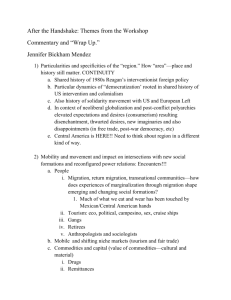

The Arc of Neoliberalism Annual Review of Sociology prepared for the

advertisement