTIVE 02/07/97 6509.11k, 33 Page 13 of 28 (4) Refer to section 31.11 and FSH 1409.11, 070, for audits required. Audits shall be made to compare at least four nonconsecutive weeks of collection activity or 10 percent of permits sold. Compare the collection register used by the Collection Officer with the Bills for Collection used to transmit receipts. Differences must be documented and reported immediately to the RO, Director of FM. c. Firewood Permits. In order to provide control over the sale and revenue distribution of these permits, the following procedure shall be used. Refer to FSM 2431.6 for additional information on the Region 6 firewood policy. (1) Firewood permits contain a serially preprinted number, but are not accountable forms. They should be issued in serial number order. (2) A separate block of contract numbers in the 900000 series is assigned by the supervisor's office to each ranger district for monthly summarization of Firewood permit sales to be input into the TSA system. (3) Each office in which Firewood Permits are sold shall maintain a Firewood Collection Register which shall identify as a minimum the 900000 series contract number, date of issuance, firewood permit number, number of load tickets issued (if appropriate), dollar amount of sale, and issuing officer. (4) All Firewood Permit sales are final and refunds shall not be made (R-6 supplement to FSM 2431.36c). (5) The Bill for Collection shall be prepared in accordance with frequency requirements. Inclusive firewood permit numbers shall be listed in the description block. The same contract number shall be used during a monthly cycle as established by the supervisor's office for all summarized firewood permits on each ranger district or other location. (6) All Bills for Collection shall show the Timber Sale Deposit Fund management code of 870xxx (xxx = Proclaimed Unit Number). (7) The Firewood Collection Register shall be totaled each time the Bill for Collection is prepared. (8) As of the month-end cutoff date listed in section 59, all firewood permits issued during the monthly cycle shall be summarized for entry into the TSA System on Cards 7001, 7002, and 7003. Refer to FSH 6509.17, Chapter 40. (9) A suggested maintenance approach is to have all individual firewood permits and copies of Bills for Collection attached to the Permit Summary and Firewood Collection Register. (10) Refer to R-6 supplement to FSH 1409.11, 070 for audits required. The auditor shall verify that permit sales are recorded on the Firewood Collection R6 SUPPLEMENT 6509.11k-97-1 EFFECTIVE 02/07/97 6509.11k, 33 Page 14 of 28 Register and its totals agree with the Bills for Collection, for at least 10 percent of the volume of business processed or four nonconsecutive weeks of collection activity during the audit period. Differences must be documented and reported immediately to the RO, Director of FM. d. Firewood Load Tickets. The use of firewood load tickets is optional, as determined by each forest. They may be used to help administer, and provide an additional degree of control over the firewood sales program, if desired. f. Rogue River Raft Permits. The Siskiyou NF shall maintain adequate records to provide effective controls and facilitate audit of these receipts. The Forest may use a "salting" process to verify money submitted for permits is properly entered in the records. 14. Special-Use Billings. New permits being issued by mail will normally be accompanied with a Bill for Collection that is to be paid when the permit is signed and returned rather than billing after the permit is executed. 15. Timber Sale Contract Billings. a. Automated Timber Sale Contract Billings Needing Corrections. When the automated billing created by the Automated Timber Sale Accounting (ATSA) System is incorrect due to missing/duplicate scale volume or other adjustments, forests shall apply the following to determine the appropriate action: (1) Any adjustments to ATSA generated bills due to scaling, collections, ineffective purchaser road credit (for active or terminating sales), or any other cause must be billed manually if the difference exceeds $5,000 or if the charges incurred in a prior month still do not appear on an ATSA generated bill. (2) If an adjustment is less than $5,000, it is not required that a manual billing adjustment be made unless there are circumstances which may result in a collection problem if the adjustment is not made. This may be the case if the sale is complete and this is the last bill, if the payment guarantee is expiring, or if the purchaser has a current record of paying late. (3) If an adjustment of over $5,000 is anticipated, but the exact amount is unknown, use judgement in determining whether to hold up issuing the original bill until the amount of the adjustment is known. If the original bill is for a large amount, send it out immediately and follow-up with a bill for the adjustment. A rule of thumb is, if the interest lost by delaying the issue of the original bill would exceed $35, send the original bill and follow-up with an adjustment when it can be calculated. For example, the lost interest on a $100,000 bill delayed for one day at 7 percent interest is $19 ($100,000 x .07/365). Thus, a unit could hold a $100,000 bill for one day, but not two. This calculation does not need to be made on every bill, but these guidelines need to be followed. This policy is based on two presumptions: R6 SUPPLEMENT 6509.11k-97-1 EFFECTIVE 02/07/97 6509.11k, 33 Page 15 of 28 --- When the Forest Service can save or make over $35, it should be done. --- From a contractual standpoint, the purchaser has removed timber and should be billed in the current month for that timber up to the point where it is cost effective for the billing to be changed. If the determination is made not to issue a manual billing but rather to generate an automated bill in the following month for an adjustment under $5,000, forests must assure that adequate payment guarantee is secured to cover the adjustment amount in addition to the normal coverage requirements (FSH 2409.15). b. Receiving Partial Payments and Rebilling Amount Due. The following is the internal accounting procedure to rebill the purchaser for partial payments made on an outstanding debt. The timber purchaser must remain in contractual breach until the debt is paid in full (FSM 2452.5 and FSH 2409.15). When the purchaser only makes a partial payment on a billing and it is necessary to manually rebill for the balance due, plus interest and administrative costs, prepare a new billing rather than resending a copy of the original billing. The new bill, with the original bill number followed by a letter suffix, should show the new issue date and a new 15day payment period before the due date. It should also include a statement describing that the billing replaces the original billing and provides information on how interest is applied. For example, under contracts governed by C4.4 (2/84), a partial payment received on a $25,000 billing due February 28 and rebilled on March 5 should contain a statement similar to the following: This billing replaces bill number ____, issued Feb. 13 for $25,000.00 Less partial payment received February 28 15,000.00 Balance overdue $10,000.00 Administrative costs $ 15.00 Plus interest at 7%: $10,000 x 7% / 365 = $1.92/day March 1 - March 5 = 5 days @ $1.92/day equal $ 9.60 Total amount due as of March 5 $10,024.60 Payments received after March 5 are subject to additional interest cost of $1.92/day. c. Billing Surety. In accordance with R-6 supplement to FSH 2409.15, Chapter 90, if the contractor fails to make payment within 5 working days of the due date, demand payment from surety. (1) When there is sufficient bonding to cover the contractor's debt (principal plus accrued late payment charges), bill the surety for the contractor's entire debt up to the penal sum of the bond. Advise surety that interest and other appropriate late payment charges continue to accrue until the debt is paid. (2) When the debt (principal plus accrued late payment charges) owed by the contractor exceeds the penal sum of the bond, bill the surety up to the penal sum of the bond and continue to bill the contractor for entire amount owed. In the first demand letter to surety, advise that interest, administrative costs, and penalty charges shall be assessed if the debt is not paid by the due date indicated on the Bill R6 SUPPLEMENT 6509.11k-97-1 EFFECTIVE 02/07/97 6509.11k, 33 Page 16 of 28 for Collection. Interest shall begin to accrue from the issue date of the Bill for Collection. (3) When the contractor has filed an appeal to the Contracting Officer's decision, the Federal Circuit held in Insurance Company of North America v. United States, 951 F2d 1244 (December 10, 1991), that a performance bond surety is liable for prejudgment interest beyond the penal sum of its bond, and that the sureties liability for interest continues to accrue during the pendency of the litigation between the contractor and the Government. This decision reinforces the Comptroller General's Decisions B-238004, B-242685, 70 Comp. Gen. 517, wherein it was held that surety is liable for interest, penalties, and administrative costs under the Debt Collection Act of 1982. Therefore, if the contractor does not make payment within 5 working days of the due date, make demand on surety up to the penal sum of the bond. Advise surety that their obligation to pay does not wait for completion of legal contests between the principal and the creditor, and that the penal sum of the surety bond does not limit their liability for interest and other appropriate late payment charges based on its own delay in responding to a Government demand on the bond. See FSH 6509.11h, Chapter 20, for further guidance. R6 SUPPLEMENT 6509.11k-97-1 EFFECTIVE 02/07/97 6509.11k, 33 Page 17 of 28 33.13 - Exhibit 01 Accessing CADI fire transaction data base FIRST NFC SCREEN. ============================================================================= == 08/01/90 D4B32782 Z015 PF1=HELP == ============================================================================= == NN NN FFFFFFFF CCCCCCCC == == NNN NN FFFFFFFF CCCCCCCC == == NNNN NN FF CC == == NN NN NN FFFFFFFF CC == == NN NNNN FFFFFFFF CC == == NN NNN FF CCCCCCCC == == NN NN FF CCCCCCCC == == ======================================================================== == == ========== Welcome to the National Finance Center ========== == == ========== Office of Finance and Management ========== == == ========== United States Department of Agriculture ========== == == ================================================================== == == (TAB) (NL) == == ENTER USER ID = FS9999 ^ PASSWORD = XXXXXX ^ NEW PASSWORD = == == == == ENTER APPLICATION NAME OR LOGOFF = OR PRESS ENTER FOR MENU == == == ============================================================================= ENTER AS HIGHLIGHTED AND NEWLINE. NEXT NFC SCREEN. ============================================================================= == 08/01/90 D4B32782 NFC MENU Z015 10:28:36 CT == ============================================================================= == == == SELECT ONE: == == == == 1. PAYROLL/PERSONNEL SYSTEMS == == 2. FINANCIAL INFORMATION SYSTEMS == == 3. PROPERTY MANAGEMENT INFORMATION SYSTEMS == == 4. ADMINISTRATIVE INFORMATION SYSTEMS == == 5. DEVELOPMENT SYSTEMS <NFC ONLY> == == 6. DATA BASE TEST SYSTEMS <NFC ONLY> == == 7. MISSION ASSIGNMENT TRACKING SYSTEM <GAO ONLY> == == == == ENTER APPLICATION NAME OR SELECTION NUMBER ==> 2 PF11 = EXIT == ============================================================================= == MESSAGE BOARD == ============================================================================= ENTER 2 AND NEWLINE. R6 SUPPLEMENT 6509.11k-97-1 EFFECTIVE 02/07/97 6509.11k, 30 Page 18 of 28 33.13 - Exhibit 01--Continued NEXT NFC SCREEN. ============================================================================= == 08/01/90 Z015 10:28:50 CT == == FINANCIAL INFORMATION SYSTEMS == == == == I. ENTRY INQUIRY SYSTEMS == == == == 1. CADI AVAILABLE 5. PLAN AVAILABLE == == 2. BLCO AVAILABLE 6. DFIS AVAILABLE == == 3. FAADS AVAILABLE 7. TPIR AVAILABLE == == 4. MASC AVAILABLE 8. ABCOINQ AVAILABLE == == == == == == II. REPORTING SYSTEMS III. UTILITIES == == == == 9. FOCUSRPT AVAILABLE 11. ISPF AVAILABLE == == 10. BATCHFOC AVAILABLE 12. VPSPRINT AVAILABLE == == == == == == == == == == == == PF1 = HELP PF3 = NFCMENU ENTER SELECTION 1-12 ==> 1 PF11 = EXIT == ============================================================================= ENTER 1 AND NEWLINE. R6 SUPPLEMENT 6509.11k-97-1 EFFECTIVE 02/07/97 6509.11k, 30 Page 19 of 28 33.13 - Exhibit 01--Continued NEXT NFC SCREEN |===========================================================================| | | | ******* ******* ***** ******* CENTRAL ACCOUNTING DATABASE INQUIRY | | * * * * * * | | * ******* * * * NATIONAL FINANCE CENTER | |* * * * * * | |******* * * ****** ******* SELECTION MENU | | | | (TAB) (NL) | | AGENCY 11 ^ SELECT 6 ^ REPORT/SYSTEM CODE | | | | | | FUNDS CONTROL | | 1. INPUT DOCUMENTS 4. GENERAL SCREEN | | 2. REPORTS 5. HELP SCREEN | | 3. CORRECTIONS | | | | | | BUDGET COST MASTER REPORTING | | 6. AGENCY SPECIFIC REPORTS 7. AD HOC INQUIRY | | 8. STATUS OF FUNDS (STANDARD) | | | | | | BUDGET COST DETAIL TRANSACTION REPORTING | | 9. ACCOUNTING CODE / OBJECT CLASS 10. RESERVED | | 11. SYSTEM CATEGORY:EMP,PUR,MST,MIS,TRN,PRP,BLC,PLN | | 12.MENU OFSYSTEM CATEGORY | | | | | | | | | | ENTER = SEND CLEAR = TERMINATE | |===========================================================================| ENTER AS HIGHLIGHTED AND NEWLINE. R6 SUPPLEMENT 6509.11k-97-1 EFFECTIVE 02/07/97 6509.11k, 30 Page 20 of 28 33.13 - Exhibit 01--Continued NEXT NFC SCREEN. |===========================================================================| |CAFS004M1 USDA - FOREST SERVICE CURRENT DATE 08/01/90 | | REPORT MENU AS OF 00/00/00 | | REPORT REPORT FISCAL YEAR 00 | | CODE TITLE | | | | | | | | | | 1. 53-1 PLAN SUMMARY | | 2. 53-2 SUBUNIT SUMMARY BY MGMT CODE | | 3. 53-3 SUBUNIT SUMMARY BY FUND | | 4. 53-4 UNIT FINANCIAL STATEMENT | | 5. 53-5 NATIONAL FUND CONTROL | | 6. 53-6 REGIONAL FUND CONTROL | | 6A 53-7 REGIONAL FUND CONTROL RECAP | | 8. 53-8 UNIT FUND CONTROL | | 8A 53-9 UNIT FUND CONTROL RECAP | | | | | | 9. 56-1 PROJECT MANAGERS STATEMENT | | | | | |10. 9X-1 FIRE TRANSACTION DATA BASE | | | | | | ENTER REPORT CODE: 10 | | | | | | | | | | | | | | CLEAR = EXIT PF1 = SELECTION MENU ENTER = SEND PF3 = REFRESH | |===========================================================================| ENTER AS HIGHLIGHTED AND NEWLINE. R6 SUPPLEMENT 6509.11k-97-1 EFFECTIVE 02/07/97 6509.11k, 30 Page 21 of 28 33.13 - Exhibit 01--Continued NEXT NFC SCREEN. |===========================================================================| |CAFT005M1 USDA - FOREST SERVICE CURRENT DATE 08/01/90 | | FIRE DATA BASE MENU | | | | | | (Just move curser to change selection criteria, use TAB after all | | entries except the last one (Route to:).) | | | | SELECTION CRITERIA: | | FIRE ONLY (Y/N): N CETR (Y/N): N ALL (Y/N): Y | | | | | | MGMT CODE P6XXXX 1/ | | SEQUENCE CRITERIA: | | 1 ORGANIZATION | | FISCAL YEAR 2 FEEDER SYSTEM | | REGION UNIT 3 OBJECT CLASS | | FEEDER SYS 4 YEAR-MONTH | | OBJECT CLASS | | YEAR-MONTH SELECTION: 1 | | | | | | GRAND TOTALS ONLY (Y/N): N | | PRINT: Y | | RANGE OF MGMT CODES (Y/N): N REMOTE ID: XXXXXXX 2/ | | ROUTE TO: YYY-ZZZ 3/ | | | | CLEAR = EXIT PF2 = REPORT MENU ENTER = SEND PF3 = REFRESH | | | |===========================================================================| NOTE 1 / MAY ENTER UP TO SIX P#'S. TAB AFTER EACH P#. NOTE 2/ REPLACE XXXXXXX WITH YOUR REMOTE ID #(RMT0XXX) OR YOUR SYSTEM NAME (R06FXXA). NOTE 3/ REPLACE YYY WITH STAFF AREA AND ZZZ WITH DRAWER NAME. DRAWER MUST CONTAIN A FOLDER NAMED "NFCFILES". IF SCREEN IS CORRECT DEPRESS NEWLINE. DEPRESS DG ERASE PAGE KEY TO EXIT. THIS EQUATES TO THE NFC CLEAR OR EXIT KEY INDICATED ON NFC SCREEN. NEXT NFC SCREEN. |===========================================================================| |V3 ENTER NEXT TASK CODE: | | LOGOFF | | | |===========================================================================| ENTER LOGOFF AND NEWLINE. R6 SUPPLEMENT 6509.11k-97-1 EFFECTIVE 02/07/97 6509.11k, 30 Page 22 of 28 33.13 - Exhibit 01--Continued NEXT NFC SCREEN. ============================================================================= == 08/01/90 D4B32782 Z015 PF1=HELP == ============================================================================= == NN NN FFFFFFFF CCCCCCCC == == NNN NN FFFFFFFF CCCCCCCC == == NNNN NN FF CC == == NN NN NN FFFFFFFF CC == == NN NNNN FFFFFFFF CC == == NN NNN FF CCCCCCCC == == NN NN FF CCCCCCCC == == ======================================================================= == == ========== Welcome to the National Finance Center ========== == == ========== Office of Finance and Management ========== == == ========== United States Department of Agriculture ========== == == ================================================================ == == == == ENTER USER ID = (TAB) PASSWORD = (TAB) NEW PASSWORD = (TAB) == == (NL) == = ENTER APPLICATION NAME OR LOGOFF = LOGOFF ^ OR PRESS ENTER FOR MENU== == == == == == == == ============================================================================= ENTER AS HIGHLIGHTED AND NEWLINE. NEXT NFC SCREEN. |===========================================================================| | | |Logged off SIM3278 | | | | | | | | | |V27156DE | |Call is disconnected | |CLEAR - DTE Clearing | | | |===========================================================================| DEPRESS (CTRL/SHIFT F1) YOU ARE NOW LOGGED COMPLETELY OFF THE NFC COMPUTER SYSTEM. R6 SUPPLEMENT 6509.11k-97-1 EFFECTIVE 02/07/97 6509.11k, 30 Page 23 of 28 33.13 - Exhibit 02 "FIRE COSTS" FOCUS MACRO DEFINE FILE CADI4 NOTE 3/ RUNDATE/A8 WITH FUND_CD = TODAY(RUNDATE) ; BUD_OBJ/A4=OBJ_CL_MAJ!OBJ_CL_SUB; FUND_CODE/A6=FY_CODE!FUND_CD!MULT_YR_IN; END TABLE FILE CADI4 ORG_LEVEL HEADING CENTER "FIRE COSTS" "PROJECT # <OTHER" "AS OF XX-XX-XX CADI4 CAS INFO" NOTE 1/ & NOTE 3/ "RUN DATE = <RUNDATE " " " SUM ACT_ACC_YTD AS 'HOURS' OBLIG_YTD NOPRINT COLL_REFUNDS NOPRINT AR_REFUNDS NOPRINT AND COMPUTE EXP_UNPD/D12.2 = OBLIG_YTD - COLL_REFUNDS - AR_REFUNDS ; IF OTHER CONTAINS P6XXXX NOTE 2/ IF WORK_ACT NE TS424 OR TS425 BY OTHER NOPRINT BY REGION BY UNIT BY FUND_CODE BY BUD_OBJ ON FUND_CODE SUB-TOTAL ON REGION FOLD-LINE ON OTHER PAGE-BREAK AND REPAGE END NOTE 1/ ENTER AS OF DATE OF CAS FILE. NOTE 2/ ENTER PROJECT NO. IF MORE THAN ONE PROJECT NO. ADD "OR P6XXXX". YOU CAN CONTINUE WITH "OR P6XXXX" FOR OTHER PROJECT NO.'S ABOVE MACRO LOCATED IN FOCUS LIBRARY - FSF, MEMBER NAME - R6FIREPR NOTE 3/ TO RUN ON PRIOR YEAR FILE CHANGE "CADI4" TO "CADI4FY". R6 SUPPLEMENT 6509.11k-97-1 EFFECTIVE 02/07/97 6509.11k, 30 Page 24 of 28 33.13 - Exhibit 03 SAMPLE FORMAT Reply to: 6530 Subject: Fire Costs for XYZ Fire (P6XXXX), Date TO: REPLY REQUESTED We are in the process of gathering costs associated with the above-referenced fire. This fire was a reimbursable fire with the State of Oregon. According to the CADI fire transaction register and fire resource orders, the following units had activity on this fire: Units with costs on CADI fire data base Units providing resources per resource orders 06--01,02,03,17,18 Region 06--Deschutes, Fremont, Gifford Pinchot, Mt. Hood, Wenatchee, Willamette Region 05--Klamath In order to meet our agreements with the State, the following information is needed: 1. Cost itemization. 2. Project Manager's Statements. 3. Transaction registers. 4. Copies of air tanker flight invoices. Please send the above information to: Josephine Monroe, XYZ National Forest, P.O. Box 11221, Sandy, OR 97654 (telephone 503-555-7777). If you have any questions, contact the above individual. Also, when sending the above information, please provide us with the name and telephone number of a contact person in the event additional information is needed. GEORGE JONES, FISCAL OFFICER R6 SUPPLEMENT 6509.11k-97-1 EFFECTIVE 02/07/97 6509.11k, 30 Page 25 of 28 33.14 - Follow-up Billings. It is important to aggressively follow-up on overdue billings to protect the Government's interests. The Unit Collection Officer shall make frequent reviews of the unpaid billing file and alert the appropriate individual when billings become overdue so timely follow-up action may be taken. Region 6 policy is to take follow-up action promptly on delinquent timber, special use, and grazing permit billings. Follow-up action on other Region 6 billings that become delinquent must be taken at least monthly. Timber sale accounting billings not paid by the due date must be brought to the attention of the resource section for follow-up action which can include suspension of the operation. Action taken must be documented in writing and retained with the unpaid billing. If the follow-up action taken is not in writing, such as a personal visit or phone call, note this on the billing. Forests should supplement this section to delineate responsibility and procedures to be followed by their unit to insure appropriate follow-up action is taken. Assess interest, penalty charges, and administrative costs in accordance with direction in FSH 6509.11h, ch. 20 on all delinquent billings, including contracts, agreements, permits, and so forth, unless specifically prohibited by the terms of the document. Follow-up billings must show, in the explanation block of the billing, the specific amounts being assessed. They must also make reference to the original principal amount, purpose for the billing, and issue date. When issuing the followup billing, use a new issue date, but use the original bill number plus an alpha character (start with A on the first follow-up, and so on) to identify it as a follow-up bill. In order to insure that the WILBARC System creates accurate information for Accounts Receivable and Aged Bill Reports for follow-up billings, use the "hand change" feature to update the information on the accounting screen to show the new amounts due and appropriate management codes, and so forth. However, retain the original issue date of the billing in WILBARC. This is done to insure that WILBARC ages the debt properly. 33.2 - Voucher for Transfers Between Appropriations and/or Funds, Form SF-1080. Use form SF-1080 to bill non-USDA agencies listed in the parent text. Bill them promptly upon completion of the work, but at least quarterly unless the agreement states otherwise. 33.3 - Voucher and Schedule of Withdrawals and Credits, Form SF-1081. Use form AD-673, Request to Bill, instead of an SF-1081 when billing another Federal agency (except the agencies listed in section 33.2 which are billed on form SF-1080). Prepare the AD-673 as shown in exhibit 01. The AD-673 shall be processed through the Department of Treasury's Online Payments and Collections System (OPAC). When issuing the AD-673, assign a bill number and file a copy in the unpaid R6 SUPPLEMENT 6509.11k-97-1 EFFECTIVE 02/07/97 6509.11k, 30 Page 26 of 28 billings file. Send the AD-673 to the NFC at the following address: USDA, OFM, National Finance Center Administrative Billings and Collections Section P.O.Box 61765 New Orleans, LA 70161 NFC collects the funds through the OPAC system and when they appear on the Subunit Transaction Register mark the AD-673 paid and remove it from the unpaid billings file. Be careful to provide correct information pertinent to the paying agency. Call the other agency and ask what information should be entered in the description block to facilitate processing on their end. Be aware that the paying agency can reverse the OPAC transaction if the explanation is not sufficient for them to process the transaction. Make sure the Agency Location Code (ALC) is correct for the paying agency. R6 SUPPLEMENT 6509.11k-97-1 EFFECTIVE 02/07/97 6509.11k, 30 Page 27 of 28 33.3-Exhibit 01 UNITED STATES DEPARTMENT OF AGRICULTURE REQUEST TO BILL PAYER BILL NUMBER 312345 NAME AND ADDRESS 6/15/93 CREDIT APPROPRIATIO WORK PLAN N CODE Management Code *Interior *U.S. Geological Survey *123 Garden Road FROM *New Orleans, LA 70129 Fund Code/Unit PERIOD COVERED TO 04/01/93 OBJECT CLASS DATE DESCRIPTION Object Class To bill for costs incurred by the Gifford Pinchon National 0250 Forest for rehabilitating area where research was done 05/31/93 AMOUNT 2/ 002231 $ 300.00 under special use permit in Packwood Randle area. Inquiries to: Howard Smith 504-256-1234 1/ For single management codes, enter in Appropriation block 02232 $ 350.00 $ 650.00 2/ For multiple management codes, enter all codes in amount block with corresponding amount and leave Appropiation block blank. BILL THROUGH OPAC ALC of Billed Agency: 14-56-7891 AUTHORITY AMOUNT TO BE BILLED I certify that the above charges are correct and proper. SIGNATURE (Administrative or Liaison DATE AGENCY DIVISION Officer) FORM AD-673 (7-75) R6 SUPPLEMENT 6509.11k-97-1 EFFECTIVE 02/07/97 6509.11k, 30 Page 28 of 28 33.4 - Transfer and Adjustment Voucher, Form AD-742. 33.41 - Preparation. 5. AD-742 Transfer and Adjustment Vouchers may be assigned a voucher number rather than a Bill for Collection number when prepared and processed through the automated MISPAY system. An AD-742 prepared as a billing document to another USDA agency must be assigned a Bill for Collection number to ensure that it is properly included in the accounts receivable report if it is still outstanding at month-end.