THE MACROECONOMICS OF HAPPINESS

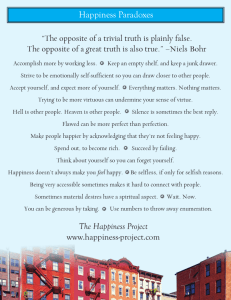

advertisement