Document 10557285

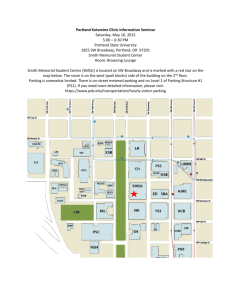

advertisement