REQUEST FOR PAYMENT TO RESEARCH STUDY PARTICIPANTS

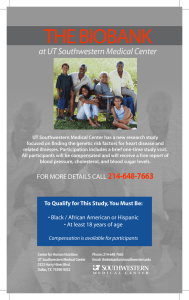

advertisement

REQUEST FOR PAYMENT TO RESEARCH STUDY PARTICIPANTS Date of Request: PI Name: Study Account #: Subledger #: Visit #: Payment Amount: $ Study IRB #: Name of Study Participant: Address of Study Participant: City, State, ZIP: Important Payment and Tax Information The U.S. Internal Revenue Service (IRS) considers payments received for participation in research as income. UT Southwestern Medical Center is required to report payments of $600 or more in a calendar year to the IRS. However, it is your responsibility to report all income, regardless of the amount, to the IRS on your annual federal tax return. UT Southwestern, as a State agency, is not allowed to make any payments to you for your participation in this research if the Texas State Comptroller has issued a “hold” on all State payments to you. Such a “hold” could result from your failure to make child support payments or pay student loans, etc. If this occurs, UT Southwestern will be allowed to pay you for your taking part in this research after 1) you have made the outstanding payments and 2) the State Comptroller has issued a release of the “hold.” Payment Information – UT Southwestern Employees If you are an employee of UT Southwestern, payment will be added to your regular paycheck and federal tax will be deducted. This form should be emailed to PayrollUTSW@utsouthwestern.edu on or before the next scheduled payroll cutoff date in order to be paid as promptly as possible. If you are you an employee of UT Southwestern, please provide Person #: Social Security Number Disclosure Information – All Subjects Disclosure of your Social Security Number (SSN) is required in order for UT Southwestern Medical Center to report miscellaneous income, as mandated by Federal law. Further disclosure of your SSN is governed by the Public Information Act (Chapter 552 of the Texas Government Code) and other applicable law. If you do not disclose your SSN, you can still be paid for your participation in the research; however, payments will be reduced by the required Federal Income Tax non-employee withholding rate, currently 28% (subject to change). Please provide your Social Security Number for the purpose of receiving payment for your participation in this research study: SSN: Note: failure to provide SSN will reduce subject payment after tax withholding to: $ Signature of Research Participant: ____________________________________ Date: Name of Research Participant: ____________________________________ Coordinator/ Designated Representative Signature: ____________________________________ Date: Coordinator/ Designated Representative Printed Name: ____________________________________ Effective October 1, 2007 Revised July, 2015