The Impacts of the Affordable Care Act: How Reasonable

Are the Projections?

The MIT Faculty has made this article openly available. Please share

how this access benefits you. Your story matters.

Citation

Gruber, Jonathan. "THE IMPACTS OF THE AFFORDABLE

CARE ACT: HOW REASONABLE ARE THE PROJECTIONS?"

Working paper series (National Bureau of Economic Research),

working paper 17168. National Bureau of Economic Research,

(June 2011). 26 p.

As Published

http://www.nber.org/papers/w17168

Publisher

National Bureau of Economic Research

Version

Author's final manuscript

Accessed

Mon May 23 10:53:12 EDT 2016

Citable Link

http://hdl.handle.net/1721.1/72971

Terms of Use

Creative Commons Attribution-Noncommercial-Share Alike 3.0

Detailed Terms

http://creativecommons.org/licenses/by-nc-sa/3.0/

NBER WORKING PAPER SERIES

THE IMPACTS OF THE AFFORDABLE CARE ACT:

HOW REASONABLE ARE THE PROJECTIONS?

Jonathan Gruber

Working Paper 17168

http://www.nber.org/papers/w17168

NATIONAL BUREAU OF ECONOMIC RESEARCH

1050 Massachusetts Avenue

Cambridge, MA 02138

June 2011

Forthcoming as part of a Forum on Health Care Reform and the U.S. Budget, National Tax Journal.

Jonathan Gruber served as a paid advisor to the Romney Administration and Massachusetts Legislature

during the development of health care reform in Massachusetts, and has since been a member of the

Commonwealth Health Connector Board that oversees implementation of the law. He was also a paid

technical consultant to the Obama Adminstration during the development of the Affordable Care Act.

The views expressed herein are those of the author and do not necessarily reflect the views of the

National Bureau of Economic Research.

© 2011 by Jonathan Gruber. All rights reserved. Short sections of text, not to exceed two paragraphs,

may be quoted without explicit permission provided that full credit, including © notice, is given to

the source.

The Impacts of the Affordable Care Act: How Reasonable Are the Projections?

Jonathan Gruber

NBER Working Paper No. 17168

June 2011

JEL No. H3,I18

ABSTRACT

The Patient Protection and Affordable Care Act (ACA) is the most comprehensive reform of the U.S.

medical system in at least 45 years. The ACA transforms the non-group insurance market in the United

States, mandates that most residents have health insurance, significantly expands public insurance

and subsidizes private insurance coverage, raises revenues from a variety of new taxes, and reduces

and reorganizes spending under the nation’s largest health insurance plan, Medicare. Projecting the

impacts of such fundamental reform to the health care system is fraught with difficulty. But such projections

were required for the legislative process, and were delivered by the Congressional Budget Office (CBO).

This paper discusses the projected impact of the ACA in more detail, and describes the evidence that

sheds light upon the accuracy of the projections. It begins by reviewing in broad details the structure

of the ACA and then reviews evidence from a key case study that informs our understanding of the

ACA’s impacts: a comparable health reform that was carried out in Massachusetts four years earlier.

The paper discusses the key results from that earlier reform and what they might imply for the impacts

of the ACA. The paper ends with a discussion of the projected impact of the ACA and offers some

observations on those estimates.

Jonathan Gruber

MIT Department of Economics

E52-355

50 Memorial Drive

Cambridge, MA 02142-1347

and NBER

gruberj@mit.edu

I. INTRODUCTION

On March 23, 2010, President Obama signed into law the Patient Protection and

Affordable Care Act (ACA), the most comprehensive reform of the U.S. medical system in at

least 45 years. The ACA transforms the non-group insurance market in the United States,

mandates that most residents have health insurance, significantly expands public insurance and

subsidizes private insurance coverage, raises revenues from a variety of new taxes, and reduces

and reorganizes spending under the nation’s largest health insurance plan, Medicare. If fully

implemented, the ACA promises to lead to a dramatically different health care landscape for the

United States in the years to come.

Projecting the impacts of such fundamental reform to the health care system is fraught

with difficulty. But such projections were required for the legislative process, and were delivered

by the Congressional Budget Office (CBO). CBO projected that the ACA would increase health

insurance coverage by 32 million people and would raise federal government spending by almost

$1 trillion over the subsequent decade, but would raise revenues and reduce spending by even

more so that the bill overall reduced the federal budget deficit. These CBO projections were

central to the legislative debate over the ACA.

In this article, I discuss the projected impact of the ACA in more detail, and describe

evidence that sheds light upon the accuracy of the projections. I begin by reviewing in broad

detail the structure of the ACA. I then review the evidence from a key case study that informs

our understanding of the ACA’s impacts: a comparable health reform that was carried out in

Massachusetts four years earlier. I discuss the key results from that earlier reform and what they

2 might imply for the impacts of the ACA. Finally, I discuss the projections of the impact of the

ACA and offer some observations on those estimates.

II. THE AFFORDABLE CARE ACT

The ACA is an enormously detailed piece of legislation which touches on many aspects

of our health care system. I begin by providing a broad outline of the ACA’s key features to help

guide the discussion of the bill’s projected effects.

A. Background: U.S. Health Care

The United States spends 17 percent of its gross domestic product (GDP) on health care,

by far the most of any nation in the world. Moreover, the rate of health care spending is rapidly

outstripping the rate of growth of our economy, so that by 2080 health care spending is projected

to account for 40 percent of the U.S. economy (CBO, 2010a).

Despite this high level of spending, there remain enormous disparities in access to health

care in our nation. For example, the infant mortality rate for whites in the United States is 0.57

percent, while for blacks it is more than twice as high, at 1.35 percent.1 Many of these disparities

can be attributed to the fact that the United States is the only major industrialized nation without

universal access to health care. Almost one in five of the non-elderly, 50 million Americans,

have no health insurance coverage. The distribution of insurance coverage is shown in Table 1

(which is based on Fronstin, 2010).

The primary source of insurance coverage in the United States is employer-sponsored

insurance (ESI), which covers the majority of non-elderly Americans in the United States. This is

due to both the risk pooling provided by the workplace setting and the large tax subsidy provided

1

The Henry J. Kaiser Family Foundation, “Infant Mortality Rate (Deaths per 1,000 Live Births)

by Race/Ethnicity, Linked Files, 2004–2006,”

http://www.statehealthfacts.org/comparetable.jsp?cat=2&ind=48.

3 to ESI. As discussed in more detail in Gruber (2011b), the federal government forgoes roughly

$250 billion per year by excluding compensation in the form of health insurance from income

and payroll taxation. Since health insurance provided through employers is purchased with pretax dollars while insurance provided outside the employment setting is bought with post-tax

dollars, there is a strong incentive for insurance to be provided in the employment setting.

There are also two major sources of public insurance coverage. The Medicare program is

a universal insurance program for the elderly in the United States, while the Medicaid program

provides coverage for many of the poor, with a particular focus on low income children. As a

result, most uninsured are not the poorest Americans, but the “working poor” — those whose

income and age leaves them ineligible for public insurance coverage and who are not offered

insurance through their places of employment.

The only avenue available to such individuals is the non-group insurance market. In most

states, however, this market discriminates against the sick. Non-group insurance often features

“pre-existing conditions exclusions” that exclude from coverage any spending on illnesses that

were present at the time of insurance purchase. Moreover, non-group insurance availability can

be limited and prices very high for those who become ill. In a dynamic sense, this market does

not provide real insurance protection against illness. As a result, those outside of the employer

and public insurance systems face significant financial risk from illness.

B. Broad Outline of the Affordable Care Act

The core of the ACA is a “three-legged stool” designed to fix the broken non-employer

insurance market in the United States and expand health insurance coverage as a result. The first

leg of the stool includes reforms to the non-group insurance market. These include outlawing

exclusions for pre-existing conditions and other discriminatory practices, guaranteeing access to

4 non-group insurance, and imposing limits on the ability of insurers to charge differential prices

by health status — prices for a given product can only vary by age (subject to a 3:1 limit) and

smoking status (subject to a 1.5:1 limit). In addition, minimum standards are set for insurance in

the non-group and small group markets, including a list of “essential benefits” that must be

included in an insurance package and a minimum “actuarial value” (the share of total spending

on the essential benefits package that is covered, on average for a typical population, by

insurance) of 60 percent.

While these reforms are viewed by most as long overdue, most experts argued that they

cannot survive in a vacuum. In particular, if individuals are guaranteed insurance access at prices

that are independent of health status, then many may “free ride” by remaining uninsured until

they are sick and then buying insurance at average prices. Under these circumstances, insurers

will have to charge high prices to all to account for the fact that the pool buying insurance is

sicker than average. The resulting adverse selection cycle leads to high prices and a failed

insurance market. Indeed, this point is not just a theoretical curiosity. In the 1990s, five states

tried to reform their non-group insurance markets in such a manner, and by 2006 these were five

of the most expensive states in the nation in which to purchase non-group insurance (Gruber,

2011a).

The second leg of the stool is therefore a requirement that individuals purchase insurance,

or an individual mandate. More specifically, most individuals in the United States are required to

have coverage or to pay a penalty, which ultimately (by 2016) amounts to the larger of 2.5

percent of income or $695.

The problem with an individual mandate, however, is that it may be impossible to enforce

— as well as inadvisable to enforce — if insurance is not affordable. This motivates the third leg

5 of the stool: government subsidies to make insurance affordable for lower income families.

Under the ACA, these subsidies come in two forms. The first is an expansion of the Medicaid

program to all individuals with incomes below 133 percent of the poverty line (which is $10,830

for individuals and $22,050 for a family of four). The second is tax credits to offset the cost of

private non-group insurance. These tax credits are designed to cap the share of income that

individuals have to spend to get insurance, beginning with a cap at 3 percent of income at 133

percent of the poverty level and rising to a cap of 9.5 percent of income at 300 percent of the

poverty level (and remaining at 9.5 percent until 400 percent of the poverty level). In addition, if

individuals have incomes below the threshold for income tax filing, or if the cheapest health

insurance option available to them costs more than 8 percent of their income, they are exempt

from the mandate penalty.

The ACA primarily finances these subsidies through six sources (with their associated

share of financing): (1) a reduction in reimbursements to private “Medicare Advantage”

programs that provide an alternative to the government Medicare program for seniors (14%); (2)

reductions in Medicare reimbursement, primarily through a reduction of the inflation adjustment

provided to hospitals each year for their reimbursements under Medicare (33%); (3) an increase

in the Medicare payroll tax by 0.9 percent, and the extension of that tax to capital income, for

singles with incomes of more than $200,000 per year and families with incomes of more than

$250,000 per year (21%); (4) new excise taxes on several of the sectors that are likely to benefit

from the expanded coverage of medical spending in the United States, including insurers,

pharmaceutical companies, and medical device manufacturers (11%); (5) the “Cadillac tax,” a

non-deductible 40 percent excise tax on insurance products that cost more than $10,200 for an

individual or $27,500 for a family in 2018, with those limits indexed each year to the consumer

6 price index (3%); and other revenue sources such as penalty payments by individuals and

employers, and taxes on the higher wages that result from reduced employer spending on

insurance (21%).

The ACA also includes a number of provisions to address the problem of rapidly rising

health costs in the United States. The first is the Cadillac tax, which should reduce the incidence

of very generous health insurance plans and thereby excessive demand for health care. The

second is new health insurance “exchanges,” state-organized marketplaces where non-group and

small group insurers must compete in a transparent marketplace that is designed to maximize

competition and lower premiums. The third is the Independent Payment Advisory Board, which

is charged with re-designing reimbursement of providers under Medicare to lower costs and

ensure quality; this board’s recommendations are subject to an up or down vote by Congress.

The fourth is a new research institute — with sizeable funding — to study the comparative

effectiveness of medical treatments, in an effort to understand which treatments are most cost

effective. Finally, there are many pilot programs examining alternative organizations and

reimbursement structures for medical providers in an attempt to finds ways to undo the

pernicious incentives of our retrospective “fee-for-service” medical reimbursement system.

There are dozens of other provisions in the ACA that are not reviewed here as well, on topics

ranging from incentives for improving the quality of health care, to a new social insurance

program for long-term care, to incentives to increase primary care provision, and so on.

III. THE MASSACHUSETTS CASE STUDY

Projecting the impacts of a fundamental reform such as that described above is an

enormous challenge. The effects of the ACA will depend on dozens of behavioral responses by

firms and individuals (as well as state governments). There are several decades of empirical

7 research in health economics that can help inform our understanding of these behavioral

responses; Gruber (2002) provides a review of some of that evidence. But this past evidence is

by necessity based on changes to the existing health insurance environment, and may not be fully

indicative of the impacts of a fundamental change in the environment as sweeping as ACA.

A. The Massachusetts Experiment

Fortunately, our understanding of the impacts of the ACA can be further informed by the

experience of Massachusetts. In April 2006, Massachusetts passed a health reform that was

based on the same “three-legged stool” as the ACA, and in many ways inspired the federal

program. Massachusetts was one of the five states that had already reformed its non-group

markets in the 1990s and, as a result, had a small and expensive non-group market. Part of the

goal of reform in the state was to fix that market, while covering the majority of the roughly

600,000 uninsured residents of the state.

The key aspects of reform in Massachusetts were to supplement the existing reforms of

the non-group market with the introduction of an individual mandate to purchase insurance and

the creation of a new program, Commonwealth Care, which provides heavily subsidized

insurance for those below 300 percent of the poverty line. In addition, a new marketplace for

non-group insurance, the Connector, was created to facilitate purchase for those who did not

have access to employer-sponsored insurance.2 The Massachusetts reform did not include much

of what is incorporated into the ACA, in particular the revenue sources — reform in

Massachusetts was financed jointly by the federal government and by an existing tax that

financed care for the uninsured — and the efforts at cost control discussed above. But it does

2

For more information on the Connector and Massachusetts health reform in general, see

www.mahealthconnector.org.

8 provide an excellent case study of the three-legged stool approach to covering the uninsured and

fixing the non-group market.

B. Results

The results of the Massachusetts reform have been encouraging along a number of

dimensions.3 First, there has been a dramatic expansion of health insurance coverage in the state.

The data vary across sources, with state-level data from the Current Population Survey (CPS)

showing a 60 percent decline in the uninsured since 2006 — over a period of time where the

share of the national population without insurance was rising by 6 percent — and data collected

by the state’s Division of Health Care Finance and Policy showing a decline of 70 percent.4

Either number indicates a sizeable reduction in the number of uninsured, with Massachusetts

having by far the lowest uninsurance rate in the nation.

A major concern with such a large expansion in access to care is that it will cause

congestion on the supply side of the market. Indeed, many have argued that we have a chronic

shortage of primary care physicians in the United States and that expanding coverage will only

worsen that shortage. This has not been the case in Massachusetts, however. A recent study by

the Massachusetts Medical Society found that average wait times for both family and internal

medicine were basically flat in the period since the law passed (Massachusetts Medical Society,

2011).

Moreover, this expansion in insurance coverage has been associated with a rise in access

to care. The share of the population with a usual source of care, the share with a doctor’s visit in

3

This section draws heavily on and updates Gruber (2011a).

The former figure comes from data tabulations from the U.S. Census Bureau, Current

Population Survey, www.census.gov; the latter figure comes from the state’s Division of Health

Care Finance and Policy, Health Care in Massachusetts: Key Indicators,

http://www.mass.gov/Eeohhs2/docs/dhcfp/r/pubs/10/key_indicators_november_2010.pdf.

4

9 the last 12 months, the share receiving preventive care, and the share receiving dental care all

rose significantly from the fall of 2006 to the fall of 2008 (Long and Masi, 2009). Miller (2011)

finds a modest reduction in the rate of utilization of emergency care in the state, while the

Division of Health Care Finance and Policy (2009) reports a 40% decline in uncompensated care

in the first year after reform

Second, rather than a crowd-out of private insurance through the expansion of a publicly

funded entitlement, there has been a “crowd-in” through a rapidly rising rate of employer-insured

individuals. According to estimates from the Current Population Survey, the share of the

Massachusetts population with employer-sponsored insurance rose by 0.6 percent from 2006–

2009, while over the same period the share of the national population with employer-sponsored

insurance fell by 4 percent. Some of this “crowd-in” is due to increased enrollment in employersponsored insurance by those endeavoring to meet the requirements of the mandate, but some

has actually been through higher rates of employer insurance offering. The rate of employerprovided insurance offering in Massachusetts rose from 70 percent in 2005 to 76 percent in 2009,

while it remained flat at 60 percent nationally (Massachusetts Division of Health Care Financing

and Policy, 2010). There is no obvious explanation for this increase in employer offering as the

law introduces incentives for employers to drop insurance (by covering their low income

employees outside the employer setting) and does little to penalize those firms that do drop

coverage. The best potential explanation for this result is that there was a non-market impact of

the mandate on employer behavior, with employees demanding coverage to meet the mandate

and employers increasing coverage to meet the demand.

Fourth, the mandate implementation has been very smooth. Over 98 percent of tax filers

required to file health insurance information with their tax returns have complied with the filing

10 requirement. Out of the at least 500,000 individuals who were uninsured before reform, only

53,000 ended up being assessed penalties for not having insurance in 2008 (the remainder either

having gained insurance or were exempt from penalties) (Massachusetts Department of Revenue,

2009). Only 2,500 of those individuals filed and followed through on appeals of their penalty;

the penalty was waived in about three quarters of the cases.5

Fifth, the costs of administering health reform have been quite low. The Connector was

given only $25 million in seed funding, and its net worth remains at $20 million. The ongoing

administrative costs are funded by an insurance charge of only 3 percent, which is very small

compared to the typical loads found in the non-group and small group markets.6

Sixth, the reform has generally been popular. Sixty-nine percent of state residents

supported reform in 2006, and that number has remained essentially unchanged, with 67%

support in 2009 (Long and Stockley, 2009).

Seventh, premiums have fallen dramatically in the non-group market. According to

America’s Health Insurance Plans (2007, 2009), from 2006–2009 non-group premiums rose by

14 percent nationally; over that same period, they fell by 40 percent in Massachusetts. Some of

that decline was due to a redution in the level of non-group benefits, but this is a sizeable decline

in any case.

Eighth, there has been no meaningful impact on employer-sponsored insurance

premiums. Cogan, Hubbard, and Kessler (2010) argue that group premiums rose in

Massachusetts from 2006–2008. Using state-level data from the Medical Expenditure Panel

Insurance Component, they show that over this period single group premiums rose by 8.7 percent

in Massachusetts, but only 6.5 percent nationally, for a 2.2 percent excess growth rate in

5

6

This figure is based on private communication with Connector staff.

This figure is based on private communication with Connector staff.

11 Massachusetts; for families, premiums grew by 12.2 percent in Massachusetts but only 8.1

percent nationally, for a 4.1 percent excess growth rate.

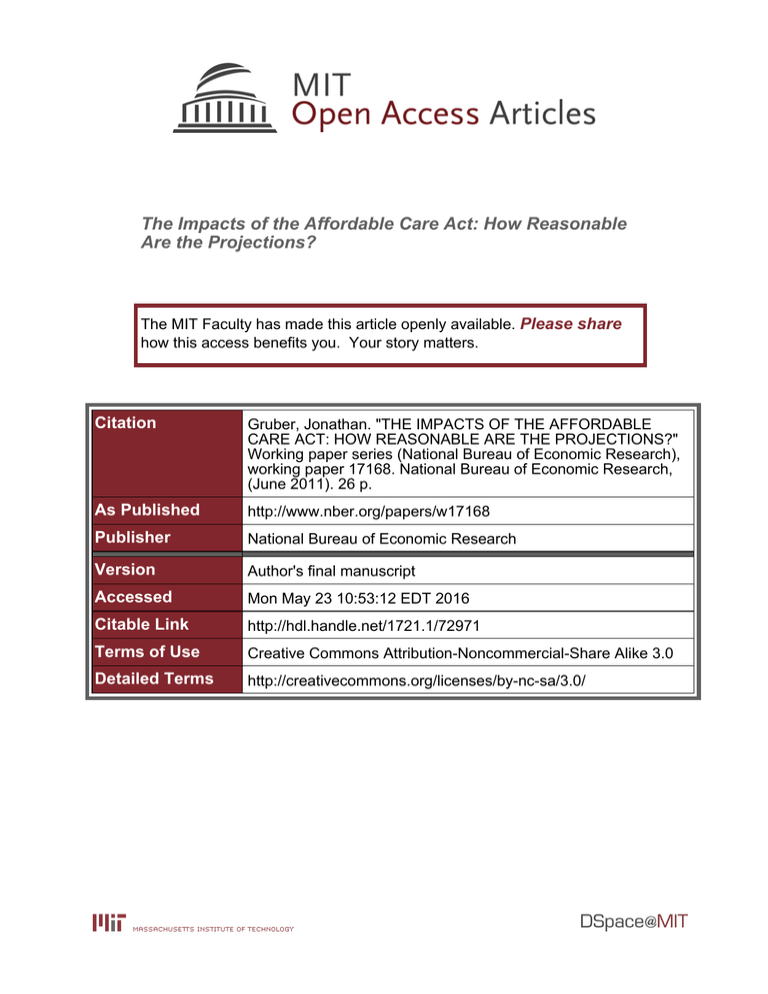

But these tabulations are very imprecise due to the very noisy nature of premium

movements over time at the state level. Over the 2006–2008 period, the standard deviation of the

state premium change was 4.6 percent for single premiums and 5.3 percent for family premiums.

This implies that the changes documented by this article are not statistically meaningful in that

they are well below a one standard deviation change in premiums. To illustrate this point further,

consider Figure 1, which shows the change in single premiums from 2006–2008 by state,

graphed against the state rankings of premium change. Massachusetts is ranked 31st, which is

somewhat higher than the median, but clearly not distinguishable from states around it. The

change in premiums for Massachusetts, for example, is well below that of other neighboring

New England states such as Vermont (ranked 46) or New Hampshire (ranked 47).7

Finally, the costs of reform at full implementation have been very close to original

projections. Legislative staff in 2006 projected that the Commonwealth Care program would cost

$750 million when fully implemented. In FY 2009, the first full year of implementation, costs

were $800 million. The Massachusetts Taxpayers Foundation (2009) undertook a comprehensive

study of the net cost of reform, taking into account the costs of Commonwealth Care and Mass

Health expansions, as well as savings through uncompensated care and supplemental payments

to safety net hospitals. The study concluded that the net cost of reform in the state has been $707

million, roughly half of which is borne by the federal government. Given that the state has newly

insured about 300,000 individuals according to survey evidence, that is a cost to the state of only

$2,350 per newly insured. This is a very low cost per newly insured compared to earlier

7

Note that the change in uninsurance rate and non-group premiums are both highly significant

relative to other states over this time period.

12 estimates of the cost of alternative approaches to expanding insurance coverage (Gruber, 2008).

This largely reflects the fact that so much of the increase in insurance coverage has been through

private coverage.

IV. IMPLICATIONS FOR THE ACA

The projections of the impacts of the ACA from CBO (2010b) are summarized in Table

2. The top panel shows projected impacts on coverage. CBO projects that there will be a very

modest erosion of employer-sponsored insurance, with large increases in both public insurance

and non-group insurance, so that there is an overall reduction in the number of uninsured of 32

million people. They also project about $940 billion in new spending, offset with $1,080 billion

in spending reductions and revenue increases, for a first decade deficit reduction of about $140

billion. Moreover, in their discussion of the bill, CBO notes that they project the deficit reduction

to increase over time, and reach more than $1 trillion in the second decade.

A. Population Movements

Perhaps the most surprising aspect of the CBO estimates is the rather modest erosion of

employer-sponsored insurance that they project. But, in fact, this estimate is consistent with past

evidence as well as with the experience of Massachusetts.

This small erosion occurs for several reasons. First, more than half of employees covered

by health insurance are in firms with more than 100 employees, and past evidence suggests that

such firms are not price sensitive in their decisions to offer insurance (Gruber and Lettau, 2004).

Second, the subsidies under the ACA are not very generous above about 250 percent of

the poverty line, so that for most firms the majority of workers will not see substantially better

deals outside of the employment setting rather than inside. To illustrate this point, I draw on the

Gruber Microsimulation Model (GMSIM), a large-scale econometric simulation model that I

13 have developed over the past dozen years to model health care reforms. To the extent that CBO

has made details of their model public, in many ways the GMSIM mirrors the CBO approach to

modeling health reform.8

To model firm behavior in such microsimulation models, it is important to understand

that firms make decisions based on the firm-wide aggregate effects of a policy. To mimic this in

GMSIM, we construct “synthetic firms” that are meant to reflect the demographics of actual

firms. The core of this computation comes from U.S. Bureau of Labor Statistics (BLS) data

providing the earnings distribution of co-workers for individuals of any given earnings level, for

various firm sizes and regions of the country. Using these data, the model randomly selects

individuals in the same firm size/region/health insurance offering cell as a given CPS worker in

order to statistically replicate the earnings distribution that the BLS data would predict for that

worker. These workers then become the co-workers in a worker’s synthetic firm.

Using these synthetic firms, we can look at the composition of firms below 100

employees to assess the extent to which low-income workers are concentrated in such firms. In

fact, we find that only one-quarter of small firms have more than 10 percent of their employees

in families with incomes of less than 133 percent of the poverty line, and virtually none have

more than 50 percent of their employees with incomes less than that amount. Only 21 percent of

firms have more than 10 percent of their employees in families with incomes of 133–250 percent

of the poverty line, and once again virtually no firms have more than half of their employees

earning in that range.

Third, this modest effect may be offset if the Massachusetts experience, where the

individual mandate appears to have led more firms to offer insurance, is repeated at the national

8

A detailed appendix that describes GMSIM is available at MIT Department of Economics,

“Documentation for the Gruber Microsimulation Model,” http://econ-www.mit.edu/files/5939.

14 level. It is unclear how large this effect will be relative to the case of Massachusetts, as federal

subsidies to non-group insurance are much less generous, although they do extend to four times

(rather than three times) the poverty line.

Fourth, there is an offsetting increase in ESI enrollment due to the mandate. A large share

of the uninsured (perhaps one-quarter) are offered and eligible for ESI but do not enroll. These

individuals will now enroll in large numbers due to the mandate.

Finally, an additional offset will be any pressure on firms to offer insurance due to the

“free rider” penalty in the ACA. This section of the ACA charges firms of more than 50

employees a large $2,000–$3,000 charge if their employees receive subsidies on the health

insurance exchange.9 This provides a strong countervailing financial incentive to firms to offer

insurance. The Massachusetts reform featured a much more modest ($300) charge.

With only a modest reduction in ESI, and an enormous expansion of public and

subsidized private insurance, CBO (2010b) projects that 32 million uninsured will gain coverage

by 2019, relative to a pre-law baseline estimate of 55 million uninsured. This estimate of a 58

percent reduction in the uninsured is somewhat lower than the reduction in Massachusetts, but

this is partly because the ACA does not provide subsidies or public insurance to undocumented

immigrants, who make up almost one-quarter of the uninsured nationally but much less than that

in Massachusetts.

B. Premium Impacts

9

In particular, if any employee joins the exchange and receives tax credits and the firm does not

offer insurance, the firm must pay $2,000 per employee (minus a 30 employee “exemption”). If

the firm offers insurance, but an employee still ends up getting tax credits in the exchange

(which can happen if the employee’s insurance contribution exceeds 9.5 percent of their

income), then the firm owes $3,000 per employee who gets tax credits.

15 CBO (2009) provided estimates of the impact of the ACA on health insurance premiums

in the non-group and employer markets. For the non-group market, CBO compares premiums in

the state-based health insurance exchanges to premiums that would exist in the non-group market

absent reform, which they compute by projecting current non-group premiums forward. Their

headline estimate is that exchange premiums will be 10–13 percent higher, on average, with

reform than in the non-group market absent reform — although for any family below 400

percent of poverty this cost could be partially offset by tax credits. As they discuss, however, this

result reflects the net impact of three effects. First, premiums will drop 7–10 percent due to an

improved health mix in that market (due to the mandate). Second, premiums will drop another 7–

10 percent due to lower prices arising from enhanced competition and other factors in the nongroup market. Finally, premiums would rise by 27–30 percent due to individuals buying more

generous policies in the exchange than they do in today’s non-group market.

Therefore, CBO estimates imply that for a given level of policy generosity in the

exchange, premiums would actually fall by 14–20 percent. This is consistent with the findings of

declines in non-group premium in Massachusetts. Thus, the overall rise occurs because

individuals buy more generous policies than the limited policies purchased in the non-group

market today. CBO (2009) does not discuss the key question of why these more generous

policies are purchased — that is, to what extent is this due to voluntary upgrades versus forced

“buying up” to meet the new minimum standards in this market? Given that the minimum

standards are fairly modest, however, it seems likely that most of the increase in plan quality

reflects voluntary upgrades.

The CBO estimates show essentially no change in group premiums: for small groups,

they estimate a range from a reduction of 2 percent to an increase of 1 percent; for large groups,

16 they estimate a range from a reduction of 3 percent to no effect. This is once again consistent

with the evidence from Massachusetts, which showed no significant impact on group premiums.

C. Budgetary Implications

CBO (2010b) estimates that the ACA subsidies and public insurance expansion will cost

$940 billion by 2019. In 2019, CBO estimates that the government will spend $214 billion to

cover 32 million people, or $6,690 per person. Deflating at 6 percent per year, health care

premium inflation to 2009 yields a cost of $3,730 per person. This is about 50 percent higher

than the cost of $2,350 per person newly covered in Massachusetts, which is plausible since

incomes are lower nationally than in Massachusetts. So once again CBO’s estimates are

consistent with — or perhaps a bit more conservative than — what was observed in

Massachusetts.

CBO also estimates that the revenue increases and spending cuts will exceed the new

level of spending, reducing the federal deficit by more than $100 billion in the first decade and

more than $1 trillion in the second decade. In the first decade alone this would be the most

fiscally responsible legislation passed by Congress since 1997.

Some have questioned the likelihood of this deficit reduction — claiming, for example,

that the numbers are “cooked” because some of the revenue raisers begin before 2014, whereas

the majority of spending doesn’t start until after 2014. But CBO estimates that the trend under

the law will actually be toward larger deficit reduction over time; indeed, the reduction in the

deficit is increasing in the last two years of the budget window. Thus, the cuts in spending and

increases in taxes are actually back-loaded — not front-loaded, as these critics imply.

Others have raised the possibility that the cuts that provide much of this financing will

never take place — and point to the experience with the physician-payment cuts required by the

17 Balanced Budget Act of 1997, which have been repeatedly delayed by Congress. As Van de

Water and Horney (2010) have highlighted, however, Congress has passed many Medicare cuts

over the past 20 years, and the physician-payment cut is the only one that has not taken effect.

That said, the fiscal responsibility promised by this legislation does depend on the ability of

future Congresses to hold to the reimbursement reductions and tax increases laid out in the ACA.

D. Health Care Costs

The best available projections of the impact of the ACA on the level and growth of health

care costs in the near term come from the Center for Medicaid and Medicare Services Office of

the Actuary (CMS). 10 With U.S. health care spending already accounting for 17 percent of GDP

and growing, there is also concern about policies that increase this spending. And, as the CMS

actuary points out, the ACA will increase national health care expenditures. At the peak of its

effect on spending in 2016, the law will increase health care expenditures by about 2 percent; by

2019, the ACA-related increase will be 1 percent, or 0.2 percent of GDP.

It is worth noting that these increases are quite small relative to the gains in coverage

under the new law. The CMS predicts that 34 million more people will be insured by 2019

(which is similar to the independent estimate of CBO) relative to a base of 254 million insured.

The agency also estimates that without this reform, health care costs would grow by 6.6 percent

per year between 2010–2019. So the ACA will be increasing the ranks of the insured by more

than 13 percent at a cost that is less than one sixth of one year’s growth in national health care

expenditures.

Alternatively, consider the fact that under this legislation, by 2019, the United States will

be spending $46 billion more on medical care than we do today. In 2010 dollars, this amount to

10

The discussion in this section draws on Gruber (2010).

18 only $800 per newly insured person, quite a low cost compared, for example, to the $5,050

average single premium for employer-sponsored insurance (Kaiser Family Foundation, 2010).

U.S. spending on health care is very high and a source of great concern, but it is the

growth rate of medical spending, not its level, that ultimately determines our country’s financial

well-being. If current trends persist, we will be spending an unsustainable 40 percent of our GDP

on health care by 2080, as the growth of health care costs continues to outstrip the growth rate of

the overall economy. In this environment, whether health care costs rise or fall by 1 percent or

even 5 percent is irrelevant — all we do is move the day of reckoning less than 1 year closer or

further away. Clearly, the key to the long-term viability of our health care system is to “bend the

cost curve.”

On this count, the CMS actuary’s news is (slightly) good: although the ACA will boost

medical spending somewhat, its incremental impact on spending will decrease over time (as

noted above, from 2 percent in 2016 to 1 percent in 2019). These declining estimates imply that

by the second decade the ACA will actually lower national health spending. This is due to

provisions such as the Cadillac tax, for which the definition of a high-cost plan is indexed to the

growth in overall prices in the economy, not the (projected to be higher) growth in health

insurance premiums. As a result, an increasing proportion of plans will be taxed, and more

people will shift into lower-cost insurance options in order to avoid paying the tax, lowering

national health expenditures.

19 V. CONCLUSION

The ACA is a transformative piece of legislation that, if fully implemented, will reshape

the U.S. health care system for decades to come. As such, it is very difficult to accurately predict

its impacts. In this article, I have reviewed the basis for the projections that do exist,

particularly based on the experience of Massachusetts with a similar program.

The real question is how far the ACA will go in slowing cost growth. Here, there is great

uncertainty—mostly because there is such uncertainty in general about how to control cost

growth in health care. There is no shortage of good ideas for ways of doing so, ranging from

reducing consumer demand for health care services, to reducing payments to health care

providers, to reorganizing the payment for and delivery of care, to promoting cost-effectiveness

standards in care delivery, to reducing pressure from the threat of medical malpractice claims.

There is, however, a shortage of evidence regarding which approaches will actually work—and

therefore no consensus on which path is best to follow.

In the face of such uncertainty, the ACA pursued the path of considering a range of

different approaches to controlling health care costs, from those that work on the demand side

(the Cadillac tax), to those that work on the supply side (innovative provider payment models),

and to those that promote the type of evidence-based medicine that is key to ensuring cost

effectiveness. Whether these policies by themselves can fully solve the long run health care cost

problem in the United States is doubtful. They may, however, provide a first step towards

controlling costs—and understanding what does and does not work to do so more broadly.

20 REFERENCES

America’s Health Insurance Plans, 2007. “Individual Health Insurance 2006–2007: A

Comprehensive Survey of Premiums, Availability and Benefits.” America’s Health Insurance

Plans, Washington, DC,

http://www.ahipresearch.org/pdfs/Individual_Market_Survey_December_2007.pdf.

America’s Health Insurance Plans, 2009. “Individual Health Insurance 2009: A Comprehensive

Survey of Premiums, Availability and Benefits.” America’s Health Insurance Plans, Washington,

DC, http://www.ahipresearch.org/pdfs/2009IndividualMarketSurveyFinalReport.pdf.

Cogan, John F., R. Glenn Hubbard, and Daniel Kessler, 2010. “The Effect of Massachusetts’

Health Reform on Employer-Sponsored Insurance Premiums.” Forum for Health Economics and

Policy 13 (2), Article 5.

Congressional Budget Office, 2009. “An Analysis of Health Insurance Premiums Under the

Patient Protection and Affordable Care Act.” Letter to the Honorable Evan Bayh (November 30).

Congressional Budget Office, Washington, DC, http://www.cbo.gov/doc.cfm?index=10781.

Congressional Budget Office, 2010a. The Long-Term Budget Outlook. Congressional Budget

Office, Washington, DC.

Congressional Budget Office, 2010b. “H.R. 4872, Reconciliation Act of 2010.” Letter to the

Honorable Nancy Pelosi (March 18). Congressional Budget Office, Washington, DC,

http://www.cbo.gov/ftpdocs/113xx/doc11355/hr4872.pdf.

Fronstin, Paul, 2010. “Sources of Health Insurance and Characteristics of the Uninsured:

Analysis of the March 2010 Current Population Survey.” Issue Brief No. 347. Employee

Benefits Research Institute, Washington, DC, http://www.ebri.org/pdf/briefspdf/EBRI_IB_092010_No347_Uninsured1.pdf.

Gruber, Jonathan, 2002. “Taxes and Health Insurance.” In Poterba, James M., (ed.), Tax Policy

and the Economy, Volume 16, 37–66. National Bureau of Economic Research, Cambridge, MA.

Gruber, Jonathan, 2008. “Covering the Uninsured in the United States.” Journal of Economic

Literature 46 (3), 571–606.

Gruber, Jonathan, 2010. “The Cost Implications of Health Care Reform.” New England Journal

of Medicine 362 (22), 2050–2051.

Gruber, Jonathan, 2011a. “Massachusetts Points the Way to Successful Health Care Reform.”

Journal of Policy Analysis and Management 30 (1), 184–192.

Gruber, Jonathan, 2011b. “The Tax Exclusion for Employer-Sponsored Health Insurance.”

21 National Tax Journal 64 (2), 511–530.

Gruber, Jonathan, and Micheal Lettau, 2004. “How Elastic Is The Firm’s Demand For

Health Insurance?” Journal of Public Economics 88 (7–8), 1273–1293.

Kaiser Family Foundation, 2010. “Employer Health Benefits: 2010.” Kaiser Family Foundation,

Menlo Park, CA, http://ehbs.kff.org/pdf/2010/8085.pdf.

Long, Sharon K., and Paul B. Masi, 2009. “Access and Affordability: An Update on Health

Reform in Massachusetts.” Health Affairs 28 (4), 578–587.

Long, Sharon K. and Karen Stockley, 2010. “Health Reform in Massachusetts: An Update As of

Fall 2009”. Urban Institute: June, 2010.

Massachusetts Department of Revenue, 2009. “Individual Mandate 2008 Preliminary Data

Analysis.” Massachusetts Department of Revenue, Boston MA,

http://www.mass.gov/Ador/docs/dor/News/PressReleases/2009/2008_Health_Care_Report.pdf.

Massachusetts Division of Health Care Finance and Policy, 2010. “Results from the 2009

Massachusetts Employer Survey.” Massachusetts Division of Health Care Financing and Policy,

Boston, MA, http://archives.lib.state.ma.us/bitstream/handle/2452/46958/ocn5495636292009.pdf?sequence=1.

Massachusetts Division of Health Care Finance and Policy, 2009. “Health Care In

Massachusetts: Key Indicators,” Massachusetts Division of Health Care Financing and Policy,

Boston, MA, http://www.mass.gov/Eeohhs2/docs/dhcfp/r/pubs/09/key_indicators_nov_09.pdf

Massachusetts Medical Society, 2011. 2011 Patient Access to Health Care Study, Massachusetts

Medical Society, Waltham, MA,

http://www.massmed.org/AM/Template.cfm?Section=Contacts_and_Directions&CONTENTID

=54336&TEMPLATE=/CM/ContentDisplay.cfm.

Massachusetts Taxpayers Foundation, 2009. “Massachusetts Health Reform: The Myth of

Uncontrolled Costs.” Massachusetts Taxpayers Foundation, Boston, MA, http://www.masstaxpayers.org/publications/health_care/20090501/massachusetts_health_reform

_the_myth_uncontrollable_costs.

Miller, Sarah, 2011. “The Effect of Insurance on Outpatient Emergency Room Visits: An

Analysis of the 2006 Massachusetts Health Reform.” Unpublished manuscript. University of

Illinois, Urbana-Champaign, IL.

U.S. Census Bureau, 2010. “Income, Poverty and Health Insurance Coverage in the United

States, 2009.” Current Population Report P60–238. U.S. Census Bureau, Washington, DC.

22 Van de Water, Paul N., and James R. Horney, 2010. “Health Reform Will Reduce the Deficit.”

Center on Budget and Policy Priorities, Washington, DC,

http://www.cbpp.org/cms/index.cfm?fa=view&id=3134.

23 Table 1

Sources of Health Insurance Coverage in the United States, 2009

Total Population

Private

Public

Employment-based

Direct purchase

Medicare

Medicaid

Uninsured

Source: Fronstin (2010).

People (millions)

304.3

Percentage of Population

100

194.5

169.7

27.2

93.2

43.4

47.8

50.6

63.9

55.8

8.9

30.6

14.3

15.7

16.7

24 Table 2

CBO Estimates of the Impact of the ACA

Uninsured

Employer

Non-group & other

Exchange

Medicaid

Coverage Provisions

Medicaid

Exchange Subsidies

Small Employer Tax

Credits

Gross Coverage Costs

Offsets

Spending Reductions

Revenue Increases

Gross Offsets

Population Effects in 2019 ($Million)

Baseline (No ACA)

54

162

30

0

35

Budget Effects ($Billion)

2019

Effect of the ACA

–32

–3

–5

24

16

2010–2019

97

113

4

434

464

40

214

938

–117

–108

–225

514

562

1076

Net Budgetary Impact

–15

–143

Notes: Subcomponents do not add to totals due to rounding and other small differences in

definitions.The difference between net budgetary impact and spending minus revenues is due to

these issues as well as other non-coverage provisions.

Source: CBO (2010b).

25 Figure 1

Percentage Change in Premiums against State Rank, 2006–2008

% Change in Premium, 2006-08

.166116

-.015421

1

31

Ranking by Premium Change

26 51