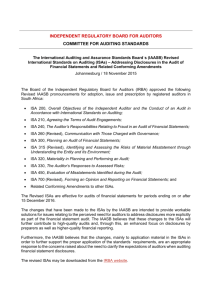

O ISA A E

advertisement