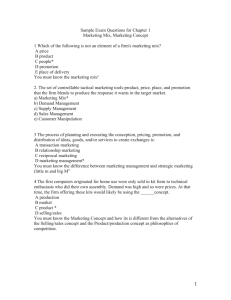

Transformational Metrics for Product Development

advertisement