Key Worker Housing: A Demand Analysis of Sean D. Sacks

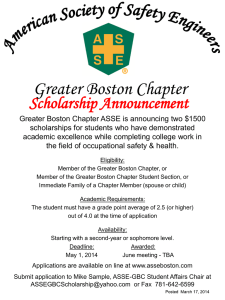

advertisement