6509.11k, 32 Page 1 of 7 FOREST SERVICE HANDBOOK

advertisement

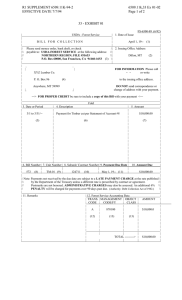

6509.11k, 32 Page 1 of 7 FOREST SERVICE HANDBOOK Portland, Oregon FSH 6509.11k - SERVICE-WIDE FINANCE AND ACCOUNTING HANDBOOK R6 Supplement No. 6509.11k-94-3 Effective February 1, 1994 POSTING NOTICE. Supplements are numbered consecutively by title and calendar year. Post by document name. Remove entire document, if one exists, and replace with this supplement. The last R-6 Supplement to this handbook was 6509.11k-94-2. This supplement supersedes Supplement 6509.11k-93-3. Document Name 6509.11k,32 Superseded New (Number of Sheets) 6 7 Digest: 32.13 - Provides cross-reference to instructions for handling special use billings, and following up on delinquent remittances. 32.43 - Adds current instructions for dealing with surpluses in BD, K-V, and other trust funds. /s/ John E. Lowe JOHN E. LOWE Regional Forester R6 SUPPLEMENT 6509.11k-94-3 EFFECTIVE 02/01/94 6509.11k, 32 Page 2 of 7 FSH 6509.11k - SERVICE-WIDE FINANCE AND ACCOUNTING HANDBOOK R6 SUPPLEMENT 6509.11k-94-3 EFFECTIVE 02/01/94 CHAPTER 30 - COLLECTIONS 32 - ADJUSTMENT, CORRECTION, AND TRANSFER OF COLLECTIONS. 32.1 - Uncollectible Remittances. Refer to FSM 6534 for information on handling uncollectible remittances. 32.11 - Action by Depositary. Disregard parent text as this does not apply under lockbox procedures. 32.12 - Action by Unit Collection Clerk. Disregard parent text as this does not apply under lockbox procedures. 32.13 - Request for Payment. Refer to FSH 2709.11, 32 for information on billing for special use fees, and following up on delinquent cases. 32.14 - Unpaid Billing File. An alternative method to the process described in the parent text is to document the facts on the original paid billing, and refer to the replacement billing issued. 32.2 - Reconciliation with National Finance Center. Disregard parent text since this is handled through the lockbox process. 32.3 - Adjustments. 32.31 - Adjustments Between Units. Refer to FSH 6509.31, Chapter 6, Section 5 for policy and instructions on transfers of expenditures between units. 32.4 - Transfers. 32.41 - Transfer of Earned Timber Sale Deposit Fund Receipts. At the end of every month, each forest shall reconcile the balance in fund code TDTD (Timber Sale Deposit Fund (TSDF)) from their Unit Financial Statement (UFS) to the ending cash balance from the same month's timber sale statements of account (TSSA). Forests are to use form R6-FS-6500-204 (4/93), RECONCILIATION OF TIMBER SALE STATEMENT OF ACCOUNT RECORDS WITH UNIT FINANCIAL STATEMENT (exhibit 01) in lieu of the form used in the parent text, and the monthly Transfer of Earned Timber Receipts worksheet as the basis for determining what items are used to reconcile the balances in the two systems. Any items that appear as reconciling items should be promptly cleared from the appropriate system so they are reflected properly within 2 months of identification. All timber sale transactions--including deposits, refunds, transfers, and charges-are processed through the Timber Sale Accounting (TSA) system. TSA then generates monthly timber sale statements of account and the related TSSA outputs, R6 SUPPLEMENT 6509.11k-94-3 EFFECTIVE 02/01/94 6509.11k, 32 Page 3 of 7 such as the monthly TSDF worksheet, and so forth. At the same time, collection, refund, and AD-742 timber-related transactions are processed independently through National Finance Center (NFC) to create the UFS's and the supporting subunit transaction registers. In effect, both systems (TSA and NFC) should be processing the same transactions. The purpose of the monthly reconciliation is to ensure forests can identify all transactions that have and have not been processed through both TSA and NFC. Any item processed successfully through both systems should not be shown as a reconciling item. The only reconciling items to pick up are those that have cleared only one system at the time of reconciliation. 1. Instructions for doing a "Quick Check Reconciliation." This is a fast method that can be used to determine how much detail a forest will need to pursue in reconciling. It is especially helpful for forests that keep current the processing of all collections, refunds, adjustments, and prior-month reconciling items. This method assumes the following: a. All deposits paid prior to monthend go into the TSA system because TSA remains open for business several days after the monthend cutoff for collection transmissions. b. Any deposits transmitted to National Computer Center-Kansas City (NCC-KC) after the monthend cutoff do not get into NFC's system as a collection (referred to as undeposited cash for the purpose of this supplement). c. The monthly timber transfers done on AD-742's are processed currently through NFC's system (in other words, they are only 1 month in arrears). d. All refunds sent to NFC in a given month, prior to the monthend Miscellaneous Payments (MISPAY) cutoff, are processed by both TSA and NFC's system. e. All reconciling items from the previous month have cleared their appropriate systems. To do the quick check, use form R6-FS-6500-204, "RECONCILIATION OF TIMBER SALE STATEMENT OF ACCOUNT RECORDS WITH UNIT FINANCIAL STATEMENT." Enter the UFS balance for the month being reconciled on line 1. Enter the "undeposited cash" amount from item 1b, above, on line 2. Enter the monthly charges from the current month's TSDF worksheet on line 4. Enter any of the above item 1d amounts that the forest knows have not been cleared from the previous month's reconciliation. Follow with the addition and subtraction. Enter the resultant value on line 6. Enter the ending cash balance from the TSDF worksheet on line 7. After entering these items on the reconciliation, line 7 (the ending cash balance from the TSDF worksheet) and line 6 (which is computed) should agree. If they do R6 SUPPLEMENT 6509.11k-94-3 EFFECTIVE 02/01/94 6509.11k, 32 Page 4 of 7 not, forests need to perform some or all of the phases shown below until they find the exact difference. Once a forest has identified a reconciling item, it should remain as a reconciling item on future months' exhibits until the transaction either appears in the appropriate system, or the original transaction is removed from its existing system. This also applies when changing fiscal years. For instance, if a $50 deposit had not been processed at NFC for one month, continue to show it until it appears on the subunit transaction register and is reflected in the balance on the UFS. 2. Instructions for Isolating Differences. Phase 1 involves comparing individual, monthly TSDF worksheet summary amounts for certain areas to the TSA transaction listings that support the worksheet. The primary transaction listing is the monthly "TSA payment detail record," which shows deposits, cash transfers, and refunds. For example, if the total deposits on the payment detail do not equal those on the worksheet, change the payment detail so it is in agreement with the worksheet. The same principle applies for refunds. This involves finding the exact transaction that is missing or in error, and making notes of the changes since they may be transactions that should be appearing in the future. The next step in this phase is to ensure the worksheet's opening cash balance agrees with the previous month's ending cash balance. If they do not, stop and resolve before proceeding. The mathematical adjustment made on the TSA worksheet below the earned basis line to credit balance accounts is to ensure only charges to receipt accounts that have had a deposit (cash) to cover them are transferred. No adjustment or reconciliation should be necessary for this item on the worksheet. Phase 2 of the reconciliation involves identifying the monthly transactions that support the UFS balance in TDTD. The support for this is the subunit transaction register for management codes 870XXX and 871XXX (XXX = proclaimed unit). Deposits, refunds, and monthly timber charges appear on this register. A quick check should be done by the forest to ensure all transactions are accounted for. Verify that the previous month's financial statement, plus current month's deposits, less refunds and charges, are equal to the new ending balance in fund code TDTD on the current month's financial statement. If there are any differences, do not proceed before resolving. Phase 3 involves comparing (by bill number, AD-742 number, and so forth) the phase 1 monthly transaction listings of the TSA system against the phase 2 monthly transaction listings from the NFC outputs for deposits, refunds, transfers, and charges to identify which transactions do not appear in the cumulative balances in either system. Since this is an accumulative process, any items that appeared as reconciling items on the previous month's reconciliation form (in other words, items which only appeared on one system at that time), and now appear in the system from which R6 SUPPLEMENT 6509.11k-94-3 EFFECTIVE 02/01/94 6509.11k, 32 Page 5 of 7 they were missing, should be dropped as a reconciling item from the current month's reconciliation form. If any work done in one of the phases reveals the discrepancy, the research can stop. A vital key in simplifying the reconciliation process is to ensure all transactions are processed correctly through the TSA and NFC systems. This includes processing the monthly AD-742 timber transfer exactly as it is shown on the TSA worksheet. Any manual changes to the worksheet may cause an out-of-balance situation; therefore, the key is to get the TSA system updated the following month for errors found in the current month, and process the monthly AD-742 from the system again. It is also imperative that refunds be processed through the electronic MISPAY program with valid contract numbers so TSA and NFC receive the same information. All forests should ensure they process their monthly AD-742 one month in arrears, and by the 25th. The AD-742 transfers timber sale deposits (the TSDF) to their respective accounts. For example, the AD-742 for June TSA business should be prepared and transmitted electronically no later than July 25. At least one month of charges reflected in the ending cash balance on the TSDF worksheets will not be reflected in the UFS TDTD balance. For example, the balance in TDTD on the June UFS will not reflect June charges from the TSDF monthly worksheet for June, since these will not be processed into the NFC system until July. In addition, there may be other AD-742's sent to NFC that were not processed. Unprocessed AD-742's should be included as reconciliation items until they clear the UFS. The total of monthly AD-742's must equal the total charges to be transferred from the worksheets for each month. Copies of the completed R6-FS-6500-204 form and forest summary of the TSDF worksheet should be sent to Financial Management on a quarterly basis by the 28th of the month following the end of the quarter. R6 SUPPLEMENT 6509.11k-94-3 EFFECTIVE 02/01/94 6509.11k, 32 Page 6 of 7 32.41 - Exhibit 01 Facsimile of RECONCILIATION OF TIMBER SALE STATEMENT OF ACCOUNT RECORDS WITH UNIT FINANCIAL STATEMENT Unit 09-Olympic NF Month Sept, 1993 1. TDTD Balance from Unit Financial Statement. 2. Add: (a) Collections processed through TSSA not yet processed on UFS. (Show by month) $ 2,069,396.53 $ $ $ (b) Refunds processed through UFS not yet in TSSA (Voucher # Contract # ) $ 3. Deduct: (a) Collections processed through UFS not yet processed through TSSA (show bill number and amount--#269 for $1,432.50) (b) Refunds processed through TSSA not yet processed through UFS (Contract # ) $ 1,432.50 $ 4. Deduct: Unprocessed AD-742's. (Show by month.) Sept 5. Other adjustments. Explain each item. (B/C # Contract # Date paid ) with documentation as to what corrective action is being taken. (a) (b) (c) Net Adjustments $ $ $ $ $ 1,258,446.28 $ 6. Net ending balance per UFS (Items 1-5). $ 809,517.75 7. Ending cash balance from TSDF Worksheet. $ 809,517.75 8. Difference (Explain if other than 0) $ A. Stratton Financial Manager October 25, 1993 Date -0- R6 SUPPLEMENT 6509.11k-94-3 EFFECTIVE 02/01/94 6509.11k,32 Page 7 of 7 32.43 - Transfer of Excess KV, Brush Disposal, Timber Salvage Sales, Erosion Control, and Pooled CWFS-Other Funds to Receipt Funds. Excess collections on Oregon and California (O&C) Forests (Mt.Hood, Rogue River, Siskiyou, Siuslaw, Umpqua, Willamette, and Winema National Forests) that are identified through the Annual Analysis process for KV, BD, and SSF funds, should be split between National Forest and O&C. Unless directed otherwise by the Regional Office (RO) or Washington Office (WO), the proper dollars should then be deposited into National Forest Fund (NFF) (fund code 5008), and O&C (fund code 5882). Current WO direction requires the RO to withdraw all National Forest portion surpluses from KV and SSF into the RO for withdrawal by the WO. To determine the proper amounts of excess collections that should be split between National Forest receipts or O&C receipts, which can vary from fund to fund depending on collection and timber sale activity, use the method below that best fits the Forest's accounting situation: 1. If a Forest has maintained cash balances in such a way that the excess collections are readily identifiable on their Central Accounting System outputs, use the actual accounting outputs. 2. If a Forest is not able to determine the exact excess from the Central Accounting System, they should establish a ratio that reasonably resembles collection value relationships by either: a. Using actual 3 year average collections from the Central Accounting System (KV O&C collections are to be accounted for separately in the Central Accounting System) for O&C versus regular National Forest collections. For example, if a Forest has collected $15 million in KV over the last 3 years, of which $3 million is KV O&C, then 80 percent ($12 million/$15 million) of any excess KV funds would be the National Forest receipts portion, and 20 percent ($3 million/$15 million) would be adjusted to fund code 5882 for the O&C receipts portion. b. Using a ratio that represents a reasonable approach. For example, if a unit determines that 10 percent of it's Salvage Sale Fund sale activity involved O&C lands, it would be reasonable to return 10 percent of the excess to the O&C fund, and the other 90 percent would be the National Forest portion.