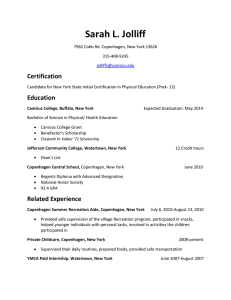

Representing Uncertainty by Probability and Possibility ‐ What’s the Difference?

advertisement

Representing Uncertainty

by Probability and Possibility

‐ What’s the Difference?

Presentation at

Palisade 2011 Risk Conference

Amsterdam, March 29‐30, 2011

Hans Schjær‐Jacobsen

Professor, Director RD&I

Copenhagen University College of Engineering

Ballerup, Denmark

+45 4480 5030

hsj@ihk.dk

www.ihk.dk

Palisade 2011 Risk

Conference

Copenhagen University College of

Engineering

1

Agenda

1. Why do we need uncertainty management?

2. Alternative representations of uncertainty

3. Some principles of New Budgeting

4. Introducing uncertainty in the cost model

5. Numerical examples

6. Resumé and perspectives

Palisade 2011 Risk

Conference

Copenhagen University College of

Engineering

2

1. Why do we need uncertainty management?

Palisade 2011 Risk

Conference

Copenhagen University College of

Engineering

3

Cost overruns and demand shortfalls

in urban rail

• Average cost escalation for urban rail projects is 45% in

constant prices

• For 25% of urban rail projects cost escalations are at least 60%

• Actual ridership is on average 51% lower than forecast

• For 25% of urban rail projects actual ridership is at least 68%

lower than forecast

(Flyvbjerg 2007)

Palisade 2011 Risk

Conference

Copenhagen University College of

Engineering

4

2. Alternative representations of uncertainty

Palisade 2011 Risk

Conference

Copenhagen University College of

Engineering

5

Two worlds of risk and uncertainty

Uncertainty

Imprecision

Ignorance

Lack of knowledge

Statistical nature

Randomness

Variability

Palisade 2011 Risk

Conference

World

Representation

and calculation

Possibility

Possibility distributions

[a; …; b]

Interval arithmetic

Global optimisation

Probability

Probability distributions

{µ; σ}

Linear approximation

Monte Carlo simulation

Copenhagen University College of

Engineering

6

Rectangular representation [a; b] and {µ; σ}

Alternative

interpretations

Possibility

distribution [a; b]

Probability

distribution {µ; σ}

1

h

h = 1/(b-a)

μ = (a+b)/2

σ2 = (b-a)2/12

0

Palisade 2011 Risk

Conference

a

Copenhagen University College of

Engineering

b

0

7

Trapezoidal representation [a; c; d; b] and {µ; σ}

Alternative

interpretations

Possibility

distribution [a; c; b]

Probability

distribution {µ; σ}

1

α

0

Palisade 2011 Risk

Conference

h

h = 2/(b-a+d-c)

μ = h((b3-d3)/(b-d)-(c3-a3)/(c-a))/6

σ2 = (3(r+2s+t)4+6(r2+t2)(r+2s+t)2

-(r2-t2)2)/(12(r+2s+t))2

α-cut

r

a

s

c

t

d

Copenhagen University College of

Engineering

b

0

8

Triangular representation [a; c; b] and {µ; σ}

Alternative

interpretations

Possibility

distribution [a; c; b]

Probability

distribution {µ; σ}

1

h

h = 2/(b-a)

μ = (a+b+c)/3

σ2 = (a2+b2+c2-ab-ac-bc)/18

α

0

Palisade 2011 Risk

Conference

α-cut

a

c

Copenhagen University College of

Engineering

b

0

9

Independent stochastic variables

Intervals

Triple estimates

{μ; σ} = {μ1; σ1} # {μ2; σ2}

[a; b] = [a1; b1] # [a2; b2]

[a; c; b] = [a1; c1; b1] # [a2; c2; b2]

μ = μ1 + μ2;

a = a1 + a2;

σ2 = σ12 + σ22

b = b1 + b2

μ = μ1 - μ2;

a = a1 - b2;

σ2 = σ12 + σ22

b = b1 - a2

μ = μ1·μ2;

a = min(a1a2, a1b2, b1a2, b1b2);

σ2 ≅ σ12·μ22 + σ22·μ12

b = max(a1a2, a1b2, b1a2, b1b2)

μ = μ1/μ2;

a = min(a1/b2, a1/a2, b1/b2, b1/a2,);

σ2 ≅ σ12/μ22 + σ22·μ12/μ24,

b = max(a1/b2, a1/a2, b1/b2, b1/a2),

if μ2 ≠ 0

if 0 ∉ [a2; b2]

Addition

Subtraction

Multiplication

Division

a = a1 + a2;

c = c1 + c2;

b = b1 + b2

a = a1 - b2;

c = c 1 - c2 ;

b = b 1 - a2

a = min(a1a2, a1b2, b1a2, b1b2);

c = c1c2;

b = max(a1a2, a1b2, b1a2, b1b2)

a = min(a1/b2, a1/a2, b1/b2, b1/a2,);

c = c1/c2;

b = max(a1/b2, a1/a2, b1/b2, b1/a2),

if 0 ∉ [a2; b2]

Table 1. Formulas for basic calculations with alternative representations of uncertain variables.

Palisade 2011 Risk

Conference

Copenhagen University College of

Engineering

10

Modelling by possibility distributions

i.e. intervals, fuzzy intervals, etc.

The actual economic problem is modelled by a function Y of n uncertain

variables Y = Y(X1, X2,…, Xn).

NB: Function can be arranged in different ways.

In case of intervals

Y is calculated by means of interval arithmetic (only applicable in the simple

case) or global optimisation (applicable in the general case).

In case of triple estimates

Extreme values of Y are calculated as above.

In case of fuzzy intervals

As above, for all α‐cuts.

Palisade 2011 Risk

Conference

Copenhagen University College of

Engineering

11

Modelling by probability distributions

The actual economic problem is modelled by a function Y of n independent

uncertain variables Y = Y(X1, X2,…, Xn).

Linear approximation

Y is approximated by means of a Taylor series

Y ≅ Y(μ1,…, μn) + ∂Y/∂X1∙(X1‐μ1) + ∂Y/∂X2∙(X2‐μ2) + … + ∂Y/∂Xn∙(Xn‐μn),

where ∂Y/∂Xi is the partial derivative of Y with respect to Xi calculated at (μ1,…,

μn).

The expected value is given by

E(Y) = μ = Y(μ1,…, μn).

The variance is approximated by

VAR(Y) = σ2 ≅ (∂Y/∂X1)2∙σ12 +…+ (∂Y/∂Xn)2∙σn2.

Palisade 2011 Risk

Conference

Copenhagen University College of

Engineering

Monte Carlo

simulation

12

Y = X(1-X), X = [0; 1]

30

25

pdf

20

Monte Carlo simulation

X = RiskUniform(0; 1)

Y = {0,167; 0,075}

15

10

Global optimisation

X = [0; 1]

Y = [0; 0,25]

(Normalised as pdf)

5

0

0,00

0,05

0,10

0,15

0,20

0,25

Y = X(1-X)

Palisade 2011 Risk

Conference

Copenhagen University College of

Engineering

13

Sum of 10 identical rectangular cost elements [7; 15]

0,06

0,05

Independent variables

Monte Carlo simulation

N{110; 7,3}

pdf

0,04

Fuzzy variables

Fuzzy arithmetic

[70; 150]

(normalized as pdf)

0,03

0,02

0,01

0,00

60

70

80

90

100

110

120

130

140

150

160

Sum

Palisade 2011 Risk

Conference

Copenhagen University College of

Engineering

14

Sum of 10 identical trapezoidal cost elements [7; 9; 11; 15]

0,08

0,07

Independent variables

Monte Carlo simulation

N{106; 5,4}

0,06

pdf

0,05

Fuzzy variables

Fuzzy arithmetic

[70; 90; 110; 150]

(normalized as pdf)

0,04

0,03

0,02

0,01

0,00

70

80

90

100

110

120

130

140

150

Sum

Palisade 2011 Risk

Conference

Copenhagen University College of

Engineering

15

Sum of 10 identical triangular cost elements [7; 10; 15]

0,08

0,07

Independent variables

Monte Carlo simulation

N{107; 5,2}

0,06

pdf

0,05

Fuzzy variables

Fuzzy arithmetic

[70; 100; 150]

(normalized as pdf)

0,04

0,03

0,02

0,01

0,00

70

80

90

100

110

120

130

140

150

Sum

Palisade 2011 Risk

Conference

Copenhagen University College of

Engineering

16

Sum of 10 identical triangular cost elements [7; 10; 15]

Palisade 2011 Risk

Conference

Copenhagen University College of

Engineering

17

Sum of 10 identical triangular cost elements [7; 10; 15]

Palisade 2011 Risk

Conference

Copenhagen University College of

Engineering

18

Sum of 10 identical triangular cost elements [7; 10; 15]

Palisade 2011 Risk

Conference

Copenhagen University College of

Engineering

19

Sum of 10 identical triangular cost elements [7; 10; 15]

Palisade 2011 Risk

Conference

Copenhagen University College of

Engineering

20

Sum of 10 identical triangular cost elements [7; 10; 15]

Palisade 2011 Risk

Conference

Copenhagen University College of

Engineering

21

Y = ∑Xi , Xi = [8; 10; 16], i = 1, …,10

0,08

0,07

Monte Carlo simulation

X = RiskTriangular(8; 10; 16)

(Uncorrelated variables)

Y = {113,3; 5,35}

0,06

pdf

0,05

Fuzzy arithmetic

X = [8; 10; 16]

Y = [80; 100; 160]

(Normalised as pdf)

0,04

Monte Carlo simulation

X = RiskTriangular(8; 10; 16)

(100% correlated variables)

Y = {113,3; 17,00}

0,03

0,02

0,01

0,00

80

90

100

110

120

130

140

150

160

Y = sum of Xi, i = 1,…,10

Palisade 2011 Risk

Conference

Copenhagen University College of

Engineering

22

n

Yn = ∑ Xi, Xi = [90/n;100/n;140/n]

cdf

i =1

n=1

n = 15

n=5

Palisade 2011 Risk

Conference

n = 10

Copenhagen University College of

Engineering

23

Some observations of probability vs. possibility

• With numerically identical input variables probability results

in less numerical output uncertainty than does possibility

• Uniform probability representation is different from interval

possibility representation

• Probability uncertainty decreases with increasing analytical

complexity whereas possibility uncertainty is independent

• Possibility uncertainty corresponds to fully correlated input

probability variables

• Monte Carlo simulation does not generally produce possibility

results

Palisade 2011 Risk

Conference

Copenhagen University College of

Engineering

24

3. Some principles of New Budgeting

Palisade 2011 Risk

Conference

Copenhagen University College of

Engineering

25

A Danish governmental initiative

• ”Best realistic budget based on available knowledge”

• Budget control is done by standardised budgets and logging of

follow‐up results

• Risk and uncertainty management is conducted during entire

project

• Estimates of unit prices, quantities and particular risks

• Experience based supplementary budget of one third of 50%

of rough budget is allocated

• Likelihood of event multiplied by impact is not accepted

• Acceptable to incur additional cost to reduce risk and

uncertainty

Palisade 2011 Risk

Conference

Copenhagen University College of

Engineering

26

The Anchor Budget

• Project with a number of activities A

• Each activity: unit price p and quantity q

• Total cost C of activities at time t = 0

• Subsequently, additional activities and costs may be

introduced

Palisade 2011 Risk

Conference

Copenhagen University College of

Engineering

27

The Event Impact Matrix

• Risk events E are identified at any time t = τ

• Additional activities may be initiated

• Impacts of Risk Events on all p and q are estimated

• We keep track of accumulated cost impacts for all

individual risk events

• Impacts from interacting (co‐acting) Risk Events are

pooled

Palisade 2011 Risk

Conference

Copenhagen University College of

Engineering

28

The Risk Budget

• All identified Risk Events are assumed to occur

• Resulting p, q and cost for each activity is calculated

• Total cost for project is calculated

• Deviations from Anchor Budget is calculated

Palisade 2011 Risk

Conference

Copenhagen University College of

Engineering

29

Risk events modify Anchor Budget

For the i’th activity Ai, we get the modified estimated cost Ciτ at time τ

Ciτ =

= (pi + ∆pi1 + ∆pi2 + … + ∆pij + … + ∆pim) · (qi + ∆qi1 + ∆qi2 + … + ∆qij + … + ∆qim)

= Ci + pi · (∆qi1 + ∆qi2 + … + ∆qij + … + ∆qim) + (∆pi1 + ∆pi2 + … + ∆pij + … + ∆pim) · qi

+ ∆pi1 · (∆qi1 + ∆qi2 + … + ∆qij + … + ∆qim)

+ ∆pi2 · (∆qi1 + ∆qi2 + … + ∆qij + … + ∆qim)

+…

+ ∆pij · (∆qi1 + ∆qi2 + … + ∆qij + … + ∆qim)

+…

+ ∆pim · (∆qi1 + ∆qi2 + … + ∆qij + … + ∆qim)

Palisade 2011 Risk

Conference

Copenhagen University College of

Engineering

30

Convenient set‐up for calculations

Event Impact Matrix at t = τ

Anchor Budget

at t = 0

Activity

p

q

Cost

E1

∆p

E2

∆q

∆Cost

∆p

E3

∆q

∆Cost

∆p12

∆q12

∆p22

∆q22

∆p32

∆q32

∆C12τ

∆C22τ

∆C32τ

∆p

Interaction

∆Cost

∆q

∆Cost

∆p13

∆q13

∆c1

∆p23

∆q23

∆p33

∆q33

∆C13τ

∆C23τ

∆C33τ

Risk Budget

at t = τ

Sum

∆Cost

p

p1τ

p2τ

p3τ

q1

∆c3τ

∆C1τ

∆C2τ

∆C3τ

Cost

A1

p1

q1

C1

∆p11

∆q11

A2

p2

q2

C2

∆p21

∆q21

A3

p3

q3

C3

∆p31

∆q31

A4

p4

q4

C4

∆p41

∆q41

∆C41τ

∆p42

∆q42

∆C42τ

∆p43

∆q43

∆C43τ

∆c4τ

∆C4τ

p4τ

q4τ

C4τ

A5

p5

q5

C5

∆p51

∆q51

∆C51τ

∆p52

∆q52

∆C52τ

∆p53

∆q53

∆C53τ

∆c5τ

∆C5τ

p5τ

q5τ

C5τ

∆C·3τ

∆cτ

∆Cτ

Sum

C

∆C·1τ

∆C·2τ

τ

q

∆C11τ

∆C21τ

∆C31τ

∆c2τ

τ

C1τ

q2τ

C2τ

q3τ

C3τ

Cτ

Table 1. Convenient set-up for calculations, n = 5, m = 3.

Anchor

Budget

Palisade 2011 Risk

Conference

Event Impact

Matrix

Copenhagen University College of

Engineering

Risk

Budget

31

Event Impact Matrix at t = τ

Anchor Budget

at t = 0

Activity

p

q

Cost

A1

100

1,000 100,000

A2

50

10,000 500,000

A3

200

500

100,000

A4

1,000

150

150,000

E1

E2

∆p

∆q

∆Cost

20

100

32,000

∆p

E3

∆q

∆Cost

25

2,500

30

∆Cost

∆Cost

p

500

35,000

120

1,125 135,000

–10,000

50

9,800 490,000

15,000

230

15,000

10

10,000

150

850,000

∆q

–200 –10,000

A5

Sum

∆p

47,000

300

12,500

45,000

35,000

Risk Budget

at t = τ

Interaction

∆Cost

500

Sum

q

Cost

500

115,000

10,000 1,000

160

160,000

45,000

300

45,000

95,000

150

945,000

Table 2. Numerical test example without event and impact uncertainty.

A1 E1: ∆Cost = (p+∆p)·(q+∆q) - Cost = p·∆q + ∆p·q + ∆p·∆q = 100·100 + 20·1,000 + 20·100 = 32,000

A1 E2: ∆Cost = (p+∆p)·(q+∆q) - Cost = p·∆q + ∆p·q + ∆p·∆q = 100·25 + 0·1,000 + 0·25 = 2,500

A1 Interaction: ∆Cost = 20 · 25 = 500

Palisade 2011 Risk

Conference

Copenhagen University College of

Engineering

32

4. Introducing uncertainty in the cost model

Palisade 2011 Risk

Conference

Copenhagen University College of

Engineering

33

Uncertain impacts and likelihoods

• Uncertain impact of Risk Events

‐ Uncertainty for all p and q from Anchor Budget

‐ Additional activities may become necessary

‐ How to estimate and represent uncertainty?

‐ Calculate uncertain Risk Budget

• Likelihood of Risk Events occurring

‐ Estimate probabilities of Risk Events occurring

‐ Construct probability distribution of total project cost

Palisade 2011 Risk

Conference

Copenhagen University College of

Engineering

34

Triangular representation [a; c; b]

Uncertain impact on unit price p = 100: ∆p = [18; 20; 25]

Uncertain impact on quantity q = 1000: ∆q = [95; 100; 125]

Uncertain impact on cost p∙q

∆Cost = (p+∆p)∙(q+∆q) − p∙q

= p∙∆q + ∆p∙q + ∆p∙∆q

∆Cost = [9,500; 10,000; 12,500] + [18,000; 20,000; 25,000] +

[1,710; 2,000; 3,125]

= [29,210; 32,000; 40,625]

Palisade 2011 Risk

Conference

Copenhagen University College of

Engineering

35

Triangular representation {µ; σ}

Uncertain impact on unit price p = 100: ∆p = {21.0; 1.47}

Uncertain impact on quantity q = 1000: ∆q = {106.7; 6.56}

Uncertain impact on cost p∙q

∆Cost = (p+∆p)∙(q+∆q) − p∙q

= p∙∆q + ∆p∙q + ∆p∙∆q

∆Cost = {33,907; 1,802} (by Monte Carlo simulation)

min = 29,551, max = 39,966

Palisade 2011 Risk

Conference

Copenhagen University College of

Engineering

36

5. Numerical examples

Palisade 2011 Risk

Conference

Copenhagen University College of

Engineering

37

Event Impact Matrix at t = τ

Activity

A1

E1

E2

∆p

∆q

∆Cost

[18; 25]

[95; 125]

[29,210; 40,625]

∆p

E3

∆q

∆Cost

[21; 31]

[2,100; 3,100]

∆p

A2

A3

∆q

∆Cost

[-210; -175] [-10,500; -8,750]

[25; 45]

[12,500; 22,500]

A4

[7,000; 16,000]

A5

∆Cost

∆Cost

[378; 775]

[31,688; 44,500]

[-10,500, -8,750]

[7,000; 16,000]

[145; 165]

[41,710; 63,125]

Sum

[12,500; 22,500]

[7; 16]

Sum

Interaction

[9,100; 19,100]

[280; 350] [40,600; 57,750]

[40,600; 57,750]

[30,100; 49,000] [378; 775] [81,288; 132,000]

Table 3. Event Impact Matrix using interval uncertainty representation [a; b]. (Anchor Budget of Table 2).

Palisade 2011 Risk

Conference

Copenhagen University College of

Engineering

38

Risk Budget at t = τ

Activity

p

q

Cost

A1

[118; 125]

[1,116; 1,156]

[131,688; 144,500]

A2

50

[9,790; 9,825]

[489,500; 491,250]

A3

[225; 245]

500

[112,500; 122,500]

A4

1,000

[157; 166]

[157,000; 166,000]

A5

[145; 165]

[280; 350]

[40,600; 57,750]

Sum

[931,288; 982,000]

Table 4. Risk Budget using interval uncertainty representation [a; b].

(Anchor Budget of Table 2 and Event Impact Matrix of Table 3).

Palisade 2011 Risk

Conference

Copenhagen University College of

Engineering

39

Risk Budget at t = τ

Activity

p

q

Cost

A1

[118; 120; 125]

[1,116; 1,125; 1,156] [131,688; 135,000; 144,500]

A2

50

[9,790; 9,800; 9,825] [489,500; 490,000; 491,250]

A3

[225; 230; 245]

500

[112,500; 115,000; 122;500]

A4

1,000

[157; 160; 166]

[157,000; 160,000; 166,000]

A5

[145; 150; 165]

[280; 200; 350]

[40,600; 54,000; 57,750]

Sum

[931,288; 945,000; 982,000]

Table 5. Risk Budget using triple estimate uncertainty representation [a; c; b].

(Combination of Table 2 and 4).

Palisade 2011 Risk

Conference

Copenhagen University College of

Engineering

40

Event Impact Matrix at t = τ

Activity

E1

∆p

A1

∆q

E2

∆Cost

{21.0; 1.47} {106.7; 6.56} {33,907; 1,802}

∆p

E3

∆q

∆Cost

{25.7; 2.05}

{2,567; 205}

∆p

A2

A3

∆q

{195; 7.36}

{33.3; 4.25}

∆Cost

{-9,750; 368}

{16,667; 2,125}

A4

A5

∆Cost

∆Cost

{539; 57.9}

{37,012; 1,851}

{-9,750; 368}

{11,000; 1,871}

{153.3; 4.25} {310; 14.7} {47,534; 2,619}

{50,573; 2,807}

Sum

{16,667; 2,125}

{11.0; 1.87} {11,000; 1,871}

Sum

Interaction

{13,567; 1,884}

{47,534; 2,619}

{37,784; 2,643} {539; 57.9} {102,462; 4,305}

Table 6. Event Impact Matrix using triangular probability input distributions {µ; σ}. (Anchor Budget of Table 2).

Palisade 2011 Risk

Conference

Copenhagen University College of

Engineering

41

Risk Budget at t = τ

Activity

p

q

Cost

A1

{121.0; 1.47}

{1,132; 6.87}

{137,012; 1,851}

A2

50

{9,805; 7.36}

{490,250; 368}

A3

{233.3; 4.25}

500

{116,667; 2,125}

A4

1,000

{161.0; 1.87}

{161,000; 1,871}

A5

{153.3; 4.25}

{310.0; 14.7}

{47,534; 2,619}

Sum

{952,462; 4,305}

Table 7. Risk Budget using triangular probability input distributions {µ; σ}.

(Anchor Budget of Table 2 and Event Impact Matrix of Table 6).

Palisade 2011 Risk

Conference

Copenhagen University College of

Engineering

42

Probabilities of

combinations

pr1=0.6 pr1=0.3 pr3=0.2 pdf

cdf

E1

E2

E3

Cost Cτ

Cost Cτ

[a; c; b]

{µ; σ}

850,000

850,000

no

no

no

0.224

0.224

no

yes

no

0.096

0.320

[859,100; 862,500; 869,100] {863,567; 1,882}

no

no

yes

0.056

0,376

[880,100; 885,000; 899,000] {887,783; 2,642}

yes

no

no

0.336

0.712

[891,710; 897,000; 913,125] {900,573; 2,810}

no

yes

yes

0.024

0.736

[889,200; 897,500; 918,100] {901,350; 3,251}

yes

yes

no

0.144

0.880

[901,188; 910,000; 933,000] {914,679; 3,380}

yes

no

yes

0.084

0.964

[921,810; 932,000; 962,125] {938,356; 3,853}

yes

yes

yes

0.036

1.000

[931,288; 945,000; 982,000] {952,462; 4,305}

Table 8. Distributions of Cτ for representations by triple estimates and probabilities.

Palisade 2011 Risk

Conference

Copenhagen University College of

Engineering

43

Distribution of cost Cτ (triple estimates, Table 8)

1.0

E1, E2, E3

E1, E3

E1, E2

cdf

E2, E3

E1

E2

0.0

800,000

Palisade 2011 Risk

Conference

E3

900,000

Copenhagen University College of

Engineering

Cost

1,000,000

44

Triangular probability Monte Carlo simulation of Risk Budget.

(Anchor Budget of Table 2, Event Impact Matrix of Table 6).

Uncorrelated

input parameters

Uncorrelated

input parameters

Most poss.:

945,000

100% correlated

input parameters

Max: 982,000

Min: 931,288

Palisade 2011 Risk

Conference

Copenhagen University College of

Engineering

45

6. Resumé and perspectives

Palisade 2011 Risk

Conference

Copenhagen University College of

Engineering

46

Resumé and perspectives

• Anchor Budget, unit prices, quantities

• Impacts of individual Risk Events

• Impacts of co‐acting Risk Events

• Impacts on individual Activities

• Uncertainty by probabilities and possibilities

• Under‐ or overestimating uncertain impacts

• Research into practical applications

End

of

presentation

Palisade 2011 Risk

Conference

Copenhagen University College of

Engineering

47

Back to

Table 6

Palisade 2011 Risk

Conference

Copenhagen University College of

Engineering

48

Back to

Table 6

Palisade 2011 Risk

Conference

Copenhagen University College of

Engineering

49

Back to

Table 6

Palisade 2011 Risk

Conference

Copenhagen University College of

Engineering

50

Back to

Table 6

Palisade 2011 Risk

Conference

Copenhagen University College of

Engineering

51

Back to

Table 6

Palisade 2011 Risk

Conference

Copenhagen University College of

Engineering

52

Back to

Table 7

Palisade 2011 Risk

Conference

Copenhagen University College of

Engineering

53

Back to

Table 7

Palisade 2011 Risk

Conference

Copenhagen University College of

Engineering

54

Back to

Table 7

Palisade 2011 Risk

Conference

Copenhagen University College of

Engineering

55

Back to

Table 7

Palisade 2011 Risk

Conference

Copenhagen University College of

Engineering

56

Thank You!

Palisade 2011 Risk

Conference

Copenhagen University College of

Engineering

57