P 3: A ’

advertisement

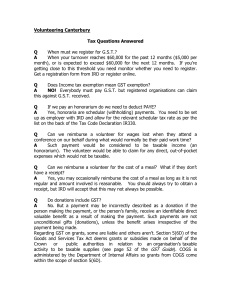

PART 3: AUSTRALIA’S FEDERAL RELATIONS This part provides information on payments for specific purposes and general revenue assistance, including GST payments, provided to the States and Territories (the States). The current framework for federal financial relations under the Intergovernmental Agreement on Federal Financial Relations (the Intergovernmental Agreement) was introduced on 1 January 2009. The Commonwealth is working in partnership with the States in a number of key reform areas benefitting all Australians. Significant progress has been made in implementing the reform agenda through the federal financial relations framework. The framework has proven to be flexible and dynamic, facilitating reform activity, including health reform, and responding to the global recession and, more recently, natural disasters. More detailed information on Australia’s Federal Relations is provided in Budget Paper No. 3, Australia’s Federal Relations 2011-12 and on the Federal Financial Relations website at www.federalfinancialrelations.gov.au. OVERVIEW OF PAYMENTS TO THE STATES The States receive substantial financial support from the Commonwealth. In 2010-11, the Commonwealth provided the States with payments totalling $98.5 billion, comprising specific purpose payments of $51.6 billion and general revenue assistance, including GST payments, of $47.0 billion, as shown in Table 24. This represents a 1.3 per cent increase in total financial assistance compared to 2009-10. Total payments to the States as a proportion total Commonwealth expenditure was 27.7 per cent in 2010-11. Table 24: Commonwealth payments to the States, 2010-11 $million NSW VIC QLD WA SA TAS ACT NT Payments for specific purposes 14,727 10,502 14,279 5,012 3,610 1,453 707 1,276 General revenue assistance 14,177 10,745 8,494 4,234 4,337 1,688 889 2,389 Total payments to the States 28,903 21,247 22,773 9,246 7,947 3,141 1,596 3,665 63 Total 51,565 46,953 98,517 Part 3: Australia's Federal Relations PAYMENTS FOR SPECIFIC PURPOSES The Commonwealth provides payments to the States for specific purposes in order to pursue policy objectives in areas that may be administered by the States. Payments to the States for specific purposes constituted 14.5 per cent of total Commonwealth expenditure in 2010-11. The Commonwealth provides the following types of Specific Purpose Payments (SPPs) to the States: • National Specific Purpose Payments (National SPPs) in respect of key service delivery sectors; • National Health Reform funding (from 1 July 2012); and • National Partnership payments — project payments, facilitation payments and reward payments. These payments cover most functional areas of state and local government activity — including health, education, community services, housing, infrastructure and the environment. National SPPs The Commonwealth supports the States’ efforts in delivering services in the major service delivery sectors though five National SPPs. These National SPPs are the primary way that the Commonwealth supports the States’ efforts in delivering services in the major sectors of health, schools, skills and workforce development, disability services and affordable housing. The States are required to spend each National SPP in the relevant sector. Payments made through the year for National SPPs are made in advance based on Commonwealth estimates of the growth factors. A balancing adjustment is made after the end of the financial year following a Determination by the Treasurer. The National SPPs are distributed among the States on the basis of payment shares specified in the Intergovernmental Agreement and population shares based on the Australian Statistician’s determination of States’ population shares as at 31 December of that year (that is, an equal per capita basis). In recognition that an immediate shift to equal per capita shares may have implications for State allocations, an equal per capita distribution is being phased in over five years from 2009-10. An equal per capita distribution of National SPPs ensures that all Australians, regardless of the jurisdiction in which they live, are provided with the same share of Commonwealth funding support for State service delivery. 64 Part 3: Australia's Federal Relations In the case of the government schools component of the National Schools SPP, the relevant population is each State’s share of full-time equivalent student enrolments in government schools. From 1 July 2012, the National Healthcare SPP will be replaced by National Health Reform funding which will comprise base funding equivalent to the National Healthcare SPP and, from 1 July 2014, efficient growth funding. These arrangements are part of the National Health Reform Agreement signed by all jurisdictions in August 2011. National Partnership payments The Commonwealth recognises the need to support the States, over and above that provided through the National SPPs, to undertake priority national reforms or collaborative projects. Under the Intergovernmental Agreement, National Partnership payments to the States are the key vehicle to support the delivery of specified projects, facilitate reforms, or reward those jurisdictions that deliver on nationally significant reforms. National Partnership agreements set out clear, mutually agreed and ambitious performance benchmarks that encourage the achievement of reforms or continuous improvement in service delivery. There are three types of National Partnership payments: project; facilitation; and reward. National Partnership project payments are a financial contribution to the States to deliver specific projects, including to improve the quality or quantity of service delivery, or projects which support national objectives. These payments are generally made on the achievement of milestones. When an area emerges as a national priority, National Partnership facilitation payments may be paid in advance of the States implementing reforms, in recognition of the administrative and other costs associated with undertaking reform. National Partnership reward payments can be used to reward those States that deliver on nationally significant reform or continuous improvement in service delivery. For reward payments, the COAG Reform Council assesses and publicly reports on the achievement of agreed performance benchmarks. The Commonwealth considers the COAG Reform Council assessments when determining reward payments to the States. Some payments for specific purposes under the previous federal financial arrangements have become National Partnership project payments. 65 Part 3: Australia's Federal Relations Total payments for specific purposes In 2010-11, the States received $51.6 billion in payments for specific purposes, a decrease of 1.8 per cent compared with the $52.5 billion the States received in 2009-10. This reflects the withdrawal of the stimulus measures put in place in response to the global financial crisis. Total payments for specific purposes, including National SPPs and National Partnership payments are shown in Table 25. Table 25: Total payments for specific purposes by category, 2010-11 $million National Specif ic Purpose Payments National Partnership Payments Total paym e nts for s pe cific pur pos e s NSW V IC QLD WA SA TA S A CT NT Total 8,494 6,400 5,229 2,656 2,087 604 417 354 26,240 6,233 4,101 9,050 2,356 1,524 849 290 922 25,325 14,727 10,502 14,279 5,012 3,610 1,453 707 1,276 51,565 Total payments for specific purposes by sector, including National SPPs and National Partnership payments are shown in Table 26. Table 26: Total payments for specific purposes by sector, 2010-11 $million Health Education Skills and Workf orce Development Community Services A f f ordable Housing Inf rastructure Environment Contingent Other Financial assistance grants to local government Total paym e nts for s pe cific pur pos e s NSW 4,374 5,423 V IC 3,263 4,009 QLD 2,678 3,313 WA 1,535 1,814 SA 1,047 1,397 TA S 594 425 A CT 202 300 NT Total 204 13,896 311 16,990 596 847 961 1,374 56 373 67 354 642 595 732 39 324 53 361 576 660 725 57 5,455 43 182 256 424 335 44 149 27 135 242 220 330 52 26 20 38 77 73 142 20 4 13 32 34 59 29 3 .. 5 19 82 528 68 7 17 11 1,718 2,754 3,519 3,735 277 6,347 239 656 492 412 246 142 67 44 30 2,089 14,727 10,502 14,279 5,012 3,610 1,453 707 1,276 51,565 Financial assistance grants to local governments The Commonwealth provided $2.1 billion in financial assistance grants to local governments in 2010-11. Table 27 provides details of these grants, which are provided to the States to be distributed to local governments in each State. An analogous payment is made to the Australian Capital Territory. Financial assistance grants are adjusted annually, based on an escalation factor that the Treasurer determines with reference to population growth and the consumer price 66 Part 3: Australia's Federal Relations index. In June 2010, the Treasurer determined an adjusted final escalation factor for 2010-11 of 1.0494. Since 2008-09, the Commonwealth has bought forward the first quarter payment from the next financial year to assist in cash management. Table 27: Financial assistance grants to local government, 2010-11 $million General purpose assistance Untied local road f unding Total NSW 469 186 656 V IC 359 132 492 QLD 292 120 412 WA 148 98 246 SA 107 35 142 TA S 33 34 67 A CT 23 21 44 NT 15 15 30 Total 1,447 642 2,089 GENERAL REVENUE ASSISTANCE General revenue assistance is a broad category of payments, including GST payments, which are provided to the States without conditions, to spend according to their own budget priorities. In 2010-11, the States received $47.0 billion in general revenue assistance from the Commonwealth, as shown in Table 28, comprising $45.9 billion in GST payments and $1.1 billion of other general revenue assistance. This represents a 5.1 per cent increase in general revenue assistance, compared with the $44.7 billion the States received in 2009-10. In 2010-11, total general revenue assistance to the States represented 13.2 per cent of total Commonwealth expenditure. Table 28: General revenue assistance, 2010-11 $million NSW V IC QLD WA SA TA S GST payments 14,158 10,736 8,494 3,236 4,337 1,688 Other general revenue assistance A CT municipal services Royalties 934 Reduced royalties 64 Snow y Hydro Ltd tax compensation 19 9 Total other general revenue assistance 19 9 998 Total general revenue assistance 14,177 10,745 8,494 4,234 4,337 1,688 A CT NT Total 853 2,385 45,887 35 - 4 - 35 938 64 - - 28 35 4 1,066 889 2,389 46,953 GST payments Reconciling GST revenue and GST payments to the States The Commonwealth makes GST payments to the States based on the revenue received from the GST. In 2010-11, GST revenue was $48.1 billion. However, GST revenue for a financial year varies from the amount of GST payments to the States for that year for several reasons including: 67 Part 3: Australia's Federal Relations • GST revenues which are recognised on a Commonwealth whole of government basis, but are not recognised because the revenues will not be remitted to the Australian Taxation Office until the following financial year; • penalties, other than general interest charge penalties, which are not included in the definition of GST to be paid to the States contained in the Intergovernmental Agreement; and • the GST component of sales by Commonwealth agencies which has been collected by those agencies but which, as at 30 June in each year, will not have been remitted to the Australian Taxation Office, because it is not due to be paid until the next Business Activity Statement is lodged. A reconciliation of GST revenue and GST payable to the States is provided in Table 29. Table 29: GST revenue and GST payable to the States, 2010-11 $million Total GST revenue less change in G ST receivab les(a) 48,093 2,010 GST receipts less non-G IC penalties collected(b ) less G ST collected b y Commonwealth agencies b ut not yet remitted to the A TO(c) 46,083 115 81 GST payable to the State s 45,887 (a) GST which is recognised on a Commonwealth whole-of-government basis, but not recognised as at 30 June of each financial year, because the revenue will not be remitted to the Australian Tax Office until the following year. (b) General interest charge (GIC) penalties are defined in the Intergovernmental Agreement as being a part of the Commonwealth’s GST revenue that is paid to the States. However, while other GST related penalties are also recognised in the Commonwealth’s GST revenue, non-GIC penalties are not defined in the Intergovernmental Agreement as being a part of the GST revenue that is paid to the States. (c) This is the GST component of sales by Commonwealth agencies which has been collected by those agencies but which, as at 30 June in each year, will not have been remitted to the Australian Taxation Office, because it is not due to be paid until the next Business Activity Statement is lodged (typically on 21 July in the following financial year). Advances of GST payments were provided to the States throughout the 2010-11 financial year based on the Commonwealth’s estimate of GST receipts at the 2011-12 Budget. GST payments to the States are expected to be $437 million higher than the advances paid during 2010-11. A balancing adjustment to compensate the States for the underpayment will be made in the 2011-12 financial year following a Determination by the Treasurer. Table 30 provides a reconciliation of GST entitlement and GST payments to the States. 68 Part 3: Australia's Federal Relations Table 30: GST payable and GST payments to the States, 2010-11 $million Total 45,887 45,450 437 GST payable to the State s less advances of GST revenues made throughout 2010-11 equals f ollow ing year balancing adjustment Distribution of GST payments among the States As agreed by COAG in the Intergovernmental Agreement, the Commonwealth distributes GST payments amongst the States in accordance with the principle of horizontal fiscal equalisation and having regard to the recommendations of the Commonwealth Grants Commission. GST relativities The Commonwealth Grants Commission recommends GST relativities to be used in calculating each State’s share of GST payments. The relativities determine how much GST revenue each State receives compared with an equal per capita share and are determined such that, if each State made the same effort to raise revenue from its own sources and operated at the same level of efficiency, each State would have the capacity to provide services at the same standard. The Treasurer made a determination on the GST Revenue sharing relativities for 2010-11 in June 2010. The relativities for 2010-11 are shown in Table 31. Table 31: GST relativities, 2010-11 2010-11 NSW V IC QLD WA SA TA S A CT NT 0.95205 0.93995 0.91322 0.68298 1.28497 1.62091 1.15295 5.07383 Applying the GST relativities to the GST pool The GST relativities were applied to estimated State populations in order to determine an adjusted population for each State. The entitlements are allocated using the population as at 31 December 2010 as determined by the Australian Statistician. Each State received its adjusted population share of the GST pool as shown in Table 31. 69 Part 3: Australia's Federal Relations Table 32: Distribution of the 2010-11 GST entitlement Population as at 31 December 2010 State revenue sharing relativities A djusted population (1) x (2) Share of GST pool $million (3) Share of adjusted population per cent (4) (1) (2) NSW V IC QLD WA SA TA S A CT NT 7,272,158 5,585,566 4,548,661 2,317,064 1,650,377 509,292 361,914 229,874 0.95205 0.93995 0.91322 0.68298 1.28497 1.62091 1.15295 5.07383 6,923,458 5,250,153 4,153,928 1,582,508 2,120,685 825,516 417,269 1,166,342 30.9 23.4 18.5 7.1 9.5 3.7 1.9 5.2 14,157.7 10,736.0 8,494.3 3,236.1 4,336.6 1,688.1 853.3 2,385.0 Total 22,474,906 N/A 22,439,859 100.0 45,887.0 (5) Table 33 provides a summary of advances made in 2010-11 against their estimated final entitlement shown in Table 32 above. The variance between advances paid in 2010-11 and the States’ determined entitlement will be provided in the 2011-12 financial year. Table 33: Summary of advances made in 2010-11 and distribution of following year adjustment across States NSW V IC QLD WA SA TA S A CT NT Total GST entitlement 14,157.7 10,736.0 8,494.3 3,236.1 4,336.6 1,688.1 853.3 2,385.0 45,887.0 2010-11 adv anc e 14,023.4 10,629.5 8,413.6 3,202.1 4,296.1 1,671.7 841.8 2,372.0 45,450.0 Follow ing y ear adjus tment 134.3 106.5 80.7 34.0 40.5 16.4 11.5 13.1 437.0 GST administration costs The Commissioner of Taxation administers the GST law and the States compensate the Commonwealth for the agreed costs incurred by the Australian Taxation Office in administering the GST as shown in Table 34. Table 34: GST administration, 2010-11 A ctual 2009-10 $million 2010-11 A ustralian Taxation Of f ice budget less prior year adjustment 590.1 27.3 666.6 -8.2 equals State government administration payments less A ustralian Taxation Of f ice outcome(a) 562.8 598.3 674.8 659.4 equa l s Com m onw e alth budge t im pact plus prior year adjustment -35.5 27.3 15.4 -8.2 -8.2 7.2 equals f ollow ing year adjustment (a) Estimated outcome for 2010-11 pending confirmation by the Australian National Audit Office. On 7 April 2011, the Ministerial Council for Federal Financial Relations agreed to a GST administration budget of $666.6 million. 70 Part 3: Australia's Federal Relations The estimated outcome for the 2010-11 GST administration expenses of $659.4 million differs from the amount paid by the States and the prior year adjustment by $7.2 million. Once the outcome for GST administration costs in 2010-11 is audited, any adjustment required will be incorporated into the States’ administration costs for 2011-12. 71 Part 3: Australia's Federal Relations Attachment A PAYMENTS TO THE STATES This attachment provides information on Commonwealth payments to the States and local governments on an accruals basis. This includes Commonwealth advances (loans) to the States, including repayments of advances and interest on advances. Most of these advances were funded from borrowings made on behalf of the States under previous Australian Loan Council arrangements. The following tables detail payments to the States for 2010-11: Table 35 — health; Table 36 — education; Table 37 — skills; Table 38 — community services; Table 39 — affordable housing; Table 40 — infrastructure; Table 41 — environment; Table 42 — contingent liabilities; Table 43 — other purposes; Table 44 — general revenue assistance; Table 45 — advances, repayment of advances and interest payments; and Table 46 — payments presented on the Australian Bureau of Statistics Government Finance Statistics (GFS) functional basis. 72 $'000 Natio nal He alth car e SPP Natio nal Par tn e r s h ip p aym e n ts Natio n al He alth Re fo r m Improv ing Public Hos pital Serv ic es Flex ible f unding f or emergenc y departments , elec tiv e s urgery and s ubac ute c are Four hour national ac c es s target f or emergenc y departments - c apital f unding - f ac ilitation and rew ard f unding Improv ing ac c es s to elec tiv e s urgery - c apital f unding - f ac ilitation and rew ard f unding New s ubac ute beds guarantee f unding Clo s in g th e Gap - No r th e r n T e r r ito r y Indigenous health and related s erv ic es He alth in fr as tr uctu r e Health and Hos pitals Fund Hos pital inf ras truc ture and other projec ts of national s ignif ic anc e National c anc er s y s tem Regional priority round V IC 2,910,696 19,568 22,856 43,487 18,849 68,125 43,650 - 8,500 10,426 - NSW 3,935,654 24,658 28,965 48,458 23,515 96,916 47,175 - 73 2,000 10,560 - 25,611 - - 16,066 60,955 35,175 19,214 30,477 16,533 QLD 2,382,259 132,100 8,790 - - 13,748 36,498 18,075 16,170 14,140 16,293 WA 1,224,586 12,170 - - 3,244 12,750 8,100 7,264 SA 958,359 Table 35: Payments for specific purposes to support state health services, 2010-11 9,000 2,584 170,000 - 4,354 8,104 4,275 3,882 3,992 3,756 T AS 263,562 13,237 - - 1,688 4,789 658 1,669 1,013 3,303 ACT 165,966 3,200 - 5,674 3,584 3,098 1,575 2,873 1,549 2,915 NT 149,440 154,800 83,378 170,000 5,674 85,048 278,486 163,333 95,629 151,216 94,290 To tal 11,990,522 Part 3: Australia’s Federal Relations $'000 He alth in fr as tr u ctu r e (co n tin u e d ) Other Health inf ras truc ture pay ments Cairns integrated c anc er c entre Children’s c anc er c entre, A delaide Contribution tow ards the new Women's and Children’s Hos pital in Hobart Funding f or Graf ton Hos pital PET s c anner f or the Wes tmead Hos pital, Sy dney Tas manian health pac kage Patient trans port and ac c omodation s erv ic es Radiation onc ology s erv ic es in North/North Wes t Tas mania Upgrading patient ac c ommodation f or Launc es ton He alth s e r vice s Early interv ention pilot program Ex tens ion of the COA G Long Stay Older Patients Initiativ e Healthy kids health c hec ks National antimic robial utilis ation s urv eillanc e program National bow el c anc er s c reening National Perinatal Depres s ion Initiativ e V IC - - 9,520 358 444 - NSW - 1,000 1,300 - 74 500 12,990 - 357 - 3,400 370 - - - - - - 2,000 - QL D 183 - - - - - - - - - WA 300 143 445 3,330 143 - - - - - - 8,000 SA 106 - 495 94 - 500 2,664 2,300 - 100,000 - - T AS Table 35: Payments for specific purposes to support state health services, 2010-11 (continued) 89 - 300 68 - - - - - - - ACT 76 - 93 - - - - - - - NT 300 1,398 445 30,035 1,126 500 500 2,664 2,300 1,300 100,000 1,000 2,000 8,000 T o tal Part 3: Australia’s Federal Relations $'000 Health services (continued) Northern Territory medical school — funding contribution Pneumococcal disease surveillance OzFoodNet Satellite renal dialysis facilities in remote Northern Territory communitites Sexual assault counselling in remote Northern Territory areas Torres Strait health protection strategy Reducing acute rheumatic heart fever among Indigenous children Royal Darw in Hospital — equipped, prepared and ready Vaccine-preventable diseases surveillance Victorian cytology service Preventive health Enabling infrastructure Healthy communities Social marketing Other East Kimberley development package — health-related projects Elective surgery w aiting list reduction plan 29,037 37,614 - - - - - 1,240 1,513 1,487 - - 1,632 1,651 1,959 - - 7,334 237 322 - VIC NSW 75 23,144 - 1,000 1,513 1,199 - - 792 714 - 237 QLD 12,606 6,260 504 1,100 606 - - 795 - - 184 WA 10,563 - 376 825 451 115 - - - - - 6 184 SA 4,622 - 116 413 140 - - - - - -2 171 TAS Table 35: Payments for specific purposes to support state health services, 2010-11 (continued) 3,582 - 80 275 97 - - - - - 129 ACT 2,833 - 52 550 62 - 14,212 795 1,386 - 272 532 134 NT 124,000 6,260 5,000 7,840 6,001 115 7,334 14,212 2,382 1,386 714 272 532 4 1,598 Total Part 3: Australia’s Federal Relations $'000 NSW VIC QLD WA Other (continued) Essential vaccines 91,765 64,939 50,406 29,291 Indigenous early childhood development — antenatal and reproductive health 5,340 1,107 6,126 2,800 Indigenous mobile dental program 728 4,373,974 3,263,373 2,678,276 1,534,729 Total Memorandum item - payments direct to local governments included in payments above Healthy communities 1,651 1,513 1,513 1,100 1,651 1,513 1,513 1,100 Total TAS 8,259 525 593,912 413 413 SA 18,843 935 1,046,546 825 825 Table 35: Payments for specific purposes to support state health services, 2010-11 (continued) 275 275 200 202,111 4,968 ACT 550 550 4,390 203,549 4,254 NT 7,840 7,840 21,423 728 13,896,470 272,725 Total Part 3: Australia’s Federal Relations 76 $'000 Natio n al Sch o o ls SPP Natio n al Par tn e r s h ip p aym e n ts Clos ing the Gap in the Northern Territory Quality teac hing, ac c elerated literac y Supporting remote s c hools — additional teac hers Teac her hous ing Digital Educ ation Rev olution Early Childhood Educ ation — univ ers al ac c es s to early educ ation Eas t Kimberley dev elopment pac kage — educ ation-related projec ts Educ ation Inv es tment Fund Fort Street High Sc hool nois e ins ulation Indigenous early c hildhood dev elopment — c hildren and f amily c entres Nation Building and Jobs plan — Building the Educ ation Rev olution — Primary s c hools f or the 21s t c entury National quality agenda f or early c hildhood educ ation and c are National Solar Sc hools Program Pre-apprentic es hip training Sc hool Pathw ay s Progam V IC 2,634,104 23,924 19,303 6,076 1,252,302 1,343 50 900 - NSW 3,377,934 31,720 26,869 10,698 3,000 16,071 1,704,113 77 2,887 4,317 - 1,016 3,038 - 983,476 - - 29,488 21,248 - QL D 2,143,148 1,217 3,480 384 628,516 4,270 10,660 11,000 - 9,700 9,324 - WA 1,075,651 732 3,493 559 467,457 - - 6,596 7,541 - SA 831,760 Table 36: Payments for specific purposes to support state education services, 2010-11 105 4,360 - 148,416 - - 1,940 2,059 - T AS 244,131 30 275 - 89,475 4,272 - 1,164 1,902 - ACT 187,321 417 20 - 85,611 11,163 - 1,940 29,200 4,196 2,228 16,290 NT 142,278 7,747 50 19,883 943 5,359,366 41,852 10,660 21,698 3,000 97,000 29,200 4,196 99,946 16,290 T o tal 10,636,327 Part 3: Australia’s Federal Relations VIC 2,369 8,646 9,391 37,618 12,744 4,008,770 NSW 2,836 10,886 46,814 81,078 103,744 5,422,967 6,710 48,522 29,931 45,280 3,312,563 QLD 706 78 1,810,052 9,143 409,843 2,369 2,800 2,234,207 2,193,195 11,598 530,497 2,836 30,926 2,769,052 299,922 706 9,308 1,756,371 1,438,773 7,662 (a) Non-government schools payments are inclusive of GST. (b) This payment includes payments paid under the Schools Assistance Act 2008. National Schools SPP(b) Digital Education Revolution Nation Building and Jobs plan — Building the Education Revolution — Primary schools for the 21st century Secure Schools Program Trade training centres in schools Total Memorandum item - payments for non- government sc hools inc luded in payments above(a) $'000 Secure Schools Program Smarter Schools Improving teacher quality Literacy and numeracy Low SES school communities Trade training centres in schools Total SA 60 191,147 647 7,471 920,970 718,692 3,013 126,316 60 2,993 694,925 562,697 2,859 3,444 2,485 11,172 14,136 13,223 21,833 31,351 39,914 1,814,039 1,396,566 WA 647 35,311 1,495 185,485 148,317 362 807 3,096 9,584 10,055 424,553 TAS - Table 36: Payments for specific purposes to support state education services, 2010-11 (continued) 31,054 281 11,875 178,255 134,238 807 608 1,921 410 11,899 299,558 ACT 281 21,037 1,500 103,737 79,644 1,556 415 3,410 9,584 3,987 310,739 NT - 1,645,127 6,899 68,368 8,843,002 7,085,608 37,000 34,001 138,462 203,261 258,974 16,989,755 Total 6,899 Part 3: Australia’s Federal Relations $'000 National Sk ills & Wor k for ce De ve lopm e nt SPP National Par tne r s hip paym e nts Better TA FE f ac ilities National Dis as ter Queens land — Community Work Plac ements Produc tiv ity Plac es Program TA FE f ee w aiv ers f or c hildc are qualif ic ations Y outh attainment and trans itions — Max imis ing engagement, attainment and s uc c es s ul trans itions Total V IC 331,870 -8 5,587 17,040 354,489 NSW 443,273 139,037 4,971 8,493 595,774 5,595 360,581 2,814 4,750 85,881 - 261,541 QLD 2,811 182,005 797 43,692 - 134,705 WA Table 37: Payments for specific purposes to support skills services, 2010-11 1,937 135,269 580 32,481 - 100,271 SA 606 38,495 396 6,339 -1 31,155 TAS 662 31,942 1,291 7,331 - 22,658 ACT 358 19,034 128 4,663 - 13,885 NT 37,502 1,717,589 16,564 4,750 319,424 -9 1,339,358 Total Part 3: Australia’s Federal Relations 79 $'000 Natio n al Dis ab ility SPP Natio n al Par tn e r s h ip p aym e n ts Trans itioning res pons ibilities f or aged c are and dis ability s erv ic es Bas ic c ommunity c are maintenanc e and s upport s erv ic es A ged c are as s es s ment Certain c onc es s ions f or pens ioners and s eniors c ard holders Certain c onc es s ions f or pens ioners National rec iproc al trans port c onc es s ions Clos ing the Gap in the Northern Territory Community s af ety — f amily s upport Field operations Food s ec urity Remote polic ing Subs tanc e abus e Home and Community Care — s erv ic es f or v eterans V ic torian bus hf ire rec ons truc tion and rec ov ery plan T o tal V IC 246,983 305,089 15,754 60,795 1,732 4,251 6,930 641,534 NSW 349,294 375,459 24,646 85,038 6,255 6,254 80 846,946 575,640 3,682 - 4,001 42,452 311,171 12,791 QL D 201,543 255,782 1,428 - 429 21,375 130,905 7,345 WA 94,300 241,782 1,455 - 387 24,186 109,427 5,096 SA 101,231 Table 38: Payments for specific purposes to support community services, 2010-11 76,536 568 - 119 7,767 34,720 1,913 T AS 31,449 33,752 273 - 179 1,725 15,217 706 ACT 15,652 82,327 47 4,726 2,907 370 44,796 6,968 77 1,181 8,906 857 NT 11,492 6,930 2,754,299 17,958 4,726 2,907 370 44,796 6,968 13,179 244,519 1,290,894 69,108 T o tal 1,051,944 Part 3: Australia’s Federal Relations $'000 Natio n al Affo r d ab le Ho u s in g SPP Natio n al Par tn e r s h ip p aym e n ts Eas t Kimberley dev elopment pac kage — s oc ial and trans itional hous ing projec ts Firs t Home Ow ners Boos t Homeles s nes s Nation Building and Jobs Plan — s oc ial hous ing Sec ond s tage c ons truc tion Repairs and maintenanc e Remote Indigenous hous ing T o tal V IC 276,746 86,722 24,938 203,154 -1 3,156 594,715 NSW 387,938 32,018 35,176 482,561 22,885 960,578 302,568 70,176 659,999 15,117 32,090 QL D 240,048 155,479 85,855 424,039 20,640 19,394 15,919 WA 126,752 84,855 19,381 220,207 11,288 9,613 SA 95,070 Table 39: Payments for specific purposes to support affordable housing services, 2010-11 29,744 2,137 73,052 3,171 4,455 T AS 33,545 22,459 59,089 9,114 2,336 ACT 25,180 13,180 471,399 527,623 518 5,974 NT 36,552 1,294,000 -1 674,989 3,519,302 20,640 177,342 130,501 T o tal 1,221,831 Part 3: Australia’s Federal Relations 81 $'000 NSW Natio n al Par tn e r s h ip p aym e n ts Eas t Kimberley dev elopment pac kage — other inf ras truc ture projec ts Inters tate road trans port 35,216 Loc al Gov ernment and Regional Dev elopment Inf ras truc ture employ ment projec ts Loc al c ommunity s porting inf ras truc ture 2,150 Nation Building Program Inv es tment Rail Road 703,363 Blac k s pot projec ts 11,177 Of f -netw ork projec ts Rail Road 22,905 Supplementary 4,408 Improv ing the national netw ork Heav y v ehic le s af ety and produc tiv ity 3,176 Roads to Rec ov ery 91,188 Nation Building Plan f or the Future Major Cities Rail Building A us tralia Fund Rail Road 432,000 North Penrith Thornton Park Car Park 1,810 Regional and Loc al Community Inf ras truc ture Program 65,487 Regional Inf ras truc ture Fund Stream 1 - Committed inf ras truc ture projec ts 1,400 QL D 7,256 8,400 - 490,488 12,078 68,544 4,389 16,135 565 76,540 28,648 10,000 V IC 20,491 250 - 19,399 269,467 12,227 3,000 14,511 8,686 68,716 - 82 247,000 68,335 - - 25,376 - 30,200 30,000 14,016 90 3,133 51,177 157,462 5,502 3,500 - 11,299 3,032 WA - 17,610 147,100 - - 1,100 7,944 3,524 34,922 84,479 5,621 2,633 - 9,234 SA 3,691 - 382 T AS - 5,564 - - 1,864 10,641 90 17,640 998 10,964 12,580 76,501 1,224 Table 40: Payments for specific purposes to support state infrastructure services, 2010-11 - 1,815 - - 16,467 467 8,120 448 966 - 382 ACT - 6,109 - - 10,723 720 8,319 40,209 1,589 - 382 NT 11,400 218,944 394,100 432,000 1,810 30,200 34,864 157,807 10,077 41,719 21,269 349,946 31,979 1,822,417 50,384 18,474 2,150 11,299 76,375 T o tal Part 3: Australia’s Federal Relations VIC 732,082 NSW 1,374,280 724,722 - 1,679 QLD East Kimberley development package — other infrastructure projects Local Government and Regional Development Infrastructure employment projects Local community sporting infrastructure 2,150 Nation Building Program Off-netw ork projects Rail Road 2,279 Supplementary 4,408 Roads to Recovery 91,188 North Penrith Thornton Park Car Park 1,810 Regional and Local Community Infrastructure Program 65,487 167,322 Total 83 59,060 4,389 76,540 28,648 173,037 68,335 140,296 4,400 - 250 - 3,000 68,711 - - - Memorandum item - payments direc t to loc al governments inc luded in payments above $'000 Seamless National Economy National Heavy Vehicles Transport Regulator National Rail Transport Safety Regulator Supplementary road funding to South Australia for local roads Total 25,376 89,112 6,970 90 51,177 - - 5,499 334,787 - - WA 17,610 52,085 31,842 - 2,633 - - 15,566 330,298 565 - SA 5,564 19,809 2,000 90 10,964 - 1,191 - - 142,139 - - TAS 1,815 1,815 - - - 28,665 - - ACT Table 40: Payments for specific purposes to support state infrastructure services, 2010-11 (continued) 6,109 10,137 4,028 - - - 68,051 - - NT 218,944 653,613 3,000 70,309 8,977 334,450 1,810 8,474 2,150 5,499 15,566 3,735,024 565 1,679 Total Part 3: Australia’s Federal Relations $'000 NSW V IC QL D WA Natio n al Par tn e r s h ip p aym e n ts Bioremediation and rev egetation Caring f or our Country 35,251 27,520 23,020 24,103 Env ironmental management of the f ormer Rum Jungle mine s ite Ex otic Dis eas e Preparednes s Program 266 27 108 6 Great A rtes ian Bas in Sus tainability Initiativ e 955 Natural dis as ter rec ov ery and rebuilding relief appeals — Commonw ealth c ontributions 1,000 11,000 1,000 Natural dis as ter res ilienc e 6,904 4,037 6,055 3,149 Plant dis eas e and eradic ation 2,595 517 Renew able remote pow er generation -36 12,567 Water f or the Future National Urban Water and Des alination Plan 5,000 National Water Sec urity Plan f or Cities and Tow ns 1,566 692 1,644 Sus tainable Rural Water Us e and Inf ras truc ture 11,330 1,338 13,049 990 56,272 38,886 56,519 43,976 T o tal Memorandum item - payments direc t to loc al governments inc luded in payments ab ove Water f or the Future 1,566 1,566 T o tal T AS 11,114 - 1,495 350 3,896 3,056 19,911 3,896 3,896 SA 4,702 17,346 6 367 2,885 1,264 202 350 1,250 23,366 51,738 1,350 1,350 Table 41: Payments for specific purposes to support state environmental services, 2010-11 84 - 267 3,101 - - 1,460 - 15 - 1,359 ACT - 112 6,974 - - 381 1,594 1,200 - 3,687 NT 6,812 6,812 53,508 277,377 9,048 5,350 13,000 26,366 4,376 14,677 1,200 428 1,322 4,702 143,400 T o tal Part 3: Australia’s Federal Relations $'000 NSW V IC QLD WA SA TAS ACT NT Total National Par tne r s hip paym e nts Ex c eptional Circ ums tanc es A s s is tanc e 143,306 52,271 12,038 22,891 -9 230,497 Hepatitis C s ettlement f und 315 40 355 Natural dis as ter rec ov ery and rebuilding(a) 229,784 271,266 5,442,857 148,638 3,095 3,530 16,608 6,115,777 373,405 323,537 5,454,895 148,638 25,986 3,521 40 16,608 6,346,629 Total (a) Actual cash paid in 2010-11 under the Natural Disaster Relief and Recovery Arrangements (NDRRA) was $2,758.4 million. The figures in the table above include a provision for amounts expected to be paid under the NDRRA in future periods. Table 42: Contingent payments to the States, 2010-11 Part 3: Australia’s Federal Relations 85 $'000 Natio n al Par tn e r s h ip p aym e n ts Digital Regions Initiativ e Improv ing polic ing in v ery remote areas Legal as s is tanc e s erv ic es Loc al Gov ernment and Regional Dev elopment Loc al Gov ernment Ref orm Fund Nativ e title Pilot of drought ref orm meas ures in Wes tern A us tralia Remote Indigenous public internet ac c es s Sinking f und on State debt Standard Bus ines s Reporting Program Tas manian f ores t c ontrac tors f inanc ial s upport program World Sailing Champions hips T o tal V IC 2,472 42,415 1,505 6,000 3 487 52,882 NSW 4,924 60,279 813 155 21 788 66,980 Table 43: Payments to support other state services, 2010-11 43,086 440 712 - 1,876 - 40,058 QL D 2,000 27,243 757 780 1,060 1,352 - 1,082 1,000 19,212 WA 19,774 116 2 876 - 1,735 - 2,099 14,946 SA 5,616 13,375 768 - 356 - 899 5,736 T AS 4,973 540 - 142 - 4,291 ACT 11,096 758 540 - 338 - 5,600 3,860 NT 5,616 2,000 239,409 2,226 26 5,491 1,060 8,117 6,000 17,076 1,000 190,797 T o tal Part 3: Australia’s Federal Relations 86 $'000 Natio n al Par tn e r s h ip p aym e n ts GST Pay ments A CT Munic ipal Serv ic es Reduc ed roy alties Roy alties Snow y Hy dro Ltd tax c ompens ation Total QL D 8,494,318 8,494,318 V IC 14,157,697 10,735,975 18,922 9,461 14,176,619 10,745,436 NSW SA T AS 3,236,052 4,336,563 1,688,089 64,152 933,645 4,233,849 4,336,563 1,688,089 WA Table 44: General revenue assistance payments to the States and Territories, 2010-11 NT 853,268 2,385,038 35,438 4,000 888,706 2,389,038 ACT 45,887,000 35,438 64,152 937,645 28,383 46,952,618 T o tal Part 3: Australia’s Federal Relations 87 $'000 Re paym e n ts Contingent liabilities Hous ing Commonw ealth-State Hous ing A greement loans Hous ing f or s erv ic e pers onnel Other hous ing Pay ments to debt s inking f unds Inf ras truc ture Railw ay projec ts Sew erage War s erv ic e land s ettlement s c heme Other purpos es A us tralian Capital Territory debt repay ments Loan Counc il — hous ing nominations V IC -1,264 -61 -328 - NSW -35,293 -1,185 -106 -61 -5,095 -292 -7,195 -2,647 -1,314 - -9,459 -721 - QLD -4,590 -389 - -8,933 -208 - WA -4,309 -838 - -12,955 -35 -119 SA -1,929 - -4,739 - TAS -1,813 - - -7,368 - ACT NT -2,395 - -664 -2,354 - Table 45: Other financial flows — estimated advances, repayment of advances and interest payments, 2010-11 -1,813 -23,065 -511 -7,247 -620 -72,043 -2,149 -9,722 -1,489 Total Part 3: Australia’s Federal Relations 88 $'000 Interest Contingent liabilities Natural disaster relief Environment Northern Territory — w ater and sew erage assistance Housing Commonw ealth-State Housing Agreement loans Housing for service personnel Other housing Infrastructure Railw ay projects Sew erage War service land settlement scheme Other purposes Australian Capital Territory debt repayments Loan Council — housing nominations Net Financial Flow VIC - - -12 -5 -22 -1,692 NSW -125 - -34,654 -2,175 -5 -3,027 -22 -19,515 -108,750 89 -7,019 -34,797 -793 - -9,656 -1,227 - - -1,961 QLD -12,000 -35,735 -156 - -9,220 -239 - - - WA -11,811 -45,901 -649 - -15,090 -95 - - - SA -5,177 -16,580 - -4,735 - - - TAS -977 -18,487 - -8,329 - - ACT -6,807 -18,054 - -1,318 -4,148 -368 - NT -977 -62,329 -279,996 -166 -4,469 -44 -74,685 -3,736 -12,477 -368 -2,086 Total Table 45: Other financial flows — estimated advances, repayment of advances and interest payments, 2010-11 (continued) Part 3: Australia’s Federal Relations 90 V IC QLD 7,952,662 246,424 25,242,412 18,267,963 20,367,648 141,809 170,539 412,452 956,213 90,212 491,619 655,560 1,818,401 780 20,859 1,989,910 1,534,729 261,269 466,090 2,000 12,567 4,217 296,451 4,656,639 9,245,511 WA 174,550 2,345,932 2,834,843 788 487 712 63,115 44,784 40,764 5,996,947 4,353,421 3,666,672 4,374,289 3,263,373 2,678,276 865,904 648,023 576,656 1,002,733 633,452 697,474 2,150 14 157,423 58,636 28,482 1,309,912 665,969 688,114 4,750 15,130,093 11,579,164 14,391,151 28,903,354 21,247,323 22,773,051 NSW (a) Payments for ‘Other purposes’ includes general revenue assistance to the States. less payments 'through' the States less f inancial assistance grants f or local government less payments direct 'to' local government equals total payments 'to' the States f or ow n-purpose expenses General public services Public order and saf ety Education Health Social security and w elf are Housing and community amenities Recreation and culture Fuel and energy A griculture, f orestry and f ishing Mining, manuf acturing and construction Transport and communication Other economic af f airs Other purposes Total paym e nts to the State s $'000 Table 46: Total payments to the States by GFS function, 2010-11 7,015,987 54,260 142,070 734,483 876 15,006 1,531,043 1,046,546 242,514 247,773 202 49,494 296,704 4,516,642 7,946,800 SA 2,857,279 24,118 67,035 192,185 768 5,736 462,943 593,912 76,641 89,352 350 12,559 133,783 1,764,573 3,140,617 TAS 1,351,666 2,090 43,775 198,181 540 4,572 326,917 202,151 38,054 61,908 282 26,850 934,438 1,595,712 ACT 3,513,392 10,687 29,932 110,960 540 55,624 318,193 203,549 42,143 532,891 1,594 112 68,300 2,442,025 3,664,971 NT 86,569,009 668,265 2,088,867 9,191,198 5,491 250,460 18,646,046 13,896,825 2,751,204 3,731,673 4,150 14,727 311,205 3,486,083 4,750 55,414,725 98,517,339 Total(a) Part 3: Australia’s Federal Relations